Top 5 KYC & Identity Verification Tools for Banks, Fintechs, and Enterprises in the USA

Collections 🗒️

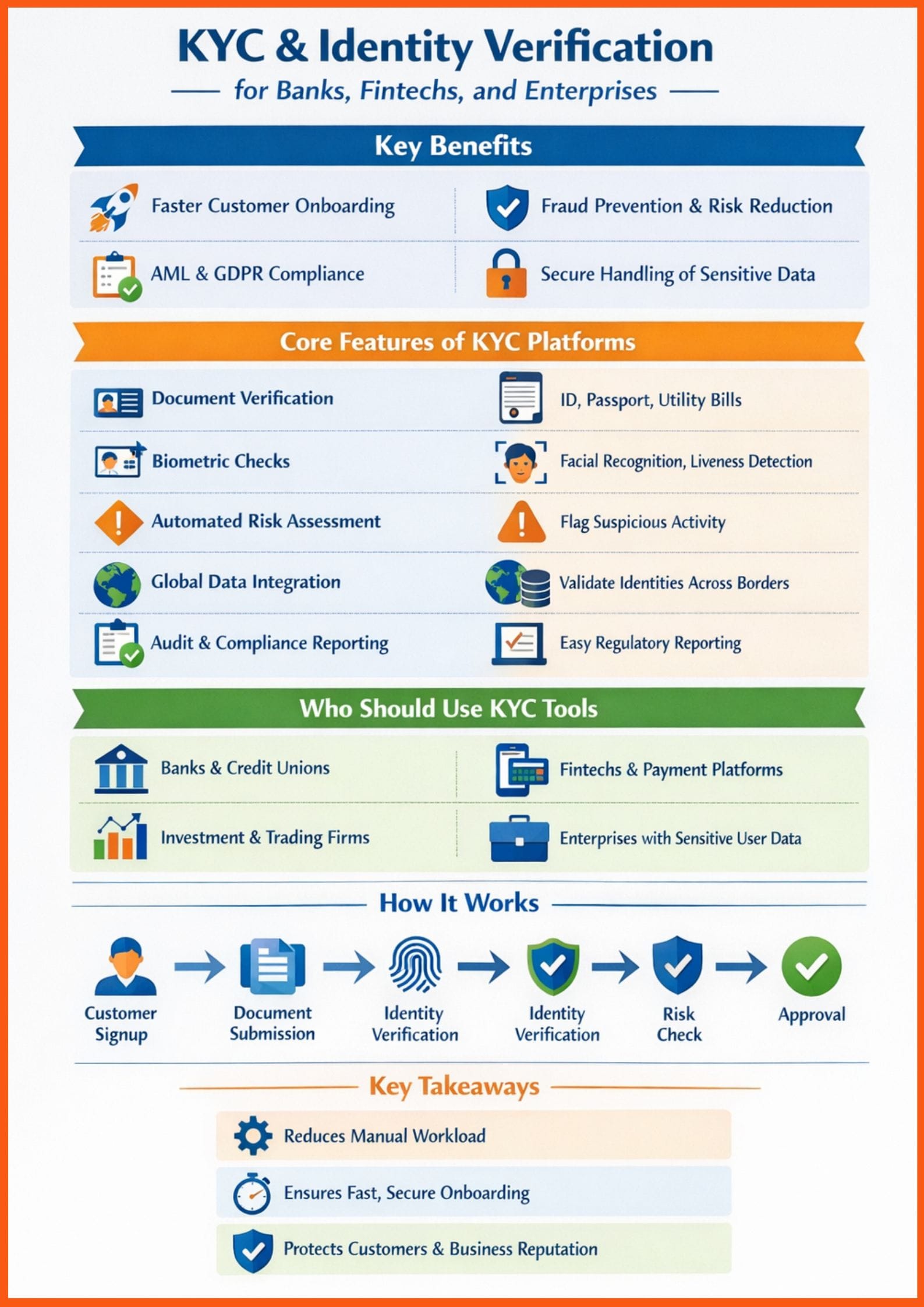

Verifying customer identities online shouldn’t slow down your business—it should power it safely and efficiently. That’s where KYC (Know Your Customer) and identity verification software come in. These tools help enterprises confirm identities, check documents, and prevent fraud in real time, all while keeping compliance with regulations like AML and GDPR simple.

Perfect for banks, fintechs, investment firms, and other regulated businesses, KYC solutions make onboarding faster, build trust, and protect sensitive data. By automating manual verification tasks, they not only save time and resources but also ensure smooth, secure customer journeys. In a world where digital interactions are growing so fast, adopting the right KYC platform is no longer optional, it is a business-critical advantage.

In this article, we explore the top enterprise KYC and identity verification platforms for 2026, highlighting what each company is best known for, who it is most suitable for, and why it stands out in the market.

