WhatsApp Pay Available For Indian Users: All You Need To Know

📖 Learning

Facebook Inc has finally launched WhatsApp Payments service in India, after years of struggle to bag a permit to run the service in India. WhatsApp Pay finally got the approval for the roll-out in the country and is available for all iOS and Android users.

“Starting today, people across India will be able to send money through WhatsApp. This secure payment experience makes transferring money just as easy as sending a message. People can safely send money to a family member or share the cost of goods from a distance without having to exchange cash in person or going to a local bank," WhatsApp mentioned in a blog.

The US social media giant WhatsApp can gradually expand its UPI base starting with as many as 20 million users. Facebook has been testing WhatsApp payments in India since early 2018 and has designed its payments feature in partnership with the National Payments Corporation of India (NPCI).

“To send money on WhatsApp in India, it’s necessary to have a bank account and debit card in India. WhatsApp sends instructions to banks, also known as payment service providers, that initiate the transfer of money via UPI between sender and receiver bank accounts,” WhatsApp said.

WhatsApp Pay has also collaborated with five leading banks in India which also includes Axis Bank, the State Bank of India, ICICI Bank, HDFC Bank and Jio Payments Bank.

According to media reports, WhatsApp will make users enter UPI Pin for every payment. The company has said that “Payments is designed with a strong set of security and privacy principles”.

How to set up WhatsApp Pay:

In order to start using the WhatsApp Payments service on your mobile phones, you need to follow these simple steps:

- Update your WhatsApp on Play Store to get the Payments feature

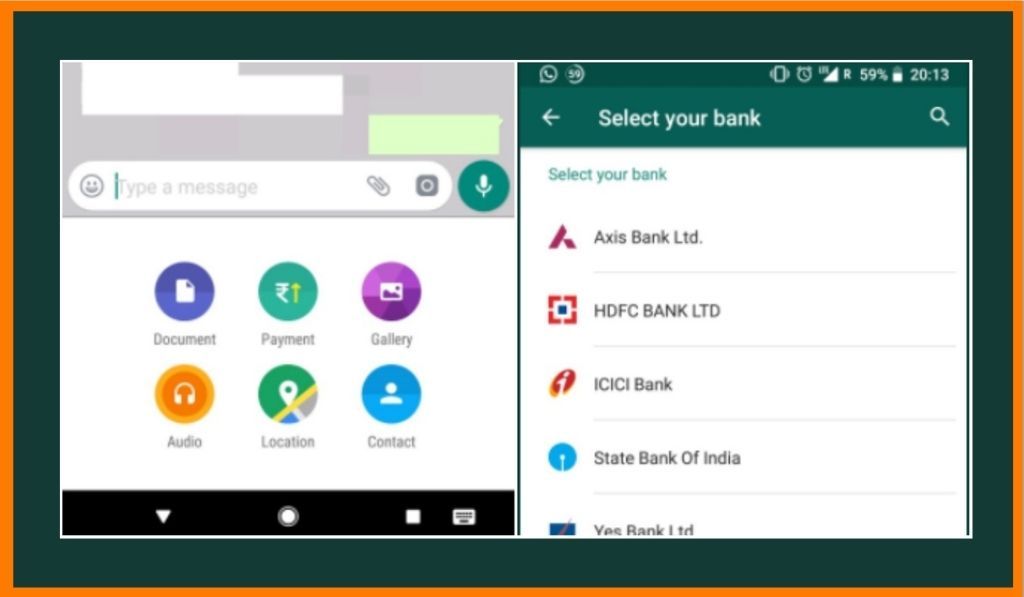

- For Android: Open the chat window and click on the three vertical dots on the top right

- Tap on the Payments option

- Open the Payments window, click on Add new payments method

- Tap on accept and continue to proceed further

- You will be taken to a new window with a list of banks that have partnered with WhatsApp

- Select the bank from the list and verify the account using the phone number. Also, use the number that is registered with the bank

- Click on allow to let WhatsApp verify your account and send texts to authenticate

- Once you enter the number, WhatsApp will verify with your bank and set up the payment.

10. Hit done and access your Payments page.

How to send money on WhatsApp:

- Choose the contact you want to send money to, In the chat window, tap on the clip icon.

- Choose the rupee icon, Enter the amount you want to send along with a note if need be.

- Enter your UPI Pin to process the transaction.

- Wait till you get a confirmation message on your chat window.