Debit & Credit Cards Trends Reshaping India's Economy

🔍Insights

India has experienced a surge in credit and debit card usage due to the rising middle class. Projections indicate that by 2025, the number of credit cards is expected to reach approximately 44 million, with debit cards reaching around 970 million. India, in recent years, has held the record for the highest number of debit cards in use globally. The implementation of the Pradhan Mantri Jan-Dhan Yojana scheme has played a significant role in this growth, resulting in the issuance of over 300 million RuPay debit cards. Launched in 2012, RuPay serves as a domestic alternative to international cards such as Mastercard, Visa, and Union Pay. Currently, the State Bank of India dominates the debit card market, while HDFC Bank holds the highest share in the credit card market.

The debit card market in India has exhibited steady growth, driven by various factors. The government has introduced initiatives to promote cashless transactions and reduce reliance on physical currency, including the Digital India campaign, which aims to provide digital infrastructure and services to all citizens, including online payment systems. Demonetization in 2016 also played a role in encouraging the use of digital payment methods.

As of October 2023, data from sources like Statista indicate that SBI and HDFC continue to lead the market share for debit cards and credit cards, respectively. However, the power dynamics within this extensive realm are complex and nuanced. SBI, the banking behemoth, commands a market share closer to 30% in debit cards issued, leveraging its vast network and rural presence. Following closely is HDFC Bank, known as the king of credit cards, with a 16-17% share. HDFC's focus on premium cards and excellent customer service attracts tech-savvy urban users.

RuPay, launched in 2012 as India's domestic card network, has emerged as a game-changer. With explosive growth, especially under Jan Dhan Yojana, RuPay has issued over 300 million cards, challenging the long-standing dominance of Visa and Mastercard with a 15.7% market share. Banking analyst Amitabh Rai emphasizes RuPay's significance, stating, "RuPay's growth demonstrates the power of a domestic alternative," highlighting its role in empowering India's financial system and reducing dependence on foreign networks.

The Emergence of Challengers: Fresh Faces Shake the Landscape

The UPI Influence: A Dawn of Change

The Credit Card Market

- HDFC Bank

- SBI Cards

- Axis Bank

- ICICI Bank

- IDFC First Bank

- American Express

- Bank of Baroda (BoB)

- AU Small Finance Bank

- IndusInd Bank

- RBL Bank

- Yes Bank

- Standard Chartered Bank

Credit Card Expansion in India

The Emergence of Challengers: Fresh Faces Shake the Landscape

Entrants like ICICI Bank and Axis Bank, both private banking institutions, are actively seeking a share of the debit card market. Simultaneously, disruptors in the form of fintech startups, such as Paytm and PhonePe, are introducing groundbreaking offerings like debit cards seamlessly integrated with digital wallets.

Shruti Sharma, an expert in payments, comments on the evolving landscape: "The debit card market is witnessing heightened competition. New players are introducing enticing features, targeting specific segments, thereby exerting pressure on traditional banks."

The UPI Influence: A Dawn of Change

India's instant payment system, UPI, is emerging as a robust contender. Its user-friendly interface and immediate transfers are contributing to a reduction in the use of debit cards for smaller transactions. Arjun Kapoor, a digital payments consultant, notes, "UPI is a significant disruptor. While debit cards will retain importance, their dominance in low-value transactions might encounter challenges."

The Reserve Bank of India (RBI) data highlights the prominence of the Unified Payments Interface (UPI) as the preferred method for money transfers, especially in the case of small-value transactions.

"The notable surge in UPI adoption for microtransactions, driven by its convenience, has significantly impacted debit card usage, causing a shift in customer preferences," stated Sunil Rongala, Senior Vice President and Head of Strategy, Innovation & Analytics at Worldline India.

So, who holds sway? It's a nuanced ballet. SBI leads in sheer numbers, yet HDFC Bank and RuPay are rapidly gaining ground. The influx of new players and the growing prominence of UPI are adding layers of complexity. Thus, the Indian debit card market resembles a rich tapestry woven with diverse threads, where the dominant force may shift as swiftly as the next digital innovation.

The Credit Card Market

HDFC Bank, India's largest private bank, maintains its leadership position in the credit card market with a commanding 20% share. Following closely are SBI Cards, ICICI Bank, and Axis Bank, each holding market shares of 19%, 17%, and 14%, respectively, as of August 2023.

