SIPs: Growing Your Wealth Brick by Brick, Leader by Leader

🔍Insights

In the Indian investment landscape, where navigating volatile markets can feel like a tightrope walk, Systematic Investment Plans (SIPs) emerge as a steady, accessible path to wealth creation. But what exactly are SIPs, and who are the titans leading the charge in this ever-growing market? Buckle up, investors, as we delve into the world of SIPs, armed with statistics and insights to inform your financial journey.

Understanding the SIP Magic

Benefits that Bloom

Market Insights: A Booming Landscape

Quotes From the Leaders

Who Leads the SIP Race?

Beyond the Numbers: Choosing Your Leader

SIP Investment Strategies

Common Mistakes to Avoid

Understanding the SIP Magic

At its core, an SIP is a disciplined investment approach where you invest a fixed amount at regular intervals, typically monthly. It's like building a house, brick by brick, with each installment adding to your financial foundation. This compounding effect, where your returns start generating returns, is the secret sauce of SIPs.

Benefits that Bloom

The beauty of SIPs lies in their numerous benefits:

- Affordability: Start small, with investments as low as ₹500, making them accessible to everyone.

- Discipline: Encourages regular savings, fostering a good financial habit.

- Rupee-Cost Averaging: Buys more units when markets are low, averaging out the cost per unit over time.

- Long-Term Focus: Encourages a long-term view of investments, ideal for wealth creation.

Market Insights: A Booming Landscape

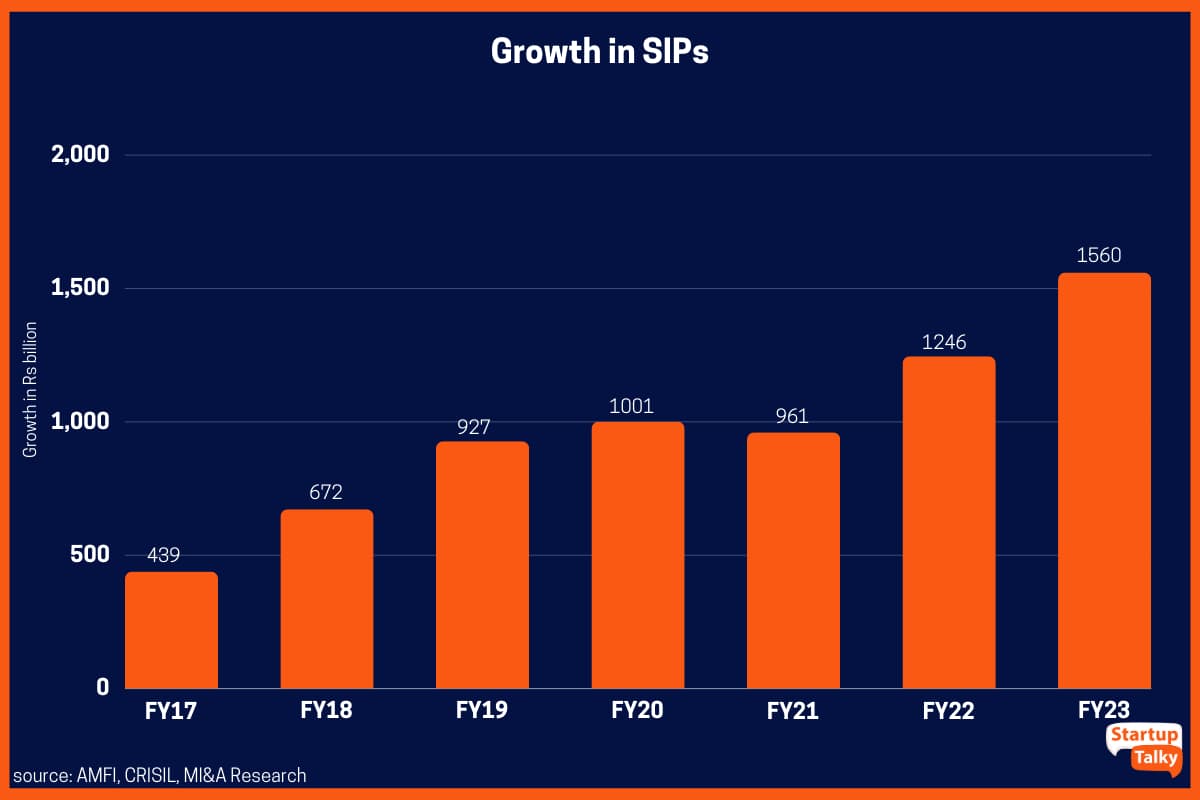

SIPs have witnessed a phenomenal surge in India, with the Association of Mutual Funds in India (AMFI) reporting a total net inflow of ₹13.48 lakh crore in mutual funds through SIPs in FY23 alone. This translates to a 22% year-on-year growth, highlighting the increasing investor confidence in this method.

Quotes From the Leaders

Nimesh Shah, MD & CEO, ICICI Prudential AMC: "SIPs have emerged as the preferred route for wealth creation in India, and we are committed to fostering this investor education and participation."

