Nikhil Kurhe of Finarkein on Building Responsible Data Infrastructure, Open Finance Innovation, and Privacy-First Growth

📝Interviews

StartupTalky presents Recap'25, a series of exclusive interviews where we connect with founders and industry leaders to reflect on their journey in 2025 and discuss their vision for the future.

In this edition of Recap’25, StartupTalky speaks with Nikhil Kurhe, Co-Founder and CEO of Finarkein, who reflects on a year marked by the rapid evolution of India’s open-finance and digital public infrastructure ecosystem. Kurhe shares how Finarkein has strengthened its role as a responsible data and workflow infrastructure provider, enabling banks, NBFCs, insurers, and fintechs to securely operationalise consent-led data frameworks such as Account Aggregator, OCEN, and ONDC-FS.

He discusses the industry’s shift from document-heavy processes to real-time, privacy-first data flows, the growing emphasis on fairness, transparency, and user agency, and how Finarkein’s investments in ethical analytics, automation, and infrastructure resilience have supported scale without compromising trust. Kurhe also highlights the role of AI in improving underwriting and observability, the opportunities emerging across global open-finance markets, and Finarkein’s intent-driven approach to expanding products, customers, and teams while staying rooted in integrity and inclusion.

StartupTalky: What service does Finarkein provide? What was the motivation/vision with which you started?

Nikhil Kurhe: Finarkein builds responsible data and workflow infrastructure for financial institutions. Our platforms help banks, NBFCs, insurers, and fintechs securely access, analyse, and use customer-permissioned data through open-finance frameworks such as Account Aggregator, OCEN, and ONDC-FS.

The motivation was rooted in a simple belief: data should empower people, not exclude them. India was building digital public infrastructure at unprecedented scale, yet institutions lacked privacy-first, reliable systems to operationalise it. Finarkein set out to become the guardrail-technology that enables innovation without compromising fairness, inclusion, or user agency.

StartupTalky: What new services have been added in the past year? What is/are the USP/s of your service?

Nikhil Kurhe: Over the last year, we have expanded significantly: deeper underwriting orchestration, cross-AA intelligence, PFM dashboarding, high-granularity financial categorisation, and more resilient raw-data pipelines.

Our USP lies in combining infrastructure reliability with ethical, responsible analytics. We help institutions reduce bias, prevent exclusion, and make better decisions, while giving users greater control over their own data.

StartupTalky: How has the industry you are in changed in recent years and how has Finarkein adapted to these changes?

Nikhil Kurhe: India’s financial sector has shifted from document-heavy processes to real-time, consent-led data flows. Regulators now expect innovation to sit comfortably alongside privacy, transparency, and user rights. Customers expect faster decisions but also want to retain agency over their information.

Finarkein adapted early. We built systems that minimise data exposure, maximise consent granularity, and provide full auditability. We invested in identity intelligence, interoperable API gateways, and fairness-aware analytics. At the same time, we strengthened regulatory engagement to stay aligned with evolving expectations.

The broader change is clear: financial innovation is no longer about acquiring more data, but about using data responsibly. That is where we position ourselves.

StartupTalky: What key metrics do you track to check the Finarkein growth and performance?

