Fintech Solutions For Cross-Border Transactions: Redefining Global Payments

✍️ Opinions

This article has been contributed by Mohar V, Co-founder and CEO, TECHVED

If you’ve ever tried sending or receiving money overseas in the early 2000s, you’ll remember the struggle — long queues at the bank, tedious paperwork, and the nerve-wracking wait for funds to clear. Cross-border transactions were a test of both patience and persistence. Before online banking and digital transfers became mainstream, Demand Drafts were one of the few available options — but they came with their own risks of loss or theft during transit. For countless people, these hurdles turned simple transactions into sleepless nights — from issuing a Demand Draft to the tense wait for its delivery.

Fast forward to today, and the story is changing dramatically. For years, systems like SWIFT and traditional banking networks dominated international payments — but they were slow, expensive, and far from transparent. Delays, hidden fees, and a lack of clarity on exchange rates often left users frustrated and anxious.

However, with India’s Digital India and Atmanirbhar Bharat movements accelerating digital transformation, the payment landscape is witnessing a powerful shift. The wave of digital transformation and technological innovation has revolutionised the landscape, turning once-complex processes into seamless, user-friendly experiences. Thanks to the RBI’s Payment Aggregator – Cross Border (PA–CB) framework, fintech firms now have a structured path to innovate. This regulatory initiative allows seamless cross-border e-commerce payments — empowering Indian merchants to easily receive international payments and global customers to pay effortlessly. Let’s take a deep look at the old times and the digital times.

The Old Challenges That Still Echo

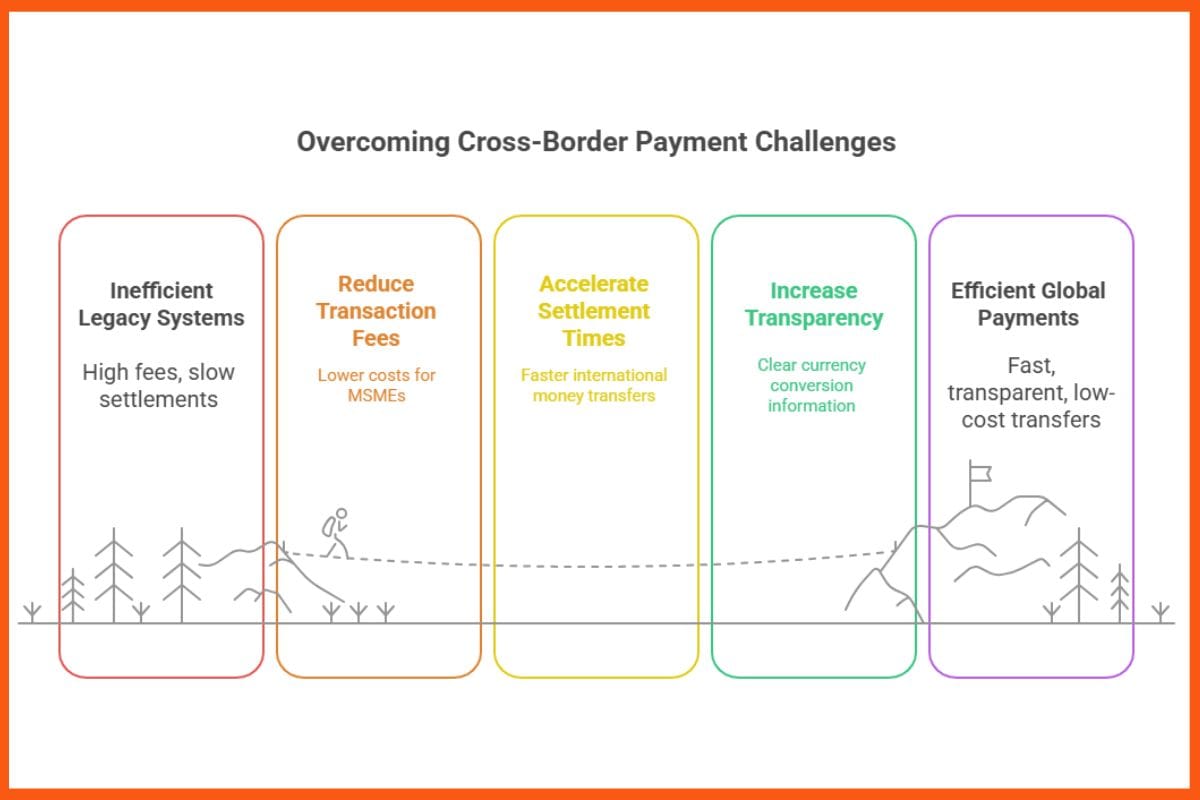

Even as systems evolved, some problems persisted:

- High transaction fees reduce the actual amount received.

