AI in Traditional Industries: How Legacy Banks are Modernising Service Operations with Agentic AI

✍️ Opinions

This article has been contributed by Nirav Choksi- CEO & Co-founder, CredAble

For years, service operations in banks meant large teams, heavy manual work and rising compliance cost. That model is now under real pressure. Banks that embed AI at scale can improve their efficiency ratio by up to 15%, as revenue grows faster than cost and operations become more automated.

At the same time, most large banks are no longer experimenting at the margins. More than 80% of institutions now allocate a 57% of their technology budget to AI, and a clear majority expect a strong return on that spend. The question has shifted from whether to adopt AI to how fast banks can modernise their operating model and move from isolated pilots to industrialised, AI enabled service flows.

In my own work with banks in India and globally across trade and working capital finance, I see a second shift under way.

Traditional analytics and chatbots are giving way to agentic AI systems that do not just predict and classify but plan, decide and act across workflows. That is where service operations start to look very different.

Why Predictive AI Isn’t Enough Anymore and What AI Agents Change

Traditional AI in banking has been narrowing. Models score a loan, detect a suspicious transaction or predict call volumes. They provide insight, but people still run the process.

Agentic AI changes the unit of work. Instead of focusing on one prediction, an AI agent takes responsibility for a goal. It can break that goal into steps, call other systems, coordinate with other agents and decide what to do next based on context.

About 33% of enterprise applications could integrate such agentic AI by 2028, up from less than 1% in 2024, especially in decision heavy areas such as credit, operations and compliance.

In practice, this means moving from a world where an analyst queries a system and then acts, to one where a digital partner prepares the full case, proposes an action and only escalates exceptions.

From Onboarding To AML: The First Battles Agentic AI Is Winning

The most visible gains are coming in front, middle and back-office functions where processes are rules intensive and document heavy.

We’ve seen scenarios in accounts payable and invoice processing where AI agents are trained to read documents, reconcile them with purchase orders and apply tax and payment rules with potentials of cut processing time by up to 80%.

In KYC, Anti-Money Laundering (AML) and regulatory checks, similar systems can collect documents, validate identity across multiple databases, monitor transactions and prepare suspicious activity reports.

Early pilots suggest potential drops of around 60% in manual reviews when agents take on screening and first level investigations.

From what I see in Indian and regional banks, the pattern is clear. Institutions are not rolling out agentic AI in one big enterprise programme. They are breaking operations into use cases and applying agents to high volume journeys first, such as onboarding, invoice validation, credit documentation or trade document checks.

This is also where AI linked working capital and trade finance use cases are moving fastest.

AI agents sit inside loan origination and supply chain workflows, pull data from core banking, enterprise ERP systems and digital public infrastructure, and then prepare a near complete file for underwriters or operations teams.

We have powered these innovations in our own platforms that can automate the initial stages of analysis, enabling banks to process applications 30–40% faster, improving major banking turnaround times.

The result is shorter cycle times and far cleaner audit trails.