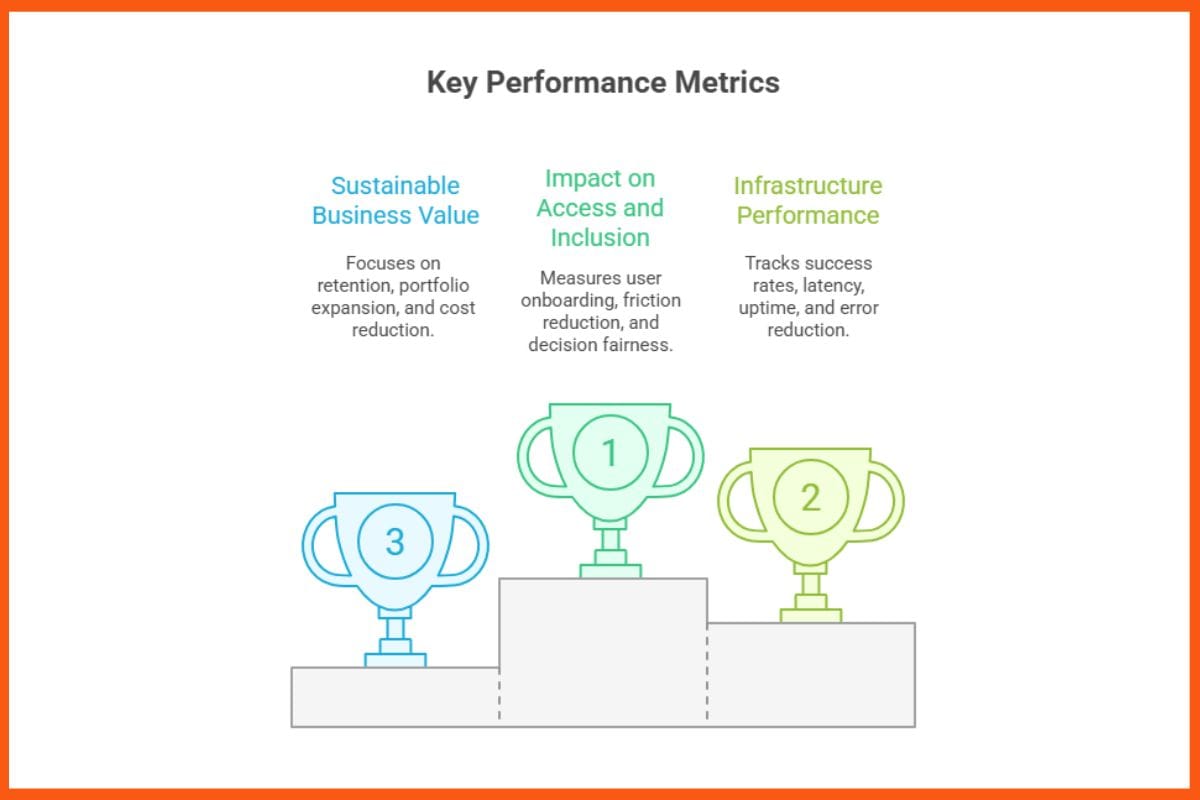

Nikhil Kurhe: We measure success along three axes:

- Impact on access and inclusion: Number of consented users onboarded, reduction in processing friction, and improved decision fairness.

- Infrastructure performance: AAs success rates, latency, uptime, observability, error-reduction, and improvement in client underwriting and verification journeys.

- Sustainable business value: Retention, expansion across portfolios, production workloads served, and reduction in client operational costs.

These metrics let us quantify both scale and responsibility. We want to grow, but not at the cost of privacy or equity, so our metrics reflect that balance.

StartupTalky: What were the most significant challenges Finarkein faced in the past year and how did you overcome them?

Nikhil Kurhe: The open-finance ecosystem is still maturing. Standards shift quickly, institutions adopt unevenly, data quality varies, and regulatory expectations continue to evolve. Building stable, high-coverage systems in this environment required persistence and tight ecosystem alignment.

We strengthened our multi-AA orchestration layer, expanded test harnesses, improved observability, and worked closely with clients’ product and compliance teams to stabilise implementations. We also increased regulatory engagement to ensure that innovation remained aligned with safeguards.

At the same time, the market is undergoing a broader behavioural shift. Customers are already moving from legacy institutions to fintechs, and as the AA system scales, we expect movement in both directions. This will extend beyond unsecured lending. The net effect is positive for consumers, but it also pushes incumbents to deepen personalisation and understand their prime customers better. As large banks catch up, fintechs will need to differentiate more sharply.

