PhonePe Success Story - How It Became India’s Leading Payments App?

📄Company Profiles

Company Profile is an initiative by StartupTalky to publish verified information on different startups and organizations.

In today's world, the emphasis is on comfort and ease, and the banking industry has seen quite a revolution in this regard. Carrying cash was rather cumbersome, which led to the birth of digital payments and mobile wallets, and PhonePe has grown up to be one of the major exponents in this sector.

Mobile apps are the preferred method for the payment of groceries, utility bills, phone recharges, etc. Even large transactions are now done digitally rather than in cash, which has not only removed the risk factors in the physical world but also streamlined the whole banking and finance sector for good.

PhonePe is one such payment app that has made the lives of millions of Indians simple. Founded in December 2015, PhonePe is currently hailed as the market leader in the digital payments space in India. The app allows users to maintain their bank accounts digitally, access them at their convenience, and use their funds for all the purposes that they want. They can easily link their credit and debit cards with a mobile wallet to make their digital payments. Furthermore, instant money transfers can also be done through PhonePe. These are only some instances when PhonePe appears to be indispensable and trust us, there are more!

If you want to know more about PhonePe's Success Story, its founders, business model, revenue model, funding and investors, revenue, growth, competitors, and more, then stay glued.

PhonePe - Company Highlights

| Company Name | PhonePe |

|---|---|

| Headquarters | Bengaluru, Karnataka, India |

| Sector | Fintech |

| Founder | Sameer Nigam, Burzin Engineer, Rahul Chari |

| Founded | 2015 |

| Valuation | $12 Billion |

| Website | phonepe.com |

PhonePe - About

PhonePe - Industry

PhonePe - Founders and Team

PhonePe - Startup Story

PhonePe - Mission and Vision

PhonePe - Name, Tagline, and Logo

PhonePe - Business Model

PhonePe - Revenue Model

PhonePe - Growth and Revenue

PhonePe - Challenges Faced

PhonePe - Funding And Investors

PhonePe - Acquisitions

PhonePe - ESOPs

PhonePe - Partnerships

PhonePe - Advertisements and Social Media Campaigns

PhonePe - Awards and Achievements

PhonePe - Competitors

PhonePe - Future Plans

PhonePe - About

PhonePe, founded in December 2015, is a renowned digital payments company that supports over 11 languages. It is among the first payment apps built on the Unified Payments Interface (UPI) and holds the distinction of being the first UPI payments app to surpass the billion-transaction milestone. The app offers a wide range of services, allowing users to send and receive money, check bank balances, make POS payments, purchase gold, and perform various transactions such as phone recharges, DTH payments, and utility bill payments. It is widely recognized and approved by Indian merchants, enabling users to book rides, order food, shop online, and more.

Obtaining regulatory approval from the Reserve Bank of India (RBI), PhonePe operates as an account aggregator. This groundbreaking service empowers Indian consumers to grant consent and securely share their financial data, including bank statements, insurance policies, and tax filings, with regulated Financial Institutions or Financial Information Users (FIUs). Through this service, users can easily apply for loans, obtain insurance, seek investment advice, and explore other financial solutions. Importantly, users retain complete control over their data consent, with the ability to request, pause, or revoke access conveniently through aa.phonepe.com or directly within the PhonePe app.

With its wide range of services, innovative features, and regulatory approval as an account aggregator, PhonePe continues to redefine the digital payments landscape in India, empowering users with secure and convenient financial solutions while putting them in control of their data.

How Does PhonePe Work?

PhonePe is a digital payment and wallet-based app that operates within the Unified Payments Interface (UPI) ecosystem. To use PhonePe, users need to download the app, link their phone numbers, and verify their bank accounts. Once set up, users can make transactions directly through the app. PhonePe acts as a mediator between users and their bank accounts, enabling seamless fund transfers, bill payments, and online shopping. The app provides a secure and convenient platform for users to manage their digital payments, ensuring a smooth and hassle-free experience.

