Tax Automation Tools for Startups and SMEs

✍️ Opinions

This article has been contributed by Manas Gond, Founder — Prosperr.io

Most companies, especially startups, SMEs, and fast-scaling organizations face a systemic problem in how they manage employee compensation, taxes, and benefits.

Between managing invoices, reconciling TDS, tracking employee reimbursements, and ensuring compliance with tax rules, small and mid-sized businesses often find themselves caught in a maze of spreadsheets, compliance-related challenges and last-minute reconciliations.

And yet, despite technology redefining every business function from HR to logistics and compliance in India,operations have remained largely manual, until recently, increasing operational complications and cost. While there is payroll software that automates disbursal, but it does not offer tax optimization, there are tax-filing platforms that help individuals, but don’t integrate with employer systems.

However, we are now witnessing a quiet but powerful shift: the rise of tax automation tools built companies large-sized as well as startups and SMEs.

The Problem: Complexity Meets Constraints

Startups and SMEs operate in high-pressure environments — lean teams, limited bandwidth, and tight budgets. Most don’t have in-house tax experts or dedicated CFOs. Instead, finance functions are often managed by small accounting teams juggling multiple roles.

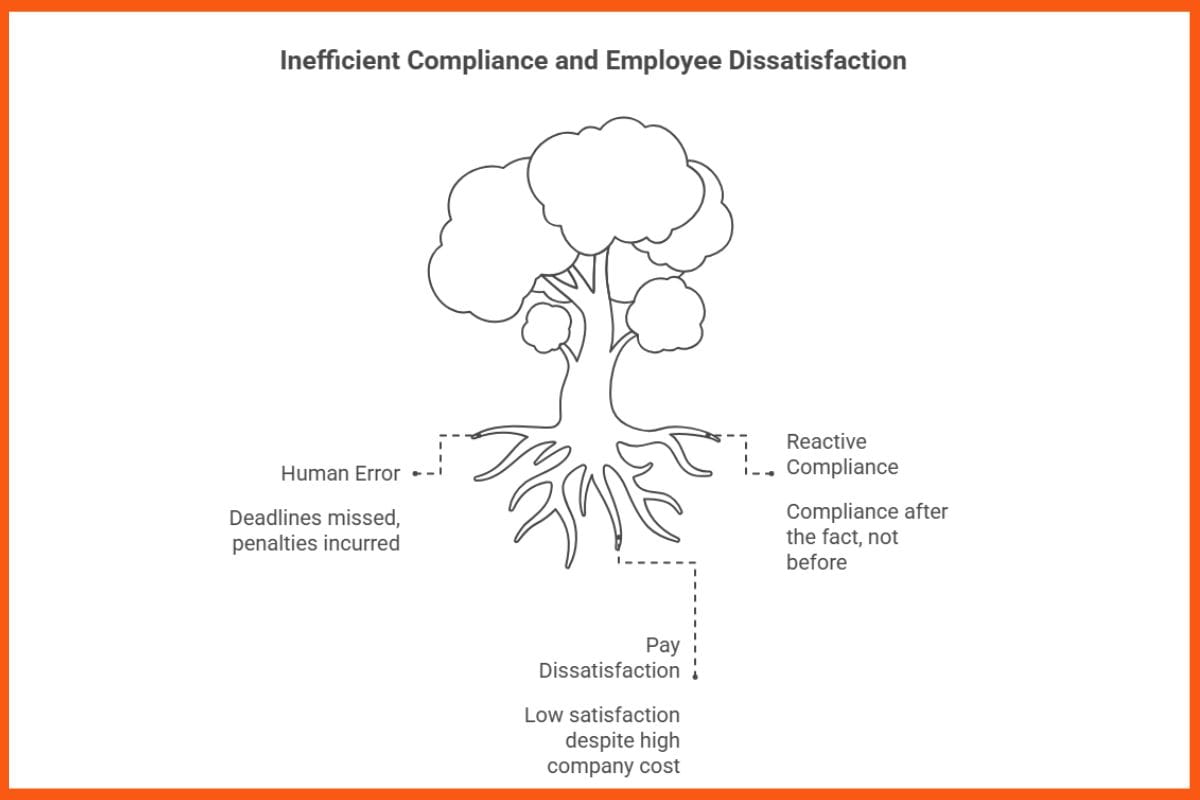

This leads to three recurring pain points:

- Missed deadlines and penalties due to human error or oversight

- Reactive decision-making, where compliance happens after the event, not before

- Low employee satisfaction with take-home pay despite high cost to company (CTC)

In a fast-moving ecosystem, this reactive approach can cost more than just time — it can erode credibility with investors, partners, and employees.

The Rise of Automation in Tax Management

Automation tools are reshaping this landscape by bringing speed, accuracy, compliance and transparency to tax filing and financial reporting.

Here’s how:

Integrated Data Capture

Modern tools sync directly with accounting software, payroll systems, and expense management platforms. Instead of manually collating invoices or expense proofs, data flows automatically — reducing reconciliation time by up to 70%.

Real-Time Tax Computation

Automated tax engines can compute advance taxes and TDS deductions in real-time. This gives business owners instant visibility into their tax position not weeks after the books close.

Error Detection and Compliance Alerts

AI-led tools can identify anomalies, flag missing entries, or alert users about mismatched tax filings before they become costly errors. Automation ensures accuracy — and more importantly, peace of mind.

Empowering Employees and Driving Financial Wellness

The benefits of tax automation extend beyond the finance department. When businesses implement systems that help employees optimize their tax-saving reimbursements, deductions, and salary structures, they effectively promote financial wellness across the organization.

For employees, that means better clarity on how to plan their salary to maximise their in-hand. For employers, it means higher satisfaction and retention — without increasing cost to company (CTC)

The Human + AI Model: Not Replacing, but Reinforcing

It’s important to clarify that automation doesn’t replace human judgment — it enhances it. The most effective systems combine AI precision with expert oversight. Accountants and advisors can now focus on interpreting insights, not chasing paperwork.

This hybrid approach, tech-driven, expert-enabled, is what’s creating a new standard for financial clarity among India’s emerging businesses. Tax automation isn’t just a technology upgrade. It represents a mindset shift — from reactive compliance to proactive clarity.

As India’s entrepreneurial ecosystem matures, automation will no longer be a luxury. It will be the invisible infrastructure that powers every responsible, growth-focused business. And as with every transformation, those who adopt early — and build their systems around data and insight — will lead the next decade of prosperity.

Must have tools for startups - Recommended by StartupTalky

- Convert Visitors into Leads- SeizeLead

- Website Builder SquareSpace

- Run your business Smoothly Systeme.io

- Stock Images Shutterstock