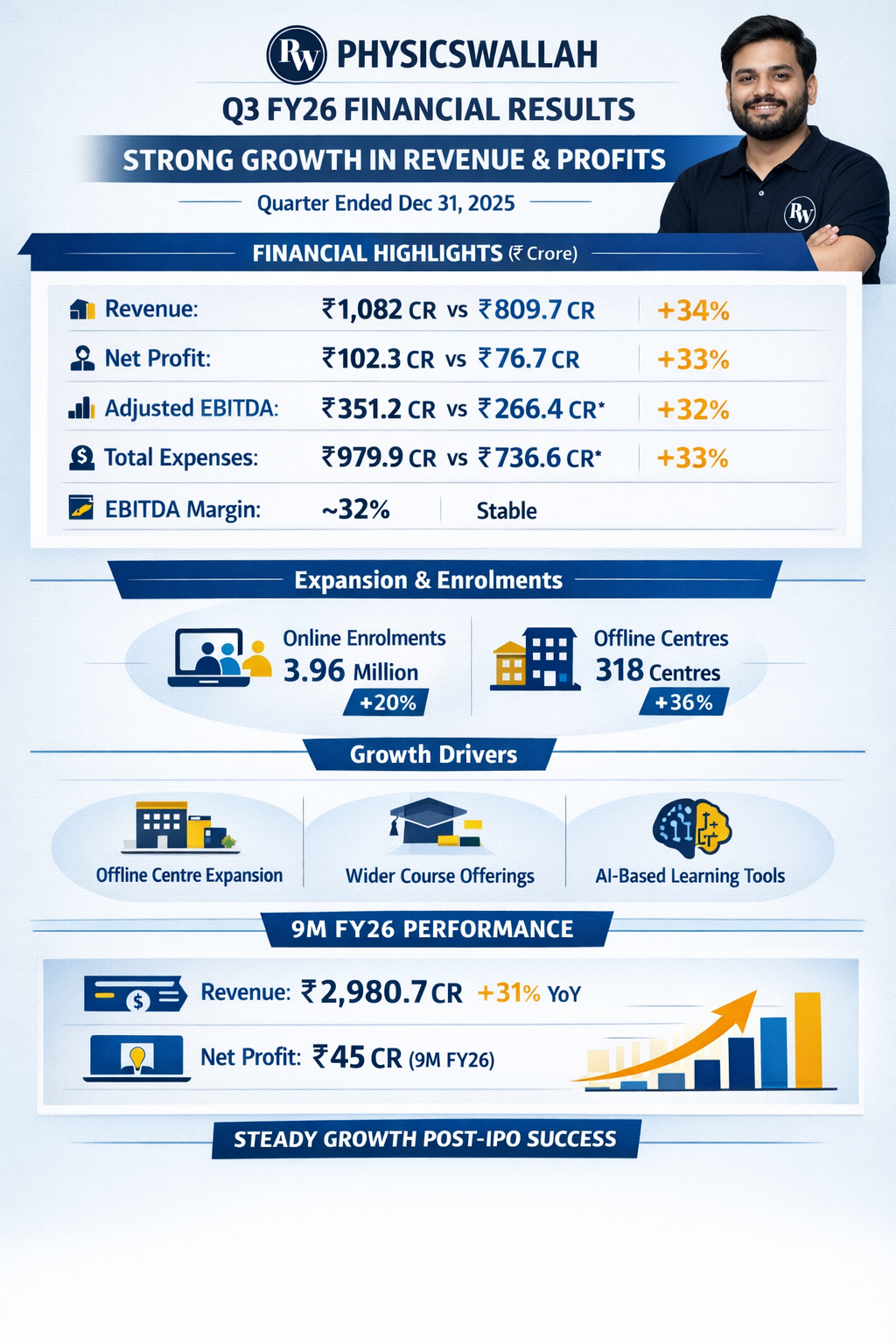

PhysicsWallah Q3 FY26 Revenue Jumps 34%, Profit Rises 33% as Edtech Growth Continues

Edtech company PhysicsWallah reported a strong set of financial results for the third quarter of FY26, showing solid growth in both revenue and profitability. The Noida-based education platform, which went public in November 2025, continues to strengthen its position in India’s competitive online and offline education market.