PhonePe - Industry

In the vibrant and rapidly evolving Digital Payments market of India, the total transaction value is anticipated to reach $180.40 billion in 2023, with a projected annual growth rate of 15.56% (CAGR 2023–2027), culminating in a projected total of $321.70 billion by 2027. PhonePe, along with Google Pay and Paytm, emerged as the dominant players, collectively accounting for nearly 96% of all UPI transactions by value in March. PhonePe continued to lead the market in terms of both value and volume for UPI transactions, solidifying its standing in the market.

PhonePe - Founders and Team

Sameer Nigam, Burzin Engineer, and Rahul Chari are the founders of PhonePe.

Sameer Nigam

Sameer Nigam is the founder and CEO of PhonePe. Prior to PhonePe, Sameer held key positions at Flipkart, including Senior Vice President of Engineering and Vice President of Marketing. Sameer's association with Flipkart dates back to 2011, when his earlier startup, Mime360, was acquired by the company. He has also worked as the Director of Product Management at Shopzilla, Inc. Sameer holds an MBA from the Wharton Business School at the University of Pennsylvania, a Master's degree in Computer Science from the University of Arizona, Tucson, and a Bachelor's degree in Computer Science from the University of Mumbai, India.

Rahul Chari

Rahul Chari is the Founder and CTO of PhonePe. He started his career as a software engineer with Andiamo Systems Inc. after completing an internship at Sun Microsystems. Chari then went on to serve in managerial positions in a couple more companies like Cisco Systems, Mime360, and Flipkart, where he served as the Senior Software Engineer, Manager, Co-founder and CTO, and Vice President of Engineering, respectively. Rahul holds a Master's degree in Computer Science from Purdue University, USA, and a Bachelor's degree in Computer Engineering from Mumbai University, India.

Burzin Engineer

Burzin Engineer is the Founder and CRO (Chief Reliability Officer) of PhonePe. He was the Vice President of Engineering and Operations at M-GO for two years before founding PhonePe. Furthermore, he has also worked with Flipkart, mime360.com, Shopzilla.com, SoftAware Inc., MarchFirst Inc., Twin Sun Inc., and AT&T Global Information Systems (Teradata). Burzin pursued his Bachelor's degree from the University of Mumbai and later completed a Master's degree in Computer Science from the University of Southern California.

Flaunt your startup with StartupTalky

800+ stories, thousands of founders, and millions of visitors. Want to be the next?

StartupTalky is where founders, entrepreneurs, startups and businesses hang out and look up to for inspiration. If you have the means, we have the medium! Inviting founders and startups who are building sustainable solutions from ground zero! Startups who run the show, StartupTalky will let the world know!

PhonePe - Startup Story

PhonePe was founded in 2015 by Sameer Nigam, Rahul Chari, and Burzin Engineer, who were ex-Flipkart employees. With a vision of simplifying transactions and making financial services accessible to all, they founded PhonePe.

In 2016, PhonePe took a significant leap forward when it caught the attention of Flipkart, one of India's leading eCommerce giants. Recognizing its immense potential, Flipkart swiftly acquired PhonePe, forging a strategic partnership that would shape the future of digital payments.

With the backing of Flipkart, PhonePe began its journey toward revolutionizing the digital transaction landscape. The founders had a groundbreaking idea to leverage the Unified Payments Interface (UPI), a newly launched infrastructure by the National Payments Corporation of India (NPCI). This decision would prove to be a turning point in PhonePe's story.

By integrating with UPI, PhonePe offered users a seamless and secure way to make transactions directly from their bank accounts. The app gained popularity for its user-friendly interface, fast processing times, and convenient features. It quickly became a trusted name in the digital payment space.

As PhonePe continued to innovate and expand its offerings, it solidified its position as a leader in the fintech industry. The platform's commitment to user empowerment, data privacy, and convenience resonated with millions of users across India.

In December 2022, Flipkart and PhonePe announced their complete ownership separation. This move granted PhonePe the independence to chart its own growth trajectory, marking a pivotal moment in its journey. Additionally, PhonePe shifted its domicile from Singapore to India in October 2022.

Today, PhonePe continues to redefine the way Indians transact digitally. With its secure and innovative solutions, PhonePe empowers users to effortlessly manage their finances, access a wide range of financial services, and experience the convenience of digital payments.

PhonePe - Mission and Vision

PhonePe's mission is to offer every Indian an equal opportunity to accelerate their progress by unlocking the flow of money and access to services.

