Easy Ways to Find an Investor for Your Startup Company

investors

Money holds paramount importance in any business, big or small. You can have the greatest idea and the best team, but without funding, you wouldn’t lift a feather. From launching to scaling your business, no matter how great your product is, how much you save, or how big you’ve grown already, the inflow of capital and financial upliftment will inevitably be a necessity.

You need the capital to reach the milestones you have set at the expected point on the timeline. Without thinking about fundraising, you’re just sucking the life and potential out of your business. The steps you need to follow to acquire the funding are simple and direct. Get noticed. Let people find you. Connect. Let’s look at some ways to find an investor or ways to earn the fuel called funding for your company.

Below are our easiest ways to find investors for your small business or startup company:

1. Go Online

2. Research And List

3. Attend Events

4. Angel Networks

5. Believe in Accelerators

6. Social Media And Networking Sites

7. Personal Marketing

8. Use Your Family And Friends

FAQ's

Conclusion

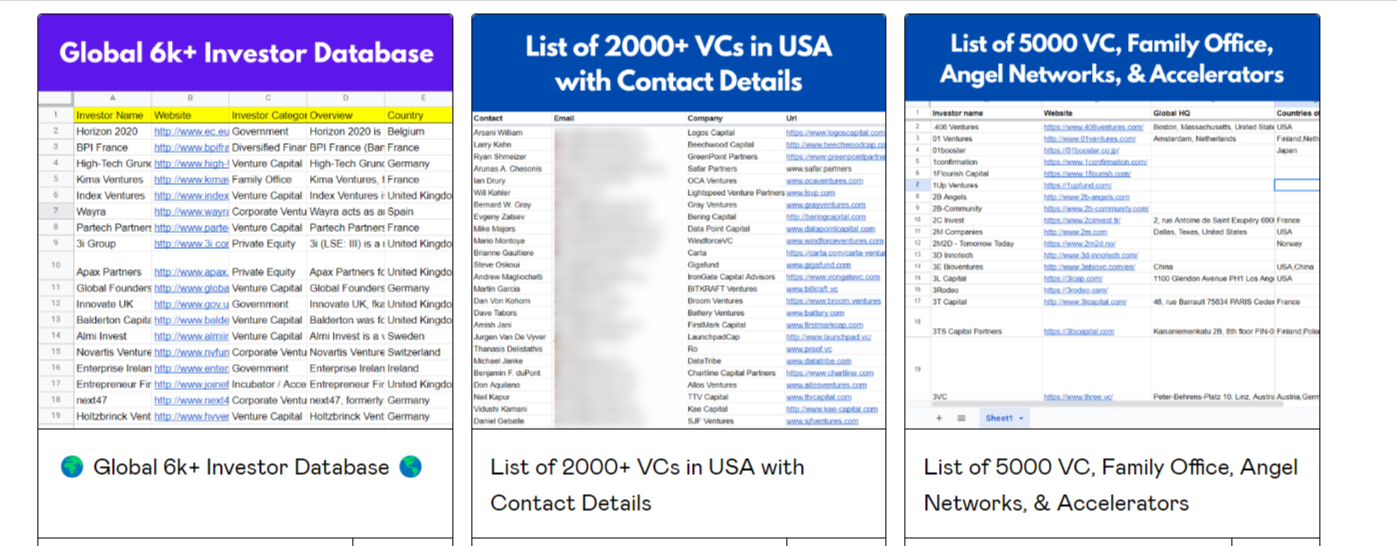

Unlock Your Startup's Potential with Our Exclusive Investor Lists and Resources

Supercharge your startup's success with our comprehensive resources. Access investor lists, pitch decks, KPIs, and fundraising guides. Connect with pre-seed investors, angel networks, and family offices, while mastering VC pitches. Ignite your entrepreneurial dreams today!

1. Go Online

The virtual world has made us connected for good. The online universe contains everything that you might possibly ask for. They have startup launching platforms, crowdfunding sites, some are highly popular with sophisticated and verified individual investors, angel investors, and even banks and people willing to deploy capital in a new stream.

Most of these platforms function in a peer-to-peer lending site fashion looking for sources offering business loans to donation-based, debt, and equity crowdfunding portals. Popular equity-based crowdfunding platforms are AngelList, SeedInvest, StartEngine, etc. Even Quora, LinkedIn can help you out, all you need to make sure is securing a credible name.

2. Research And List

Go online and make an inventory of your immediate contacts in the network create a list of investors who you feel would vibe with your goals and mission. Shortlist 30 to 50 of these and aim at securing their attention. Reach out to them in an informal environment, unfold your ideas, ask for genuine feedback, and always adapt using those suggestions, the next time you contact them.

