Top Crypto Insurance Providers in the US: Secure Your Crypto, Reduce Your Risk

Collections 🗒️

The crypto and Web3 risk infrastructure sector is becoming a core part of the digital finance ecosystem. As blockchain adoption grows, the need for asset protection, smart contract security, decentralized insurance, and stablecoin-based financial systems is increasing. These solutions help reduce risk, improve trust, and support large-scale adoption of digital assets.

This ecosystem includes crypto insurance providers, decentralized cover platforms, smart contract security protocols, and stablecoin payment infrastructure companies. Each plays a different role in building safer and more reliable blockchain systems. This overview brings together key companies from this space and explains how they support security, scalability, compliance, and long-term growth in the digital economy.

Crypto Insurance Providers in the US Comparison

| Platform | Founded | Headquarters | Regulation (USA) | Coverage Type | Assets Insured | Security Measures | KYC Requirement | Best For | App Availability |

|---|---|---|---|---|---|---|---|---|---|

| OpenCover | 2013 | San Francisco (United States) | Decentralized, on-chain underwriting partners | Smart contract hacks, stablecoin depegs, oracle manipulation, governance attacks | 100+ protocols and protocol combinations | Vetted on-chain underwriters, ERC-721 Proof of Cover | Not explicitly stated, but implied through on-chain nature | Retail, institutional, DeFi users seeking on-chain risk protection | Web-based platform |

| Evertas | 2017 | Chicago (United States) | Backed by Lloyd's of London, A+ Rated coverage | Crime/Theft/Loss (digital assets, private keys), Mining Property, Platform Failure, Insider Theft/Loss, D&O, Digital Property (NFTs) | Crypto custodians, miners, exchanges, investment funds, family offices, NFTs | Proprietary cryptonative underwriting process, Lloyd's of London backing, A+ rated policies | Policies issued through licensed brokers, implying KYC/AML | Institutional investors, mining operations, crypto custodians, high-net-worth individuals | Web-based |

| Sherlock | 2021 | Austin (United States) | Functions as an insurance alternative, not directly regulated as traditional insurance | Smart contract exploits, audit risks | DeFi protocols | Collaborative audits, audit contests, bug bounties, Sherlock AI, Sherlock Shield (financial coverage) | Not explicitly stated, focus on protocol security | DeFi protocols, Web3 projects seeking comprehensive smart contract security and financial coverage | Web-based platform |

| Bridge Mutual | 2020 | Wyoming (United States) | Decentralized, user-governed ecosystem, no KYC | Smart contracts, stablecoins, exchanges | Various crypto assets | Blockchain-based transparency, 2-phase voting for claims, Consensys Audit, Zokyo Audit | No KYC | DeFi users, those seeking decentralized, community-driven coverage | Web-based Dapp, Mobile version available |

| FairSide | 2021 | Detroit (United States) | Community-aligned theft coverage, not traditional insurance | Crypto theft (drains, scams, hacks) | On-chain assets (Bitcoin, Ethereum, 1000+ digital assets, NFTs, DeFi, RWAs) | Community-aligned, powered by $FAIR token, on-chain experts for claims | Not explicitly stated, but typical for on-chain protocols | Retail users, those seeking broad theft coverage for on-chain assets | Web-based App |