Chandresh Nigam, MD & CEO, Axis Mutual Fund: "Disciplined investing through SIPs has helped millions of Indians achieve their financial goals, and we see this trend accelerating in the years to come."

Navneet Munot, CIO, SBI Mutual Fund: "SIPs offer a powerful tool for wealth creation, and their increasing popularity reflects the growing financial awareness among Indian investors."

Who Leads the SIP Race?

In the landscape of financial technology, companies such as Groww, Angel One, and PhonePe have emerged as prominent distributors of mutual fund products. In November 2023, this trio collectively facilitated nearly 50% of the new Systematic Investment Plans initiated.

According to the AMFI, November 2023 marked the opening of over 3 million SIPs, with fintech platforms playing a pivotal role in approximately 1.3 million of these transactions. Among the notable contributors, Groww led the way by initiating over 700,000 new SIPs, while Angel One and PhonePe generated more than 200,000 and 120,000 SIPs, respectively.

In addition to these figures, Paytm Money reported an increase of around 76,000 new SIPs in November, while ET Money added approximately 60,000 new SIPs during the same period.

Ujjwal Jain, the CEO of SharedotMarket, the wealth management arm of PhonePe, highlighted the substantial growth in SIP transactions on their platform over the past two years, as outlined in the report.

This surge in fintech-driven SIP openings coincides with a broader trend of rapid growth in the mutual fund sector in India. Local equity funds, in particular, have experienced inflows for an impressive 33 consecutive months, extending through November 2023.

Beyond the Numbers: Choosing Your Leader

While market share paints a broad picture, your individual choice of an SIP provider should involve careful consideration. Factors to ponder:

- Fund Performance: Track record of the fund and its alignment with your risk appetite and investment goals.

- Expense Ratio: Lower expense ratios translate to better returns for you.

- Investment Options: Variety of schemes offered to cater to your diverse needs.

- Investor Service: Track record of customer service and support offered by the fund house.

SIP Investment Strategies

Implementing diversified investment strategies is crucial for optimizing SIP returns. This involves distributing investments across different sectors and fund types, mitigating the impact of underperforming sectors or asset classes. Diversification can encompass a mix of Equity, Debt, and Hybrid funds, with a focus on varied industries or geographies within each category.

Regularly reviewing and rebalancing your SIP portfolio is essential to ensure alignment with your investment goals and risk tolerance. Economic conditions, market trends, and personal circumstances evolve over time, necessitating adjustments in your investment mix. Rebalancing entails selling portions of overperforming investments and acquiring more underperforming ones to maintain the desired asset allocation.

Adopting a long-term perspective is ideal for SIPs, leveraging the power of compounding over time. A prolonged investment horizon helps weather short-term market volatilities, allowing for potential recovery and growth.

Consistent contributions to SIPs, irrespective of market conditions, enable cost averaging over time, contributing to better long-term returns. Aligning each SIP with a specific financial goal aids in selecting the right type of fund, determining the investment horizon, and specifying the amount.

Periodically reassessing risk tolerance is crucial, as life situations may alter, necessitating adjustments in the SIP portfolio.

Common Mistakes to Avoid

- Investors in SIPs should steer clear of common pitfalls for a successful and profitable investment journey.

- Attempting to time the market is counterproductive, as SIPs are designed for regular, disciplined investing irrespective of market conditions.

- Ignoring risk tolerance can lead to investing in funds that are either too aggressive or too conservative, causing undue stress or financial losses.

- Thorough research is imperative before committing to any SIP, considering the fund's past performance, the fund manager's track record, and investment philosophy.

- Consistency in investing is vital to leverage the advantages of Rupee Cost Averaging (RCA) and maximize long-term growth.

- Chasing past performance may lead to suboptimal decisions, as it does not guarantee future results. Understanding the reasons behind a fund's performance is crucial.

- Considering the tax implications of investments is essential, as different Mutual Fund Schemes have varied tax treatments that can impact net returns.

Making informed decisions for SIP investments in 2024 hinges on factors such as financial goals, risk tolerance, and investment horizon. By understanding these elements and avoiding common pitfalls, investors can align their decisions with long-term financial objectives, ensuring a more effective and rewarding SIP investment experience.

Remember

The SIP journey is personal, and the "leader" ultimately depends on your specific financial goals and investment preferences. So, research, evaluate, and choose wisely. Investing through SIPs is a marathon, not a sprint. Stay disciplined, stay informed, and watch your wealth grow, brick by brick, towards a brighter financial future.

FAQs

What is a Systematic Investment Plan (SIP)?

A Systematic Investment Plan (SIP) is a disciplined investment approach where you invest a fixed amount at regular intervals, typically monthly. It's like building a house, brick by brick, with each installment adding to your financial foundation.

What are the benefits of SIP?

The main benefits of SIP are as below:

- Affordability

- Discipline

- Rupee-Cost Averaging

- Long-Term Focus

Is money safe in SIP?

SIP is a very safe method to invest in mutual funds.

Must have tools for startups - Recommended by StartupTalky

- Convert Visitors into Leads- SeizeLead

- Payment Gateway- Razorpay

- Spy on your Competitors- Adspyder

- Manage your business smoothly- Google Workspace