Top 6 Revenue-Based Financing Platforms in India Helping Startups to Grow

Collections 🗒️

The concept of revenue-based financing startups originated in the United States. It is a capital-raising model which provides funds to new startups and in return, asks for a percentage of that startup's gross revenue.

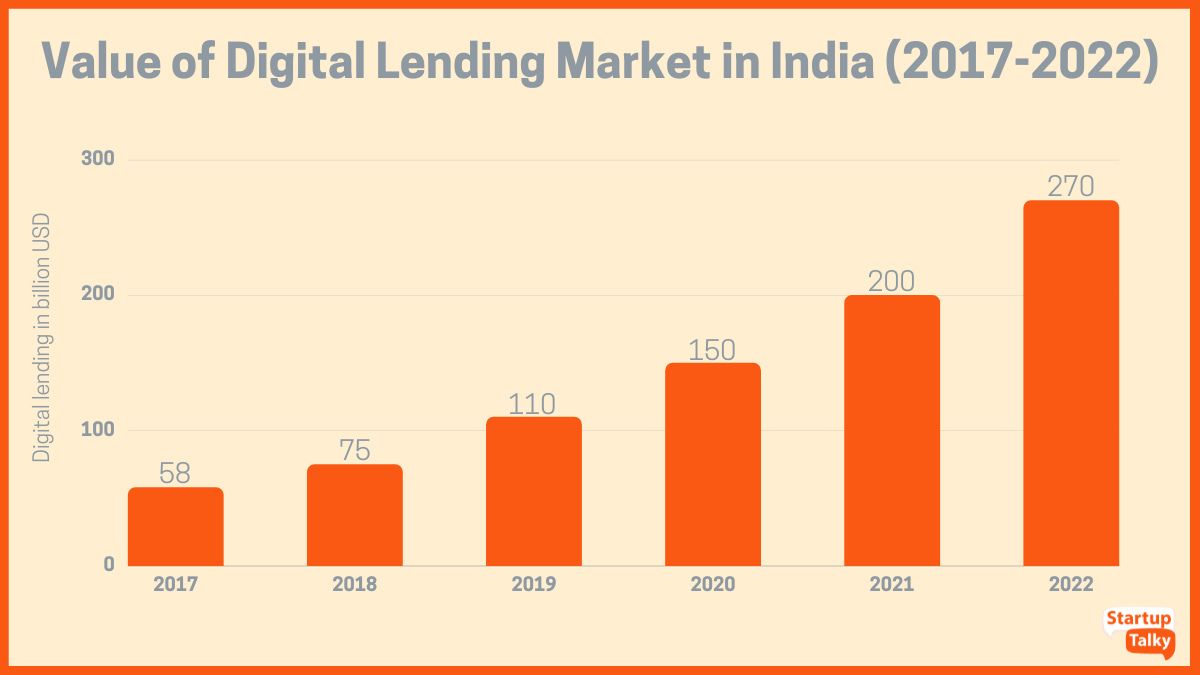

Do you know that the global market size of revenue-based startups is expected to attain $42,349.44 million by the year 2027? It has already reached $901.41 million in the year 2019. Its regular advancement indicates the growing popularity of such revenue-based startup models.

In this write-up, we will discuss what exactly revenue-based financing startups are. You will also be introduced to its future and 5 top revenue-based financing startups. Let's dive in to explore more about them.

What Are Revenue-Based Financing Startups?

Is Revenue-Based Financing Risky?

What Does the Future of Revenue-Based Financing Startups Look Like?

Top Revenue-Based Financing Startups

What Are Revenue-Based Financing Startups?

Revenue-based financing startups are known to be a helping hand for small businesses that need financing. In this system, small startups or companies take funds to foster their business. The investors in return sign a deal that offers a part of the gross revenue of the company to investors.

