2026 BFSI Outlook: Embedded Finance, AI-Led Verification & Digital Banking Innovation

✍️ Opinions

This article has been contributed by S. Anand, Founder & CEO, PaySprint

India’s financial ecosystem is undergoing one of the fastest transformations in the world. What once required physical paperwork, manual verification, and fragmented systems is now being shaped by APIs, artificial intelligence, and integrated digital rails. As someone who has spent over two decades building financial infrastructure and working closely with regulated entities, banks, and fintech innovators, I believe we are standing at an inflection point, a shift from digitisation to intelligent financial infrastructure.

This shift is being powered by three forces: embedded finance, AI-led verification, and next-generation digital banking architecture.

Embedded Finance: Invisible, Integrated, Inevitable

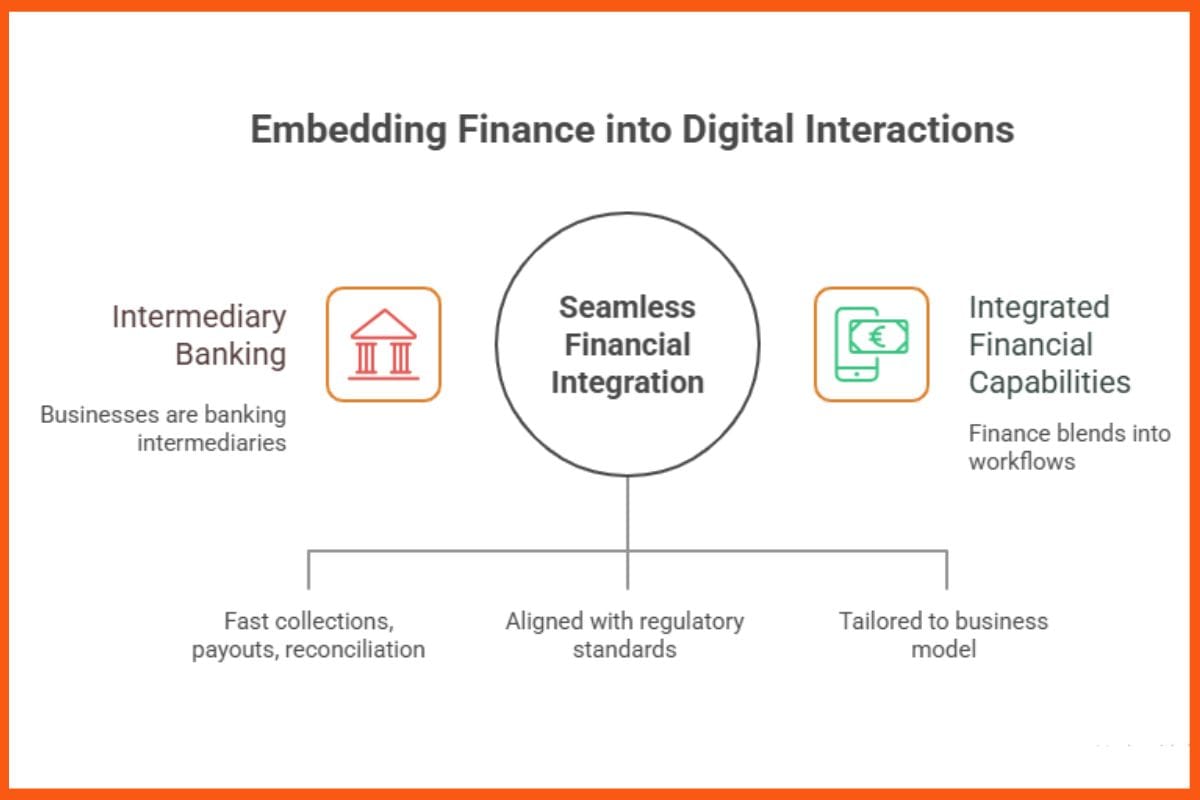

The future of finance is not about banks alone, nor about fintech alone. It is about financial capabilities embedded into every digital interaction.Businesses, whether they are logistics companies, marketplaces, ed-tech platforms, retailers, or SaaS providers, no longer want to be intermediaries to banking. They expect financial features to blend seamlessly into their workflows.

