How Asset-Light Models Are Enabling Scalable, Sustainable, and Profitable Growth

✍️ Opinions

This article has been contributed by Aman Mehra, Co-founder of Tribe Stays

Hospitality, whether CoLiving or Hotels, have gone through many iterations of business models, especially post COVID. In today’s fast-moving business landscape, brands across sectors are rethinking how they expand.

Traditional growth like owning heavy assets, investing upfront in CAPEX, and managing OPEX in-house is giving way to a more scalable, adaptive approach: the asset-light model. This shift isn’t just a trend. It’s becoming the strategic backbone for modern, future-focused companies aiming to scale fast, remain profitable, and preserve cash while still delivering exceptional value.

As a co-founder of a rapidly scaling hospitality brand, I’ve witnessed firsthand how asset-light strategies can transform an organisation’s trajectory. The reason is simple, in an uncertain world, flexibility is king.

Why the Asset-Heavy Model Is Becoming Obsolete

For decades, businesses viewed ownership as the ultimate indicator of strength — more buildings, more infrastructure, more investment meant more control. But the last several years have made one truth abundantly clear: Capex + Opex + Rent is not sustainable. Unless you’re a legacy brand like a Taj or Oberoi. Owning everything blocks cash, slows growth, and creates operational rigidity. You simply cannot keep up with the demand growth in an exploding India.

The stress of maintaining, upgrading, and scaling physical assets often dilutes a company’s ability to innovate or respond to consumer behaviour or scale. Traditional models also create long payback periods - sometimes more than 8-10 years, making profitability harder to achieve. This is especially true in sectors like ours, where owning hostels or hotels can delay ROI by years. The maths just does not make sense for scale.

In contrast, an asset-light strategy liberates companies from considerable risk and slow growth.

What Exactly Is an Asset-Light Model?

At its core, an asset-light model allows companies to control the business without owning the underlying physical assets. Instead of investing heavily in buying the property, construction, CAPEX, companies focus on:

- Brand building

- Technology and systems

- Customer experience

- Sales and Business Development

Ownership of the assets rests with landlords and developers. This arrangement allows both sides to do what they do best — owners invest in assets, brands focus on maximizing returns from those assets. They act as partners rather than a standard landlord-tenant relationship.

Scalability: Growing Fast Without Tying up Cash

Perhaps the biggest advantage of the asset-light model is speed of expansion. When a company doesn’t have to invest its own capital into every new property or facility, growth becomes exponentially faster.

Think of hospitality’s evolution over the last decade. The world’s largest hotel chains — Marriott, Hilton, IHG — have grown primarily through operator contracts and franchising, not asset ownership. They have enough cash to buy asset. They choose not to. For this very reason.

In retail, D2C brands are expanding through dark stores, outsourced manufacturing, pop-up formats, and franchise networks rather than building large, owned footprints.

The benefit is clear: You can scale at a pace that owning asset just does not allow you to.

Sustainability: Doing More With Less

Asset-light models are naturally more sustainable than asset heavy.

Hospitality provides a strong example here. Instead of developing new buildings, asset-light operators can repurpose existing properties like hostels, hotels, residential and even commercial assets. This saves time, opens options and uses existing non-performing real estate.

From a business standpoint, sustainability also means building models that can survive ups and downs for a long time — economic slowdowns, regulatory changes, market corrections, and operational challenges. Asset-light companies weather shocks better because their fixed costs are lower and their exposure to depreciation and debt is minimal. This avoid constant dropping of assets and benefits long term partnerships with developers as well.