The vision statement of PhonePe is, "Our Vision is to build India’s largest transaction platform anchored on payments. A scalable ecosystem that creates maximum positive impact for all stakeholders".

PhonePe - Name, Tagline, and Logo

The name of PhonePe sounds quite similar to its peers, Google Pay, Amazon Pay, and more because it is essentially a payments app. However, PhonePe has an interesting take on the word "pay" by using "Pe" in its name. This evokes the Hindi connotation of the term, aligning with its operation on mobile phones. The brand chose the color purple as its primary color and incorporated it into the logo. The linguistic mixing of Hindi and English in writing "Pe" helps users recall the Hindi connotation.

PhonePe goes by the tagline "Karte Ja. Badhte Ja," which means "Keep doing, keep growing," written on a very positive note that hints toward the transactions on the app and the expansion of the business of PhonePe.

PhonePe - Business Model

PhonePe operates on a combined B2B and B2C business model in the digital payments and financial services sectors.

Consumer Side: On the consumer side, PhonePe offers a digital payment platform that allows users to make seamless transactions using their smartphones. Users can link their bank accounts, debit cards, and credit cards to the PhonePe app, enabling them to make payments, transfer money, recharge mobile phones, pay bills, and more. PhonePe provides a user-friendly interface and a secure platform for convenient and efficient financial transactions.

Merchant Side: PhonePe also caters to merchants by providing them with payment solutions and tools to accept digital payments. Merchants can use the PhonePe app or integrate PhonePe's payment gateway into their own applications or websites. This enables them to accept payments from customers using various payment methods, including UPI, cards, and wallets. PhonePe offers features such as payment notifications, transaction history, and easy reconciliation to enhance the merchant's payment experience.

PhonePe has also obtained a license from the RBI (Reserve Bank of India) to provide services related to money transactions and payment systems in India. The company strives to expand its user base, generate profits, and offer additional services beyond traditional banking transactions.

The PhonePe Services encompass a comprehensive range of offerings, including Pre-Paid Instruments, Gift cards, Payment gateways, Recharges and Bill Payments, Insurance, Mutual Funds, Gold sales, and purchases, and switch interfaces and access. These services exemplify PhonePe's dedication to delivering a diverse and user-centric platform that caters to various financial needs.

PhonePe - Revenue Model

PhonePe operates on a revenue model that encompasses various streams of income.

Transaction Fees: PhonePe generates revenue by charging transaction fees or commissions on each transaction made through its platform. This includes fees on UPI payments, bill payments, recharges, and other financial transactions processed through the app.

Merchant Services: PhonePe offers merchant services, enabling businesses to accept payments through its POS machines. PhonePe earns revenue by charging merchants a fee for using its POS machines and accepting payments from customers.

Insurance Brokerage: With its insurance brokerage license obtained from the IRDAI (Insurance Regulatory and Development Authority of India), PhonePe offers insurance products to its user base. The company earns revenue through commissions on insurance policy sales.

Affiliate Commissions: PhonePe partners with various brands and vendors to promote their products and services to its users. It earns affiliate commissions when users make purchases or engage with partner offerings through the PhonePe platform.

Advertising and Promotions: PhonePe generates revenue through advertising and promotional activities. Brands and businesses can leverage PhonePe's platform to reach a large user base, and PhonePe charges fees for advertising and promotional placements on its app.

Data Insights: PhonePe leverages its extensive user database to gather valuable insights on payment patterns, customer behavior, and preferences. These insights can be used for targeted marketing and data-driven decision-making, potentially generating revenue through data analytics services or partnerships.

PhonePe - Growth and Revenue

PhonePe, founded in December 2015, was acquired by Flipkart in 2016 for about $20 million. Since then, the company has experienced remarkable growth, reaching a valuation of over $12 billion in 2023.

PhonePe became the first UPI-based app to surpass 10 million downloads in 2017 and has consistently ranked among the top finance apps in major app stores. It has emerged as a leading player in UPI transactions and achieved the milestone of 1 million app transactions in a day in 2017. With its popularity as a digital payments service provider, PhonePe recorded $2 billion in monthly transactions in October 2021. Company has reached 5 billion (5.33 billion) transactions via unified payments interface (UPI) for the first time in the month of October 2023.

