Billionaires Who Went Broke | Bankrupt Billionaires

Collections 🗒️

People usually think that they just need a paycheck to become rich. If they keep making money and spending it simultaneously, they'll be rich. But we very well know the secret to becoming rich is way beyond just paychecks. A better understanding of this can be taken from the example of those billionaires who didn't think twice before spending and ultimately, filed for bankruptcy.

This article covers those billionaires who declared bankruptcy or claimed to be completely broke at some point in their lives. Now, you might be thinking, what makes a person bankrupt, especially when they have billions of dollars? Various factors come here such as lousy investment, massive fraud cases, economic downturn, and many more. But the bottom line here is, that they didn't plan any backups and went on and on with their money. And that's what sank their ship!

As we have a basic understanding here, let's get on with knowing the stories of how these billionaires become bankrupt.

Billionaires Who Became Bankrupt

- Mike Tyson

- Elizabeth Holmes

- Aubrey McClendon

- Vijay Mallya

- Eike Batista

- Sean Quinn

- Bernie Madoff

- Björgólfur Guðmundsson

- Allen Stanford

- Sam Bankman-Fried

- Jocelyn Wildenstein

- Anil Ambani

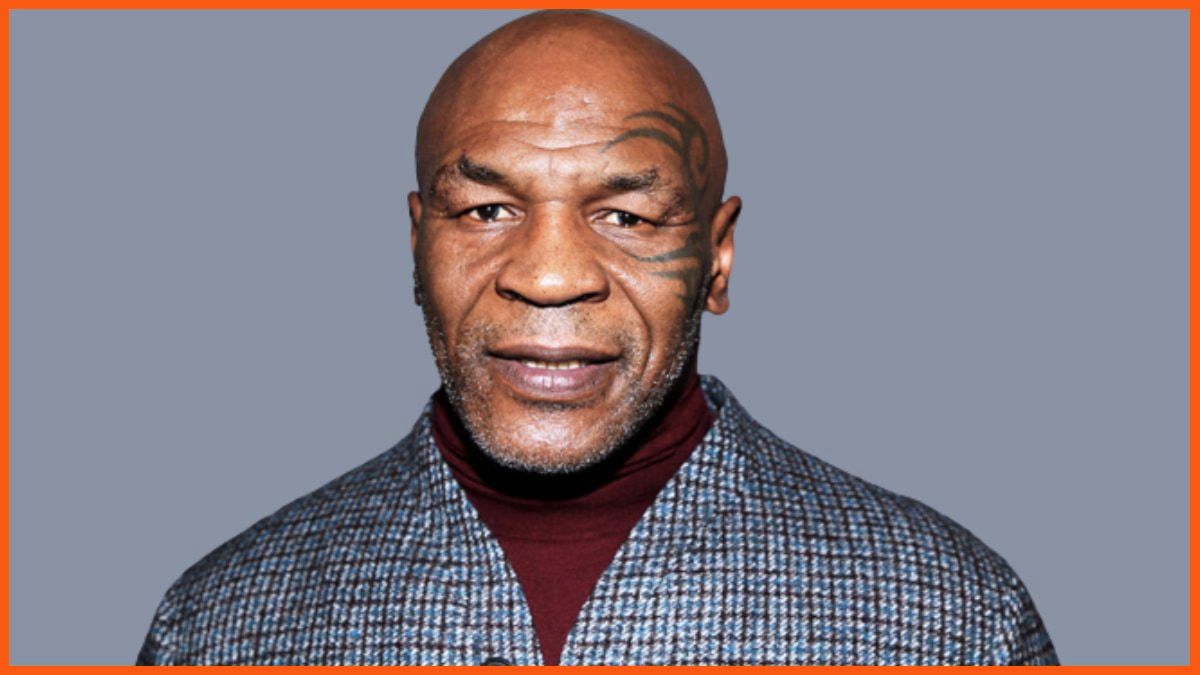

Mike Tyson

| Occupation | Professional Fighter |

|---|---|

| Bankruptcy Year | 2003 |

| Reason for Bankruptcy | Poor Financial Management and Legal Issues |

We can get started with Mike Tyson, the super famous fighter who used to earn up to $22 million per fight, which ultimately became a lifetime earning of half a billion dollars. Even after such big paychecks, he filed for Chapter 11 bankruptcy in 2003 as per the Benjamin Law. The reason for this bankruptcy is the huge debt that sank him.

The debts were so high that the law firm reported that Mike Tyson owed $38.4 million to the creditors which included the Internal Revenue Service along with his ex-wife, Monica Turner.

Elizabeth Holmes

| Occupation | Founder and CEO, Theranos |

|---|---|

| Bankruptcy Year | 2013 |

| Reason for Bankruptcy | Fraud |

The woman who made it to the cover of Forbes for founding the incredible startup worth $9 billion, Elizabeth Holmes, was forced to declare bankruptcy. She was convicted of criminal fraud through her company, Theranos. Her company claimed to be developing a revolutionary blood test that will come in the form of testing hundreds of diseases and medical conditions with just a few drops. But later it was proved that the company was not even close to developing such technology. This resulted in Elizabeth Holmes awaiting sentencing for facing up to 20 years in prison.

