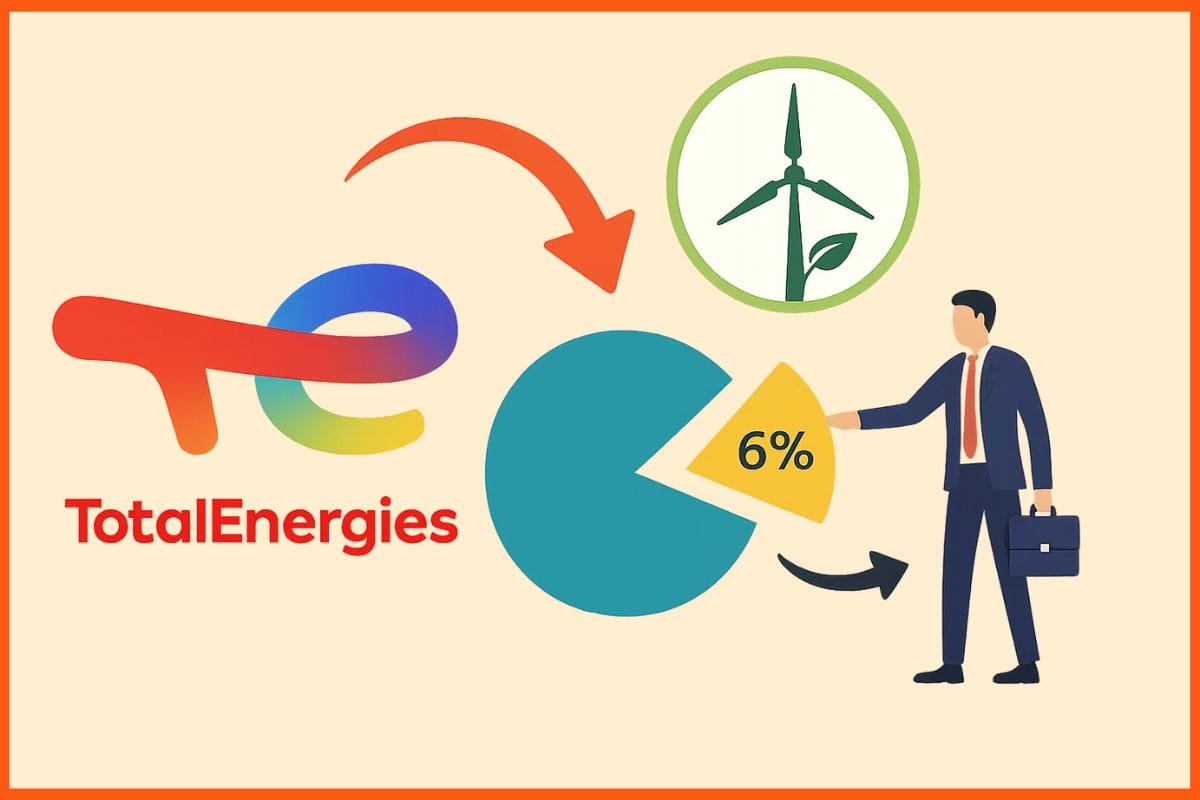

TotalEnergies to Divest 6% Holding in Adani Green Energy Amid Strategy Shift

According to many media sources, TotalEnergies is getting ready to sell up to 6% of Adani Green Energy (AGEL). Through two companies, TotalEnergies Renewables Indian Ocean Ltd (15.58%) and TotalEnergies Solar Wind Indian Ocean Ltd (3.41%), the French energy giant presently owns nearly 19% of the Adani Group's renewable energy division. TotalEnergies purchased its share of AGEL in 2021 for about $2.5 billion, and it is currently worth almost $8 billion, an industry executive with knowledge of the situation told a media site. They now plan to remove a portion of the earnings from the table. According to the reports, Adani Green Energy might be offered the stake in order to assess the proposal.

TotalEnergies to Reduce Debet Burden Via Disinvestment

Patrick Pouyanné, the CEO of TotalEnergies, informed investors in September that although AGEL was still a robust and expanding business, the corporation would not be expanding its green energy agreement with Adani. He has stated, "I would be very happy to sell my stake in Adani Green." In January 2021, Total paid $2.5 billion to acquire a 20% minority stake in AGEL and 50% ownership in its operating solar portfolio (more than 2 GW), supporting the French major's aspirations for renewable energy.

Additionally, the investment granted Total a position on the board of AGEL. As part of its efforts to lower its debt load, TotalEnergies is reportedly looking into selling a number of renewable energy assets throughout Asia. According to Reuters, the corporation last month revealed plans to reduce its yearly capital spending by $1 billion, bringing it down to $15–17 billion annually between 2027 and 2030. The action is a component of a larger $7.5 billion savings initiative.

About AGEL

One of India's biggest renewable energy enterprises, Adani Green was established in 2015. Its operating renewable capacity is more than 16.6 GW, and by 2030, it hopes to reach 50 GW. Additionally, AGEL is building the largest renewable energy plant in the world on a 538 square km plot of bare wasteland in Khavda, Gujarat. This area is five times larger than Paris.

Total Energies and AGEL established a joint venture last September, and together they oversee a portfolio of 1,150 MW of these solar projects. To speed up the development, TotalEnergies consented to provide $444 million. In the gas industry, Total and Adani have also had a long-standing collaboration. With Adani Group and TotalEnergies owning 37.4% of the joint venture, the two have been operating it since 2018.

Their investments include gas marketing, LNG terminal assets, and city gas distribution, including shares in LNG facilities in Dhamra and perhaps Mundra. The public stockholders own the remaining 25.2% of the company. Total provides the platform with LNG supply and retail experience.

|

Quick Shots |

|

•TotalEnergies

plans to sell up to 6% of its stake in Adani Green Energy (AGEL). •The

French major currently holds ~19% in AGEL through two subsidiary companies. •TotalEnergies

originally invested $2.5 billion in 2021; its stake is now valued at ~$8

billion. •The company aims to book profits by

offloading part of its holding; AGEL may be offered first right of

consideration. |

Must have tools for startups - Recommended by StartupTalky

- Convert Visitors into Leads- SeizeLead

- Website Builder SquareSpace

- Run your business Smoothly Systeme.io

- Stock Images Shutterstock