How Value-Maximizing, Customer-Centric Rewards Are Reshaping Credit Behavior in 2025

✍️ Opinions

This article has been contributed by Jvalin Sethi, Co-Founder & Director, Tiger FinTech

India’s payments stack has made the act of spending almost invisible. The new contest is for value clarity.

In 2025, Indian cardholders are not swayed by theatrics or teaser vouchers so much as by whether a product can tell them in seconds what they will tangibly gain from everyday use. The shift shows up in the numbers as much as in sentiment. India closed FY25 with roughly 110 million credit cards outstanding, expanding at about 14% CAGR over the last three years, while annual spend per card rose from ~INR 1.32 lakh in FY22 to ~INR 1.92 lakh in FY25. At the same time, co-branded propositions have moved from novelty to norm, with about 46% of urban, online-savvy respondents reporting at least one co-branded card in their wallet. Together, these signals point to a market consolidating share with products that deliver visible, repeatable value rather than sporadic thrills.

Rails Are Ready; Value Design Is the Differentiator

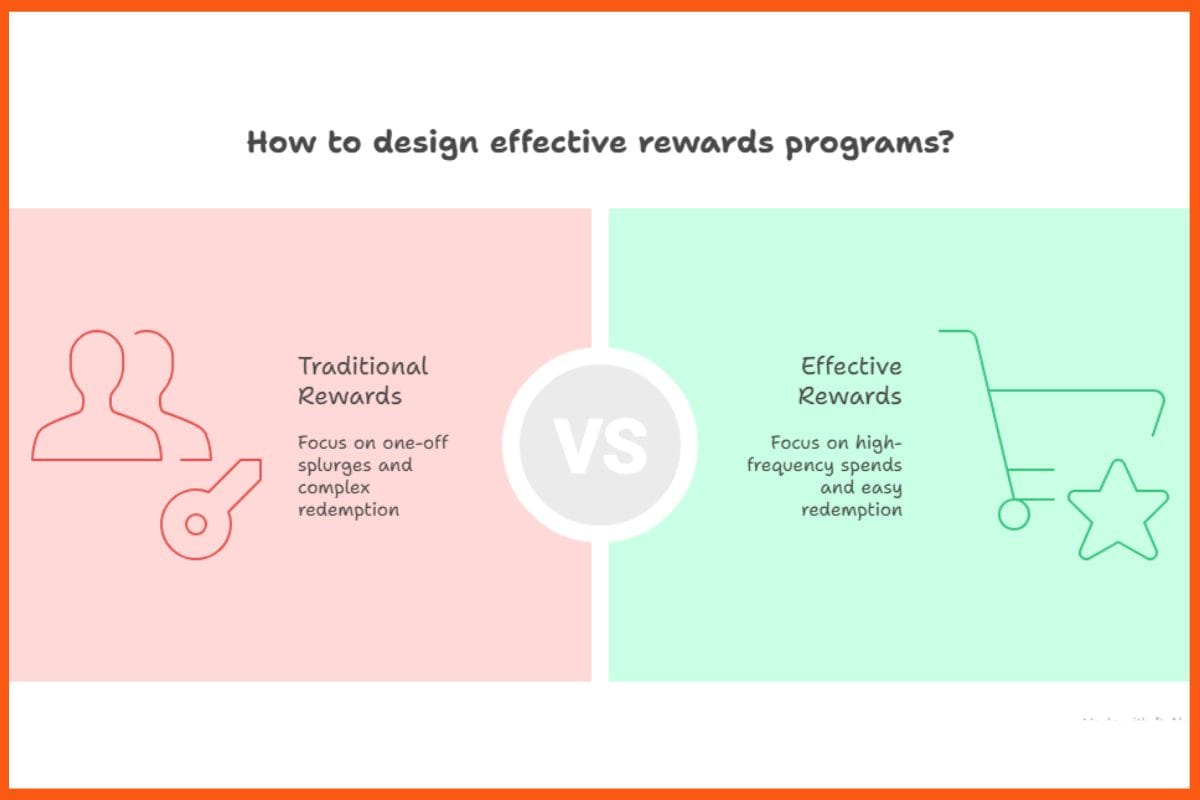

UPI normalized instant, reliable payments. Consumers now expect the same legibility from rewards. That means rupee-denominated meaning, not catalog arithmetic. Products that keep earn-and-burn mechanics simple, present relevant categories that mirror monthly budgets, and convert earnings into cash-equivalent outcomes without hoops are the ones moving to top-of-wallet.

