Best Profitable MSME Finance Business Ideas Built for Stability, Not Consumers

Collections 🗒️

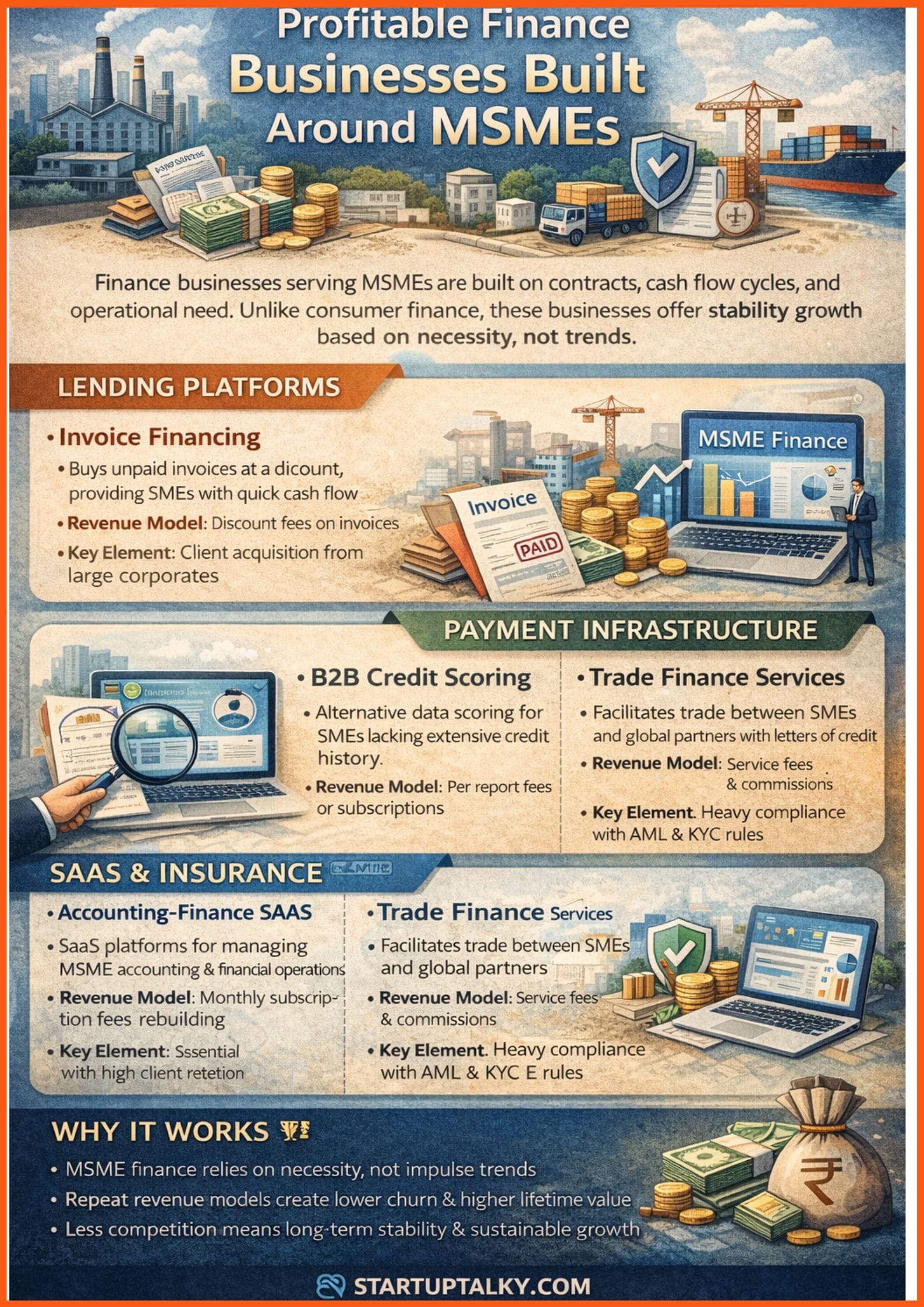

The financial world often focuses on retail consumers, but for founders and investors, the real stability lies in MSME finance. Businesses built around Micro, Small, and Medium Enterprises (MSMEs) are not driven by impulse spending or trends. They operate on contracts, cash flow cycles, and necessity. A business customer is predictable because their financial needs are directly linked to survival, operations, and growth.

