Manish Aggarwal of FINQY on Reinventing Vehicle-Backed Lending for Digital India

📝Interviews

StartupTalky presents Recap'25, a series of exclusive interviews where we connect with founders and industry leaders to reflect on their journey in 2025 and discuss their vision for the future.

In this edition of Recap’25, StartupTalky speaks with Mr. Manish Aggarwal, Founder and CEO of FINQY, on how the company redefined vehicle-backed lending by transforming Car Par Loan into a fully digital, AI-powered financial ecosystem. Drawing from over two decades of experience in sales, distribution, and lending, Aggarwal reflects on 2025 as a foundational year focused on speed, transparency, and partner empowerment across India’s evolving credit landscape.

He goes on to discuss how FINQY strengthened deep bank integrations, introduced AI-driven valuation and underwriting engines, and built a unified platform that seamlessly connects customers, dealers, DSAs, and financial institutions. The conversation explores shifting borrower behaviour toward secured, purpose-driven lending, the growing role of automation and predictive analytics in risk assessment, and the rising demand for embedded finance in the automobile ecosystem.

StartupTalky: FINQY has innovated with solutions like Car Par Loan. What were the key milestones or product developments your team achieved in 2025?

Mr Manish Aggarwal: 2025 was a defining year for us at FINQY. With Car Par Loan, we didn’t just build a lending product — we built a digital ecosystem that brings together customers, dealers, DSAs, and banks on one unified platform.

Some of the milestones that shaped our year include:

- Deep Bank Integrations: We advanced our partnerships with IDFC and Piramal, and several more are in progress. My vision is simple: a frictionless, end-to-end digital lending journey where customers can complete the entire process without unnecessary touchpoints.

- AI-Driven Valuation & Decision Making: We introduced intelligent valuation tools, savings & EMI calculators, and real-time eligibility engines. These have helped us compress decision-making timelines from days to minutes — something the industry has long needed.

- Partner & Dealer Portal: This is something I’m personally proud of. Having spent decades in sales and distribution, I understand the gaps that DSAs and dealers face. Giving them transparency, footfall, lead tracking, and payout visibility in one place has been a game-changer.

- Full-Cycle Customer Experience: We’ve moved beyond disbursal. We’re building an ecosystem where customers can compare options, evaluate impact, understand their financial posture, and make informed decisions — all in one click.

2025 set the foundation. The real acceleration begins now.

StartupTalky: How did customer behaviour and borrowing patterns change this year?

Mr Manish Aggarwal: From my vantage point — someone who has observed lending behaviour for over 25 years — 2025 marked a very clear shift in how customers think about borrowing:

- Digital Borrowing Became the Default: More than 70% of our users completed the loan journey without human intervention. This clearly validates that India is ready for digital-first lending at scale.

- Secured Lending Gained Serious Momentum: With interest rate fluctuations and economic uncertainty early in the year, consumers gravitated toward asset-backed products like Car Par Loan. They wanted:

- Higher eligibility

- Better pricing

- The ability to raise capital without disturbing cash flow

- Purpose-Driven Borrowing Replaced Consumption-Driven Borrowing: This is the most interesting behavioural shift. People are now using vehicle-backed loans for:

- Business expansion

- Education

- Medical needs

- Weddings

Borrowers today are far more strategic — they want the most efficient loan, not the fastest one.

StartupTalky: Which technologies made the biggest impact on efficiency, risk assessment, or customer experience in 2025?

Mr Manish Aggarwal: 2025 was the year when AI stopped being a buzzword and became mission-critical for us.

Key technologies that truly transformed our operations:

- AI-Driven Eligibility & Risk Engines: We built proprietary models that analyse vehicle value, customer behaviour, credit history, and cash flow patterns. This has brought accuracy, consistency, and precision into our decisioning.

- Automated Document Intelligence: With AI + OCR, we can now extract, validate, and process bank statements, RC details, income documents, and KYC instantly — significantly reducing manual intervention.

- Predictive Behaviour Models: These models help us personalise nudges, recommendations, and communication — improving conversions and delivering a more intuitive experience.

- Partner Portal Technology: Dealers and DSAs now work with unprecedented clarity. Lead tracking, commissions, payouts, and loan status updates are all available in real time.

In short, technology allowed us to deliver what modern lending must promise: speed, accuracy, and trust.

StartupTalky: What trends or challenges stood out in 2025?

Mr Manish Aggarwal: The year brought a unique combination of regulatory evolution, market shifts, and competitive pressures:

- Regulatory Focus Intensified: RBI’s enhanced guidelines around data privacy, customer consent, and digital lending nudged the industry in the right direction. At FINQY, we’ve always believed in compliant, transparent processes, so adapting came naturally.

- Rising Competition in Vehicle-Backed Lending: More players entered the space, but very few offered a complete digital experience. This pushed us to double down on simplicity and scalability.

- Higher Expectations from Partners: Having spent decades building distribution networks myself, I could clearly see how expectations had evolved — partners now demand real-time visibility and instant payouts. Our technology roadmap reflects that.

- Market Volatility: Uncertain economic cycles made secured lending more attractive — strengthening the relevance of Car Par Loan.

StartupTalky: What were the biggest operational or strategic challenges in offering vehicle-backed loans, and how did you address them?