PhonePe's growth is evident through its innovative offerings, including the Smart Speaker, Pulse platform, Pincode App, merchant lending platform, and POS devices.

PhonePe Smart Speaker

PhonePe expanded its offerings with the launch of the PhonePe Smart Speaker in August 2022, aimed at enhancing the payment tracking experience at stores. Equipped with multilingual payment notifications and up to 4 days of battery life, these speakers are installed at merchants' doorsteps for a nominal initial cost of Rs 50 and a monthly rental fee of Rs 50.

PhonePe Pulse

PhonePe Pulse is a leading platform in India that launched in September 2021 and provides comprehensive data and insights on digital payment trends. It offers valuable information on the country's digital payment landscape through an interactive map showcasing transactions, enabling users to understand the adoption and usage patterns of digital payments across various regions. PhonePe Pulse is a valuable resource for government, media, industry analysts, merchants, startups, and academic institutions, offering deep insights into consumer and merchant behavior.

PhonePe Pincode App

PhonePe launched Pincode, a new consumer-facing application that operates within the framework of India's Open Network for Digital Commerce (ONDC), in April 2023. This allows PhonePe to strengthen its presence in the eCommerce space and directly compete with rivals like Paytm. Pincode focuses on hyperlocal commerce and offers categories such as grocery, food, pharma, electronics, home decor, and fashion. The app aims to provide a seamless shopping experience, with plans to expand to multiple cities. With this, PhonePe is the first player to have a dedicated app on the ONDC platform, supporting the government's push for digital commerce in India.

PhonePe Merchant Lending Platform

In June 2023, PhonePe launched its merchant lending platform. This innovative platform aims to address the challenges faced by small and medium enterprises (SMEs) in accessing organized credit. By leveraging its extensive base of over 35 million merchants, PhonePe enables banks and non-banking financial companies (NBFCs) to provide credit digitally and seamlessly. Through the PhonePe for Business app, SMEs can experience a streamlined and quick loan approval process, ensuring timely access to credit for their growth and development.

Phone.Pe Launches App Share.Market

PhonePe, a major player in the fintech industry with strong backing from retail giant Walmart, took a significant step forward by venturing into the world of stock broking on 30 August, 2023. They did so by introducing their new mobile application aptly named "Share.Market.

This user-friendly app is set to provide individuals with the means to partake in stock trading, invest in mutual funds, and even delve into the world of Exchange-Traded Funds (ETFs). This move not only marks a significant expansion of PhonePe's services but also positions them to cater to a broader audience looking to explore the world of financial markets through a convenient and accessible platform. It's a noteworthy development in the ever-evolving landscape of fintech, with PhonePe aiming to make stock market participation more accessible to the masses.

"We launched lending, insurance, and payment gateway businesses recently. We started mutual fund distribution four years back and now we are entering the stock broking business under its subsidiary PhonePe Wealth," said Sameer Nigam, founder and chief executive officer (CEO) of PhonePe.

PhonePe Point-of-Sale (POS) Device

PhonePe has expanded its presence in the digital payment ecosystem by entering the point-of-sale (POS) device market. This strategic move positions PhonePe to compete with industry players like Pine Labs, Paytm, and Razorpay, offering reliable and efficient payment solutions for merchants accepting payments via debit cards, credit cards, and UPI. By leveraging its expertise in digital payments, PhonePe aims to provide seamless transactions for customers in both online and offline environments, catering to the diverse needs of businesses.

