How the Zomato revenue model evolved: A deep dive into its business strategy

From food discovery to a profitable ecosystem: The Zomato revenue model

Everyone in India knows Zomato. But its path to a massive ₹351 crore profit in FY24 wasn't just about dropping off your biryani. It’s a story of strategic pivots, scaling operations, and diversifying its business.

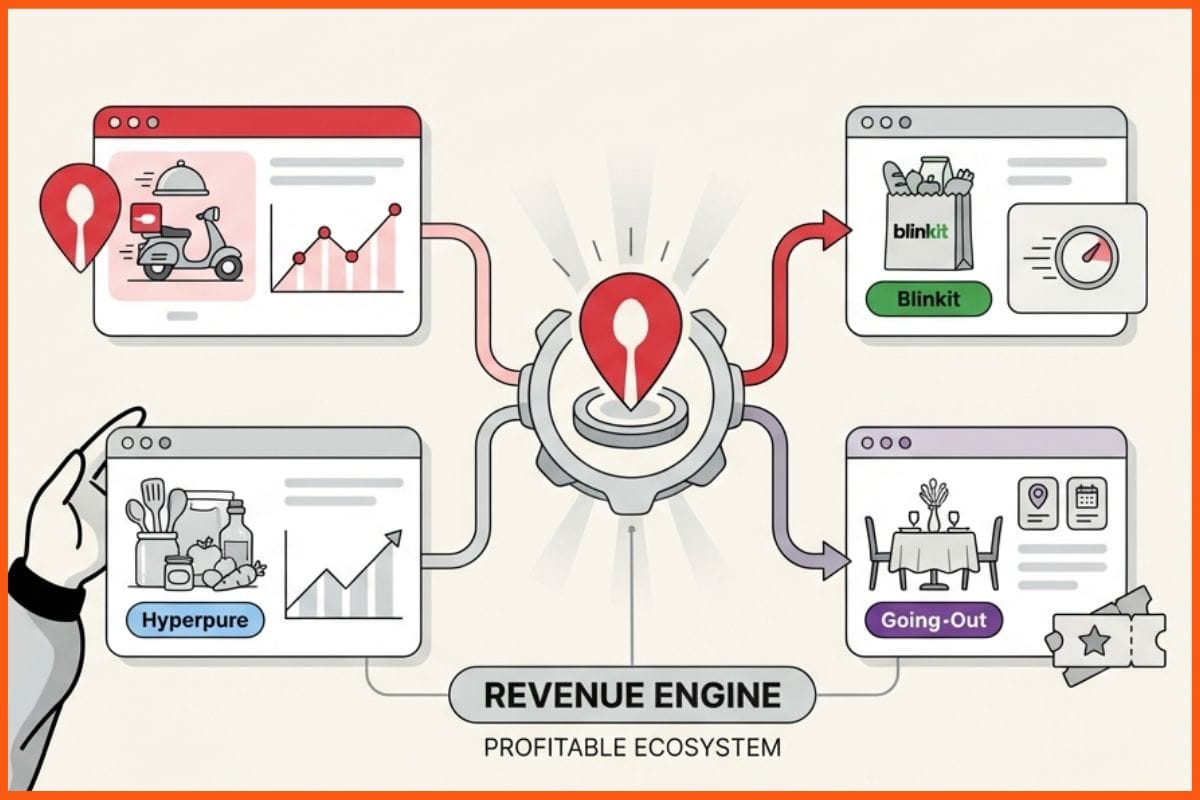

Let's break down how Zomato makes money and see how it pieced together such a strong, connected business. It’s not just one company; it’s an engine running on four main parts: food delivery, super-fast groceries with Blinkit, kitchen supplies for restaurants with Hyperpure, and its "going-out" arm for dining experiences. This whole setup now serves over 6.3 crore unique customers in more than 800 cities across the country.

Zomato’s shift from burning cash to making a profit is the kind of startup story we at StartupTalky have been covering for over 10 years. It’s these journeys that push the next generation of founders to dream bigger and build businesses that can weather any storm.