MSME-focused finance businesses offer something consumer finance rarely does: long-term stability. These models are rooted in B2B finance, professional relationships, and operational demand rather than hype. For founders, this means building sustainable finance businesses that solve real problems in the MSME ecosystem, instead of chasing short-lived consumer trends

MSME Finance Business Models (Overview Table)

| Business Model | Who It Serves | Revenue Model | Capital Requirement | Risk Level | Scalability |

|---|---|---|---|---|---|

| Invoice Factoring | Manufacturers & Suppliers | Discount fees on invoices | High | Medium | High |

| Supply Chain Finance | Large buyers & MSME suppliers | Interest & platform fees | High | Low | Very High |

| Vendor Finance Hubs | Equipment sellers & buyers | Commission & interest | Medium | Medium | High |

| B2B Credit Scoring | Lenders & MSMEs | Subscription & per-report | Low | Low | Very High |

| Trade Finance Agency | Importers & Exporters | Service fees & commissions | Low | Low | Medium |

| MSME Insurance Broker | Small business owners | Policy commissions | Low | Low | High |

| Accounting-Finance SaaS | Service-based MSMEs | Monthly subscription | Medium | Low | Very High |

| Asset Leasing Services | Construction & Tech firms | Monthly lease payments | Very High | Medium | Medium |

| Compliance Finance | Regulated MSMEs | Project fees & retainers | Low | Low | Medium |

| Cash Flow Advisory | Growth-stage MSMEs | Consulting fees | Low | Low | Low |

Best MSME-Focused Finance Businesses

Here is a list of some of the best MSME-focused finance businesses explaining who it serves, how it makes money, why MSMEs need it and why it is profitable:

MSME Invoice Financing

What it is: A service that buys outstanding invoices from MSMEs at a small discount, providing them with immediate cash.

Who it serves: Small manufacturers or service providers who wait 30 to 90 days for payments from large clients.

How it makes money: By charging a percentage fee (discount rate) on the total value of the invoice.

Why MSMEs need it: It bridges the gap between finishing a job and getting paid, ensuring they can pay staff and buy raw materials.

Why it is profitable: The risk is often tied to the creditworthiness of the large corporate payer, not just the small business.

Key Business Element: Client acquisition model

This business grows by partnering with large corporations to offer early payments to their entire list of small suppliers.

Supply Chain Finance Platforms

What it is: A digital platform that connects large “anchor” buyers with their MSME suppliers to facilitate early payments.

Who it serves: Tier 2 and Tier 3 suppliers who are often overlooked by traditional banks.

How it makes money: Through platform usage fees and a small spread on the financing provided.

Why MSMEs need it: It provides lower-cost capital because the financing is based on the strong credit rating of the large buyer.

Why it is profitable: It creates a “sticky” relationship between the buyer, the supplier, and the platform, leading to repeat transactions.

Key Business Element: Technology need

Success depends on a seamless digital portal that integrates with the ERP systems of large corporate buyers.

Vendor Financing Hubs

What it is: A middleman service that helps equipment sellers offer financing options directly to their MSME customers at the point of sale.

Who it serves: Dealers of industrial machinery, medical equipment, or office technology.

How it makes money: Commissions from lenders and sometimes a share of the interest margin.

Why MSMEs need it: It allows them to acquire essential tools without a massive upfront cash outlay.

Why it is profitable: It solves a sales problem for the vendor, making them a loyal partner who brings in constant new leads.

Key Business Element: Trust requirement

The business must build deep trust with both the equipment vendors and the financial institutions providing the capital.

Business Credit Scoring Services

What it is: An alternative data provider that builds credit profiles for MSMEs using non-traditional data like utility bills and social proof.

Who it serves: Fintech lenders and banks that want to lend to MSMEs but lack traditional financial data.

How it makes money: Charging lenders for every credit report generated or through annual subscriptions.

Why MSMEs need it: It helps “invisible” businesses prove they are reliable, opening doors to formal loans.

Why it is profitable: Once the algorithm is built, the cost of generating an additional report is almost zero.

Key Business Element: Regulation exposure

Data privacy laws and financial reporting standards are the primary hurdles this business must navigate.

Trade Finance Services

What it is: A specialist firm that provides letters of credit and guarantees to help MSMEs engage in international trade.

Who it serves: Small businesses importing raw materials or exporting finished goods.

How it makes money: Service fees for processing documents and commissions on the value of the trade.

Why MSMEs need it: It reduces the risk of not receiving goods or not getting paid when dealing with overseas partners.

Why it is profitable: It requires deep expertise rather than massive capital, allowing for high margins on professional services.

Key Business Element: Compliance load

Handling international transactions requires strict adherence to anti-money laundering (AML) and “know your customer” (KYC) rules.

MSME Insurance Distribution

What it is: A digital brokerage focused specifically on business risks like professional indemnity, fire, and workers' compensation.

Who it serves: Small workshops, retail shops, and professional service firms.

How it makes money: Recurring commissions from insurance companies for every policy sold and renewed.

Why MSMEs need it: One single accident or lawsuit can bankrupt a small business; insurance provides a vital safety net.

Why it is profitable: Business insurance policies have higher premiums and better retention rates than personal car or home insurance.

Key Business Element: Revenue predictability

Annual renewals create a highly stable and predictable income stream that grows over time.

MSME Accounting-Finance Services

What it is: A hybrid of software and professional services that manages the entire “back office” finance function for a small firm.

Who it serves: Growing MSMEs that are too big to do their own books but too small for a full-time CFO.

How it makes money: Monthly retainer fees for ongoing accounting, tax filing, and financial reporting.

Why MSMEs need it: It keeps them compliant with tax laws and gives them the data they need to make better business decisions.

