Register your Business for MSME in 9 Simple Steps

loan proposal

MSME (Micro, Small and Medium Enterprise), loans are mostly offered to start-ups and small business owners. In this intense moment of lockdown, many startups and small businesses are incurring a huge loss, the government offered assistance by rolling out MSME loans for startups and small business owners. After this news, many startups and small business are working hard to get there business registered to this loan.

What is MSME Loan?

MSME loan is an unsecured loan defined by the Indian Government and RBI, that is provided by various financial firms to startups and small businesses on a short term basis.

You are eligible for this loan if Your business is involved in either of the two classes—the manufacturing or service sector.

For investments in the manufacturing sector:

- Micro – Less than Rs.25 lakh

- Small – More than Rs.25 lakh and less than Rs.5 crore

- Medium – More than Rs.5 crore and less than Rs.10 crore

For investments in the service sector:

- Micro – Less than Rs.10 lakh

- Small – More than Rs.10 lakh and less than Rs.2 crore

- Medium – More than Rs.2 crore and less than Rs.5 crore

Financial Documents Required

- Identity proof (PAN card, Aadhaar card, Voter’s ID, passport, etc.)

- Residence proof

- Business address proof

- Balance sheets for the last three years

- Income tax returns

- Sales tax returns

- Projected balance sheets

- Project report

- Photocopies of title deeds/lease deeds offered as primary and collateral securities

Here’s some information you may be asked to include in your application form for an MSME loan:

- Application date

- Name of the enterprise

- Registered office address

- Address of the factory or shop

- If the enterprise belongs to SC/ ST/ OBC/Minority community

- Telephone number

- E-mail address

- Mobile number

- PAN Card number

- Constitution (proprietorship, partnership firm, private limited company, limited company, cooperative society)

- Date of establishment

- State where the business is located

- Branch where the business is located

- Name of proprietors or partners or directors along with their age, academic qualification, address, telephone number, and experience

- Existing activity

- Name of associate concerns and nature of the association

- Mention the existing credit facilities, if any

- List out the proposed credit facilities

How to Apply for an MSME Loan in 9 Simple Steps

- Visit udyogaadhaar.gov.in website. This is a national portal for registration of Micro, Small & Medium Enterprises.

- Fill in the information like Aadhaar number, Name of the Entrepreneur. Once you enter all the details click on validate and generate OTP.

3. You will receive an OTP on your mobile number which is linked to your Aadhaar card. After you enter the OTP click on validate and an Application form will appear.

4. Fill in your personal and professional Details.

5. After Registering Different types of loans will be shown. Click on apply Now on the loan you require for your business.

6. Once you enter the loan amount Fill in information about your business to proceed further

7. Fill in your personal information

8. Attach the Documents Required such as Aadhar card, Address proof, KYC etc.

9. Once you complete the process, a Declaration form will Appear. Click Agree on declaration form and you will be successfully registered for MSME loan.

An application number will be provided to you keep that application number for further reference.

Also read:

How to Pitch Investors for your Business | Mistakes to Avoid

Now two enterprises fall under the MSME category:

According to the Micro, Small and Medium Enterprises Development (MSMED) Act, 2006 enacted by the Government of India, the Micro, Small & Medium Enterprises (MSME) are categorized into 2 classes – Manufacturing and Service Enterprise.

Enterprises with Rs 1 crore investment and Rs 5 crore turnover would now qualify as micro enterprises.

Businesses with an investment of less than Rs 10 crore and turnover less than Rs. 50 crore will now be classified as small enterprises.

The definition for medium enterprises has been revised upwards to an investment of Rs 50 crore and a turnover of Rs 250 crore.

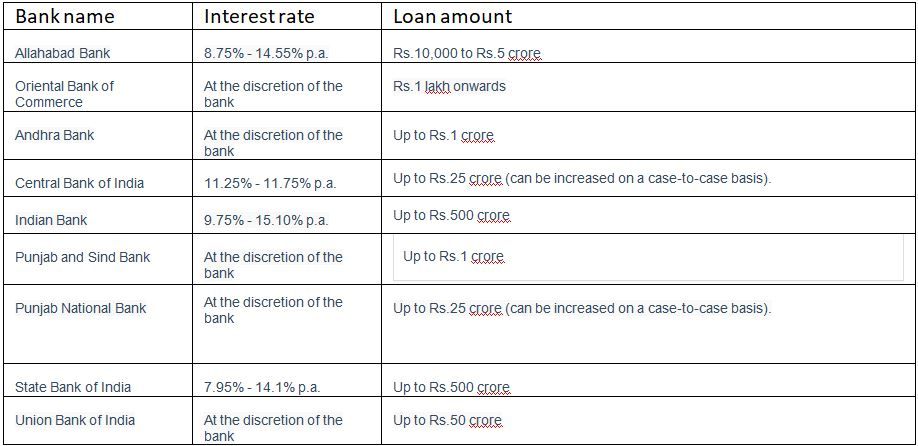

Top Banks offering loans with interest rates

FAQ About MSME

Do all banks offer MSME loans?

All private and public sector banks in India have objectives prescribed by the Reserve Bank of India (RBI) for lending to the MSE sector. Under these guidelines, domestic stated commercial banks (except small finance banks and regional rural banks) and foreign banks with more than 20 branches will allocate 7.5% of their Adjusted Net Bank Credit (ANBC) or credit equal to the amount of off-balance sheet exposure, to the micro enterprises sector.

I am an MSME entrepreneur. Will banks extend any guidance to me besides offering me a loan?

Yes, entrepreneurs in the MSME sector can avail the listed services offered by banks:

- Financial literacy and consultancy support

- Rural Self Employment Training Institutes (RSEITs)

What happens if I fail to make the payment for my MSME loan on time?

In cases where the buyer is incapable to pay the supplier, he/she shall be liable to pay compound interest with monthly rests to the supplier on the amount from the appointed day or on the agreed day, at 3 times the bank rate declared by the RBI.

Are there any guidelines laid down by the RBI regarding interest rates on MSME loans?

Yes, RBI has advised all banks to rate the interest rates on MSME loans only regarding the base rate to enhance transparency in lending rates.

This was your complete guide about MSME, if you have any further query you can visit your nearest bank branch and inquire about MSME.

Must have tools for startups - Recommended by StartupTalky

- Convert Visitors into Leads- SeizeLead

- Website Builder SquareSpace

- Run your business Smoothly Systeme.io

- Stock Images Shutterstock