Best Fraud Monitoring Tools for Startups & Enterprises: A Comparative Guide for Businesses

Collections 🗒️

In today’s digital economy, financial fraud is a growing risk for businesses of all sizes. Fraud monitoring tools help detect, prevent, and respond to suspicious activities in real time. These platforms protect transactions, customer data, and company revenue while supporting regulatory compliance.

For startups, fintech companies, e-commerce platforms, and large enterprises, fraud prevention software is not optional. It is a core part of risk management, business security, and customer trust in an increasingly online world.

Top Fraud Monitoring Tools: A Comparative Overview

To provide a clear, at-a-glance reference for businesses evaluating their options, this table highlights leading fraud detection platforms based on their core strengths and target markets.

| Tool Name | Founded | Country | Category | Best For | Core Use Case |

|---|---|---|---|---|---|

| SEON | 2017 | Hungary | Fraud & AML | Startups & Fintech | Real-time digital footprint analysis |

| Sift | 2011 | USA | Digital Trust & Safety | E-commerce Marketplaces | Account takeover (ATO) prevention |

| Riskified | 2012 | Israel | E-commerce Fraud | Large Retailers | Chargeback guarantee & automation |

| Signifyd | 2011 | USA | Commerce Protection | Enterprise Merchants | Revenue optimization & fraud insurance |

| DataVisor | 2013 | USA | AI-Powered Fraud & Risk | Financial Institutions | Detecting unknown fraud with UML |

| Kount | 2007 | USA | Identity Trust | Global Enterprises | Multi-layered identity verification |

| ThreatMetrix | 2005 | USA | Digital Identity | High-Security Sectors | Real-time device & behavior analysis |

How We Chose These Tools

Our selection process for the best fraud monitoring tools was guided by a comprehensive set of criteria designed to address the needs of both agile startups and established enterprises. We prioritized platforms that demonstrate a clear commitment to innovation, security, and scalability.

- Fraud Detection Capability: Core effectiveness in identifying and preventing a wide range of fraud types.

- Real-Time Monitoring: Ability to analyze data and provide risk assessments with minimal latency.

- AI/ML Intelligence: Use of advanced algorithms, including supervised and unsupervised machine learning, for predictive accuracy.

- Compliance Readiness: Features that support adherence to regulatory standards like PSD2, GDPR, and AML directives.

- Scalability: Capacity to handle growing transaction volumes and expanding business needs without performance degradation.

- Integration Ecosystem: Availability of APIs, SDKs, and pre-built connectors for seamless integration with existing tech stacks.

- Industry Applicability: Proven success across key sectors, including fintech, e-commerce, banking, and digital services.

- Data Security Standards: Adherence to top-tier security protocols like PCI DSS and SOC 2 to ensure data protection.

- Enterprise Adoption: Strong track record of deployment and trust among large, global organizations.

- Startup Usability: Ease of implementation, flexible pricing, and a supportive onboarding process for emerging businesses.

List of Best Fraud Detection Platforms

Here, we explore the capabilities, strengths, and limitations of each of the top fraud prevention software solutions to help you make an informed decision.

SEON

SEON offers a powerful and agile fintech fraud solution that enriches data in real time using digital footprints, email, and phone number analysis. Its platform is engineered for speed and flexibility, allowing businesses to uncover sophisticated fraud rings and automate risk decisions without creating friction for legitimate users.

Pros:

- Rapid integration timeline, often completed within days via a single, developer-friendly API.

- Transparent, modular pricing that allows startups to scale their fraud prevention efforts as they grow.

Cons:

- Lacks the extensive physical identity document verification capabilities of some larger, legacy systems.

- The highly customizable rules engine can present a steep learning curve for teams without dedicated fraud analysts.

Sift

Sift’s Digital Trust & Safety Suite provides a comprehensive enterprise fraud management solution powered by a massive global data network. By analyzing over 70 billion events per month, its machine learning models accurately identify high-risk behaviors, preventing payment fraud and securing user accounts from takeovers.

Pros:

- Leverages a vast cross-merchant data network to identify and block known fraudsters.