What is Zomato? A timeline of key milestones

It all kicked off in 2008 when Deepinder Goyal and Pankaj Chaddah started "Foodiebay." The idea was simple: put restaurant menus online so people didn't have to guess.

What started as a listing site grew quickly. By 2010, it was called Zomato, had gone international, and made the huge jump into food delivery. That move transformed it from a directory into the food-tech platform it is today, holding a massive 58% of the market share in India.

Along the way, Zomato made several strategic acquisitions. Buying Uber Eats' India business was a major step. The acquisition of Blinkit was a key strategic move. It positioned Zomato in the growing quick commerce market and paved the way for its next big growth spurt.

Deconstructing Zomato's business model

At its heart, Zomato runs a four-sided marketplace that connects users, restaurants, delivery partners, and B2B suppliers. This creates a network effect that adds a layer of defensibility to its business model. Let's look at the pieces.

- The B2C marketplace: This is the Zomato you use every day. It links over 6.3 crore users with a network of more than 300,000 restaurants. For users, it’s all about convenience. For restaurants, it’s a direct line to millions of potential customers.

- The hyperlocal delivery network: None of this would work without the logistical power of over 4 lakh monthly active delivery partners. This huge fleet is the engine that drives both food delivery and the fast-paced world of quick commerce.

- Quick commerce with Blinkit: Acquiring Blinkit was a key strategic move. Zomato now delivers over 30,000 products in just minutes from a growing web of dark stores. This is not a peripheral business; Blinkit became Adjusted EBITDA positive in March 2024 and is aiming for 1,000 stores by March 2025, showing just how central it is to Zomato's future.