Aubrey McClendon

| Occupation | Co-founder, Chesapeake Energy |

|---|---|

| Bankruptcy Year | 2016 |

| Reason for Bankruptcy | Fraud |

The next in the line is Aubrey McClendon, co-founder of Chesapeake Energy, which is an oil and gas company with a net worth of $1.2 billion. He was accused of unfair manipulation of bids for drilling rights along with charges of federal conspiracy. However, due to an unfortunate car accident, McClendon died a day later of the accusations.

Based on reports, he sank deep into several debts which resulted in bankruptcy when he died.

Vijay Mallya

| Occupation | Former Owner, Kingfisher Airlines |

|---|---|

| Bankruptcy Year | 2016 |

| Reason for Bankruptcy | Failed airline business and legal issues |

A very well-known name in India, Vijay Mallya was an airline and liquor tycoon famous for his luxurious and high-flying lifestyle. He was the owner of Kingfisher Airlines, which is a now-defunct Indian airline.

Early in 2012, Vijay Mallya was reported to have racked up several debts to the banks for his airline business. However, he failed to return the money that he borrowed from the Indian bank which led to a search party for him at the bank.

But with a diplomatic passport, he attained it by becoming a member of the upper house of Parliament in India and fled to the UK afterward.

According to a report, Vijay Mallya is accused of bank fraud and money laundering charges of Rs 90 billion.

A bankruptcy petition was used to recover £1.145 billion in owed funds after which his net worth was reduced.

Eike Batista

| Occupation | Former CEO, EBX Group |

|---|---|

| Bankruptcy Year | 2013 |

| Reason for Bankruptcy | Adverse economic scenario |

Eike Batista, the name that was made the seventh richest person in the world, ultimately declared bankruptcy. He was an oil baron with the oil company, OGX. However, due to his failure in managing the production target, he started losing money. And the situation worsened when Brazil's economy suffered a tough time.

And when in the year 2012, Eike Batista's net worth was estimated to be $30 billion, it fell into money laundering and corruption and he filed for bankruptcy.

Sean Quinn

| Occupation | Founder, Quinn Group |

|---|---|

| Bankruptcy Year | 2011 |

| Reason for Bankruptcy | Debts |

This Irish Businessman who was once noted as the richest man in Ireland according to Forbes went bankrupt because of huge debt from the banks. Starting with cement manufacturing, Quinn’s biggest decision of entering the hospitality industry turned the way. In 2008 it was estimated the Quinn group owed 2.8 billion British pounds to the Anglo-Irish Bank. A lavish lifestyle without debt repayment and owning luxurious hotels as a new venture put down Quinn completely.

Another hard fate that hit Quinn was Quinn's insurance levied a sum of 3.25 million pounds and 200000 million pounds personally. This was due to Quinn Insurance issuing loans against the Financial regulation of Ireland. The wholesome amount was used in investing in stocks and for other luxuries.

In the year 2012, the Ireland government declared Sean Quinn bankrupt and was sent to jail for 9 weeks. Perhaps Quinn used the law "Right to be Forgotten" to delete his lavish lifestyle details from the internet.

Bernie Madoff

| Occupation | Founder, Bernard L. Madoff Investment Securities |

|---|---|

| Bankruptcy Year | 2008 |

| Reason for Bankruptcy | Ponzi Scheme |

Bernie Madoff, the biggest fraudulent sentenced to 150 years punished ever in the history of mankind. This man ran the biggest and longest Ponzi Scheme over 17 continuous years. The Ponzi Scheme was worth 65 billion dollars. He netted many investors to invest in the scheme by attracting them to an investment firm named Penny Stock Brokerage. The fraud worth was 65 billion dollars. But it was all known to the world when Madoff confessed the whole matter to two of his sons and that’s where the game began. The unimagined thought of Madoff was his sons Mark and Andy revealed the entire story to the FBI. The shocked FBI arrested Madoff and punished him serving 150 years sentence with forfeiture of 170 billion dollars. Many of his investors killed themselves, Mark’s suicide two years after the tragedy, and the entire fraud life of Madoff remains.

Björgólfur Guðmundsson

| Occupation | Chairman, Landsbanki |

|---|---|

| Bankruptcy Year | 2008 |

| Reason for Bankruptcy | Global financial crisis and business troubles |

Iceland's second richest man Björgólfur Guðmundsson went bankrupt for over 500 million Euros in the year 2008. He was already jailed for about a year on a bookkeeping offense in the early 1990s. After becoming the chairman of the bank Landsbanki, Björgólfur Guðmundsson misused a lot of money and became a disaster for Iceland's economy. He owed more than 500 million dollars personally which devastated his faith.