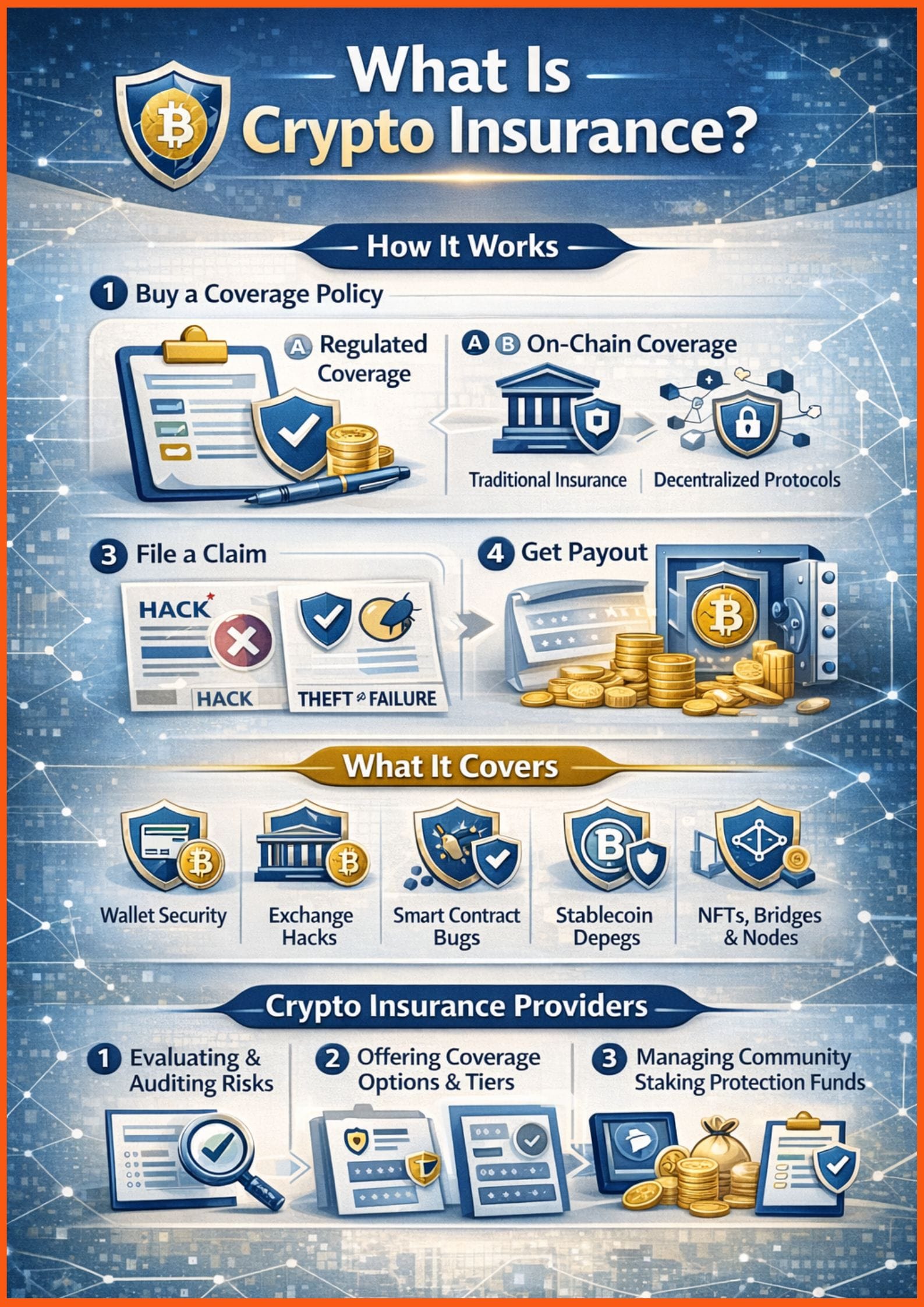

What is Crypto Insurance?

Crypto insurance is a form of protection for digital assets like cryptocurrencies, stablecoins, NFTs, and on-chain funds against risks such as hacks, theft, smart contract failures, exchange breaches, and system exploits. It works like traditional insurance but is designed for the crypto ecosystem, offering coverage through regulated insurers or decentralised protocols. Crypto insurance helps individuals, investors, and businesses reduce financial risk and protect their digital wealth in an increasingly complex blockchain environment.

List of Best Crypto Insurance Providers in the US

OpenCover

OpenCover is a US-based crypto insurance provider known for its innovative approach to on-chain risk protection. The platform operates through decentralized, on-chain underwriting partners, offering coverage against smart contract hacks, stablecoin depegs, oracle manipulation, and governance attacks.

It provides protection for over 100 protocols and protocol combinations, utilizing vetted on-chain underwriters and ERC-721 Proof of Cover for enhanced security. While not explicitly stated, its on-chain nature implies a focus on transparency and potentially different KYC requirements compared to traditional financial institutions. Users can access services via its web-based platform, making it suitable for retail, institutional, and DeFi users seeking robust on-chain risk protection.

Pros

- Covers major DeFi risks like hacks, depegs, and smart contract failures

- Easy on-chain access through a web app

- Supports many protocols and blockchains

- Transparent pricing and coverage options

Cons

- Claims process can be complex

- Not all losses are covered

- On-chain insurance is still new

Evertas

Evertas is a US-based crypto insurance provider renowned for its institutional-grade coverage backed by Lloyd's of London, offering A+ Rated policies. The platform provides comprehensive coverage for crime/theft/loss of digital assets and private keys, mining property, platform failure, insider theft/loss, Directors & Officers (D&O) liability, and digital property like NFTs.

Evertas's proprietary cryptonative underwriting process and the backing of Lloyd's of London ensure high security standards. Policies are issued through licensed brokers, implying strict KYC/AML protocols. It is best suited for institutional investors, mining operations, crypto custodians, and high-net-worth individuals requiring extensive and highly rated insurance for their digital assets.

Pros

- Backed by Lloyd’s of London

- High coverage limits for large institutions

- Trusted by exchanges, funds, and custodians

- Strong legal and compliance structure

Cons

- Not suitable for small users

- Expensive compared to DeFi cover

- Slower onboarding process

Sherlock

Sherlock is a US-based Web3 security and smart contract auditing platform that functions as an insurance alternative, providing financial protection for DeFi protocols. While not directly regulated as traditional insurance, Sherlock Shield offers coverage against smart contract exploits and audit risks.