Mr Manish Aggarwal: Three challenges stood out for us:

- Fragmented Ecosystem: Traditionally, banks, DSAs, dealers, and customers operate in silos. We solved this by building one integrated platform that brings the entire lifecycle — valuation, KYC, underwriting, and disbursal — into one clean flow.

- Inconsistent Vehicle Valuation: Used-car prices fluctuate widely across regions. Our AI-driven valuation platform improved consistency and eliminated underwriting mismatches.

- Balancing Speed with Compliance: In lending, you cannot compromise on either. With automated document processing, real-time validations, and API integrations, we managed to maintain both — speed and regulatory integrity.

StartupTalky: Looking ahead, which fintech segments or technologies will grow fastest in 2026?

Mr Manish Aggarwal: 2026 will be the year of embedded, intelligent, and personalised finance.

Here’s where I expect the most rapid growth:

- Vehicle-Backed Lending will pick pace as it’s secure, predictable, and accessible.

- AI-Led Underwriting will gain popularity as behaviour and asset-backed decision making is quickly becoming the norm.

- Embedded Finance in Automobiles will scale dramatically with financing options getting integrated into showrooms, digital car platforms, and marketplaces.

- Buy Now Pay Later for High-Value Repairs & Accessories will be the way to go as it is a category that’s ripe for innovation.

- Digital-First Insurance Distribution will find greater acceptability as its driven by transparency and comparability.

We’re aligning our product roadmap closely with these shifts.

StartupTalky: How will digital and asset-backed lending evolve in India over the next few years?

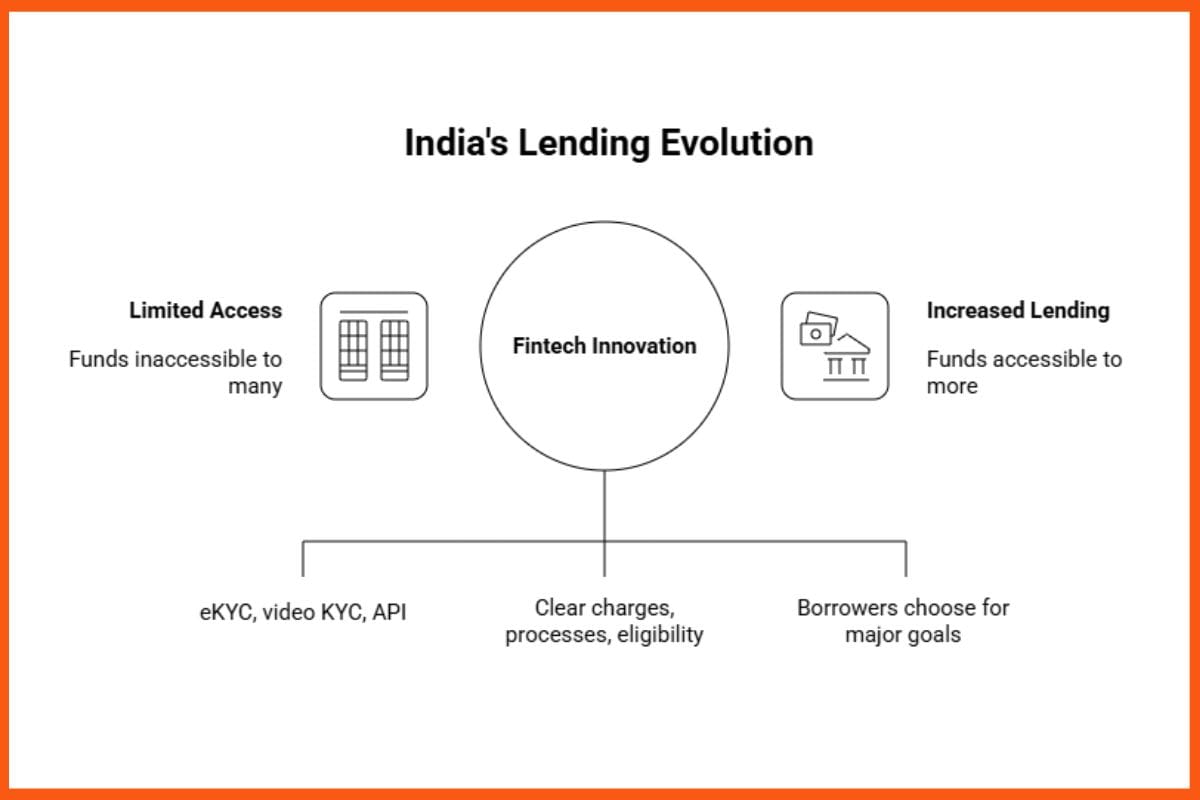

Mr Manish Aggarwal: India is entering the most exciting phase of its lending evolution.You will see evolution happening in the following areas:

- Accessibility: Customers across Tier 3 and Tier 4 markets will be able to access funds with unprecedented ease thanks to the eKYC, video KYC, and API-based verifications

- Transparency: Borrowers will demand more clarity on charges, processes, eligibility, and valuation. Fintechs who embrace transparency will win customer trust quickly.

- Adoption: As comfort levels rise, we’ll see more borrowers choosing asset-backed loans for major life and business goals.

At FINQY, our commitment is clear: Build lending that is fast, fair, and financially empowering — for every Indian.

Explore more Recap'25 interviews here.

Must have tools for startups - Recommended by StartupTalky

- Convert Visitors into Leads- SeizeLead

- Website Builder SquareSpace

- Run your business Smoothly Systeme.io

- Stock Images Shutterstock