Digital Finance Adoption in Small Businesses and Startups

✍️ Opinions

This article has been contributed by Piyush Arora , Head of Corporate Strategy and Investment, Turbostart

Over the past ten years, digital finance has moved from being a niche concept to an essential part of business operations. For small businesses and early-stage startups, it is no longer an optional tool but a foundation that aids growth, and financial stability.

Unlike age-old systems that usually rely on manual accounting ledgers and physical documents, digital finance uses technology to make transactions quicker, transparent, and easily measurable. These modern financial systems ensure accuracy, and easy access to capital, allowing smaller enterprises to function with the convenience once limited to larger organizations.

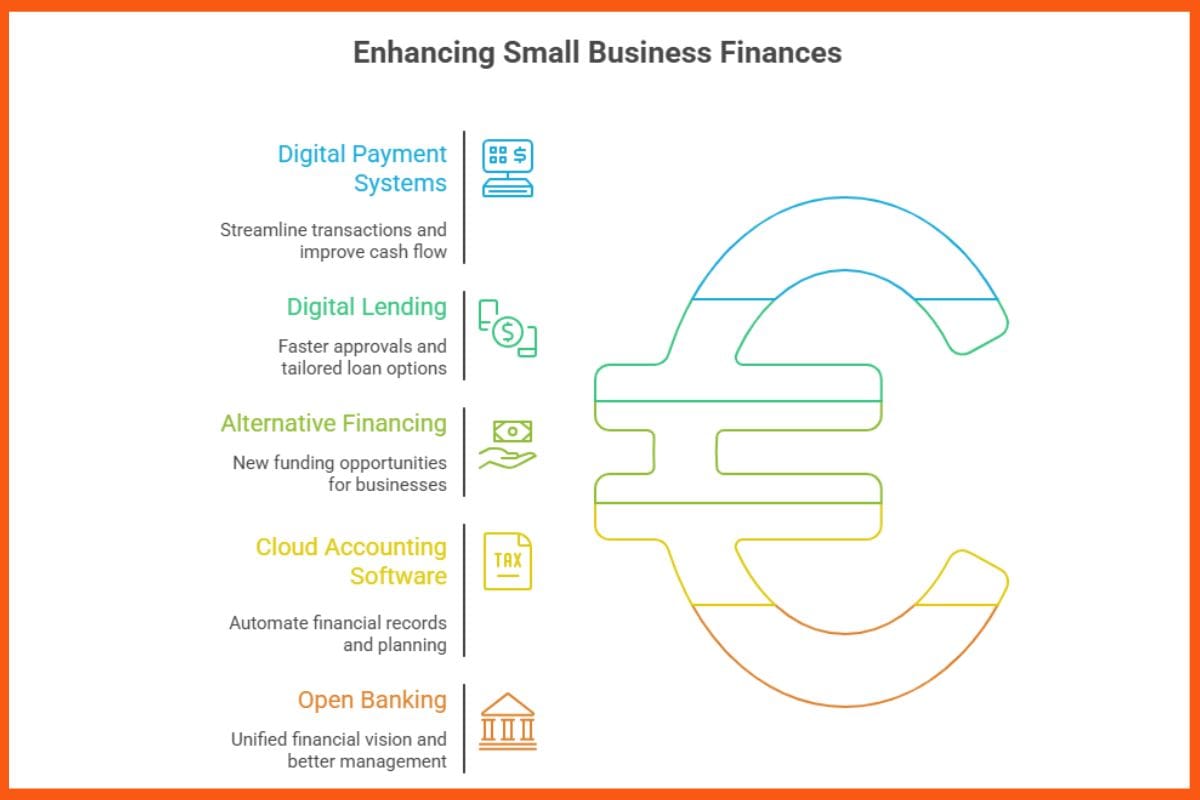

The 5 Key Divisions of Digital Finance for Small Businesses and Startups

- Digital Payment Systems: E-wallets and instant payment applications make transactions smoother, secure, and easier to track. They improve cash flow while reducing dependence on physical currency for small businesses. This helps startups manage day-to-day operations smoothly, shorten payment cycles, and maintain stronger financial discipline.

- Digital Lending: Fin-tech firms now assess creditworthiness using different algorithms to track transactions, online sales, and behavioral trends of users. This allows faster approvals and tailored loan options. For small businesses, it opens access to working capital even without extensive credit histories, reducing reliance on traditional banking barriers.

