Silver’s Next Big Surge Trouble: China to Put Silver Export Restriction From January 1

- China, which controls up to 70% of global silver supply, is tightening exports from 2026. - After January 1, the silver shortage could increase to more than 2,500 tonnes annually. - India is aggressively buying physical silver, importing over 1,700 tonnes in October alone.

All those Instagram reel predictions that silver will become costly are perhaps coming true. China supplies 60-70% of global silver and is not restricting its exports. Starting on January 1, 2026, China will no longer allow silver exports. Apparently, the global silver shortage is around 2,500+ tonnes per year, and after China steps back, it could increase to 5,000+ tonnes per year. Experts say that high demand for green energy is to blame. Does this mean the global silver market is in trouble? What happens to the silver market in India? For all that, learn more.

China Is Restricting Silver Exports (Big Deal)

According to The Hindu, China will stop the free flow of silver exports starting from January 1, 2026. The Chinese government has mandated a government licence to export silver. The rule will remain in effect in 2027 as well. So, who will get these licenses?

According to reports, only large, state-approved companies can obtain the license, and small exporters will be blocked by default. Large exporters who produce at least 80 tonnes of silver per year, anything below that, stand no chance.

Why Is China Restricting Silver Export?

China is the world's 2nd-largest silver miner, accounting for 60–70% of global silver production. Primarily, the country wants to reserve its "national resources.” Experts believe China’s real goals are:

- To save silver for its own solar panel and electronics industries.

- It wants to push global silver prices higher.

- Wants to utilise this dependency of the world (for its silver) to control the countries.

- To make silver a geopolitical weapon (just as it did earlier with rare earth metals).

Eventually, make the world feel the silver shortage.

The Global Silver Market Is Already in Trouble...

According to The Economic Times and several other reports, silver has been in deficit (short supply) for several years (specifically from 2021). The current shortage is approximately 2,500 tonnes per year. Once China's silver restrictions take effect, this number could increase to more than 5,000 tonnes per year. In the meantime, prices will surge massively (as China had hoped).

India Is Purchasing Large Quantities of Silver...

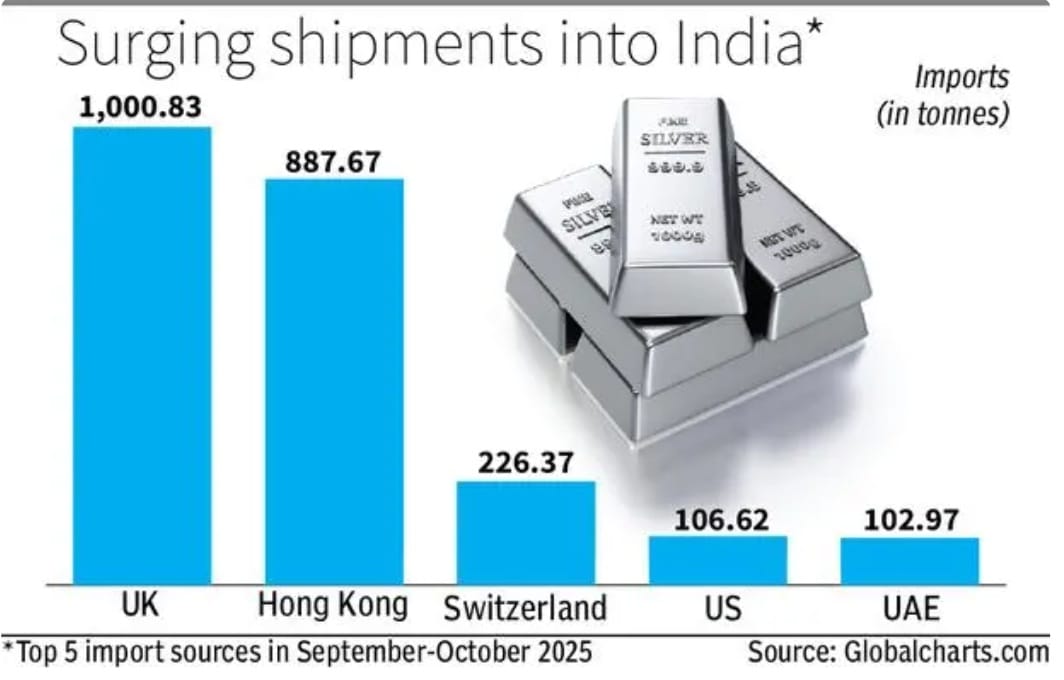

India has shown a strong physical demand around September–October. In October alone, India bought 1,715 tonnes of silver. India usually gets silver from:

- UK: ~1,000 tonnes

- Hong Kong: ~880 tonnes (however, Hong Kong is suspected to have leased silver from China (borrowed by London Bullion Merchants) and later shipped it to India).

- Switzerland: 225 tonnes

- UAE: 140+ tonnes

JP Morgan’s Silver Move Is Extremely Important...

Big institutions like JP Morgan expected the prices to rise, and here is what they did:

- JPMorgan held short positions (betting that prices would fall).

Between June and October:

- It closed short positions of 200 million ounces (6,750 tonnes).

- And bought 750 million ounces (23,437 tonnes) of physical silver.

Current Silver Prices Based on the Latest Market Data (Including International and Indian Prices)

Final Words...

Silver has risen 115% this year (2025). And there's a shortage everywhere. Canada’s Royal Mint and US Mint are out of silver, both coins and bars. And China is all set to implement export restrictions, sparking new geopolitical tensions with Silver.

Must have tools for startups - Recommended by StartupTalky

- Convert Visitors into Leads- SeizeLead

- Website Builder SquareSpace

- Run your business Smoothly Systeme.io

- Stock Images Shutterstock