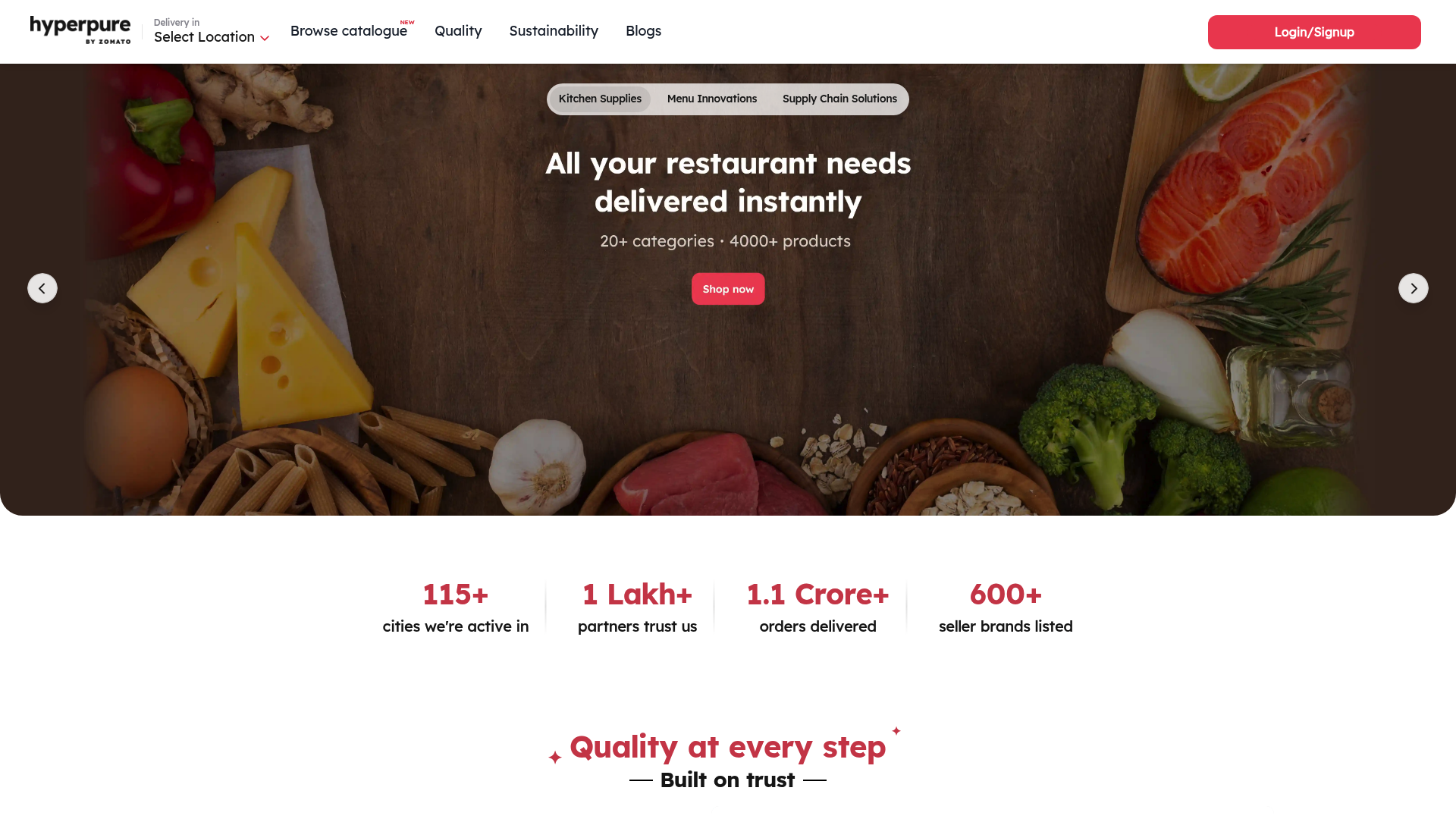

B2B supply chain with Hyperpure: Hyperpure is a key part of Zomato's strategy. Hyperpure is a B2B service that provides fresh ingredients and kitchen supplies to over 1 lakh restaurant partners. It makes the ecosystem stickier, as restaurants start relying on Zomato for their core supplies, not just for orders. This creates a strong and expanding B2B income stream.

Juggling a business with so many moving parts is a huge undertaking, and it's something we see in many of today's top startups.

A deep dive into the Zomato revenue model

So, how does Zomato actually make money from this complex setup? It’s not just one thing, but a mix of several income streams working in harmony.

Food delivery

This is the core of Zomato's business. The main source of income is the commission it charges restaurants on each order, which can be as high as 25% of the order value. This part of the business is a giant, bringing in ₹6,361 crore in FY24, which is 53% of the company's total revenue.

On top of that, Zomato adds delivery fees and a small platform fee to each order, paid by the customer. These charges help manage the high costs of logistics and have been key to making each delivery more profitable.

Restaurant advertising and promotions

With millions of people scrolling the app daily, Zomato owns some prime digital real estate. It cashes in on this by letting restaurants pay for more visibility. Over 12,000 restaurants advertise on Zomato using sponsored listings, banner ads, and better placement in search results. This is a high-margin business that leverages the platform's large user base.

Subscriptions: Driving loyalty with Zomato Gold

Zomato Gold is the company's tool for keeping customers coming back. For a regular fee, subscribers get benefits like free delivery on orders over ₹199 from nearby places and up to 30% extra off at more than 20,000 partner restaurants. The idea is simple: get people to order more often, lock in your most valuable customers, and create a steady, recurring income stream.

Hyperpure: The B2B powerhouse

Hyperpure demonstrates Zomato's ecosystem strategy in action. This B2B division makes money by selling quality ingredients and kitchen supplies directly to its network of over 1 lakh restaurant partners. Its growth has been significant, with revenue shooting up 111% year-over-year in FY24.

Here's an interesting tidbit: over 60% of Hyperpure's revenue now comes from businesses that aren't restaurants, mostly by supplying products to sellers on Blinkit. This creates an internal synergy that strengthens both platforms.

Blinkit: Quick commerce

Blinkit represents Zomato’s entry into the future of retail. It earns money from the markup on groceries and other items sold from its dark stores, plus any delivery fees. Just like Hyperpure, its revenue growth has been significant, with revenue more than doubling in FY24. Reaching Adjusted EBITDA profitability in March 2024 was a major milestone, proving that the quick commerce model can work financially.

