Dhivya Abirami Shares How Creddinv Makes Startup and Alternative Investments Accessible to All

Interview

StartupTalky presents Recap'25, a series of exclusive interviews where we connect with founders and industry leaders to reflect on their journey in 2025 and discuss their vision for the future.

In this edition of Recap’25, StartupTalky speaks with Dhivya Abirami, Lead – Content Marketing & PR at Creddinv, who shares insights on making startup and alternative investments more accessible, transparent, and meaningful for investors. She highlights the challenges individual investors face in gaining direct equity access, staying updated post-investment, and building diversified portfolios across asset classes.

Abirami elaborates on how Creddinv bridges these gaps through structured investment programs, curated startup discovery, and a full-lifecycle digital platform that combines equity, mutual funds, bonds, and alternative assets. The conversation also explores how Creddinv leverages technology, personalized dashboards, and investor engagement programs to enhance transparency, build trust, and support informed decision-making, along with the platform’s roadmap for 2026 aimed at broadening investment options, deepening portfolio intelligence, and strengthening investor education.

StartupTalky: What does Creddinv do today and how does it help investors discover and participate in high-potential investment opportunities?

Dhivya Abirami: Creddinv is a digital investment platform that connects investors - especially HNIs/UHNIs and sophisticated investors - to curated opportunities in startup equity and other asset classes. It enables investors to access direct cap table investments in promising Indian startups through structured programs like the Premium Series and Seed Series, where investors can participate in private funding rounds and become actual equity holders.

The platform offers features including:

- Discovery of vetted startups raising capital

- A personal dashboard to track portfolios and updates

- Lower minimum ticket sizes (as small as INR 1 Lac) for startup investing

- Curated insights and due diligence data to support informed decisions

Creddinv also broadens investment scope beyond startups into mutual funds, bonds, PMS, AIFs, and other traditional/alternative assets through its Creddinv ONE ecosystem - helping investors build diversified wealth portfolios without leaving the platform.

StartupTalky: What was the original vision behind starting Creddinv, and what gap did you see in the startup and alternative investment ecosystem that needed solving?

Dhivya Abirami: Creddinv was founded to bridge the gap between investors and high-growth startups by making startup investing more accessible, transparent, and meaningful. Traditionally, direct startup investing in India has been restricted to venture capital firms, a small set of angel investors, or individuals with deep personal networks. Even when investors gained access, the journey often ended at cheque writing - with very limited visibility, updates, or structured engagement post-investment.

The founders identified a clear gap: lack of post-investment support and transparency for individual investors. Most platforms focused heavily on deal access, but offered little in terms of ongoing communication, portfolio tracking, or structured founder-investor engagement after the investment was made.

Creddinv was built to solve this by creating a full-lifecycle investment platform, not just a deal-listing marketplace.

The original vision centered on:

- Providing direct equity participation in startups through real cap table access, not pooled or indirect exposure

- Making investment data and due diligence transparent and accessible, so investors clearly understand what they are backing

- Delivering strong post-investment support, including regular startup updates, milestone tracking, portfolio visibility, and structured communication, so investors stay informed long after capital is deployed

- Supporting both investors and founders with a cleaner, more organised private investment journey

- Educating investors on alternative investments through insights, tools, and contextual information to enable better long-term decision-making

StartupTalky: Over the past year, how has Creddinv evolved its offerings across startup investments, mutual funds, or investor insights to better serve its growing community?

Dhivya Abirami: Creddinv has achieved several notable expansions:

- Built a community of 9,000+ registered investors and listed 14 portfolio startups, demonstrating traction in private market investing.

- Launched a subscription model for investors, eliminating platform fees on direct investments and attracting serious participants.

- Expanded investment options through Creddinv ONE, broadening the platform beyond startups to include mutual funds, bonds, insurance, PMS, and AIFs.

- Released The Smart Investor App to provide a mobile, personalized investment experience, including tailored startup discovery and engagement features.

StartupTalky: Creddinv positions itself as a 100% digital and transparent platform. What are the key differentiators/USPs vs. traditional investment discovery channels?

Dhivya Abirami: Key differentiators include:

- Direct Cap Table Access: Unlike many platforms that offer indirect or curated exposure, Creddinv lets investors take actual equity ownership in startups.

- Subscription-Driven Model: The platform uses an investor subscription model to focus engagement and align interests, with no platform fee on actual investments.

- Built-In Diversity: Through Creddinv ONE, investors can access both alternative and traditional assets under one roof.

- Digital Dashboard & Tools: A personal dashboard with portfolio tracking, real-time updates, and curated insights helps investors manage and monitor commitments without manual tracking.

- Mobile Experience: With a standalone Smart Investor App, users receive notifications, personalized recommendations, and founder engagement features, which enhances transparency and interaction.

StartupTalky: How does Creddinv use analytics, technology, or AI to deliver actionable insights and personalized recommendations?

Dhivya Abirami:

- Curated Startup Evaluation: Startups are vetted on criteria such as product-market fit, founder credibility, traction, and scalability—bringing a structured analytical approach to deal selection.