Why it is profitable: It is a “must-have” service; businesses rarely fire their accountant even during a downturn.

Key Business Element: Capital need

This is a low-capital business that relies more on skilled staff and efficient software than on large cash reserves.

Equipment Finance Services

What it is: A specialist lender or lessor that focuses on specific types of business assets like delivery vans or kitchen equipment.

Who it serves: Logistics companies, restaurants, and small-scale printers.

How it makes money: The difference between the cost of borrowing capital and the lease payments received from the MSME.

Why MSMEs need it: It matches the cost of the equipment with the revenue it generates, preserving cash for other needs.

Why it is profitable: The equipment itself serves as collateral, making it easier to recover value if the business fails.

Key Business Element: Risk type

The primary risk is the physical depreciation or obsolescence of the equipment being financed.

MSME Compliance Finance Services

What it is: A firm that helps MSMEs fund the costs of meeting new regulations, such as green energy upgrades or data security audits.

Who it serves: Businesses in highly regulated sectors like food production, healthcare, or finance.

How it makes money: Project-based fees for implementation and financing margins for the necessary upgrades.

Why MSMEs need it: Regulations are often mandatory; businesses must comply to stay open, but often lack the immediate funds to do so.

Why it is profitable: It targets a non-discretionary spend, meaning the business has no choice but to pay for the service.

Key Business Element: Compliance load

The business must stay ahead of changing laws to remain a valuable advisor to its clients.

Working Capital Advisory Firms

What it is: A consultancy that helps MSMEs optimise their internal processes to free up cash without taking on new debt.

Who it serves: Established MSMEs with messy balance sheets or inefficient inventory management.

How it makes money: Success-based fees (a percentage of the cash freed up) or flat consulting retainers.

Why MSMEs need it: Many businesses are “asset rich but cash poor”; they need expert help to unlock the money hidden in their operations.

Why it is profitable: It delivers a clear, measurable return on investment, making it easy to justify the fees to the client.

Key Business Element: Risk type

The main risk is operational; if the client does not follow the advice, the expected cash flow improvements will not happen.

Why MSME Finance Businesses Are More Stable Than Consumer Finance

Founders often find that MSME finance is a more reliable path than retail lending. One major reason is payment discipline. A business views its financial obligations as a core part of its operations. If a business fails to pay its suppliers or lenders, it loses its ability to trade. This creates a natural pressure to pay that is often stronger than in the consumer world.

Furthermore, these businesses often enjoy contract-based revenue. While a consumer might stop using an app on a whim, a business usually signs a long-term agreement for its financial services. This leads to a repeat revenue model, where the cost of keeping a customer is much lower than the cost of finding a new one. Because the MSME has a high business dependency on these services, they are less likely to switch providers frequently. Finally, lower default behaviour is common because business owners are professional actors who understand the long-term cost of a ruined reputation.

What Founders Should Understand Before Entering MSME Finance

Entering the MSME space requires a different mindset than building a consumer app. The first thing to master is trust cycles. Businesses do not buy from strangers overnight; you must prove your reliability over months, not days. This leads to a model of relationship selling, where personal connections and professional reputation matter more than flashy marketing.

Founders must also be experts in compliance basics. Dealing with business money means following strict rules regarding taxes and financial reporting. Cash flow discipline is equally vital; your own business must be a model of stability if you are to advise others on theirs. Success also depends on risk control, specifically understanding how to spot a healthy business versus one that is struggling. Ultimately, reputation building is your greatest asset. In the B2B world, a single bad mistake can travel fast, but a solid track record will bring you more business than any advertisement ever could.

Conclusion

MSMEs are the backbone of the economy, and they make for much better long-term customers than individual consumers. While consumer finance often relies on high-volume “hype” and risky lending, MSME finance is built on utility, stability, and professional relationships. These businesses are sustainable because they solve essential problems that every company faces, from managing cash flow to staying compliant. Founders who stop chasing consumer trends and start building for MSMEs will find a market that is not only profitable but also deeply resilient.

FAQs

Why are MSME-focused finance businesses more stable than consumer finance?

MSME finance businesses are more stable because they operate on contracts, recurring transactions, and operational necessity. Unlike consumer finance, which depends on discretionary spending and trends, MSME finance is driven by business survival needs such as cash flow, compliance, payroll, and working capital, making revenue more predictable and resilient.

What makes MSME finance businesses more profitable in the long term?

Long-term profitability in MSME finance comes from repeat revenue, contract-based relationships, lower customer churn, and high switching costs. Businesses rely on financial services for daily operations, which creates stable income streams, better retention, and stronger lifetime value compared to consumer finance models.

Which MSME finance business models are the most scalable?

The most scalable MSME finance models include supply chain finance platforms, B2B credit scoring services, accounting-finance SaaS, invoice financing, and MSME insurance distribution. These models scale through technology, data, and network effects rather than heavy physical infrastructure.

Must have tools for startups - Recommended by StartupTalky

- Convert Visitors into Leads- SeizeLead

- Website Builder SquareSpace

- Run your business Smoothly Systeme.io

- Stock Images Shutterstock