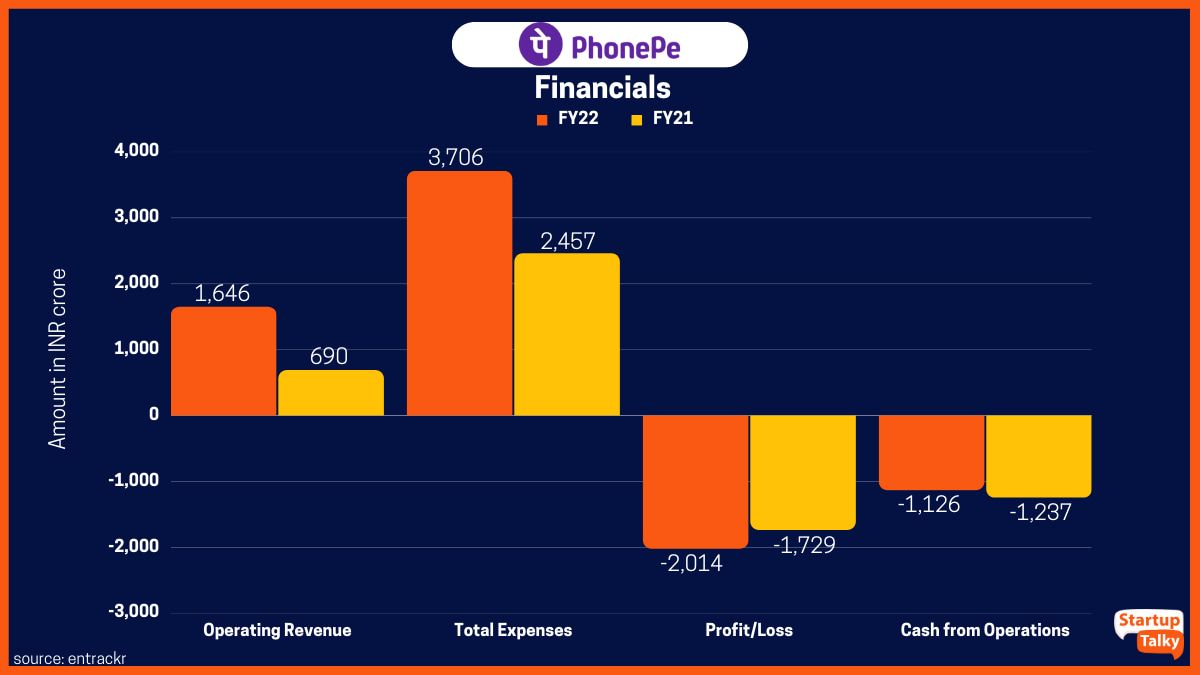

PhonePe Financials

PhonePe witnessed robust revenue growth, surging 77% growth to Rs 2,914 crore in FY23 from Rs 1,646 crore in FY22.

The company claims that in FY23, as opposed to FY22, its EBITDA for the payment segment stood at negative Rs 1,755 crore where in FY22 it was negative Rs 1,622 crore.

PhonePe - Challenges Faced

Starting up was indeed a big challenge for PhonePe because the industry was quite new and rather unexplored. However, the PhonePe acquisition by Flipkart settled things.

Blockage by ICICI Bank and Airtel

PhonePe was blocked on January 14, 2017, by ICICI Bank because the PhonePe transactions did not meet the NPCI guidelines. Though the NPCI initially instructed ICICI to allow UPI transactions via PhonePe on January 19, 2017, the regulatory body confirmed a day later that the digital payments service provider had indeed violated the UPI norms. Airtel was another company that blocked PhonePe transactions on its platforms during the same period.

This led PhonePe to close its operations on Flipkart's website, which helped the startup align itself with the terms stated in the updated verdict from the NPCI. The digital payments app resolved all of these issues with ICICI and Airtel by February 2017.

QR Code Burning Incident

PhonePe faced a notable incident where its QR codes were allegedly burned by employees of Paytm. PhonePe promptly filed a police complaint at Surajpur Lakhnawali police station in Greater Noida. Upon identification of the individuals involved, including a Paytm Area Sales Manager (ASM) and a former PhonePe employee, Paytm took immediate action and suspended them. Paytm emphasized its commitment to upholding high standards of work ethics and stated that it does not tolerate any form of misconduct.

Domicile Shift and Investor Contribution

Another challenge PhonePe encountered was the process of shifting its domicile from Singapore to India. PhonePe's investors contributed approximately Rs 8,000 crore in taxes to facilitate this domicile shift. This significant financial contribution from investors played a vital role in aligning PhonePe's operations with the regulatory framework in India.

PhonePe - Funding And Investors

PhonePe has raised over $2.6 billion in funding across 18 rounds as of May 2023. The ongoing financing round has propelled Walmart-backed PhonePe's valuation to $12 billion, with investments from notable investors including General Atlantic.

