The Modern BFSI Playbook: Why banks need consulting + technology under one roof

✍️ Opinions

This article has been contributed by Muzammil Patel Co-founder and CEO Acies Consulting

In the world of solutions, what matters is outcomes. Concepts, ideas, and frameworks are only as relevant as their actual implementation and benefits derived therefrom. For a very long time, advice and methodologies were conceived by people different from those involved in implementing that advice. The segregation of advisory and implementation was largely caused by the need for differing expertise related to domain knowledge and technology. Technology was seen as a difficult domain by people possessing expertise largely because of the effort and time involved in mastering the technical arts of architecting, coding, and maintaining complex systems.

As technology has become more democratized with simplification, templatization and most importantly the advent of no-code platforms, the gulf between advisory and implementation is beginning to disappear. In today’s world, advisory not backed up by technology and more importantly technology purpose built or purpose modified to solve the specific problem at hand leads to very little ROI. In the modern financial services industry, vendor systems or expert advice in isolation aren’t the way to play. The modern BFSI architecture is being built by people with domain expertise who can deliver technology driven outcomes.

The Return on Investment

For long the BFSI sector has operated with a standard delivery model: hire consultants to design frameworks and processes and then find technology vendors who will match the requirement. For what falls in the cracks after, find smaller bespoke technology vendors to fill the gap. The result is a mishmash of system and processes being managed and maintained by different people often with differing objectives or views on outcome. Each party in the process insulated from the work of the other but ultimately leading to the financial institution bearing a large technical debt. The cost of technical debt ultimately impacts the cost of delivering service to the ultimate customer who is increasing elastic to price changes as competition and pressure from emerging fintech eats into the traditional financial services business.

In essence, traditional BFSI cannot afford the technical debt anymore as the end consumer simply won’t pay for the inefficiencies resulting from disconnects between concept and implementation. This leads to shrinking ROI and potentially negative ROI for institutions especially when it comes to flow businesses and transaction processing. The ROI for the BFSI sector lies in people with domain expertise delivering outcomes through technology and project scope being defined by outcomes and not consulting ideas.

Blending in and Replacing Legacy Systems

The current technical debt for a traditional BFSI player is already quite high. Most BFSI players realized that technology is one of the largest cost bases on the earnings statement. The answer most sought after today is in negotiating harder with technology providers through investment in procurement capacity. While this yields some results for a few quarters, it doesn’t hide away the real problem for too long. The gap between concept and reality is far too wide to bridge through contract negotiations. With the amount of technical debt already existing, an organization simply can’t go for a revamp by overhauling all legacy systems without significantly disrupting customer operations.

The answers lie in making sure new investments in consulting service come with technology and not just bits and pieces tools but technology that is robust and enterprise grade and can replace legacy tech. The answers also lie in making sure that new consulting and tech investments are platform driven in each area of expertise (for example risk, regulation, or trade) so that there is not a mishmash of new systems sitting on different technologies and thought processes. Blending in and replacing legacy tech needs a platform-based approach backed by domain expertise and not discrete specialized tools that create new technical debt.