- An intuitive user interface and powerful data visualizations simplify the investigation process.

Cons:

- The pricing structure can be a significant investment for small businesses with lower transaction volumes.

- Harnessing the full power of its custom machine learning models requires specialized expertise.

Riskified

Riskified is a market leader in e-commerce fraud prevention, best known for its chargeback guarantee model. The platform uses advanced AI to make instant approve/decline decisions, shifting the liability for fraudulent chargebacks from the merchant to Riskified and thereby protecting revenue streams.

Pros:

- A 100% chargeback guarantee on all approved transactions provides financial certainty.

- High degree of automation dramatically reduces the operational overhead of manual order reviews.

Cons:

- The AI decisioning process operates as a "black box," offering limited insight into specific decline reasons.

- Its focus is heavily on transactional fraud, making it less suitable for other use cases like internal or non-monetary fraud.

Signifyd

Signifyd’s Commerce Protection Platform is designed to maximize revenue for enterprise retailers by distinguishing between legitimate and fraudulent customers. It combines big data, machine learning, and a financial guarantee to help merchants approve more orders and grow fearlessly.

Pros:

- Focuses on revenue optimization by safely approving a higher percentage of orders.

- Offers seamless, pre-built integrations with major e-commerce platforms like Shopify, BigCommerce, and Magento.

Cons:

- The guarantee-backed model comes at a premium price point that may not be viable for all businesses.

- Customization options can be limited for merchants facing unique or niche fraud vectors.

DataVisor

DataVisor is a premier cybersecurity fraud tool that excels at identifying coordinated and previously unseen fraud attacks. Its platform utilizes Unsupervised Machine Learning (UML) to detect malicious patterns across massive datasets without relying on historical training data, making it ideal for large financial institutions.

Pros:

- Exceptional at detecting sophisticated, large-scale fraud rings and emerging threats in real time.

- Provides a holistic risk engine that covers the entire customer lifecycle, from onboarding to transactions.

Cons:

- Implementation is a complex process that requires significant technical resources and expertise.

- The enterprise-grade capabilities come with a high price tag suited for large-scale deployments.

Kount

Now an Equifax company, Kount delivers one of the most powerful transaction monitoring systems available, built on a foundation of deep identity and device intelligence. Its Identity Trust Global Network links billions of data points to deliver real-time trust decisions and protect against a wide array of digital fraud.

Pros:

- Enhanced identity verification capabilities through access to Equifax’s extensive consumer data.

- Highly scalable architecture designed to support the needs of large, global enterprises.

Cons:

- The user interface and overall platform can feel less modern compared to newer, cloud-native competitors.

- The integration process can be more rigid and demanding than more agile solutions.

LexisNexis ThreatMetrix

ThreatMetrix is an enterprise-grade digital fraud protection platform that provides powerful digital identity intelligence. It analyzes the complex interplay between devices, locations, and anonymized identity data to distinguish between trusted users and potential threats with remarkable accuracy, serving top-tier banks and global corporations.

Pros:

- Unmatched global device intelligence and a vast shared identity network for comprehensive risk assessment.

- Strong support for regulatory compliance, including robust features for KYC and AML requirements.

Cons:

- The total cost of ownership is among the highest in the market, making it inaccessible for most startups.

- Requires a dedicated team of specialists to configure and manage its complex system effectively.

Conclusion

The continued growth of the digital economy is linked to the ability of businesses to manage risk and combat fraud. As this landscape evolves, so does the sophistication of fraudulent actors, making the adoption of advanced fraud monitoring tools a cornerstone of sustainable success. These platforms are essential not only for protecting financial assets but also for ensuring compliance and building lasting customer trust. By investing in resilient enterprise fraud management infrastructure, businesses can secure their operations, enhance platform integrity, and confidently navigate the complexities of digital growth.

