How Rural Entrepreneurs Are Embracing Digital Finance for Growth

✍️ Opinions

This article has been contributed by Mr. Amit Nigam, Executive Director & CEO of FindiBANKIT

Every financial inclusion initiative in India has followed the same playbook: build the infrastructure, expand the bank branches, deploy more ATMs, create better apps, and adoption will follow. Yet for decades, rural India remained stubbornly underbanked.

Unfortunately, the assumption was wrong. Rural communities don't lack access to technology, but rather lack access to trust.

This is why a shopkeeper in Madhya Pradesh who starts offering digital banking services achieves more adoption in six months than a bank branch manages in six years. The difference isn't the technology. It's that rural India operates on principles of trust and familiarity, where local entrepreneurs understand that the critical infrastructure isn't physical or digital, it's social. When a trusted shopkeeper becomes a financial services provider, adoption barriers that have hindered banks for decades dissolve within months.

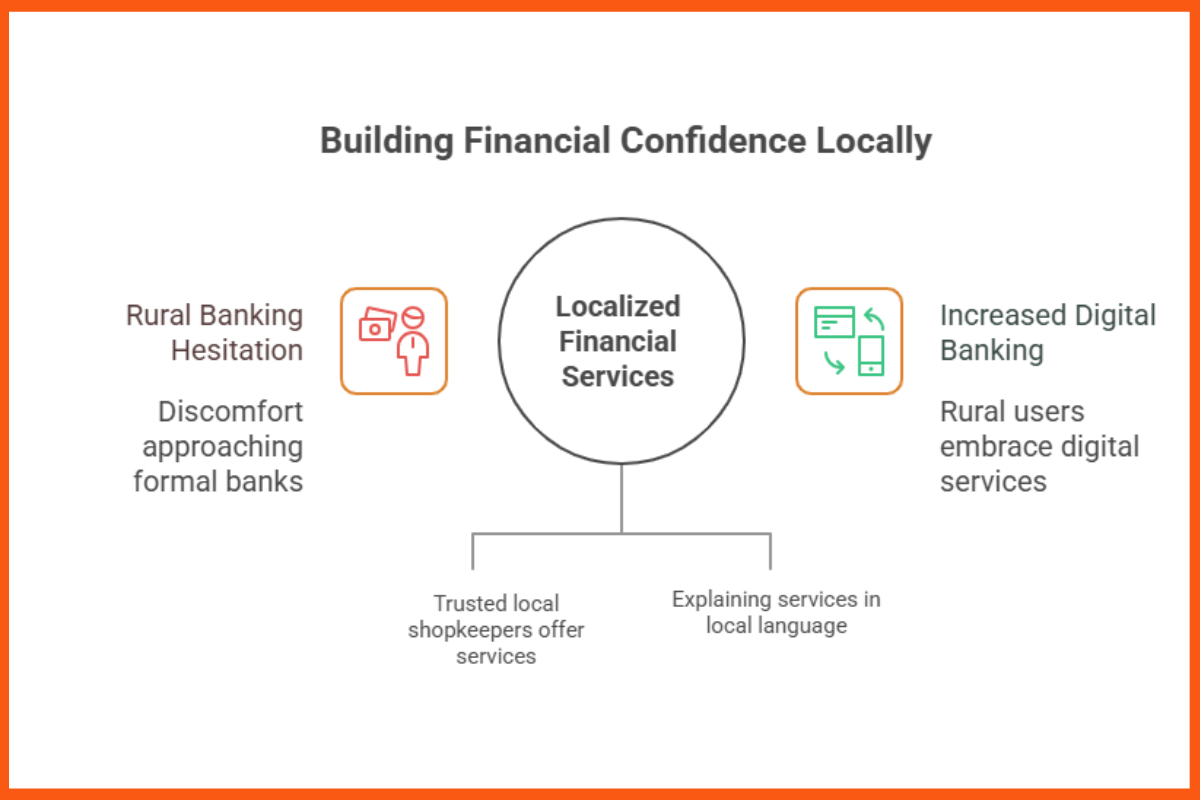

Building Financial Confidence

For decades, formal banking meant long journeys to the nearest branch, endless queues, and paperwork that felt designed to exclude rather than include. Operationally, it meant dealing with strangers who spoke a different language, literally and culturally. Banks built their legitimacy on marble floors and formal procedures. While such formality often appeals to urban customers, it tends to create a quiet hesitation among rural visitors—an underlying fear or discomfort when approaching banks for their financial needs. But it is changing now. A shopkeeper in Madhya Pradesh or a small business owner in Bihar can now offer services that were once the exclusive domain of banks, i.e., money transfers, bill payments, cash withdrawals, and even insurance products. What makes this shift remarkable is the trust it generates when delivered by someone from within the community.

People need to feel confident about using digital services, and that confidence grows when the person explaining an AADHAR-enabled payment system or offering Insurance services speaks their language, understands their hesitations, and has earned their trust over years of serving the neighborhood. This localized approach has proven more effective than any marketing campaign. According to recent data, rural and semi-urban India now represents over 57% of new digital banking users, a dramatic increase driven largely by these grassroots entrepreneurs.

The Economics of Empowerment

This raises an important question. What draws someone to become a digital finance entrepreneur? The answer is straightforward, it offers sustainable income with dignity. Unlike traditional employment that might require migration to cities, this model allows people to build businesses within their own communities. Commission structures, when transparent and fair, provide steady earnings. More importantly, the work commands respect. When villagers line up at someone's outlet for assistance with government benefit transfers or to check their Jan Dhan account balances, that entrepreneur becomes an essential community resource.

