The Sampat Saga: How India's Original Value Investor Redefined Success

🔍Insights

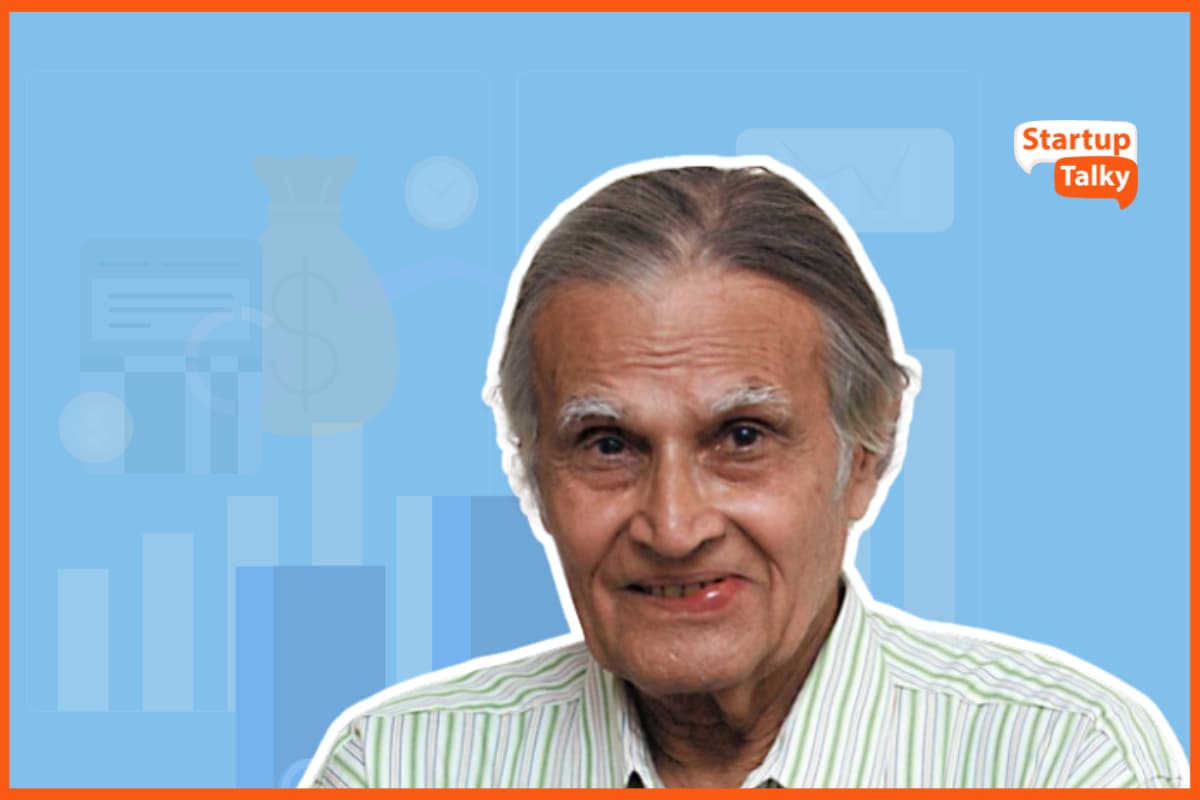

Chandrakant Sampat hailed as India's Original Value Investor, emerges as a luminary figure whose investment philosophy continues to echo through the corridors of financial wisdom, especially pertinent during the booming era of Initial Public Offerings (IPOs) in India. Renowned for his sagacious approach to investing, Sampat's principles offer a timeless guide for navigating the dynamic landscape of IPOs, embodying the essence of value investing in a period marked by fervent market activity. As India witnesses an upsurge in IPOs, Chandrakant Sampat's legacy stands as a beacon, guiding investors with his profound insights and unwavering commitment to prudent, value-driven investment strategies.

In the 1950s, he departed from his family business, captivated by the world of stocks and investments. Sampat's counsel to investors was clear: keep expenses low and focus on a select few companies that are easily understandable.

Chandrakant Sampat emphasized the simplicity of comprehending stock markets, asserting that all one needs is a pen and chequebook. His investment principles revolved around choosing companies with understandable business models, minimal debt, commendable Return on Capital Employed (RoCE), a strong history of dividend payouts, and limited capital expenditure. "To excel as an investor, all one needs to do is dream." While this advice may appear clichéd, it carries profound significance, especially in the context of Chandrakant Sampat.

Sampat strategically invested in FMCG giants like Hindustan Unilever (HUL), Nestle, Colgate, and Indian Shaving Products (Gillette) after their initial public offerings, holding onto these stocks for extended periods. Through prudent management, including dividend payouts and bonus shares, he effectively reduced the average cost to nearly negligible levels. Sampat also acknowledged that mistakes and market experiences are invaluable sources of knowledge.

In his personal life, Chandrakant Sampat prioritized fitness and health, maintaining a routine of regular jogging and adhering to a simple, junk-free diet. He was a proponent of self-education, critiquing societal and traditional educational norms, though recognizing the limitations of such thinking. A follower of the Bhagavad Gita, he often quoted shlokas from the ancient text.

Peter F Drucker, a luminary in management theory, was a significant influence on Sampat. He often quoted Drucker and aligned with his theories and philosophies. The core belief shared with Drucker was that profits achieved at the expense of innovation and company downgrades are not genuine profits but rather a destruction of capital. Sampat advocated investing in companies committed to continuous improvement and innovation.

Sampat's golden rule of investment centered on studying a company's fundamentals before investing, a practice that contributed significantly to his success. Even today, modern investors continue to draw inspiration from his investment philosophy, aiming to construct multi-bagger portfolios.

