How UPI is Reshaping Digital Payments in India

✍️ Opinions

This article has been contributed by Richika Dadheech, Founder & Managing Director, FiatPe

In less than a decade, India’s payments landscape has transformed at a scale few nations can match. Since its launch by the National Payments Corporation of India (NPCI) in 2016, the Unified Payments Interface (UPI) has redefined how money moves, shrinking transactions that once took minutes or hours into instantaneous, seamless exchanges.

What began as an alternative to card swipes or net banking has evolved into one of the world’s most advanced real-time payment infrastructures, powering everything from a tea vendor’s daily sales to high-value merchant settlements.

The Numbers That Tell the Story

As of 2025, UPI processes over 13 billion transactions every month, contributing to more than 80% of India’s total digital payment volume. Its exponential growth has been driven by interoperability, zero-cost consumer transactions, and the rapid digitisation of India’s informal economy.

The Reserve Bank of India’s push toward a cash-lite ecosystem, coupled with the government’s Digital India vision, has made digital payments convenient and expected.

This transformation is more than technological; it’s behavioural. Consumers now trust QR codes more than currency notes. From street vendors to retailers, India’s payment experience is unified and borderless. UPI has levelled the playing field for millions, including India’s 75 million MSMEs, which are the backbone of the economy.

Why Businesses Are Re-engineering Around UPI

For businesses, UPI is no longer just a payment method; it’s a data-driven growth engine. Every transaction generates insights into consumer behaviour, cash flow, and business efficiency. With settlement cycles now measured in seconds, working capital is freed up faster than ever.

From large enterprises to local retailers, businesses are integrating UPI acceptance with analytics, billing, and accounting systems. This convergence is powering smarter decision-making and real-time visibility into operations.

Multi-mode payment devices combining UPI, cards, and even Buy Now Pay Later (BNPL) are quietly revolutionising checkout experiences across sectors. Features like dynamic QR codes, tap-and-pay options, and instant voice confirmations ensure that no payment goes unnoticed, blending convenience with confidence.

The Technological Backbone of the Revolution

UPI’s rise coincides with India’s cloud-first digital revolution. Today’s payment platforms are not isolated utilities but interconnected ecosystems linking consumers, merchants, and banks.

Fintech players like FiatPe are building plug-and-play APIs, enabling effortless pay-ins, payouts, and reconciliations. Bulk disbursals through IMPS/NEFT/RTGS, split payments for multi-vendor transactions, and automated verification have made financial operations seamless.

Even complex processes, KYC, Aadhaar validation, and compliance workflows, are now digitised. Businesses can manage reconciliation, settlements, and onboarding from a single interface, a once-unthinkable level of simplicity.

