How Policy And Innovation Together Can Unlock Financial Access for Women-Led MSMEs

✍️ Opinions

This article has been contributed by Neha Juneja, Co - Founder, IndiaP2P & EquiRize

Women-led micro, small and medium enterprises (MSMEs) are central to livelihoods and local economies across India. Yet while policy attention has intensified, many women entrepreneurs still operate at the smallest end of the enterprise spectrum, the so-called nano and micro segments, where product–market fit for conventional credit is weak. Closing that gap requires a pragmatic combination of policy, product design, and capital-market innovation.

The Scale and Shape of the Opportunity

India’s MSME sector remains large and structurally skewed toward the smallest firms. Recent policy analysis reiterates that MSMEs account for roughly 29–30 per cent of GDP. More recent ASUSE/ASUSE-style estimates put the number of unincorporated establishments in 2023–24 at ~7.34 Cr. while as of February 2025 th eUdyam Portal boasts an impressive total of 5.93 Cr. registered MSMEs with a vast majority being micro-enterprises.

These enterprises are critical employers and exporters, but the register is dominated by micro and nano firms, with micro units making up the vast majority of registered enterprises. This skew is important because it means policy and finance interventions that target small-scale enterprises at scale will disproportionately shape the sector’s trajectory.

Who are Nano Enterprises and Why They Matter

Nano enterprises are the smallest, often informal, business units: single/few-person shops, home-based producers, kiosk vendors, and similar low-turnover activities. They are not a formal legal category within the MSME Act, but multiple field studies and policy papers treat them as a distinct segment, typically firms with turnover well under INR 1 crore and very limited fixed assets. Formalizing and financing these enterprises is not merely an inclusion exercise; it addresses the largest reservoir of productive activity in the economy. Estimates of India’s unincorporated non-farm MSMEs remain large (the NSS and subsequent analyses point to tens of millions of enterprises), and policies that reach this cohort can have outsized employment and livelihood effects.

What We Know About Financing Nano and Women-Led Enterprises

A growing body of research shows that access to even small, well-designed credit can increase resilience, enable inventory and equipment investments, and, in many cases, raise earnings for nano entrepreneurs. Longitudinal evaluations commissioned by philanthropic partners and conducted by research institutions have found positive impacts from tailored credit products, while also highlighting the limits of simply transplanting standard microfinance or business-loan models into this segment. These studies underline that product cadence, repayment flexibility, and non-financial support matter as much as loan size. IFMR LEAD’s evaluation reports average increases of ~25% in monthly turnover and ~27% in profits between baseline and endline; enterprises reported a 16% increase in employment, and 9% of enterprises hired staff after credit access. These are India-specific, micro-level impact estimates showing that credit can move outcomes when products fit the segment. These numbers are a clear indicator for policy makers and investors to further deepen their exposure to this segment.

Why Women-Led Firms Deserve Targeted Attention

Women entrepreneurs, especially those running nano enterprises, face constraints that differ in degree and kind from male-run firms: limited collateral, archaic consent requirements sought by lenders from male family members, mobility constraints, and constrained networks for market access and inputs. At the same time, evidence frequently shows disciplined repayment behavior and measurable household spillovers when women control enterprise income. In fact, despite lower incomes and much lesser proportion of formal incomes, Indian women tend to have higher credit scores than men levelized for all income profiles. Those twin facts, heightened constraint plus strong credit discipline, argue for deliberate product and delivery design rather than a one-size-fits-all approach.

The results of supporting this sector are a big positive for the overall economy and evidenced frequently. For instance conservative estimates suggest women-owned small establishments employ ~22–27 million people i.e. cover nearly 10% of all Indian households.

SIDBI and other analyses estimate the overall MSME credit gap at ~INR 30 lakh crore (INR 30,00,000 crore) and highlight that the gap is higher for women-owned enterprises (estimates often state ~35% higher credit shortfall for women-owned firms) — i.e., women-owned MSMEs face a significantly larger financing shortfall

The Role of Policy: Stability, Incentives, and Data

Policy matters in three interlocking ways. First, regulation provides stability and consumer protection that can enlarge private capital flows when it is predictable and proportionate to risk. Second, targeted incentives, whether priority sector carve-outs, digital ID and KYC streamlining, or procurement set-asides, can lower the cost of outreach and underwriting. Third, public digital infrastructure (GST data, digital payment trails, Aadhaar-linked records) creates the verifiable data that makes small-ticket credit underwritable at scale. Recent government analyses and policy frameworks stress these levers and point to the need for calibrated, segment-specific instruments that recognize nano enterprises’ scale and informality. Such as a 7.5% ANBC sub-target for lending to micro-enterprises is part of the PSL architecture, which helps mobilise formal bank lending to very small units if banks choose to meet it through MSE lending.With digital transactions and number of GST registered taxpayers growing, acceleration of credit is expected.

Product Design and Delivery: What Works

Experience from field pilots and program evaluations suggests several practical design principles:

- Offer smaller ticket sizes with repayment schedules timed to cash-flow cycles. Include elements of gender-intelligence in the design.

- Use alternative data (digital transaction histories, merchant receipts, e-commerce logs, mobile payment patterns) to build credit signals where traditional documentation is absent.