Two critical aspects Sampat emphasized were free cash flow and the longevity of a business for wealth creation. His advice included investing in companies with minimal or no debt, coupled with a deep understanding of the chosen companies. Additionally, he recommended checking if the P/E ratio of shares is approximately 13 to 14 times the current year's earnings and whether shares are available at a yield between 3.5 to 4%.

Opt for Companies with Strong Management

Embrace Cost Efficiency

Navigating Bearish Markets

Tech Acceleration as a Threat to Capital Markets

Top Stock Selections

Success Principles of Sampat

Investment Philosophy in Summary

Influence on Other Investors

FMCG Dominance and Cautious Exit

Opt for Companies with Strong Management

Chandrakant Sampat advocated for investors to select shares of companies with a robust management team. He advised investing in shares when they are at their eight or ten-year low or when companies are trading 40% lower than their 52-week high. Additionally, Sampat recommended focusing on companies with minimal capital expenditure and a Return on Capital Employed (RoCE) of not less than 25%.

Embrace Cost Efficiency

Sampat's investment philosophy emphasized the importance of keeping expenses low and placing trust in the power of compounding.

Navigating Bearish Markets

In the latter phase of Sampat's investment journey, he adopted a bearish stance on the market. During this period, he allocated investments to cash or cash equivalent instruments, steering clear of stock markets due to global market policies causing asset price inflation. He expressed dissatisfaction with the corporate governance policies of Indian companies and harbored reservations about the performance of the Indian economy and corporate sector. Sampat noted the rising fiscal deficit in India and the scarcity of valuable investment options, with numerous listed companies having negative Economic Value Added (EVA).

Tech Acceleration as a Threat to Capital Markets

Chandrakant Sampat harbored concerns about the global threat posed by the rapid acceleration of technology, viewing it as a potential menace to the survival of capital markets. According to Sampat, technological innovations led to shorter business cycles, thereby reducing the lifespan of companies. He asserted that companies needed to generate cash flows to adapt to new technological developments, as the diversion of funds towards technology left limited room for capital formation. Companies with outdated technology, Sampat warned, were at risk of failure, posing a potential threat to capital markets.

Top Stock Selections

Chandrakant Sampat placed significant emphasis on two critical factors for wealth creation: free cash flow and the long-term viability of a business. His bullish stance on the Fast-Moving Consumer Goods (FMCG) sector manifested in the accumulation of shares from prominent blue-chip companies during the mid-'70s, showcasing his acumen for identifying successful investments. Some of his notable picks included Hindustan Unilever (formerly Hindustan Lever), Procter & Gamble (initially Richardson Hindustan), Gillette (then known as Indian Shaving Products), Nestle, and Colgate.

Success Principles of Sampat

Capital Allocation: Sampat deemed capital allocation as the cornerstone of a business. He firmly believed that the combination of capital and innovation imparts value to a company. A successful business, in his view, should be capable of growing with minimal cash.

Portfolio Concentration: Advocating a concentrated approach, Sampat limited his investment portfolio to only 8-10 outstanding companies. He staunchly opposed a diversified portfolio, asserting that in a broad spectrum, numerous companies may falter, with only a handful proving successful. In contrast, a focused portfolio ensures that even one exceptional performer can significantly contribute to wealth accumulation.

Emphasis on Innovation: Sampat was a staunch supporter of innovation, aligning with the principles of management theorist Peter F. Drucker. Recognizing technological innovation as a driving force behind shorter business cycles and consequently shorter company lifespans, Sampat subjected potential investments to a rigorous evaluation of productivity and innovation.

Views on Valuations: In contrast to conventional beliefs, Sampat did not place great emphasis on valuations. Relying on his ability to envision the future, he assigned value to a company based on his unique foresight. He notably expressed his skepticism toward traditional valuation metrics, underscoring his confidence in his visionary approach to investment decisions.

Investment Philosophy in Summary

Sampat's investment philosophy is centered on investing in multi-bagger companies with minimal debt and capital expenditure, consistent dividend payments, and strong fundamentals. He adhered to a long-term investment strategy, prioritizing low expenses and placing faith in the power of compounding. Sampat had a knack for identifying undervalued stocks before other investors recognized their true value.

Influence on Other Investors

Chandrakant Sampat's views resonated widely on Dalal Street, with renowned investors like Radhakishan Damani, the founder of DMart, following his investment philosophy without hesitation. Sampat's influence extended to his suggestion to the Bombay Stock Exchange (BSE) to charge a listing fee based on the number of shares a company intended to issue, rather than a flat fee. This proposal would allow BSE to earn additional income whenever a company raised funds through an IPO or announced a bonus issue.

FMCG Dominance and Cautious Exit

While FMCG companies dominated Sampat's portfolio, he made a conscious decision to cease investing in the later years of his investment journey. His disapproval stemmed from aggressive management practices where promoters prioritized personal enrichment without adequately benefiting minority shareholders.

Parag Parikh, a distinguished value investor and the founder of Parag Parikh Financial Advisory Services (PPFAS), went as far as likening Sampat to the Warren Buffett of India. Sampat's influence on Parikh was so profound that, upon Sampat's passing in 2015 at the age of 86, Parikh expressed, "Whatever I am, it is because of Mr. Sampat. He was my inspiration to enter the capital markets." In these words, Parikh acknowledged the transformative impact of Sampat's wisdom and guidance, attributing his success and entry into the financial realm to the inspiration drawn from this iconic figure.

Must have tools for startups - Recommended by StartupTalky

- Convert Visitors into Leads- SeizeLead

- Payment Gateway- Razorpay

- Spy on your Competitors- Adspyder

- Manage your business smoothly- Google Workspace