Fi Money Sunsets Consumer Dreams for an Enterprise AI Future

Fi Money, a once-celebrated star in India's neo-banking firmament, is undertaking a significant strategic pivot, moving away from its consumer-facing financial products to focus on a B2B model centered on Artificial Intelligence. The move, announced by co-founder and CEO Sujith Narayanan in a recent LinkedIn post, comes amid mounting financial pressures, a shrinking workforce, and a challenging regulatory environment that has hampered the growth of the entire Indian neo-banking sector.

In his post, titled "On Change, Gratitude, and the Next Chapter of Fi," Narayanan acknowledged that while the company's ambition in the B2C space was right, "not every bet paid off the way we hoped." He stated that the leadership team's reflection pointed towards a new direction where the company consistently excels: "deep technology, AI, and building complex systems for startups & large enterprises alike." This shift, he explained, necessitates the sunsetting of some consumer products and will result in the elimination of several roles.

The Unraveling of the Neo-Bank Dream

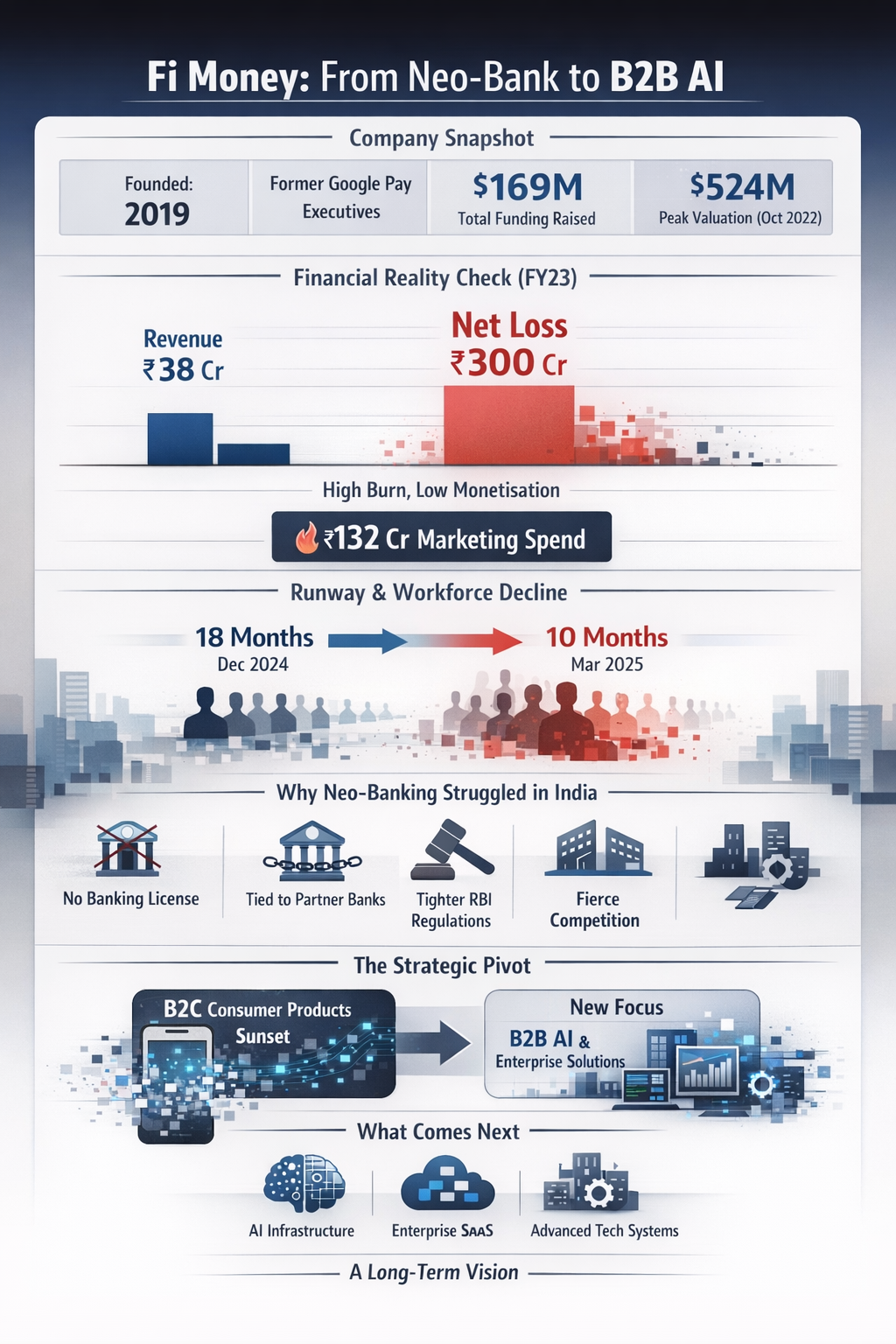

Founded in 2019 by former Google Pay executives Sujith Narayanan, Sumit Gwalani, and others, Fi Money (registered as Epifi Technologies) quickly captured the attention of top-tier investors. The company raised a total of $169 million across five funding rounds, backed by prominent names such as Ribbit Capital, Peak XV Partners (formerly Sequoia Capital India), Alpha Wave Global, and Temasek

Its post-money valuation peaked at $524 million in October 2022.

Fi aimed to revolutionize banking for India's digital-native millennials and Gen Z by offering a suite of services through a sleek mobile app. These included savings accounts (in partnership with Federal Bank), automated savings tools, expense tracking, and investment options. However, the path to profitability proved elusive.

Recent reports paint a grim financial picture. According to an in-depth analysis by Inc42, Fi Money's runway had dwindled from an estimated 18 months in December 2024 to just 10 months by March 2025. The company posted a net loss of ₹300 crore (approximately $36 million) on an operating revenue of just ₹38 crore (approximately $4.6 million) in the fiscal year 2023. This high burn rate was fueled by aggressive marketing spends, which reached ₹132 crore in FY23, to acquire users who ultimately had low lifetime value.