List of Best Enterprise KYC and Identity Verification Software in the USA

| Company | Best Known For / Who It’s Best Suited To | Key Strengths / Why It Stands Out |

|---|---|---|

| Alloy | Large banks and fintechs needing full lifecycle identity decisioning | Unifies 250+ data sources for automated KYC/identity checks, KYB and compliance; custom workflows & global onboarding with strong fraud and AML capabilities. |

| HyperVerge | Firms needing fast AI‑powered document & face KYC globally | AI‑driven identity and liveness checks with real‑time results and low‑friction onboarding; supports banks, gaming, crypto, and marketplaces. |

| Vouched | Businesses seeking flexible, industry‑specific ID verification | High accuracy identity validation with low false positives, tailored to sectors like finance, automotive, healthcare, rentals, and the gig economy. |

| Trust Stamp | Enterprises focusing on privacy‑first biometric identity verification | Biometric matching with spoof‑resistant technology and strong data protection, ideal for secure authentication and fraud reduction. |

| Fraud.net | Large organisations that need identity checks tied to fraud/risk systems | Combines KYC and identity verification with advanced fraud detection and risk analytics across multiple channels. |

Alloy

Best for: Banks and large fintechs needing centralised identity decisioning.

Alloy’s identity platform brings together over 200 data sources into one API, helping banks, credit unions and fintechs automate KYC, KYB (Know Your Business) and compliance checks from onboarding through ongoing monitoring.

It’s trusted by hundreds of financial organisations worldwide because it reduces manual reviews, boosts approval rates and keeps compliance consistent across global markets. Alloy also offers flexible workflows so teams can shape identity checks to their exact risk policies and test changes safely before going live.

Why it matters: Gives enterprises a single source of truth for identity decisions, combining compliance, fraud prevention and onboarding into one coherent system.

HyperVerge

Best for: Quick international onboarding with strong AI identity checks.

HyperVerge specialises in AI‑centric KYC and identity verification that verifies identities (including document and facial matching) quickly and accurately, even on low‑bandwidth connections. Its technology reduces onboarding drop‑offs and meets compliance needs globally, covering more than 190 countries. This makes it especially useful for enterprises with diverse customer bases and those operating in emerging markets.

Why it matters: Its AI models are trained on large datasets, enabling high automation rates (often 90%+), so businesses can verify more customers in less time while reducing fraud risk.

Vouched

Best for: Organisations seeking flexible, industry‑tailored identity verification.

Vouched offers a modern AI‑powered identity verification platform that works well across sectors, from financial services (bank account openings, credit checks) to healthcare and automotive. It focuses on accurate document and biometric checks with high conversion rates and low false positives, helping companies speed up onboarding without sacrificing security. Vouched also supports workflows tailored to specific industries, so enterprises can address unique compliance or user experience needs.

Why it matters: With ready‑made solutions tailored to different industries, Vouched helps teams deploy identity verification quickly without reinventing the wheel.

Trust Stamp

Best for: Privacy‑centric identity verification with strong biometric safeguards.

Trust Stamp combines biometrics, AI and privacy‑preserving techniques to verify identities securely at scale. Instead of storing raw biometric data, it creates transformed digital identity tokens that protect sensitive information while allowing organisations to confirm a person’s identity for onboarding or ongoing checks. This privacy‑first approach makes it attractive for firms that handle highly sensitive identities or operate in sectors where data protection is critical.

Why it matters: Offers robust identity verification with enhanced privacy protections, making it ideal for trust‑dependent industries like finance, government and healthcare.

Fraud.net

Best for: Enterprises that want identity verification built into broader risk and compliance workflows.

Fraud.net’s platform blends identity and document checks with real‑time fraud detection, compliance screening and risk scoring. It helps large organisations manage KYC alongside AML (Anti‑Money Laundering) and ongoing monitoring without stitching together multiple point solutions. Its adaptive machine‑learning models reduce false positives and boost legitimacy checks, which means enterprises can approve genuine users faster while flagging suspicious cases.

Why it matters: Adds value by embedding identity verification into a full suite of risk and compliance tools, making it ideal for complex, regulated environments.

Choosing the Right KYC Tool for Your Business

Selecting the right KYC platform is not just about ticking regulatory boxes. Consider these questions:

- Scale of operations: Do you serve customers globally or in specific regions? Tools like HyperVerge and Alloy offer wide geographic coverage.

- Industry needs: If you need workflows tailored to specific use cases (healthcare, automotive), Vouched may be a strong choice.

- Privacy priorities: For firms where privacy is a core value, Trust Stamp provides secure identity verification with reduced data exposure.

- Integration with risk engines: If you want identity checks as part of a wider fraud and compliance infrastructure, Fraud.net offers a comprehensive suite.

Every enterprise has its own priorities, whether that’s flexibility, speed, privacy or compliance depth. These solutions reflect the best of what’s available in 2026 to help you verify identities confidently, reduce fraud risk and deliver smoother customer journeys.

FAQs

What is KYC, and why is it important for banks and fintechs?

KYC (Know Your Customer) helps banks, fintechs, and enterprises verify customer identities, prevent fraud, and comply with regulations like AML and GDPR. Using KYC software ensures secure and smooth digital onboarding.

Which KYC tools are best for enterprises?

The top KYC tools in 2026 include Alloy, HyperVerge, Vouched, Trust Stamp, and Fraud.net, known for fast identity verification, compliance, and fraud prevention tailored to banks, fintechs, and regulated businesses.

How do KYC and identity verification software improve customer onboarding?

KYC platforms automate identity checks, document verification, and risk assessment. This reduces manual effort, speeds up approvals, and creates a secure, trustworthy onboarding experience for customers.

Must have tools for startups - Recommended by StartupTalky

- Convert Visitors into Leads- SeizeLead

- Website Builder SquareSpace

- Run your business Smoothly Systeme.io

- Stock Images Shutterstock