Three things are making this integration mainstream:

- API-driven switch infrastructures that allow collections, payouts, and reconciliation to happen in milliseconds.

- Modular compliance frameworks that allow non-financial companies to offer financial experiences while staying fully aligned with regulatory standards.

- The rise of sector-specific financial journeys, where escrow, credit, insurance, or payouts are tailored to the exact business model rather than offered as generic services.

Embedded finance is no longer a “feature differentiator.” It is becoming part of the economy’s operating system. The winners will be those who build interoperable, compliant, and scalable rails, not just the front-end experiences.

AI-Led Verification: From KYC to Intelligent Trust Infrastructure

Verification has always been the backbone of financial services. But as digital penetration deepens, the challenge is no longer just identifying individuals or businesses; it is verifying them instantly, accurately, and contextually.

AI is enabling a new era of verification:

- Document intelligence can extract, validate, and cross-verify identity details in seconds.

- Behavioural analytics can detect anomalies far beyond what static rules would allow.

- Pattern-based fraud detection is moving us from reactive to predictive compliance.

- KYB and entity verification are becoming increasingly critical as digital adoption of MSMEs accelerates.

The aim is not speed alone. It is about building trust at scale, ensuring businesses can onboard customers, partners, and vendors securely without the friction that traditionally slowed down financial systems.

In the next decade, I expect verification frameworks to become dynamic trust ecosystems, where AI determines risk levels in real time and automatically adjusts the required checks.

Digital Banking Innovation: Beyond Interfaces, Towards Infrastructure

Digital banking is often mistaken for apps, dashboards, or user interfaces. But true innovation lies in the invisible layers, the orchestration engines, the routing logic, the core banking integrations, and the compliance frameworks that sit underneath.

Three major trends will define the next phase:

Banking-as-Infrastructure

Banks are increasingly opening up their core capabilities through API ecosystems. This is enabling fintechs and enterprises to innovate without replacing banking fundamentals, a partnership-led evolution rather than a disruption-led one.

Real-Time Money Movement

Businesses now expect instant payouts, real-time reconciliation, and automated settlement logic. The shift from batch processing to intelligent payment orchestration is redefining financial operations.

RegTech as an Enabler, Not an Obligation

Compliance is no longer a checkbox function. With AI and automation, it becomes continuous, contextual and embedded directly into financial journeys. This makes digital banking not only faster but also safer.

The Road Ahead: Interoperability, Integrity, and Inclusion

If India’s financial landscape has taught us anything, it is that scale demands both innovation and discipline. Infrastructure must be resilient, secure, and interoperable, and innovation must align with regulatory expectations, not run ahead of them.

The future belongs to ecosystems where:

- Banks contribute trust and regulatory strength

- Fintechs contribute agility and experience design

- API providers deliver the rails that connect both

- AI builds intelligence across every layer

Most importantly, this evolution is pushing financial inclusion beyond urban centres, helping businesses across Bharat access modern financial capabilities without needing to become experts in banking.

Conclusion

We are entering a phase where finance becomes embedded, verification becomes intelligent, and digital banking becomes invisible yet indispensable. The organisations that will lead this transformation are those that treat financial infrastructure not as a product, but as a responsibility to the economy, to businesses, and to the millions of individuals who rely on these systems every day.

As India continues to build one of the strongest digital economies in the world, our collective focus must remain on trust, transparency, and technology working together. That is where the next decade of financial innovation truly lies.

Must have tools for startups - Recommended by StartupTalky

- Convert Visitors into Leads- SeizeLead

- Website Builder SquareSpace

- Run your business Smoothly Systeme.io

- Stock Images Shutterstock