Profitability: For the Landlord and the Operator

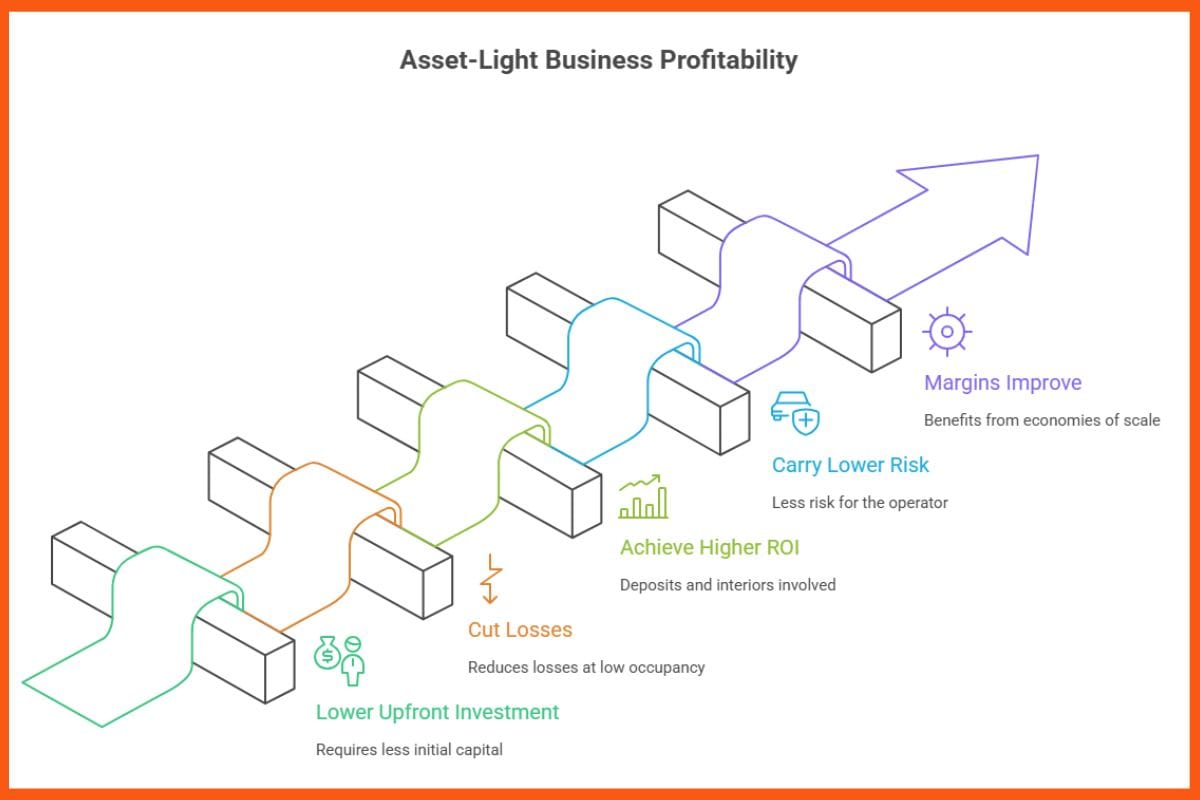

One of the misconceptions about asset-light businesses is that they sacrifice profitability for the operator. This is not true. In reality:

- They require lower upfront investment from the operator

- They help cut losses at low occupancies

- They achieve higher (ROI) as usually only deposits and interiors are involved

- They carry lower risk

Once an asset-light platform reaches scale or tops price points, its margins improve significantly. The brand benefits from economies of scale in technology, operations, marketing, and distribution — all while generating consistent revenue without the burden of locking in to physical assets.

But What’s in it for the Developer?

This is probably the most appropriate question. Asset light models work well only if occupancy and revenue are robust enough to provide higher returns for your developer partner. If, as an operator, you’re sharing as much as market rent, it makes no sense.

In premium, high revenue and high occupancy businesses, landlords make almost 20-40% higher than market rent per month. This, then, makes sense for them to absorb the risk from the operator and invest CAPEX. Also, they always own the property and have flexibility in who operates it.

For businesses like Tribe, this is a massive advantage. Instead of locking capital into real estate, we focus on design, hospitality excellence, technology-driven operations, and growing our network with strong asset partners.

Why Asset-Light Works So Well in India

India is a unique market, where demand is growing rapidly but returns on owned assets can be unpredictable due to low rental yield from residential and commercial ventures. This, added on with rising construction costs, red tape and the intent to hold assets, creates a unique entry point for high yielding hospitality products.

Asset-light models bypass many of these hurdles, making them ideal for high-growth sectors and competitive markets.

Additionally, India’s investor landscape is shifting. Owners and developers prefer stable, long-term income through partnerships with trusted operators, while operators prefer flexible, low-capex growth. The handshake is natural.

Conclusion: Growth With Intelligence, Not Weight

Asset-light models represent a fundamental shift in how brands scale — from “own everything and burn” to “own the Experience and scale” They allow companies to remain flexible, innovative, and customer-centric, while accelerating expansion and maintaining financial discipline - for a long time.

In the hospitality space and beyond, the brands that win will be those that focus on their strongest competencies — experience, technology, service, and brand — while partnering with asset owners and developers who bring infrastructure and investment.

Asset-light isn’t just a business strategy anymore.

It’s the blueprint for scalable, sustainable, and profitable growth in the new economy.

Must have tools for startups - Recommended by StartupTalky

- Convert Visitors into Leads- SeizeLead

- Website Builder SquareSpace

- Run your business Smoothly Systeme.io

- Stock Images Shutterstock