Here is a detailed list of PhonePe funding and investors below:

| Date | Amount Raised | Round | Lead Investors |

|---|---|---|---|

| May 22, 2023 | $100 million | Private Equity | General Atlantic |

| April 12, 2023 | $100 million | Private Equity | General Atlantic |

| March 17, 2023 | $200 million | Corporate | Walmart |

| February 14, 2023 | $100 million | Private Equity | - |

| January 19, 2023 | $350 million | Private Equity | General Atlantic |

| August 18, 2021 | $350 million | Corporate | Walmart |

| December 14, 2020 | $21 million | Corporate | Flipkart |

| December 3, 2020 | $700 million | Corporate | Walmart |

| April 27, 2020 | $28 million | Corporate | Flipkart |

| February 26, 2020 | $59.6 million | Corporate | Flipkart |

| December 10, 2019 | $78.8 million | Corporate | Flipkart |

| October 22, 2019 | $54.7 million | Corporate | Flipkart |

| July 30, 2019 | $93.5 million | Corporate | Flipkart |

| March 22, 2019 | $101 million | Corporate | Flipkart |

| August 9, 2018 | $60 million | Corporate | Flipkart |

| April 1, 2018 | $42.7 million | Corporate | Flipkart |

| March 23, 2018 | $69.4 million | Corporate | Flipkart |

| October 4, 2017 | $33.4 million | Corporate | Flipkart |

PhonePe - Acquisitions

PhonePe has made six acquisitions, including Indus OS, Zopper, GigIndia, Indus App Bazaar, OpenQ, and WealthDesk. Notably, it acquired OpenQ and WealthDesk in a combined deal worth $75 million in May 2022. In July 2022, PhonePe announced the acquisition of Indus' parent company, OSLabs, after reaching an amicable settlement with Affle Global.

| Acquiree Name | Date | Amount |

|---|---|---|

| Indus OS | July 29, 2022 | $60 million |

| OpenQ | May 18, 2022 | $25 million |

| WealthDesk | May 17, 2022 | $50 million |

| GigIndia | March 22, 2022 | - |

| Indus App Bazaar | May 19, 2021 | $60 million |

| Zopper | July 16, 2018 | - |

PhonePe - ESOPs

PhonePe offers ESOPs to its full-time employees. In November 2021, the company conducted a buyback of ESOPs worth Rs 135 crores, benefiting 75% of its workforce who have completed at least one year of service. Additionally, as part of the separation from Flipkart, eligible employees will receive a one-time cash payout from a $700 million employee stock option (ESOP) buyback conducted by Flipkart. These payouts aim to compensate for the loss of PhonePe's value in the stock options.

PhonePe - Partnerships

PhonePe has seen many partnerships over the years that it has been operating. Here's a dive into some of the most important ones:

- PhonePe partnered with Axis Bank in July 2021 on the UPI multi-bank model. It has already collaborated with Yes Bank.

- Ola collaborated with PhonePe in July 2020 to allow Ola payments through the PhonePe app and wallet.

- PhonePe has partnered with Flipkart to digitize cash-on-delivery payments in July 2021.

- PhonePe became the official payments partner for KBFC in September 2021.

- Edelweiss General Insurance tied up with PhonePe in December 2021 with the aim of offering digital motor insurance products.

- In April 2022, PhonePe and Extreme IX entered into a strategic partnership with the objective of minimizing latency in the PhonePe app during transactions.

PhonePe - Advertisements and Social Media Campaigns

PhonePe actively engages in advertisements and social media campaigns to promote its digital payments platform and services. The company has launched successful marketing campaigns to raise brand awareness and drive user engagement.

One of PhonePe's notable campaigns was launched during the IPL in 2020, featuring popular actors Aamir Khan and Alia Bhatt. This highly successful marketing campaign effectively conveyed the message of encouraging people to embrace digital payments for their convenience and security. The campaign highlighted the seamless transaction experience offered by PhonePe.

In April 2023, PhonePe launched its new brand campaign, 'PhonePe - Insurance your way’, focused on motor insurance. The campaign aims to convey the unique advantages of purchasing motor insurance through PhonePe, highlighting the convenience, reliability, and absence of unwanted calls or unnecessary add-ons.