- Alternative Financing: Mass funding and micro lending create new funding opportunities for businesses that lack traditional banking relationships by connecting them to individual and institutional investors. This helps startup or small business owners to receive funds more quickly, expand the sources of their capital, and validate business ideas directly with their target customers.

- Cloud Accounting Software: Digital accounting tools now automate invoicing, inventory tracking, and bookkeeping. They maintain accuracy in financial records instantly that are important for audits and financial planning. For startups, this results in better financial planning as fewer errors made by man, leaving behind more scope to scale the business.

- Open Banking: Regulated and safe data-sharing systems between banks and authorized third parties give startup founders a unified vision of their funds. This enables better credit management and gives founders access to a number of financial tools. It also helps small enterprises make well-thought financial decisions, track performance across accounts, and access newer financial tools suited to their company size and requirements.

Together, these innovations have changed how small firms manage finances, access funds, and stay relevant in domestic and international spheres.

The Evolution of Financial Operations in India and How it Matters

India’s digital architecture is helmed by innovations like IndiaStack, the Unified Payments Interface (UPI), and the Account Aggregator model has built a secure and seamless system for digital finance. It encourages innovation with strict guidelines for data protection and transparency.

The rise of digital finance reflects a mix of technological progress, updated regulations, and increasing digital awareness among entrepreneurs. Traditional banking systems remain slow and paperwork-heavy, whereas digital tools offer efficiency, inclusion, and instant execution. Automation now ensures that even the smallest firms can maintain accurate records that are essential for building lender confidence and unlocking credit opportunities.

Just a few years ago, who could have imagined that even a transaction in Paise could be settled electronically in a matter of seconds, or loan approved within a matter of minutes. Time and liquidity are limited resources for entrepreneurs. Digital finance solves both by offering easy access to finances and enhancing visibility over financial cycles. Integrated cloud platforms bring together banking, invoicing, and analytics, that help startup founders make faster, informed decisions.

The benefits are tangible:

- Operational efficiency: Automation in financial management reduces manual work and costs, while increasing capacity for business growth.

- Cash flow clarity: Instant tracking of income and expenses supports timely decision-making.

- Wider market reach: The acceptance of online payments helps firms expand their consumer base and take part effectively in e-commerce.

- Improved access to credit: Modern credit models use alternative data to identify risks, allowing inclusion of firms with little or no formal credit history.

- Financial inclusion: Well-managed digital payments create a formal financial trail for micro and unorganised firms, helping them connect with traditional banking.

Another important change is the rise of embedded finance, where non-financial industries such as retail and logistics integrate payment, lending, or insurance within their platforms, creating higher value. For example, when you book tickets, you can purchase travel insurance as a bundle.

Barriers to Use for Small Businesses or Startups

Despite quick progress, adoption challenges still remain. Encouraging digital record-keeping, simplifying onboarding processes, and instilling trust through uncomplicated and user-friendly systems will be important for higher adoption. The barriers are not only technical but also behavioral, as trust and ease of use play major roles in acceptance.

Low awareness of digital platforms, fear of data security, and poor internet access continue to affect small firms, particularly in rural or semi-urban regions.

Many small enterprises operate in an unorganised manner, with little documentation of their daily transactions. Clarity of regulations and benefits of operating in an organised environment would help in the adoption of digital finance platforms.

Looking Ahead

Digital finance is surely going to shape the future of an enterprise’s growth. Artificial intelligence will refine the credit evaluation processes, blockchain will improve data security, and open APIs will support seamlessness across various financial tools.

For small enterprise owners or startup founders, this shift offers greater financial access and control over operations. For investors and policy makers, it promotes transparency and inclusion. And for the larger economy, it supports expansion through resilience and equal opportunity, as demonstrated recently by the Government of India in their decision to reduce GST to support growth.

Digital finance is more than a technological milestone. It represents a step toward a more equitable economic framework. When even the smallest enterprise can transact, borrow, and expand through digital systems, growth becomes not just faster but fairer.

Must have tools for startups - Recommended by StartupTalky

- Convert Visitors into Leads- SeizeLead

- Website Builder SquareSpace

- Run your business Smoothly Systeme.io

- Stock Images Shutterstock