- Personalized App Features: The Smart Investor App provides tailored recommendations, notifications, and curated discovery based on investor interests and behavior.

- Data Dashboard: Investors can track milestones, performance, and updates through a unified digital dashboard, making portfolio monitoring actionable.

- Investor Engagement Programs: Creddinv uses engagement insights to design sector-specific cohorts and deepen investor understanding of sectors and opportunities.

StartupTalky:What was one major challenge faced this year in scaling credibility or adoption, and how did you address it?

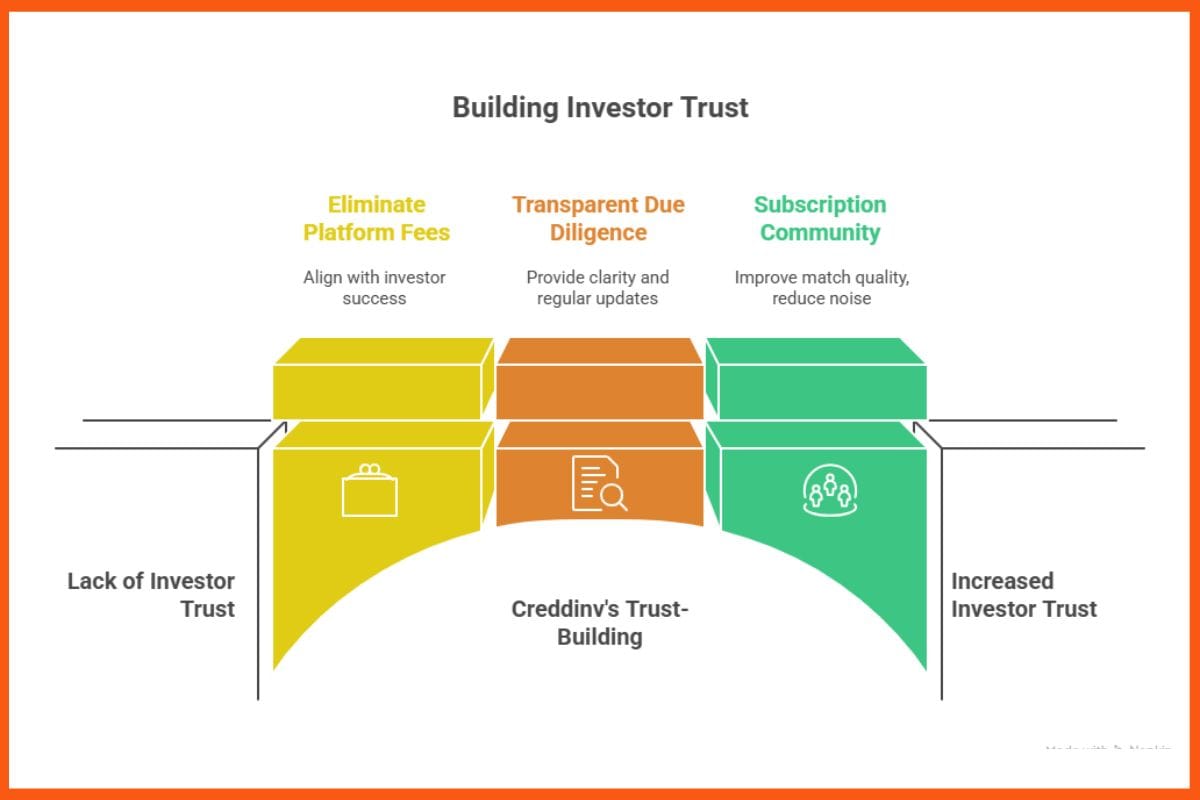

Dhivya Abirami: A core challenge for any private investment platform is building investor trust - especially when shifting funds into illiquid, alternative assets.

Creddinv addressed this by:

- Eliminating platform fees on investments to signal alignment with investor success.

- Providing transparent due diligence, cap table clarity, and regular updates via dashboards.

- Creating a subscription community of serious investors, reducing noise and improving match quality.

These measures help lower entry barriers, improve transparency, and build credibility with early users.

StartupTalky: What one practical piece of advice would you share with founders building fintech or investment-led service businesses?

Dhivya Abirami: Focus relentlessly on trust, transparency, and education. In investment-led products, users entrust you with capital and long-term financial outcomes. Providing clear, data-driven due diligence, recurring performance insights, and intuitive digital experiences builds credibility faster than feature-only products.

StartupTalky: Looking ahead to 2026, what are the key priorities and growth plans for Creddinv?

Dhivya Abirami:

- Accelerating investor engagement and education programs.

- Strengthening its data-driven investment discovery process.

- Broadening sector-specific startup cohorts and investment options.

- Deepening portfolio intelligence features and potentially expanding international investor access in compliance with regulations.

- Enhancing digital product experiences, including app features and personalized analytics.

Explore more Recap'25 interviews here.

Must have tools for startups - Recommended by StartupTalky

- Convert Visitors into Leads- SeizeLead

- Website Builder SquareSpace

- Run your business Smoothly Systeme.io

- Stock Images Shutterstock