The company also utilizes social media platforms to share informative content, customer stories, and special offers, aiming to establish a strong presence in the digital payments industry and educate users about its platform's advantages.

PhonePe - Awards and Achievements

Some of the prominent awards and achievements received by PhonePe include:

- Recognition by the National Payments Corporation of India (NPCI) for driving the largest number of merchant transactions on the UPI network in 2018.

- Best Mobile Payment Product or Service Category at the IAMAI India Digital Awards 2019.

- Excellence in the Insurtech category at Assocham's Fintech and Digital Payments Awards 2021.

- Winner at the Third ET BFSI Innovation Tribe Virtual Summit & Awards (APAC edition).

- Winner at the 8th Annual India Retail and e-Retail Awards 2019.

- Winner at the IAMAI 9th India Digital Awards 2019.

- Best BFSI Brand 2023 at The Economic Times Best BFSI Brands Conclave.

- Best Payment Solutions and Best Insurtech of the Year at the BW Festival of Fintech 2023.

PhonePe - Competitors

The top competitors of PhonePe include Google Pay, Amazon Pay, Whatsapp Pay, Juspay, Paytm, MobiKwik, BharatPe, and more.

- GPay is a Google-developed digital wallet platform and online payment service. Released in 2011, GooglePay initially offers contactless payment options.

- Amazon Pay was founded in 2007 and serves as an online payment processing service owned by Amazon, headquartered in Seattle.

- Whatsapp Pay is a payments service provider powered by the social media giant Facebook, which owns Whatsapp, to help users send and receive money while chatting.

- Juspay is an online platform used for mobile-based payments. Juspay was founded in 2012.

- Paytm is a pioneer of the Indian eCommerce payment system. It is a financial technology company. Paytm was founded in 2010.

- MobiKwik is an Indian company. It has a mobile phone-based payment system. MobiKwik was founded in 2009.

- BharatPe is a platform, particularly for retailers and businesses. It is a QR-based payment app. The company was founded in 2018.

PhonePe - Future Plans

PhonePe has ambitious plans for the future, including aiming for an IPO in 2024–2025. The company seeks to leverage its strong user base, innovative technologies, and strategic partnerships to drive growth and expand its market presence. With a focus on seamless payments and financial inclusion, PhonePe aims to enhance its product offerings, expand its merchant network, and provide a comprehensive ecosystem of services. Going public will provide additional opportunities for investment and propel the company's expansion plans in the competitive digital payments landscape.

FAQs

What is PhonePe?

PhonePe is a popular digital payments platform in India, known for its seamless and secure transactions using UPI technology. It allows users to make payments, transfer money, recharge phones, and pay bills through their smartphones.

Who is the founder of PhonePe?

Sameer Nigam, Rahul Chari, and Burzin Engineer are the founders of PhonePe.

Who is Burzin Engineer from PhonePe?

Burzin Engineer is the Founder and CRO (Chief Reliability Officer) at PhonePe. He was previously Director of Engineering at Flipkart.

What is PhonePe Switch?

PhonePe Switch is a feature within the PhonePe app that allows users to conveniently access a variety of apps and services, such as food delivery, transportation, and e-commerce, all in one place. It eliminates the need to download and install multiple apps individually, providing a seamless experience for users.

What is the PhonePe Merchant Lending Platform?

PhonePe's Merchant Lending Platform offers digital credit solutions to SMEs through the PhonePe for Business app in partnership with NBFCs, facilitating quick access to funds for their growth.

What is PhonePe's valuation?

PhonePe's valuation has reached $12 billion as of June 2023, reflecting its significant growth and successful fundraising efforts.

What is PhonePe's revenue in FY23?

In the first nine months of 2022, PhonePe achieved a revenue of Rs 1,913 crore.

How many Phonepe users did the app register?

PhonePe users have crossed the 350 million mark, as of January 2022.

Does PhonePe charge customers anything for transactions?

No, transactions made through the PhonePe app are free of charge for customers. There are no additional costs associated with using PhonePe to make transactions.

When was the PhonePe app launched?

PhonePe was founded in 2015, and its app, based on the Unified Payments Interface (UPI), went live in 2016.