Lessons From the Field and What Warly Movers Are Getting Right

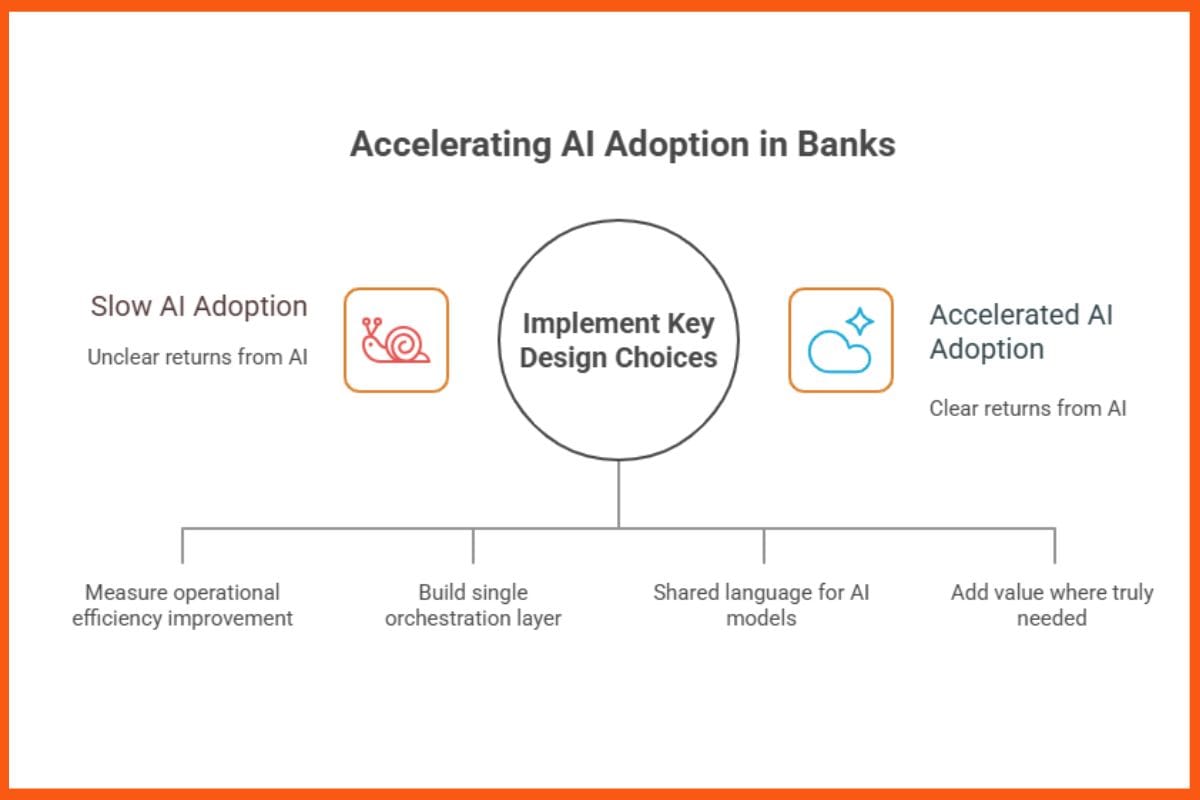

Across banks that are making real progress, I see four design choices.

First, they anchor AI on measurable operational metrics. It is not enough to say that an AI agent has been deployed. The target is often framed in terms of percentage improvement in efficiency ratio, reduction in handling time or reduction in manual touches. This aligns with findings that banks expect clear returns from AI investments and are prepared to increase AI budgets when value is demonstrated.

Second, they treat service operations as a product, not a collection of teams. That means building a single orchestration layer across front, middle and back office.

In one bank we work with, AI agents orchestrate a full procure to pay flow, from invoice capture to payment scheduling. Humans step in at predefined exception points.

The team now measures straight through processing rates in the same way that a product team tracks release quality.

Third, they invest early in AI literacy and trust.

Strong optimism about AI, but also concern about risk, governance and workforce impact. Banks that move fastest are those where operations, technology, risk and business teams have a shared language for how models work, how they fail and how they are controlled.

Fourth, they embed human review where it truly adds value.

In the best implementations I have seen, operations teams are not removed. Their role shifts to supervising AI agents, handling complex cases, improving prompts and policies and feeding back into model improvement.

Why Governance Must Move as Fast as the Algorithms

Modernising service operations with AI is not a technology exercise alone. It is an exercise in risk and governance. Agentic systems can act across products, legal entities and jurisdictions. That demands tight controls on data access, clear role definitions for AI agents, and robust monitoring of decisions.

Explainability, audit trails and traceability are non negotiable, especially in regulated processes like credit, KYC or trade finance. This is where board and regulator conversations are evolving. The key questions are no longer limited to model risk or bias. They extend to operating model questions.

Who is accountable when an AI agent takes a decision within a workflow. How do we evidence that human oversight is real and not symbolic. How do we ensure that third party AI services align with the bank s own control framework.

The Next Operating Model

The data is now clear. Banks that commit to AI at scale can unlock double digit improvements in efficiency, while most peers are already directing a large share of their technology budgets into AI with high expectations for returns. At the same time, agentic AI offers tangible gains in core service operations, from cutting invoice processing time to reducing manual compliance workload.

The next wave of advantage will come from how banks stitch these elements together into a new operating model. In my own journey, the most successful programmes start small but think system wide.

They pick critical service journeys, embed AI agents end to end, build the right guardrails and then reuse those patterns across the institution. Modernising service operations in the age of AI and agentic AI is not about replacing people with machines. It is about designing a model where AI handles repeatable, rules based work and people focus on judgement, relationships and resilience. Banks that make that shift first will not only run leaner service operations. They will set the pace for how banking works in an AI enabled world.

Must have tools for startups - Recommended by StartupTalky

- Convert Visitors into Leads- SeizeLead

- Website Builder SquareSpace

- Run your business Smoothly Systeme.io

- Stock Images Shutterstock