Consider the ripple effects. A woman in some rural area who starts offering digital banking services earns for herself while also enabling others to participate in the formal economy. Farmers can receive crop insurance payouts directly. Daily wage workers access their MGNREGA payments without intermediaries. Senior citizens can check pension deposits without traveling. Each transaction might be small, but collectively, they represent economic dignity for thousands who were previously dependent on distant banks or exploitative middlemen.

Navigating Real Challenges

Yet, this transformation hasn't been without friction. The path to success faces three persistent challenges that shape the daily reality of rural digital finance, starting with limited digital literacy among customers, language barriers in technology interfaces, and initial skepticism about the safety of digital transactions.

Successful entrepreneurs adapt by becoming educators. They walk customers through each step, explain security features in simple terms, and build trust through consistency. Government initiatives like the Pradhan Mantri Jan Dhan Yojana have created infrastructure, but it's these local champions who make the schemes functional rather than merely aspirational. They bridge the gap between policy and practice.

Recent studies show that a majority of rural users prefer accessing financial services through trusted local touchpoints rather than digital-only platforms, reinforcing the irreplaceable role of human intermediaries in India’s digital adoption journey.

Where Opportunity Meets Purpose

The growth of rural digital finance entrepreneurs represents something larger than financial inclusion statistics. It demonstrates a fundamental principle: technology doesn't disrupt trust-based systems. It amplifies them when deployed intelligently. These entrepreneurs have successfully created informal financial hubs where transactions happen alongside conversations, where doubts are addressed with familiarity, and where digital India becomes tangible and accessible. It also suggests that India's digital transformation in rural areas will not follow the urban blueprint of app-first, human-light services. It will be hybrid, relationship-heavy, and locally adapted.

The future of financial services in rural India won't be determined by the sophistication of algorithms or the speed of app downloads. It will be shaped by individuals who understand that technology is only as valuable as the human connection that delivers it. They're proving that meaningful economic change doesn't require abandoning tradition; it requires adapting it thoughtfully. One transaction, one customer, one community at a time.

Must have tools for startups - Recommended by StartupTalky

- Convert Visitors into Leads- SeizeLead

- Website Builder SquareSpace

- Run your business Smoothly Systeme.io

- Stock Images Shutterstock