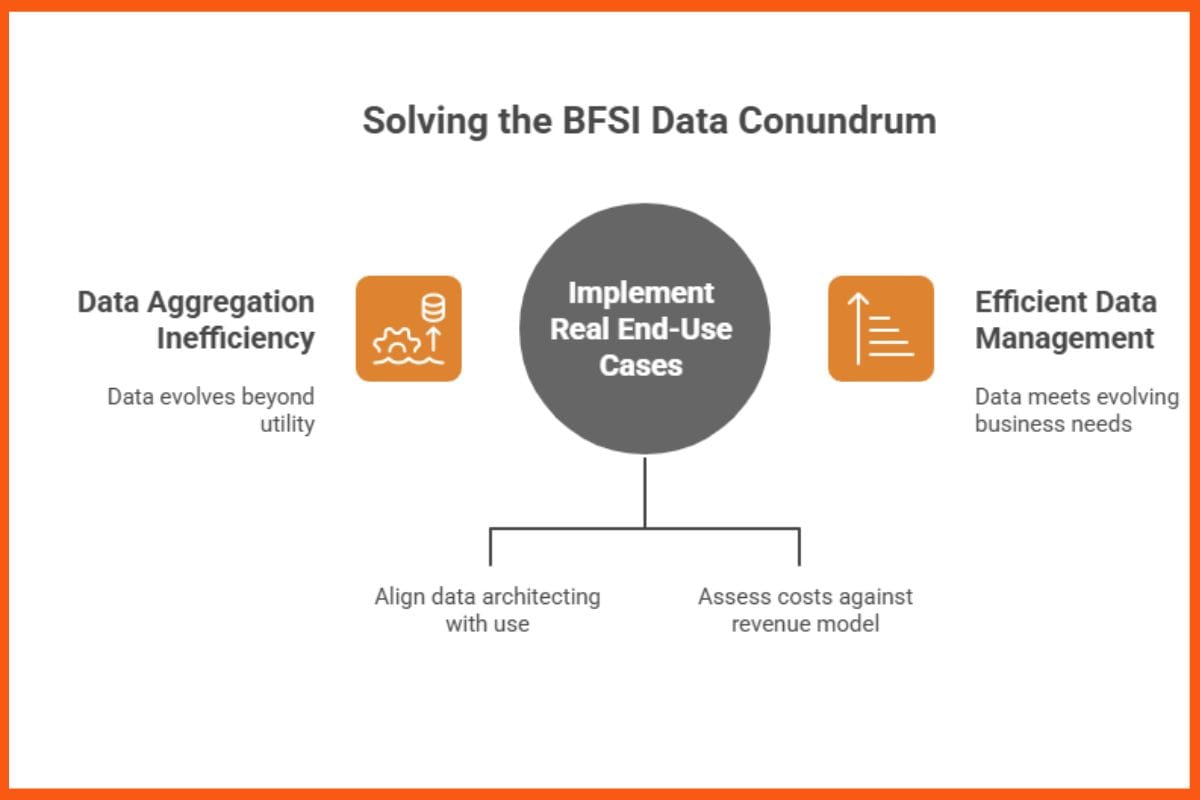

The Data and Architecting Conundrum

The data conundrum in BFSI has long been attempted to be solved through data warehouses or lakes or other such aggregation methods. The challenge has always been that by the time the data is aggregated, the use case for which it was aggregated has evolved far beyond the utility of the aggregation. Again, the problem has traditionally been that millions of dollars have been spent on ideas of data architecting which are removed from the implementation of real end-use cases. The theory rarely matches the end-use on the ground. What has amplified costs in the idea that data technologies that are cloud native are a more efficient way to manage data. The reality in general has been that cloud native data technologies cost more for ingress and egress alone than an organization can afford given its revenue model.

The answer again lies in advice and implementation being use case driven and not driven by the idea of aggregating data based on frameworks and concepts. Data technologies today allow for seamless integration between systems without engaging in significant aggregation and no-code technologies allow for data aggregation to happen without complex data warehousing frameworks. The answer lies in focusing on the intended outcome and delivering both consulting and technology to fulfil that outcome without getting into long-winded data consulting projects.

The Advisory Redundancy

In a world where information barriers break everyday and information flows freely, advise is not a pre-requisite for outcome. More importantly, the time taken to collate advise and take decisions can be ill-afforded in a world that changes rapidly. Advisory is still valuable for the expertise and experience which cannot entirely be replaced by AI but suffers from a problem of speed to implementation. Advise today is valuable if the technology to back it is also produced almost immediately. Putting the money where the advisory mouth is the only way advice and expertise can continue to be relevant in today’s world.

The modern BFSI playbook for technology and consulting firms alike cannot be about distinguishing technology and domain expertise. The barriers between those skillsets have already been broken as technology democratization continues with the advent of AI and no-code platforms. The coordinated application of those skill sets through an outcome-oriented platform approach is what will drive the next wave of growth in BFSI services.

Must have tools for startups - Recommended by StartupTalky

- Convert Visitors into Leads- SeizeLead

- Website Builder SquareSpace

- Run your business Smoothly Systeme.io

- Stock Images Shutterstock