- Long settlement times, often taking two to five days

- Limited awareness and a lack of transparency around currency conversions.

- Complex documentation that slows down or deters cross-border transfers.

- Fragmented user experiences across different platforms.

These challenges especially affected MSMEs — small businesses trying to grow internationally but often held back by the inefficiencies of legacy systems.

How Fintech Is Transforming the Game

Fintech companies are turning these age-old struggles into smooth, digital-first experiences. Their platforms are simple, intuitive, and designed so that anyone — from senior citizens to small-town entrepreneurs — can transact globally with ease. They’ve transformed international money transfers—making them faster, more affordable, and effortless. Here’s how this revolution is unfolding.

- Fast and Affordable Money Transfers: Modern platforms like Western Union Digital and Remitly have revolutionised international remittances. Instead of waiting days for money to arrive, transfers can now happen in minutes — and at a fraction of traditional banking fees. Today, sending money to family, friends, or businesses abroad has become remarkably seamless. Take Remitly, for instance — instead of waiting three days for a traditional bank transfer from India to the US, funds can now arrive within hours and at significantly lower costs. It’s convenience redefined.

- Effortless Payment Collection for Businesses: For MSMEs, time is money. The new-age platforms like Cashfree enable small exporters and freelancers to collect international payments quickly, without drowning in paperwork or surprise deductions. Previously, a small exporter in India might struggle with complex paperwork and hidden charges while receiving money from abroad. With the help of such platforms, a simplified dashboard, quick settlements, and clear fee structures mean businesses can focus on growth rather than compliance headaches.

- Smart Technology Behind the Scenes: API-based infrastructure has been a game-changer. It connects online stores directly with payment gateways, enabling real-time, secure transactions from anywhere in the world. For example, an online store in India can connect Cashfree’s API to its website, so any order from abroad is processed instantly and securely.

Artificial Intelligence is also stepping in — detecting and preventing fraud, automating compliance checks, and offering predictive analytics. They also help with regulatory checks, so businesses stay compliant with the law automatically. This not only enhances security but also helps businesses make smarter, data-driven decisions.

A few companies improve things further through digital transformation by further enhancing this ecosystem, enabling Multi-channel Integrations. Their Predictive AI helps businesses forecast trends, spot payment issues, and drive smarter business decisions.

- UPI Goes Global : The biggest breakthrough, however, comes from India’s beloved UPI (Unified Payments Interface). From local tea vendors to CEOs, everyone has embraced UPI as the go-to mode of payment. The era of the ‘Dada ka batwa’ — when cash was considered king — is long gone. Today, India’s UPI system has redefined convenience, proving that a simple scan or tap can replace the bulkiest wallet. Now, with international expansion underway, sending money from India to countries like Singapore could soon be as simple as scanning a QR code. The wallet of the future truly fits in your palm.

What Does This Mean for You?

Fintech has truly taken the stress out of moving money across borders. What was once a tedious, uncertain, and costly process has now become seamless, secure, and accessible to everyone.

Whether you’re sending money to support your family abroad, getting paid for freelance projects, or managing an export-import business, technology has made the experience dramatically smoother. Transactions that once took days now happen in hours or even minutes. Currency conversions are more transparent, tracking is real-time, and hidden charges are slowly becoming a thing of the past.

The Road Ahead

What began as a convenience is now becoming a catalyst for economic empowerment. As governments, regulators, and fintech pioneers continue to collaborate, the dream of borderless money movement is turning into a tangible, transformative reality. The future of cross-border payments isn’t just about speed — it’s about trust, accessibility, and inclusion. The future of finance is not just digital — it’s democratic, inclusive, and undeniably global.

A new era of financial freedom is unfolding — one transaction at a time.

Must have tools for startups - Recommended by StartupTalky

- Convert Visitors into Leads- SeizeLead

- Website Builder SquareSpace

- Run your business Smoothly Systeme.io

- Stock Images Shutterstock