For the quarter ended 31 December 2025, the edtech unicorn delivered higher income, improved profits, and stable margins, supported by rising student enrolments, offline centre expansion, and growing demand for digital learning services.

PhysicsWallah Q3 FY26 Financial Results Snapshot

| Metric | Q3 FY26 | Q3 FY25 | YoY Change |

|---|---|---|---|

| Revenue from Operations | ₹1,082 crore | ₹809.7 crore | +34% |

| Net Profit | ₹102.3 crore | ₹76.7 crore | +33% |

| EBITDA (Adjusted) | ₹351.2 crore | ₹266.4 crore* | +32%* |

| EBITDA Margin | ~32% | ~33%* | Stable |

| Total Expenses | ₹979.9 crore | ₹736.6 crore | +33% |

| Online Enrolments (9M FY26) | 3.96 million | 3.30 million | +20% |

| Offline Centres (as of Dec 2025) | 318 centres | 234 centres* | +36%* |

PhysicsWallah Q3 FY26 Financial Performance: Revenue, Profit and Expenses

PhysicsWallah reported operating revenue of ₹1,082 crore in Q3 FY26, registering a 34% year-on-year growth compared to ₹809.7 crore in the same quarter last year. The growth was driven by higher paid subscriptions, expansion of offline learning centres, and wider course offerings across exam preparation and school education segments.

The company’s net profit increased by 33% year-on-year to ₹102.3 crore, up from ₹76.7 crore in Q3 FY25. On a quarter-on-quarter basis, profit also improved from ₹69.7 crore in Q2 FY26, reflecting better operating performance after its IPO.

However, expenses also moved higher. Total expenditure rose to ₹979.9 crore, up around 33% compared to the previous year. The increase was mainly due to higher employee costs, marketing spends, technology investments, and offline centre expansion.

Despite rising costs, the company managed to protect profitability due to strong revenue growth and scale benefits.

EBITDA Margins and Operational Efficiency Strengthen

PhysicsWallah reported adjusted EBITDA of ₹351.2 crore in Q3 FY26, translating into a margin of over 32%, indicating improved operational efficiency. The stable margin performance shows that the company is managing its expansion while maintaining cost discipline.

This improvement reflects better monetisation of digital platforms, higher utilisation of offline centres, and increased enrolment volumes across courses.

Online and Offline Expansion Driving Growth

The company’s growth continues to be supported by both its online and offline education models.

In the first nine months of FY26, PhysicsWallah recorded over 3.96 million online enrolments, marking a 20% year-on-year increase. At the same time, its offline business expanded to 318 centres across India, with offline enrolments growing 36% year-on-year.

The company has also widened its reach beyond traditional competitive exams into state board education, regional language learning, and school-level programmes. Courses in languages such as Marathi, Gujarati and Kannada are helping PhysicsWallah reach students in non-metro and regional markets.

Alongside this, the platform has increased its focus on AI-based learning tools, including personalised learning paths, AI-enabled doubt solving, and digital mentoring support, aimed at improving student engagement and learning outcomes.

Nine-Month FY26 Performance and Business Outlook

For the nine months ended 31 December 2025, PhysicsWallah posted operating revenue of ₹2,980.7 crore, representing around 31% growth year-on-year and already exceeding its full-year FY25 revenue.

Net profit for the nine-month period stood at around ₹45 crore, impacted by one-time costs and post-listing expenses, but operational performance remained stable.

Following the Q3 results, PhysicsWallah shares ended slightly higher, reflecting positive market sentiment around its growth trajectory and post-IPO performance.

Must have tools for startups - Recommended by StartupTalky

- Convert Visitors into Leads- SeizeLead

- Website Builder SquareSpace

- Run your business Smoothly Systeme.io

- Stock Images Shutterstock