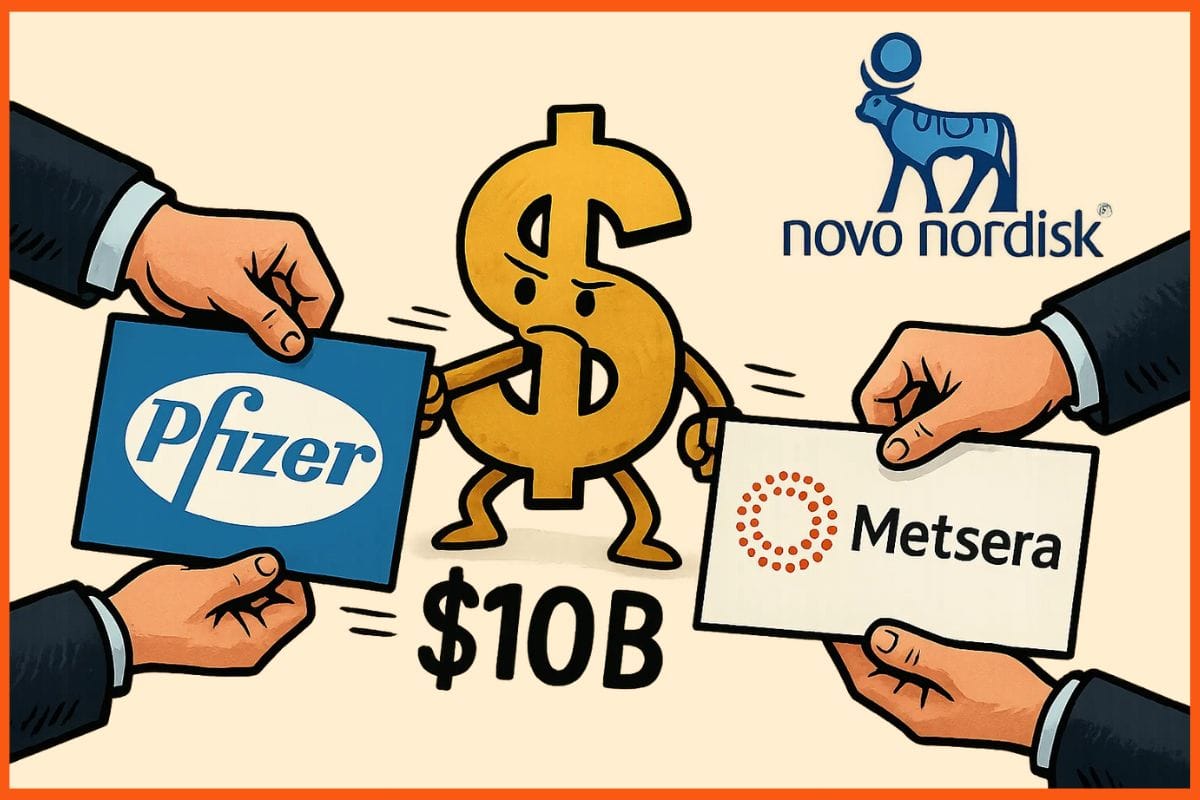

Pfizer Secures $10 Billion Metsera Acquisition After Intense Bidding War With Novo Nordisk

In a $10 billion agreement, Pfizer Inc. has agreed to buy Metsera Inc., a weight-loss medication firm. This purchase comes after a heated bidding war with Novo Nordisk A/S, a rival pharmaceutical business. According to Bloomberg, this disclosure places Pfizer in a strong position to win the startup's bidding fight with Novo Nordisk, even though the deal is not yet formally concluded.

Late on November 7, Metsera revealed that Pfizer's offer includes a payment of up to $86.25 per share, which includes an initial cash payment of $65.60 per share. Additional payments of up to $20.65 per share may also be made under the terms of the agreement, provided that specific milestones are met. According to a statement from the firm, Metsera's board decided that the latest Pfizer bid was the best deal for shareholders.

The New Deal Will Act as a Catalyst for Pfizer

According to a Bloomberg news report earlier, the acquisition is a significant strategic move for Pfizer, which is relying on Metsera's drug pipeline to compete with top competitors and create a combination of therapies that executives believe could revolutionise the way obesity is treated in the years to come.

After one patient in a clinical trial showed symptoms of liver damage, Pfizer ceased manufacturing its internal obesity pill in April, raising rumours that the corporation might now try to enter the fiercely competitive weight-loss industry through acquisitions. Additionally, the loss put more pressure on Albert Bourla, the CEO, to restock Pfizer's pipeline. Pfizer's prior offer for the weight-loss medication company was 5 cents per share lower than the new agreement. Earlier Friday, Bloomberg News reported that Pfizer had raised its offer.

Pfizer to Re-entre Obesity Drug Market After the Acquisition

In the market for obesity medications, Metsera is regarded as one of several promising next-generation products. The company is working on a few experimental weight-loss medicines, such as an injectable medication that might be used less frequently than the top-selling medications from Novo Nordisk A/S and Eli Lilly & Co.

One of its medications, MET-233i, assisted patients in losing up to 8.4% of their body weight in just 36 days, according to recent research. According to a previous Bloomberg story, it is still in the early phases of development and will not be available to patients for several years.

|

Quick Shots |

|

•Pfizer

acquires Metsera in a $10 billion deal after a competitive bidding war with

Novo Nordisk. •CEO

Albert Bourla aims to rebuild the company’s drug portfolio and regain

momentum in the obesity space. •Metsera’s

drug pipeline includes next-generation weight-loss therapies, potentially

less frequent injectable options. •Lead

candidate MET-233i showed 8.4% weight loss in 36 days in early trials. •The

drug is still in early-stage development, with commercial availability years

away. •The deal marks Pfizer’s re-entry

into the high-growth obesity treatment market dominated by Novo Nordisk and

Eli Lilly. |

Must have tools for startups - Recommended by StartupTalky

- Convert Visitors into Leads- SeizeLead

- Website Builder SquareSpace

- Run your business Smoothly Systeme.io

- Stock Images Shutterstock