The platform secures DeFi protocols through a multi-faceted approach including collaborative audits, audit contests, bug bounties, and Sherlock AI. Its focus is on providing comprehensive lifecycle security for Web3 projects, making it ideal for DeFi protocols and Web3 projects seeking robust smart contract security and financial coverage against technical vulnerabilities. Sherlock operates primarily through a web-based platform.

Pros

- Combines audits with financial protection

- Strong focus on smart contract security

- Community staking model

- Trusted by DeFi projects

Cons

- Lower coverage limits

- DAO claims process can be slow

- Requires technical knowledge

Bridge Mutual

Bridge Mutual is a US-based decentralized crypto coverage platform known for its user-governed ecosystem and no-KYC policy. The platform offers coverage for smart contracts, stablecoins, and exchanges, allowing users to protect various crypto assets.

Bridge Mutual ensures transparency and fairness through its blockchain-based system, which includes a 2-phase voting process for claims and audits by Consensys and Zokyo. Its decentralized nature means it does not require traditional KYC, making it accessible to a global audience. Users can access its services via a web-based Dapp and a mobile version, making it best for DeFi users and those who prefer community-driven, transparent, and accessible coverage solutions.

Pros

- Fast cross-border payments

- Stablecoin-based infrastructure

- Strong developer APIs

- Supports wallets, cards, and payments

Cons

- Needs technical integration

- Depends on stablecoin regulations

- Not consumer-focused

FairSide

FairSide is a US-based crypto theft coverage provider that positions itself as a community-aligned alternative to traditional insurance. The platform offers broad theft coverage for on-chain assets, including Bitcoin, Ethereum, 1000+ digital assets, NFTs, DeFi, and RWAs, protecting users against drains, scams, and hacks.

FairSide is powered by its $FAIR token and utilizes on-chain experts for claims investigation, emphasizing a community-driven approach to security. While not a traditional regulated insurer, its focus is on providing accessible and comprehensive theft protection for on-chain assets. It is best suited for retail users seeking broad theft coverage for their digital assets and operates through a web-based app.

Pros

- Simple cost-sharing protection model

- Low entry barrier for users

- Community-based governance

- Wallet-level protection focus

Cons

- Limited adoption

- Small coverage pools

- Slower claim resolution

How to Choose the Right Crypto Insurance Provider in the US

Choosing the right crypto insurance provider in the US means balancing regulation, security, coverage, and trust. Focus on these essentials:

- Regulatory Compliance: Prefer providers aligned with FinCEN guidelines, state licences, and relevant SEC/CFTC frameworks. This ensures oversight and investor protection.

- Coverage Scope & Custody Model: Check what’s covered, custodial wallets, exchanges, DeFi protocols, smart contracts, private key theft, stablecoin risks, and who controls the assets.

- Security & Audits: Look for regular audits, penetration testing, multi-signature systems, code audits, and bug bounty programmes.

- Pricing Transparency: Ensure clear premiums, deductibles, limits, and claim impact on future costs. Avoid hidden fees.

- Solvency & Claims Reliability: Check proof-of-reserves, capital backing, and payout history. A transparent claims process is critical.

FAQs

Is crypto insurance legal in the USA?

Yes, crypto insurance is legal in the USA. Traditional insurance companies offering crypto-related policies are regulated by state insurance departments, similar to other forms of insurance. Decentralized coverage protocols, however, operate under different legal frameworks and may not be subject to the same regulations as traditional insurers.

Which crypto insurance platforms are regulated in the US?

Platforms like Evertas, which are backed by established entities like Lloyd's of London and issue policies through licensed brokers, operate within traditional regulatory frameworks. Other platforms may adhere to FinCEN guidelines or state-specific crypto regulations, but it's crucial to verify the regulatory status of each provider.

What types of crypto assets can be insured?

Crypto insurance can cover a wide range of digital assets, including major cryptocurrencies like Bitcoin and Ethereum, stablecoins, NFTs, and other on-chain assets. Coverage can extend to assets held in custodial wallets, on exchanges, and within DeFi protocols.

Can DeFi assets be insured in the US?

Yes, DeFi assets can be insured in the US. Both traditional insurers and decentralized protocols offer solutions for covering risks associated with DeFi, such as smart contract vulnerabilities, stablecoin de-pegs, and oracle failures. The regulatory landscape for DeFi insurance is still evolving, so understanding the specific terms and conditions of each provider is essential.

Must have tools for startups - Recommended by StartupTalky

- Convert Visitors into Leads- SeizeLead

- Website Builder SquareSpace

- Run your business Smoothly Systeme.io

- Stock Images Shutterstock