Allen Stanford

| Occupation | Former Chairman and CEO, Stanford Financial Group |

|---|---|

| Bankruptcy Year | 2009 |

| Reason for Bankruptcy | Ponzi scheme and legal issues |

Robert Allen Stanford alleged massive ongoing fraud of 7 billion dollars and over amounts uncalculated. This biggest fraud ran the biggest Ponzi scheme under the name of Stanford Financial Groups which is defunct now. In 2009 FBI and SEC imposed several violations of acts on Stanford such as a money laundering case, a Ponzi scheme, violated financial securities, and many more. This mesmerizing brain manipulated many clients by showing hypothetical records as real data to pitch them and invest in him. Although tried to fly off from the US to Antigua with failed attempts he surrendered himself to the FBI in 2009 and the same year the Judicial Law of Florida sentenced him to 110 years. Being absent of guilt he even applied for an appeal in 2014 but got rejected in 2015.

Sam Bankman-Fried

| Occupation | Founder, FTX |

|---|---|

| Bankruptcy Year | 2022 |

| Reason for Bankruptcy | Liquidity crunch |

Sam Bankman-Fried had made his fortune through FTX exchange and Alameda Research trading firm and established himself as Crypto King. FTX crashed in November 2022 due to a liquidity crunch. The crypto exchange collapsed after it emerged Alameda had been using FTX customer assets to cover trading losses. Its users began withdrawing their investments at a rapid pace. As a result, Sam filed for bankruptcy for both of his firms.

On Nov 11, 2022, FTX filed for Chapter 11 bankruptcy protection in the US. The fall of FTX and bankruptcy filing have impacted the crypto industry worldwide.

Before FTX's collapse, he ranked the 41st richest American in the Forbes400 and the 60th richest person in the world by The World's Billionaires. His net worth peaked at $26.5 billion.

The US Court has charged him with Securities fraud, Wire fraud, and Conspiracy. He faces a maximum of 115 years in prison if convicted on all eight counts and sentenced to serve each charge consecutively. He has been released on a $250 million bond and is under house arrest. On Jan 03, 2023, he pleaded not guilty to fraud and other charges.

Jocelyn Wildenstein

| Occupation | Socialite |

|---|---|

| Bankruptcy Year | 2003 |

| Reason for Bankruptcy | Debt |

The woman was famous as a "Catwoman" because of her looks, Jocelyn Wildenstein was a big socialite. Based on reports, she used to spend $1 million on shopping and $5,000 on her phone bill per month. She is a former wife of the late Alec Wildenstein, who used to be a billionaire in his days.

Later in 2018, Jocelyn Wildenstein declared bankruptcy and claimed that she had $0 in her bank account.

Anil Ambani

| Occupation | Businessman |

|---|---|

| Bankruptcy Year | 2020 |

| Reason for Bankruptcy | Bad Investments, Debt |

The younger son of Dhirubhai Ambani, Anil Ambani hasn’t had much luck since 2002. After his father's death, the $15 billion Reliance business split, with Anil getting control of companies like Reliance Communications, Reliance Capital, and Reliance Infrastructure, while his brother Mukesh took over Reliance Industries.

In the past 15 years, he has gone from being the world’s sixth richest person with $42 billion in 2008 to facing bankruptcy, selling family assets to pay lawyers, and seeing his companies auctioned. He was even threatened with jail by the Supreme Court. Recently, the Securities and Exchange Board of India (SEBI) banned him from the stock market for five years in August 2024.

Conclusion

We can say that with mere paychecks, one doesn't stay rich. Some of the billionaires are or were forced to file for bankruptcy in their lives. Many of these served jail time because of money laundering and severe debts, such as Allen Stanford, Eike Batista, and many more. To make you familiar with this, we rounded up these above-mentioned billionaires who filed for bankruptcy.

FAQs

Has a billionaire ever gone broke?

Usually, billionaires and their teams are smart enough to protect their wealth. However, unfavorable situations can make them bankrupt. Adverse economic scenarios, bad investment decisions, or fraud can make billionaires file for bankruptcy.

Which billionaires went Bankrupt?

Some billionaires who became bankrupt are:

- Mike Tyson

- Elizabeth Holmes

- Aubrey McClendon

- Vijay Mallya

- Eike Batista

- Sean Quinn

- Bernie Madoff

- Björgólfur Gudmundsson

- Allen Stanford

- Sam Bankman-Fried

- Jocelyn Wildenstein

- Anil Ambani

Was Vijay Mallya a billionaire?

Yes, Vijay Mallya was a billionaire with a net worth ranging from $1 billion to $1.5 billion. in years 2006-2012.

How many billionaires are there in the world?

There are 2781 billionaires in the world as of 2024.

Must have tools for startups - Recommended by StartupTalky

- Convert Visitors into Leads- SeizeLead

- Website Builder SquareSpace

- Run your business Smoothly Systeme.io

- Stock Images Shutterstock