The company then needs to pay off the debt in periodic instalments. The investors will keep holding the revenue shares of the company unless and until the amount taken is paid back to the investors. The revenue-based financing market can be divided on the basis of the following:

- Enterprise size

- Region

- Industry vertical

Enterprise size refers to the size of the startups. For instance, the startup can either be a small-sized enterprise, a micro-enterprise, or a medium-sized enterprise. Region basis refers to the major regions or communities of such startups, observed globally. The market is expanding its legs in regions including Europe, North America, LAMEA, and the Asia Pacific. Industry vertical refer to the startup industries' distribution into entertainment and media, IT and Telecom, BFSI, healthcare, consumer goods, etc.

Is Revenue-Based Financing Risky?

The revenue-based financing startups work on the model of generating revenue by small startups and providing a part of it to investors. But what if these small startups fail to generate healthy revenue and the company keeps suffering losses?

The fund providers don't even have any kind of security in case the company suffers failures. In this case, the guarantee of even landed money return seems unclear.

So, what can we do to reduce such risks? The investors can perform the historical interpretation and potential recognition of companies on several grounds beforehand. A decent successful historical portfolio ensures success predominantly.

In the case of borrowers, revenue-based financing is less risky as the startup is not required to dilute its equity or keep an asset as security.

What Does the Future of Revenue-Based Financing Startups Look Like?

The idea of Swiggy and Zomato has revolutionized the world. Following these giants, several small startups or other kitchens have come into existence. But the only issue with them is the lack of cash.

Similarly, several startups have been identified particularly in SaaS, Direct 2 Consumer (D2C), and education niche which needs funding. The people behind these startups are not looking forward to taking bank loans because they have almost nothing to keep as security among banks. Here comes the need for revenue-based financing, which seems the future of these small startups.

Revenue-based financing startups help new businesses to grow by providing them with the capital they need. With more and more new entrants trying to establish their businesses, the future of these startups is sure to be bright.

Top Revenue-Based Financing Startups

Here is the list of a few giant revenue-based financing startups that have been providing absolute access to cash for several years:

BHIVE Investech

Founded: 2014

Founders: Shesh Rao Paplikar, Sandeep Gupta, Monnappa Bayavanda

Founded by Shesh Rao Paplikar, Sandeep Gupta, and Monnappa Bayavanda, Bhive Investech is one of the leading revenue-based financing startups, established in the year 2014.

Their investment and equity-raising history speak for itself. BHIVE Investech has raised more than INR 28 crores of investment for assets. The value is more than 15 crores when it comes to equity raised for the workspace.

BHIVE provides investments mostly in commercial real estate (CRE). It is known to manage the entire cycle from property sourcing to exit. This process includes property scouting, legal due diligence, purchase process, investor's property possession, maintenance and revenue generation, and investment exit.

GetVantage

Founded: 2019

Founders: Bhavik Vasa, Amit Srivastava, Sachin Tagra

Launched in 2020, GetVantage offers entrepreneurs access to equity-free capital between US$10,000 - US$1.3 million (₹ 5 lacs - ₹ 10 crore) in as fast as 5 days, as a founder-friendly alternative to traditional funding sources (like venture capital and bank debt). Over 7,500 businesses have registered on the platform for non-dilutive financing while 350+ have got funded so far. They use a data-driven approach to eradicate bias and power faster funding decisions to help brands double down on key growth areas like marketing, inventory, logistics, and expansion.

What’s the catch you might ask? There is none. They simply ask founders to apply online by connecting their marketplace, marketing, and revenue accounts to their tech-driven dashboard. Post this, they provide the Founder with a bespoke funding offer in 48 hours and fund them in as fast as 5 days.

No equity. No interest. No collateral. No personal guarantees. No warrants. No paperwork. No bias. No excuses. GetVantage takes just one flat fee (6-14%) that’s recovered as a small percentage of future revenues of the businesses.

Also, in early 2021, GetVantage launched foundersforfounders.org, an initiative to give back to the growing community of founders and entrepreneurs.