The core challenge this year was balancing speed, stability, and responsibility in a fast-changing ecosystem. The way forward has been discipline, collaboration, and sustained clarity of purpose.

StartupTalky: What are the different strategies you use for marketing? Tell us about any growth hack that you pulled off.

Nikhil Kurhe: Our marketing philosophy mirrors how we build: practical, credibility-first, and grounded in real financial workflows rather than buzzwords. The core idea is simple; we focus on explaining the problems the industry genuinely struggles with. Most of our traction comes from breaking these challenges down in ways that product, engineering, and business teams immediately recognise as real.

A significant share of our growth has come from being present in meaningful industry conversations: policy forums, fintech founder groups, digital infrastructure events, and open-finance discussions. When teams repeatedly see us contribute insight rather than a sales pitch, it naturally generates the right kind of inbound.

We also invest in strong use-case narratives: faster onboarding, clearer underwriting signals, safer data flows, and better customer journeys. These resonate far more than feature-led messaging because they illustrate outcomes, not claims.

One of our most effective growth levers has been how we use LinkedIn. Instead of treating it as a broadcast platform, we built a story-led presence by sharing technical insights, standards work, and learnings from implementation at scale. Over time, this created not just reach but relevance. People now connect because they see how we think and solve, not just what we sell—and that has made every inbound conversation significantly warmer and more meaningful.

StartupTalky: What are the important tools and software you use to run your business smoothly?

Nikhil Kurhe: We use cloud-native, security-first infrastructure: internal observability platforms, multi-AA orchestration engines, API gateways, high-availability data processors, and SOC2-aligned security tooling. Our DevSecOps pipelines enforce privacy and compliance by design. We also maintain internal dashboards for consents, data flows, and risk insights.

StartupTalky: What opportunities do you see for future growth in your industry in India and the world? What kind of difference in market behavior have you seen between India and the world?

Nikhil Kurhe: Globally, regulators are converging on consent-based, interoperable data frameworks—PSD3 in Europe, new open-banking mandates in Africa and the Middle East, and early open-finance pilots in Southeast Asia. India has already operationalised many of these models at scale.

India moves fast, at population scale, supported by strong public infrastructure. Global markets move more cautiously with deeper emphasis on privacy, risk, and standardisation. This gives Finarkein a unique role: helping international markets adapt India’s learnings while respecting their own contexts and cultures. The opportunity is enormous; responsible data ecosystems will shape financial access worldwide.

StartupTalky: How are you using AI, whether in service delivery, internal processes, or customer experience, and what impact has it created?

Nikhil Kurhe: AI powers multiple layers of our platform. We use it to automate underwriting logic, detect anomalies in financial behaviour, categorise transactions, and accelerate data cleaning and enrichment. Internally, AI helps us improve system observability; the result is faster decisioning for clients, lower failure rates, and more accurate customer insights without compromising privacy or consent.

StartupTalky: How do you plan to expand the Customers, service offering, and team base in the future?

Nikhil Kurhe: We will deepen our presence within Indian BFSI portfolios while expanding to global markets where open-finance standards are taking root. On the product side, we will continue investing in identity intelligence, risk monitoring, decentralised consent, and sector-specific flows in lending, insurance, and wealth.

Team expansion will be targeted—more engineering, policy, and ecosystem development capabilities to support large-scale deployments across geographies.

StartupTalky: One tip that you would like to share with another Service company founder?

Nikhil Kurhe: Build with integrity from day one. In infrastructure businesses, especially those touching people’s data, trust compounds faster than scale. If you design systems that respect the user, regulators, and society, clients will naturally see you as a long-term partner rather than a vendor.

Explore more Recap'25 interviews here.

Must have tools for startups - Recommended by StartupTalky

- Convert Visitors into Leads- SeizeLead

- Website Builder SquareSpace

- Run your business Smoothly Systeme.io

- Stock Images Shutterstock