- Combine credit with low-cost business support such as digital onboarding, bookkeeping templates, and market linkage facilitation to improve loan performance and uplift incomes.

- Leverage agent networks and local points of service to address mobility and more importantly validation of business and income profiles. It may be said that phygital models have seen the most commercial success in this segment.

These features reduce unit economics friction and make small loans administratively viable for lenders while improving uptake by women entrepreneurs.

Capital Mobilisation: Blending Sources and Sharing Risk

Bridging finance gaps at scale requires diversified capital structures and while the overall credit gap in the Indian economy is large women entrepreneurs further face an additional 35% gap per SIDBI estimated. Herein, institutional capital can scale proven products; and retail or quasi-retail channels (fractional credit products, P2P Lending) can broaden the investor base. Structured finance vehicles and first-loss buffers, when transparently governed, can attract mainstream capital into small-ticket loans without offloading borrower risk.

Implementation Risks and Trade-Offs

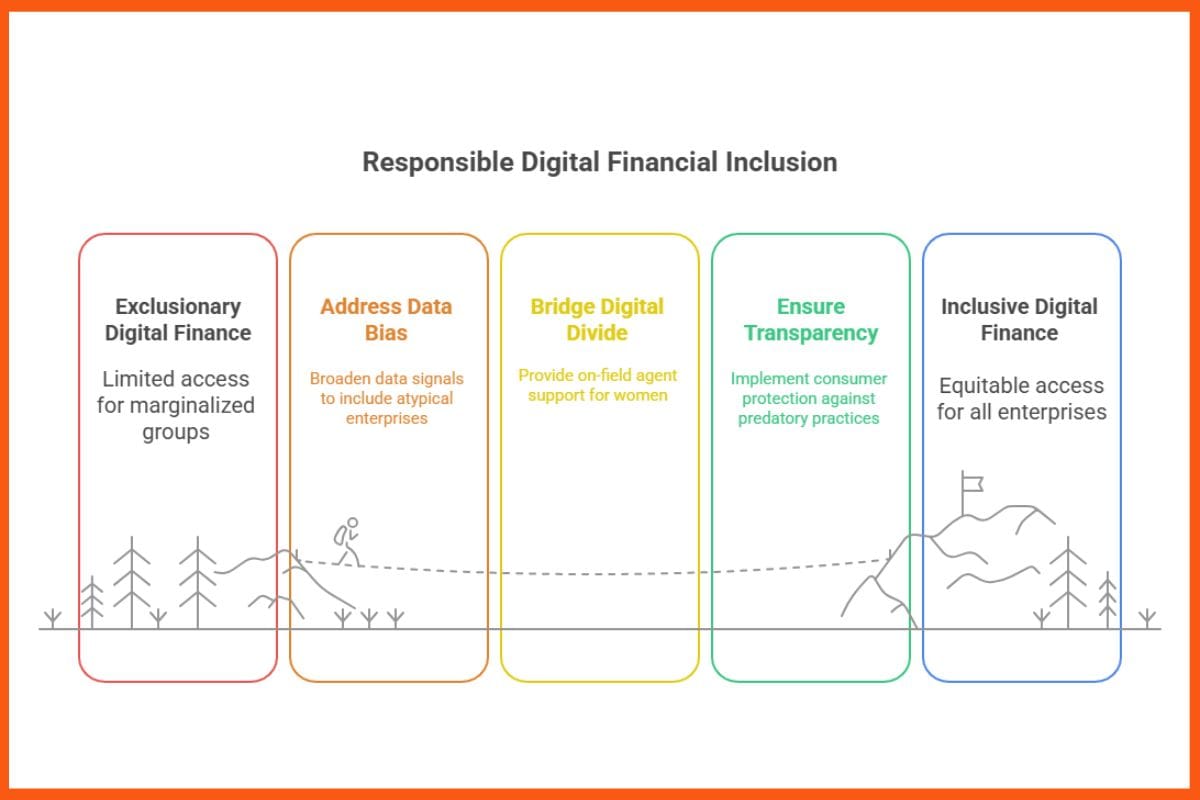

Three practical cautions are worth naming. First, standardisation drives efficiency but can exclude atypical enterprises; over-reliance on narrow data signals risks false negatives. Second, digital journeys reduce costs but can worsen access gaps for digitally marginalised women unless complemented by on-field agent support (lesser women have access to smartphones and digital tools than men). Third, scaling must preserve transparency and consumer protection to avoid over-indebtedness or predatory pricing. Interventions by RBI in the last 24 months have been aimed at controlling the latter 2 factors indicating that such sector-wide tendencies persist i.e. policy and market designers should treat these not as obstacles but as governance constraints to be actively managed.

A pragmatic roadmap

For policymakers and market actors seeking measurable gains, the near-term agenda is straightforward: recognise nano enterprises in policy frameworks; invest in interoperable data (GST-grade verification and payment flows) that support micro-underwriting; subsidise product R&D and first-loss facilities to demonstrate viability; and pair credit with digitally scalable non-financial supports. These steps, taken together, shift the problem from “how to serve” to “how to scale responsibly.”

Must have tools for startups - Recommended by StartupTalky

- Convert Visitors into Leads- SeizeLead

- Website Builder SquareSpace

- Run your business Smoothly Systeme.io

- Stock Images Shutterstock