The opposite is also true. Rotating exclusions, opaque point valuations, and redemption friction suppress engagement even when headline rates look attractive. In a world benchmarked by speed, value needs to be computable at a glance and redeemable without ceremony.

What Effective Rewards Look Like In Practice

The most effective constructs in 2025 share a family resemblance. They privilege predictability over puzzles. They map accelerators to high-frequency spends such as groceries, mobility, utilities, fuel, and mainstream e-commerce instead of pushing users toward one-off festival splurges. They surface progress in real time so a user knows where they stand against caps before frustration sets in. And when it’s time to use the benefit, redemption behaves like a payment method rather than an obstacle course.

When these conditions hold, the market’s macro indicators growing cards-in-force alongside rising per-card spend make sense. Consumers concentrate their activity on fewer products that consistently reduce their monthly outlay.

Co-Brands: From Logo Placement to Everyday Fit

With co-brands already widespread among digital urban users, the question is no longer whether to partner but how deeply the partnership aligns with routine life.

The successful models reduce an individual’s real monthly spend where it regularly occurs, not at the margins. That implies fewer categories executed well and tighter integration at checkout. It also means straightforward policies on returns and refunds that respect the promise of the reward, and offers that adjust to context rather than living only in campaign windows.

When partnerships meet that bar, value becomes visible at exactly the moment a user decides how to pay, reflecting why co-branded ownership is already mainstream among urban online users.

Responsible Rewards Encourage Responsible Credit

A common concern is that richer rewards might fuel overconsumption. In practice, design choices can nudge the opposite. When accelerators sit on essentials and caps are sensible rather than provocative, users are more likely to spend within plan. When apps provide gentle, timely cues before a cap resets, before a billing cycle closes redemption becomes timely rather than aspirational. Clear disclosures around fees, EMI terms, and utilization support the same outcome. The reward becomes a tool for planning rather than a trigger for impulse.

Compliance-by-Design, Trust by Default

Trust is increasingly a function of product experience, not just policy manuals. Journeys that embed consent capture, auditable trails, and liveness checks where necessary reduce complaints and redesigns later. Unambiguous terms do the same.

As supervisors continue to emphasize transparency and fairness, the simplest path to alignment is to bake clarity into mechanics: straightforward earn rates, visible caps and timelines, cash-equivalent redemption where promised, and reversals that don’t penalize diligence create fewer disputes and better unit economics.

Designing for Bharat, Not Only Metros

The next tranche of growth will come from users whose devices are modest and whose bandwidth is intermittent. Language preferences will extend beyond English. Rewards must survive those realities. Interfaces should degrade gracefully and support offline-first capture with reliable sync.

Simple and plain language explanations that feel native rather than stiff or translated wording, it reaches more people. Products that only work smoothly for the top decile will underperform where the broader market is headed.

Execution: Measure What Changes Behavior

If payments aim to be instant, simple, and universal, rewards should aim to be clear, predictable, and usable. That calls for operational metrics that go beyond issuance counts. Time to first redemption says more about product-market fit than time to issuance.

Redemption rates and breakage by cohort reveal where friction lives. Share-of-wallet concentration shows whether everyday categories are doing their job. Complaint ratios tied to terms clarity highlight where rules confuse without improving risk outcomes. Processes that do not change a decision, duplicate fields, ambiguous exceptions, rules that add latency should be retired. The exception path should return to being the exception.

Where the Landscape Lands

With a larger base of active cards, faster growth, higher per-card engagement, and co-brands embedded in everyday life, 2025 is the year value becomes the product, not the promotion. The headline indicators ~110 million cards outstanding, ~14% three-year CAGR, per-card spends rising from ~INR 1.32 lakh to ~INR 1.92 lakh, and co-brand ownership at ~46% among urban online users all point in the same direction.

As consumers become more intentional, they reward propositions that respect their time and intelligence: rewards they can understand quickly, use easily, and rely on repeatedly. When value is designed this way, behavior follows. Spend consolidates, redemptions rise, and loyalty is earned rather than bought.

That is a healthier outcome for users, partners, and the credit ecosystem as a whole.

Must have tools for startups - Recommended by StartupTalky

- Convert Visitors into Leads- SeizeLead

- Website Builder SquareSpace

- Run your business Smoothly Systeme.io

- Stock Images Shutterstock