MCX Gold Price Hits Fresh Record as Safe-Haven Rush Intensifies

MCX gold price surged to a new all-time high today, extending its relentless rally as investors doubled down on safe-haven assets amid global uncertainty, a weakening US dollar, and rising geopolitical risk premiums.

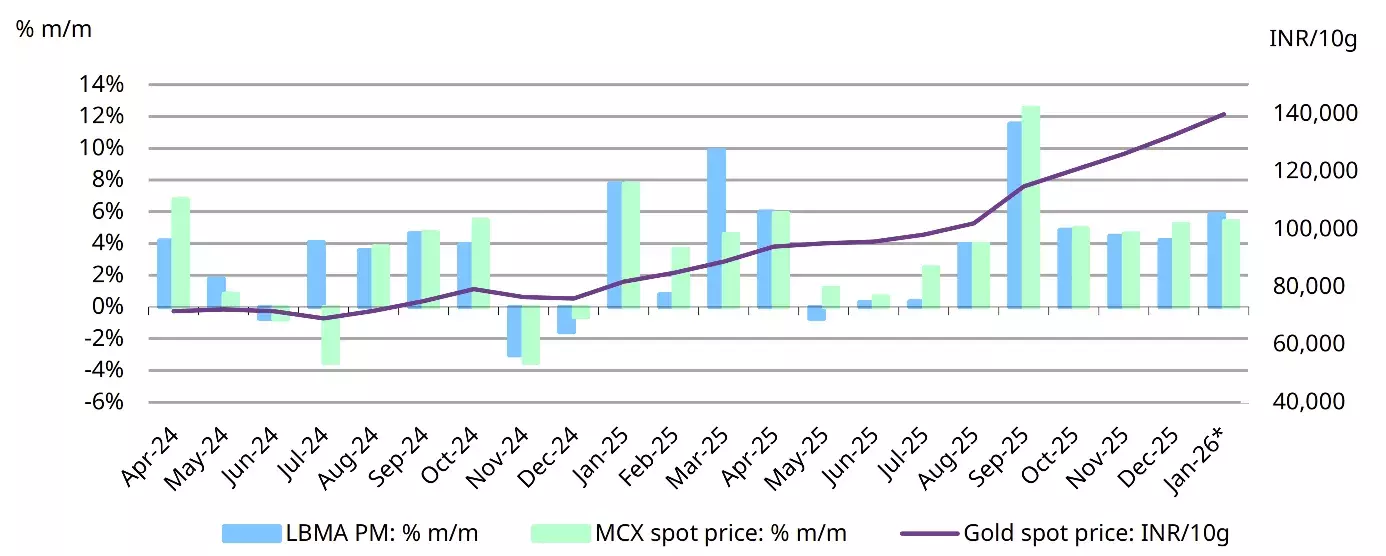

On the Multi Commodity Exchange (MCX), gold futures crossed the psychological ₹1,71,000 per 10 grams mark, reflecting strong domestic participation and alignment with record-breaking global bullion prices. The move marks one of the sharpest short-term upswings seen in recent years, with momentum firmly tilted in favour of the bulls.

What’s Driving the MCX Gold Price Rally?

The current rally in MCX gold price is not speculative froth—it is rooted in a convergence of macro and structural factors.

1. Weak US Dollar Environment

The US dollar index has slipped to multi-year lows, sharply improving gold’s appeal as a store of value. A softer dollar directly boosts rupee-denominated gold prices, even without aggressive local buying.

2. Elevated Global Risk Perception

Markets are pricing in persistent geopolitical tensions, policy unpredictability, and trade friction. In such environments, gold historically attracts defensive capital, and today’s price action confirms that trend.

3. Interest Rate Expectations

While policy rates remain unchanged for now, forward-looking markets are discounting lower real yields ahead. This erodes the opportunity cost of holding non-yielding assets like gold, strengthening its investment case.

4. Strong Physical and Investment Demand in India

Despite elevated prices, demand from high-net-worth investors and long-term allocators remains resilient. Gold ETFs and futures positions continue to see inflows, suggesting conviction rather than panic buying.

MCX Gold vs Global Gold: In Sync, Not Isolated

The surge in MCX gold price mirrors a sharp rally in overseas spot markets, where gold has repeatedly posted record intraday highs. Importantly, the domestic premium has remained stable, indicating healthy price discovery rather than artificial scarcity.

This synchronization suggests the rally is globally driven, with Indian prices acting as a reflection—not an outlier.

Technical View: Trend Still Strong

From a technical standpoint, MCX gold remains firmly in an uptrend:

| Level Type | Price Zone (₹ / 10g) |

|---|---|

| Immediate Support | 1,66,000 – 1,67,500 |

| Major Support | 1,60,000 |

| Near Resistance | 1,74,000 |

| Breakout Zone | Above 1,75,000 |

Momentum indicators continue to show strength, though short-term consolidation cannot be ruled out after such a steep rise.

Should You Buy Gold at These Levels?

At current prices, gold is not a short-term trading bet—it is a risk-hedging instrument.

- For traders: Volatility is elevated. Chasing breakouts without risk controls is dangerous.

- For investors: Systematic accumulation on dips still makes strategic sense, especially for portfolio protection.

- For hedgers: Gold continues to outperform most traditional hedges in the current macro cycle.

The Bigger Picture

The rise in MCX gold price is not just about inflation or currency moves—it reflects a broader loss of confidence in policy stability and fiat strength globally. Until clarity emerges on growth, rates, and geopolitics, gold’s role as capital insurance remains firmly intact.

Bottom line: Gold is expensive—but it is expensive for a reason. And markets are clearly signalling they are willing to pay that price.

Must have tools for startups - Recommended by StartupTalky

- Convert Visitors into Leads- SeizeLead

- Website Builder SquareSpace

- Run your business Smoothly Systeme.io

- Stock Images Shutterstock