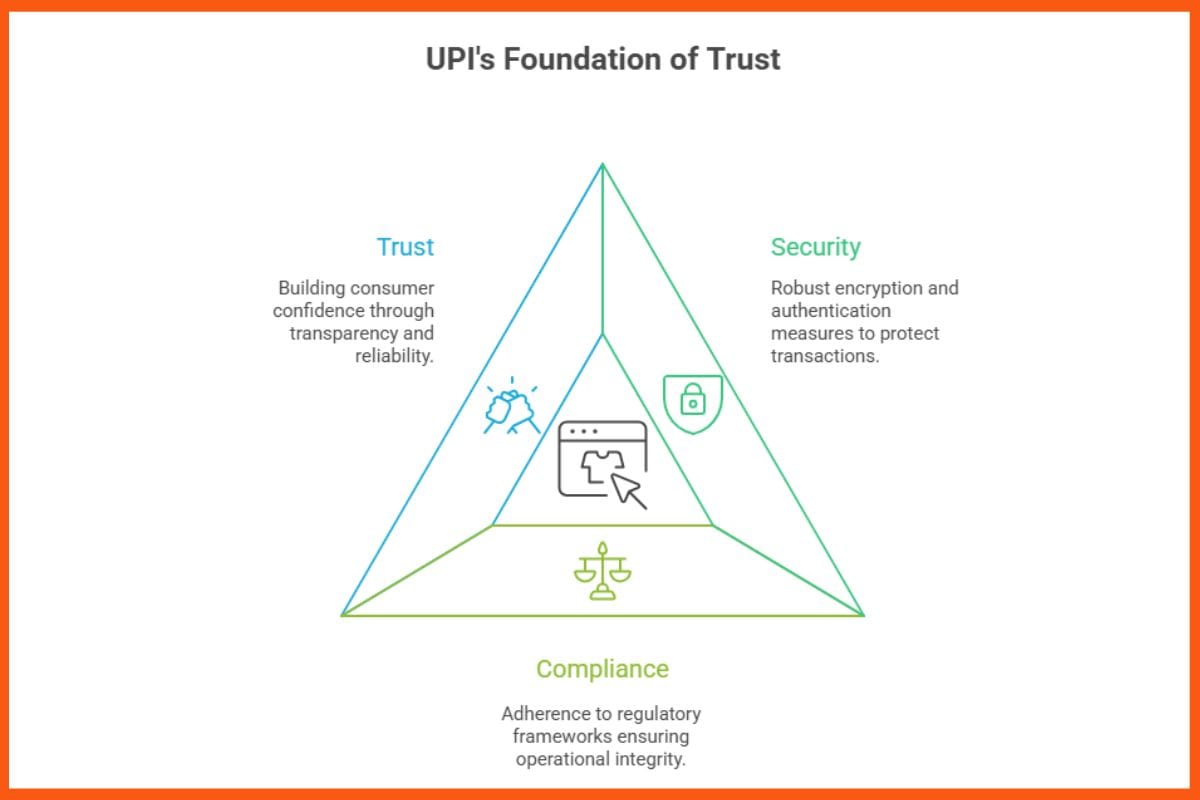

Security, Compliance, and Trust: The Three Pillars

While speed and scalability define UPI’s success, its foundation rests on trust. NPCI’s robust regulatory framework ensures encryption, authentication, and fraud monitoring at scale. Payment providers add another layer of protection through PCI-DSS certifications, tokenisation, and AI-based fraud detection.

Features like real-time alerts, multilingual sound confirmations, and transparent dashboards reinforce consumer confidence especially in semi-urban and rural markets, where trust and technology must go hand in hand.

The familiar sound of “payment received” in one’s local language is more than a confirmation; it’s reassurance that technology can be human, too. Fintech isn’t just about faster payments, it’s about deeper trust. When a small merchant hears “payment received” in their own language, that’s not just technology working, that’s empowerment.

UPI and the Era of Embedded Finance

UPI has paved the way for embedded finance, where payments, lending, and banking seamlessly coexist. Recurring UPI payments, digital wallets, and instant settlements are enabling new financial use cases, from subscription models to payroll automation.

A retail chain, for instance, can now manage salaries, vendor payouts, and reconciliations directly from a connected banking dashboard. These unified workflows save time, reduce errors, and improve liquidity visibility, redefining how businesses operate.

As the ecosystem matures, demand is shifting from simple acceptance tools to end-to-end financial orchestration platforms that combine payments, analytics, and compliance under one secure system.

Empowering MSMEs and the Long Tail of Commerce

The greatest beneficiaries of UPI’s rise are India’s MSMEs, which account for over 30% of GDP. For small merchants, accepting digital payments is no longer a challenge but a competitive advantage.

Compact smart PoS devices, integrated QR+card+soundbox terminals, and Android-based payment interfaces are helping small retailers manage billing, inventory, and reporting all from one device.

This convergence of affordability, accessibility, and innovation is helping millions of small enterprises step into the formal digital economy one transaction at a time.

The Road Ahead

The next chapter for UPI will be defined by personalisation, AI-led insights, and cross-border capabilities. Pilot programs in countries like Singapore and the UAE are already proving India’s potential to set global standards in real-time payments.

Domestically, UPI will continue integrating with credit, savings, and insurance products, evolving into a universal financial gateway. Artificial intelligence will deepen its role in fraud prevention, risk scoring, and customer experience.

Conclusion: From Payments to Empowerment

UPI’s success is not merely about digitising payments, it’s about democratising finance. It has turned every smartphone into a digital wallet, every small business into a digital enterprise, and every transaction into a growth opportunity.

UPI is the next phase of fintech innovation in making digital acceptance frictionless, affordable, and inclusive, enabling merchants, corporates, and consumers to thrive in an increasingly cash-lite India. UPI is not just changing how India pays, it’s reshaping how India works, earns, and grows.

Must have tools for startups - Recommended by StartupTalky

- Convert Visitors into Leads- SeizeLead

- Website Builder SquareSpace

- Run your business Smoothly Systeme.io

- Stock Images Shutterstock