Going-out: Dining and live events

Beyond just delivery, Zomato is also getting into the "going-out" scene. This area includes services for dining out, like table reservations and Zomato Pay, plus live events through Zomato Live. While it's smaller than the other parts of the business, it's growing quickly, with revenue up by 51% YoY in FY24. This shows Zomato wants to own the entire food experience, from your couch to a night out.

| Revenue Stream | How it Works | Target | Strategic Importance |

|---|---|---|---|

| Food Delivery | Commission on orders + platform & delivery fees. | Restaurants & Customers | Core revenue driver (53% of FY24 revenue). |

| Advertising | Paid placement and banners for restaurants. | Restaurants | High-margin monetization of platform traffic. |

| Subscriptions (Gold) | Recurring fee for user benefits like free delivery. | Customers | Increases loyalty and order frequency. |

| Hyperpure (B2B) | Margin on B2B ingredient and supply sales. | Restaurants & Blinkit Sellers | Deepens ecosystem integration; high-growth B2B arm. |

| Blinkit (Q-Commerce) | Margin on grocery/essentials sales + delivery fees. | Customers | Key future growth driver; achieved profitability. |

| Going-Out | Fees for dining-out services and event ticketing. | Restaurants & Customers | Diversification into experiences. |

The financial story: The journey to profitability

To really get Zomato's success, you need to know the difference between Gross Order Value (GOV) and Revenue. GOV is the total value of everything sold on the platform, while revenue is the slice Zomato gets to keep (like commissions and fees).

For a long time, Zomato was known for prioritizing growth, which involved significant cash expenditure. However, this has changed. The FY24 results were a turning point: revenue from operations jumped 71% year-over-year to ₹12,114 crore. More importantly, the company went from a loss of ₹971 crore in FY23 to a profit of ₹351 crore in FY24 (source: Zomato Annual Report).

Of course, the company still faces challenges. The company competes with Swiggy, deals with high operational costs, and has to carefully balance discounts to keep customers in a market where everyone is looking for a deal.

Turning a profit after years of losses is a huge moment for any startup. Following these financial turning points and funding stories is a core part of what we do at StartupTalky and in our articles. We aim to give the startup community a clear, data-backed picture of how the ecosystem is doing.

For a more detailed visual explanation of how these different business segments work together to create a profitable company, check out the video below. It offers a clear breakdown of Zomato's journey and its complex revenue streams.

Embedded iFrameThis video from Pavan Sathiraju explains the different revenue streams of Zomato, including food delivery, Blinkit, and Hyperpure.

The cost of convenience: A breakdown for every stakeholder

All this convenience has a price. Let's break down the costs for everyone in the Zomato world.

- For Customers: The app is free, but the costs can add up. You'll usually pay a delivery fee, a platform fee, and taxes on each order. If you order a lot, you can opt for the Zomato Gold subscription, which gives you perks like free delivery on certain orders.

- For Restaurants: The cost structure for restaurants can be significant. Restaurants pay a big commission, sometimes up to 25% of the order's value. But that’s not all. Some restaurant owners report there's also a 1.84% payment gateway fee, a ₹35 flat delivery fee for longer distances, and even fines if their app prices don't match their in-store menu (source: Reddit discussion). For some small businesses, these fees can take over 37% of their revenue from an order before they even pay for ingredients.

- For Delivery Partners: The gig economy model means delivery partners are a flexible cost. They're typically paid based on a mix of things like distance, time, and performance bonuses. This pay structure is a major part of Zomato's operating costs.

Key lessons from the Zomato revenue model

When you step back, Zomato's business is a great example of how to diversify and build a deeply connected ecosystem. It has successfully transformed from a simple app into a tech platform that has a hand in every part of the food industry.

For entrepreneurs, Zomato's journey offers a key lesson: building multiple, synergistic revenue streams can lead to a more resilient business model. This involves market adaptability and the strategic willingness to pivot from restaurant listings to food delivery, and then again to quick commerce and B2B supplies.

Zomato's story is an example of building a resilient, scalable business in India. For founders who want to create their own legacy, understanding these kinds of strategic shifts is essential. At StartupTalky, we've been telling the stories of India's most innovative startups for over fifteen years.