3. Attend Events

Visibility is a key aspect when it comes to obtaining funds, you need to become the first choice of the investors you’re aiming for. You need to be in their heads when they make their decision. Prior research about the guests of the event and arranging meetings with prospective investors will go a long way.

Engage in the coding marathon, organized networking functions, industry trade shows, sporting events, charity fundraisers, film festivals, etc.

4. Angel Networks

Member-based networks that provide service by location are called angel networks. They basically function from a fund that has been set aside by an investment firm to source deals for the network. Applications are prescreened, the angels can stay anonymous, and founders can gather offers from up to a hundred investors at one place rather than moving from one angel to another.

These angel investors might not just invest in your business, but can provide you with the complete mentorship, share their contacts, help you build your own network. Sites like Funded.com and Angel Capital Association can assist you with angel investors looking for an opportunity.

5. Believe in Accelerators

Accelerators are incubators for startups, they help to nourish the startup leading to it to a path of success. They open their gates to serious entrepreneurs looking for genuine guidance and monitoring. They would be ready to introduce you to other investors, give business advice.

Usually while applying for accelerator programs, you must do extensive research and keep a check on records of their success.

These investors wish to take a bigger role in making your idea into a practical business model, it’s possible that they might be looking for a piece of your startup in exchange for funding. So, before collaborating with them, you might need to analyse how much you are willing to give up.

6. Social Media And Networking Sites

Believe it or not, the social space can do wonders, being cost-effective, it might be the best way to get discovered. You can post and update about your developments or collaborate with influencers to promote you.

The most popular channels to acquire attention on social media are:

- LinkedIn can be used to talk about your company or to seek quality introductions to pass social proof.

- Facebook for maintaining cordial contact after one or two meet-ups with the investor. This helps in trust-building.

- Twitter for meaningful conversations and knowing about what the investor shares.

Beyond these, there are many professional social sites that bring you in the ring with all types of investors in the industry. These might also connect you to the global investor environment.

Some professional social networking sites to consider for investor connections include EFactor, Xing, Cofoundr, and Meetup.

7. Personal Marketing

You need to have a strategy to prove your worth and raise those funds, then only you can see the growth graph rise. If it seems necessary, let your product go public, get in the hands of influencers, customers so that it might catch the eye of the investor.

If you’re successful in getting real customers, the pressure to obtain money from other sources will automatically lessen.

Make use of freemium and hybrid business models that can help get your product in the market for less cost, and let it gather the limelight.

A Guide to Marketing Your Business on LinkedIn

8. Use Your Family And Friends

Your friends and family might be your angels in disguise, and it won’t be a hard sell to convince them as they already trust you and know that you're passionate. Just remember personal and professional relationships are best when kept separate. Maintain written records and inform them about any risks involved.

You can also use your friends as abridge between you and investors, ask your friends in the industry for their recommendations. Climb your way up in the network, many investors specialize in specific markets, like biotech, retail, exports, or mobile app development, so they trust the network to find the right company.

At this stage of the development of your startup, perseverance might be the most crucial requirement. Do not get discouraged, if the funding doesn’t show up at your doorstep just after one attempt or maybe fifty, remember that there are infinite opportunities waiting for you to knock. The one best suited for your business model and your needs would come around as what you’re seeking is also seeking you.

Conclusion

Getting an investor to invest in your company is necessary to upscale your business. Take small steps. Network with people through social media channels. Interact with the social media community of like-minded people. Pitch your idea to angel investors or potential investors. A private investor can be s person or company who has the potential to invest in your company or startup. All these investors have only one goal in their minds. The goal of helping a company or startup is to succeed and get a good return on their investment.

Before pitching your idea to the investors you have to keep this n your mind at first. All these Investors look for people who have experienced entrepreneurs and with a management team that has a track record of high performance and leadership in the company's industry or in prior ventures. Most investors will do thorough research on your business, your expertise, your team's background, and your background in the industry.

FAQs

How to Find Investors for Small Business?

- Ask Family or Friends for Capital

- Apply for a Small Business Administration Loan

- Consider Private Investors

- Contact Businesses or Schools in Your Field of Work

- Try Crowdfunding Platforms to Find Investors

How to find investors in India or How to Get Investors for a Startup in India?

- Create a profile on AngelList

- Prepare a record of investors to share your ideas with

- Brush up your networking skills

- Have a classy intro

- Tell them why they should invest in your startup

Who are the top investors in India?

Top Investors in India:

- Radhakishan Damani

- Raamdeo Agrawal

- Porinju Veliyath

- Dolly Khanna

- Ashish Kacholia

- Vijay Kedia

How to get funding for startup India?

Startup Funding Options in India:

- Go for Crowdfunding

- Consider Self-funding

- Get in touch with the Venture Capitalists

- Try Angel Investment

- Try Angel Investment

- Focus on the close

- Terms of the deal