FAQs

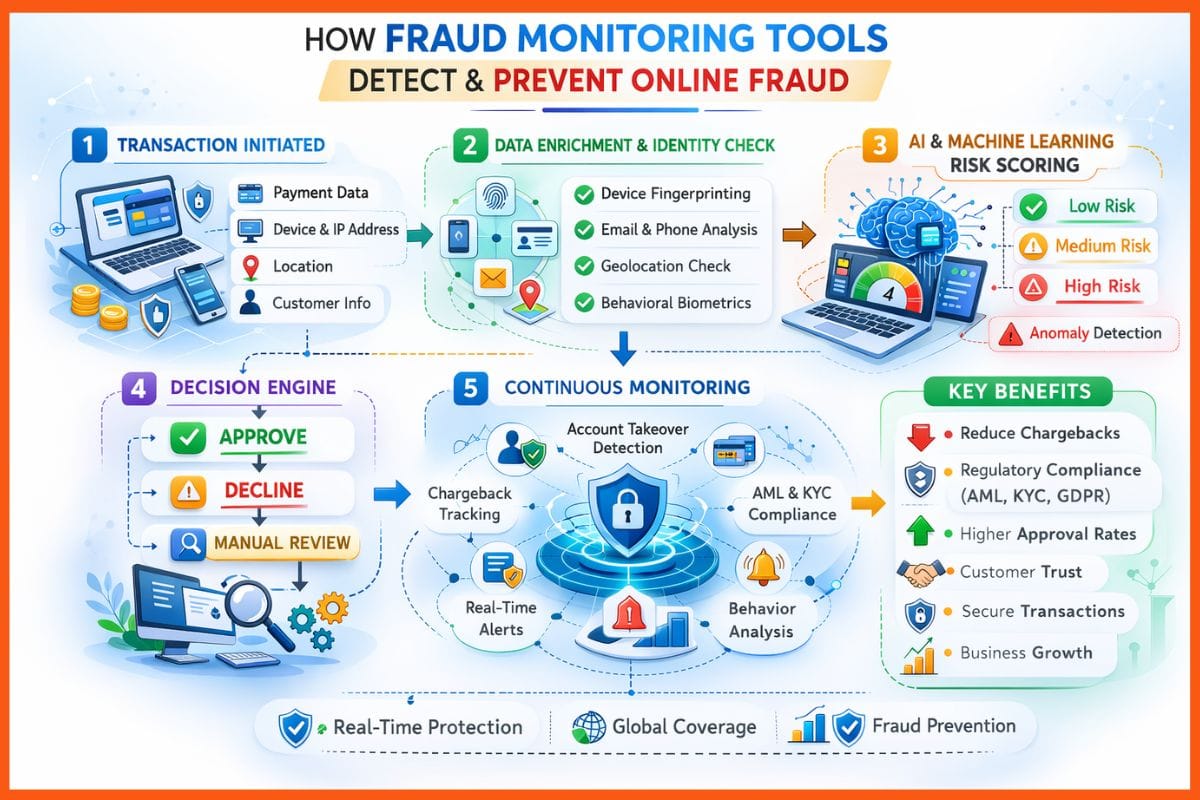

What are fraud monitoring tools and how do they work?

Fraud monitoring tools are software platforms designed to detect, prevent, and respond to fraudulent activities in real time. They work by analysing transactions, user behaviour, device data, and digital identities using AI and machine learning algorithms. These tools flag suspicious activity, reduce chargebacks, and help businesses maintain compliance with regulations like AML, KYC, and GDPR.

Which businesses should use fraud detection software?

Fraud detection software is essential for startups, fintech companies, e-commerce platforms, and large enterprises that handle online payments or sensitive customer data. Any business processing digital transactions can benefit from these tools to prevent financial losses, secure customer accounts, and protect their brand reputation.

What features should I look for in the best fraud prevention tools?

Top fraud prevention tools should offer real-time monitoring, AI-powered risk scoring, device and identity verification, anomaly detection, and regulatory compliance support. Additional features like automated decision engines, chargeback protection, and multi-layered identity checks help businesses reduce fraud while improving approval rates and customer trust.

Must have tools for startups - Recommended by StartupTalky

- Convert Visitors into Leads- SeizeLead

- Website Builder SquareSpace

- Run your business Smoothly Systeme.io

- Stock Images Shutterstock