| Metric | Value | As Of |

|---|---|---|

| Total Equity Funding | $169M | Jul 2022 |

| Peak Valuation | $524M | Oct 2022 |

| FY23 Net Loss | ₹300 Cr | Mar 2023 |

| FY23 Revenue | ₹38 Cr | Mar 2023 |

| Employee Count | < 100 | Apr 2025 |

A Sector in Crisis

Fi's struggles are symptomatic of a broader crisis within India's neo-banking sector. These digital-only banks operate in a regulatory grey area, unable to hold a banking license themselves. They must partner with traditional banks, which limits their autonomy and creates a complex, multi-layered support structure that often frustrates customers.

Furthermore, the Reserve Bank of India (RBI) has introduced stricter regulations for digital lending, which has squeezed the primary revenue stream for many fintech players. The intense competition from both other venture-backed startups like Jupiter and Niyo, and the digital offerings of incumbent banks, has made it difficult for any single player to achieve sustainable differentiation and profitability.

As a result, the industry is witnessing a wave of consolidation and strategic shifts. Some players, like Slice and BharatPe, have pursued small finance banking licenses to gain more control over their operations. Fi's pivot to a B2B AI model represents another path, one that leverages its technological prowess while abandoning the challenging consumer market.

The Human Cost and the Road Ahead

The strategic realignment at Fi is not without its human cost. The company has seen significant layoffs, with its workforce shrinking from a peak of over 380 to fewer than 100 employees by April 2025. Narayanan's post acknowledged the difficulty of these decisions, stating, "Saying goodbye to many colleagues is never easy. We are committed to handling this transition with respect, clarity, and support".

While the B2C journey has ended for Fi, the company is betting its future on the enterprise space. By focusing on its core strengths in AI and deep technology, Fi hopes to build a lasting, profitable business. The transition marks a pivotal moment for the company and serves as a cautionary tale for the Indian fintech ecosystem, highlighting the immense challenges of building a successful consumer-facing financial services business in a highly competitive and regulated market.

Must have tools for startups - Recommended by StartupTalky

- Convert Visitors into Leads- SeizeLead

- Website Builder SquareSpace

- Run your business Smoothly Systeme.io

- Stock Images Shutterstock