Velocity

Founded: 2020

Founders: Saurav Swaroop, Atul Khichariya, Abhiroop Medhakar

Velocity is owned by IIT Bombay alumni, Saurav Swaroop, Atul Khichariya, and Abhiroop Medhakar. Established in the year 2020, Velocity is dedicated to providing budgets for particularly D2C and eCommerce startups. Velocity promises 3 F's which refers to flexible, fast, and fair finance requirements.

It has a promising portfolio having more than 550 eCommerce investments. The brands that have raised capital from this platform claim to have experienced a 1.5x growth post-funding. In its not-so-long quest, Velocity has more than INR 2100 crore+ fundable revenues connected to it.

To get funding from Velocity, a person needs to fill out an online form which demands information about cost details and revenue requirements of a startup. You get an email from Velocity in the next 24 hours. If your demand is approved, you get the required funding in the next 4 days.

Klub

Founded: 2019

Founders: Anurakt Jain, Ishita Verma

Klub is another revenue-based financing startup in India that provides capital specifically to SaaS companies. It can fund your SaaS business with up to INR 30 crores of initial investments. Klub replies within 2 days after receiving the funding request. Klub's 3 F's for financial funding relates to a flexible, frequent, and founder-friendly budget.

Klub boosts of having 1700+ crores portfolio revenue. More than 2500 brands have signed up on this platform and the brands that received capital from it delivered a 50% growth after the funding. It provides fantastic capital solutions for logistic platforms, marketplaces, and gateways.

N+1 Capital

Founded: 2020

Founders: Rahul Chowdhary, Ashish Singla

The N+1 Capital was established in 2020 by Rahul Chowdhary and Ashish Singla. N+1 Capital invests in the companies that have more than INR 12 crore revenue in the last financial year, have 25% or more gross margin, have no to low existing debt, and ones that possess growth.

The company pays more heed to innovative startups in its investment selection process. Other values which are observed by N+1 capital to nominate its users include agility, data-driven N+1 Capital algorithms, persistence, and empathy. It offers 4 times of monthly revenue in the investment amount. Its repayment mechanism asks for a monthly revenue share of 2%-9%. The payback period varies from 1 to 3 years.

KredX

Founded: 2015

Founders: Manish Kumar, Anurag Jain

KredX is one of India's largest supply chain finance platforms that is meant to support the growth of businesses without the inconvenience of any collateral. It is a platform that allows businesses to raise funds for their working needs.

KredX provides revenue-based financing services that businesses can easily access without any collateral. Businesses can avail of this by simply committing a percentage of their monthly or annual revenue to the platform. The company also provides various cash management solutions like buy now pay later, accounts payable management, accounts receivable management, and more.

Since its inception in 2015, KredX has helped more than 23,000 businesses and has processed 2 million transactions worth $4 billion to date.

Conclusion

Therefore, the growing popularity and significance of revenue-based financing startups seem to be in the veins of the world. It has become vogue among Indian entrepreneurs too. The above-mentioned successfully running companies are the live example of the same. If you too have an amazing startup idea but lack money, these financing startups are a one-stop solution for your crisis.

FAQs

What is revenue-based financing?

Revenue-based financing is a capital-raising model which provides funds to new startups and in return, asks for a percentage of that startup's gross revenue.

Which are popular revenue-based financing startups?

The most popular revenue-based financing startups are:

- BHIVE Investech

- Velocity

- Klub

- N + 1 Capital

- GetVantage

- KredX

Is revenue-based financing better than other debt instruments?

Revenue-based financing offers easy accessibility to capital which makes it better than other debt instruments like venture debts or bank loans.

Must have tools for startups - Recommended by StartupTalky

- Convert Visitors into Leads- SeizeLead

- Website Builder SquareSpace

- Run your business Smoothly Systeme.io

- Stock Images Shutterstock