Chinese Funded Startups in India might find it difficult for capital investments

china

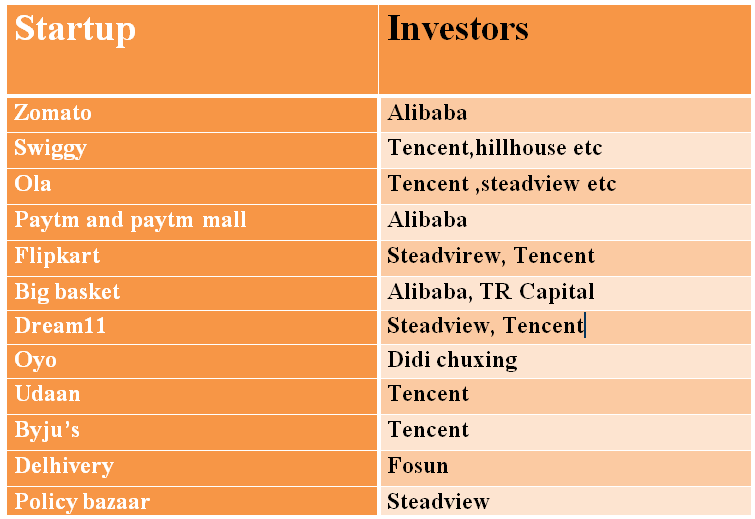

Due to the ongoing military standoff at the Indo-China border, Chinese funded startups may face challenges in raising capital for their businesses. Chinese investors have found Indian startups valuable and deeply invested in top startups like Paytm, Zomato, BigBasket, and many more but soon these startups may face challenges in capital investments for their businesses due to the ongoing military standoff between two countries.

The military standoff may affect the Chinese invested startups in India and Chinese funded businesses, as per the reports Chinese investors have funded over 18 out of 30 unicorns in India which is roughly around $3.9 billion of investments in 2019.

Chinese investments in India

Businesses that already have Chinese investors deeply invested cannot afford to back out at this moment and will not, but early growth stage startups in India which are looking out and rely on foreign investments may find it difficult to find foreign capital investments for their startups.A startup founder said "While investments from china have slowed down, other avenues have open up from countries like the United States, UK, and the middle east".

Foreign investors find investing in India attractive because India has an attractive risk-return trade off and India remains the second-fastest growing economy in the world.

Also read:How India is Boycotting Chinese products

Impact of FDI on Indian Startups

The Department for Promotion of Industry and Internal Trade (DPIIT) through a Press Note No.3 of 2020, has announced that any of India’s neighboring countries will require the Indian Government approval in case of any FDI investments in India. Many have speculated that this move is aimed to restrain Chinese investments in India.

The companies that are going to be affected the most by the foreign direct investment (FDI) norms are Big basket, Ola and payments platform Paytm, these startups have so far received billions of dollars investments from Chinese companies.The FDI makes it compulsory for all the investors including Chinese direct and indirect investors to seek government approval before investing in Indian companies. This will create a hurdle for the Chinese investors such as Alibaba and Tencent who have invested billions in Indian startups.

Also read: Secrets To Chinese Investment in Indian Startups – Even In This Down Economy

“The new FDI guidelines essentially imply Chinese capital would require prior government approval. In effect, given the uncertainty around approval, startups will shy away from Chinese capital. In the immediate future, this could impact PhonePe and potentially Paytm at a later date," said Ashneer Grover, CEO and co-founder, BharatPe.

lately Bigbasket was backed with a funding close to $50 million from Alibaba. The amount was funded to the company when it was struggling to meet the operations requirements due to restrictions imposed by the lockdown.

Top Chinese funded startups in India

According to the data gathered by Tracxn, C Chinese investors have backed unicorns like Byjus, Paytm, Ola, Oyo, Swiggy, Zomato, Dream11, and Udaan, while some investors have also invested in soonicorns (a term used for potential unicorns) such as Practo, ShareChat, Meesho, and CarDekho.

The new FDI guidelines is going to affect the current investments as well as the investments by neighboring countries who are interested in investing in Indian startups.

Must have tools for startups - Recommended by StartupTalky

- Convert Visitors into Leads- SeizeLead

- Website Builder SquareSpace

- Run your business Smoothly Systeme.io

- Stock Images Shutterstock