The credit card segment is experiencing rapid growth in India, with a credit card defined as a physical or virtual payment instrument issued with a pre-approved credit limit, enabling the purchase of goods and services and cash advances, subject to terms and conditions. The industry is witnessing significant transformation with advancements in the digital space and the widespread adoption of contactless payment methods. According to recent data from the Reserve Bank of India (RBI), credit card spending reached a record INR 1.4 trillion in May 2023, reflecting a 5% month-on-month increase.

Exploring the landscape of credit card issuers in India reveals a diverse array of options catering to various categories such as travel, dining, movies, shopping, and lifestyle. Let's delve into some of the key credit card issuers in the country:

HDFC Bank

As one of the largest private banks in India, HDFC Bank not only holds a significant market share but also stands out as the largest card issuer in the country. As of September 2022, HDFC Bank boasts over 1.70 crore active credit cards, securing a notable 28.4% market share in credit card spending, according to RBI data from July 2022. Among the popular HDFC credit cards available in the market are:

- HDFC Bank Infinia Credit Card

- HDFC Bank Diners Club Black Credit Card

- HDFC Bank Regalia Credit Card

- HDFC Bank Millennia Credit Card

- HDFC Bank Diners Club Privilege Credit Card

- HDFC Bank MoneyBack Plus Credit Card

These offerings cater to diverse needs and preferences, making HDFC Bank a prominent player in the credit card landscape.

SBI Cards

The State Bank of India (SBI) stands as one of India's largest public sector banks, offering cards and various payment services under SBI Card, a non-banking financial company affiliated with SBI. With its initial public offering in 2020, SBI Card ranks as the second-largest card issuer in India, providing a diverse range of cards, including lifestyle, rewards, shopping, travel, fuel, and business cards. SBI customers benefit from the extensive global network maintained by the bank. Notable SBI credit cards in the market include:

- SBI Elite Credit Card

- SBI Card PRIME

- SBI Simply Click Card

- BPCL SBI Card

- SBI Simply SAVE Card

- BPCL SBI Credit Card

Axis Bank

As the third-largest credit card issuer in India, Axis Bank secured its position after merging with CitiBank, acquiring Citi's affluent and premium credit card business and specific operations. Offering a broad spectrum of credit cards ranging from entry-level to business-class categories, Axis Bank tailors its cards to meet diverse customer needs. Some of the popular Axis Bank credit cards include:

- Axis Bank ACE Credit Card

- Flipkart Axis Bank Credit Card

- Axis Bank Vistara Credit Card

- Axis Bank Neo Credit Card

- Axis Bank My Wings Credit Card

- Axis Bank Select Credit Card

ICICI Bank

As the second-largest private sector bank in India by revenue and market capitalization, ICICI Bank is a versatile issuer of credit cards catering to various spending categories, including dining, shopping, movies, and travel. The bank offers a robust rewards program and an extensive variety of no-annual-fee credit cards, such as:

- ICICI Sapphiro Credit Card

- ICICI Coral Credit Card

- ICICI Rubyx Credit Card

- ICICI Platinum Chip Credit Card

- Amazon Pay ICICI Credit Card

- ICICI Bank HPCL Super Saver Credit Card

IDFC First Bank

Formed through the merger of IDFC Bank and Capital First Bank in December 2018, IDFC FIRST Bank entered the credit card industry in 2021, providing cards for both high-end customers and the masses. As a popular credit card issuer in the country, IDFC FIRST Bank offers exclusive cards with maximum benefits and minimal charges. Among the well-received IDFC First Bank credit cards are:

- IDFC FIRST Millennia Credit Card

- IDFC FIRST Wealth Credit Card

- IDFC FIRST Select Credit Card

- IDFC FIRST WoW Credit Card

- IDFC FIRST Classic Credit Card

American Express

American Express, widely known as AmEx, is a multinational company based in the United States, renowned for its premium credit card offerings on a global scale. AmEx operates its expansive credit card network, making it a significant player in the industry. Having entered the Indian market in 1993, AmEx swiftly established itself as one of India's premier credit card providers. Offering a variety of credit cards with exclusive benefits across categories like reward programs, travel, movies, dining, and more, AmEx has become a popular choice.

Noteworthy American Express credit cards available in the market include:

- American Express Platinum Card

- American Express Platinum Reserve Credit Card

- American Express Gold Card

- American Express Platinum Travel Credit Card

- American Express SmartEarn Credit Card

Bank of Baroda (BoB)

As one of India's major public sector banks, Bank of Baroda (BoB) offers a diverse range of exclusive credit cards in both premium and basic categories to cater to varied customer needs. BoB credit cards come with numerous privileges, including welcome benefits, low joining fees, and high rewards rates.

Popular Bank of Baroda credit cards available in the market include:

- BoB CMA One Credit Card

- BoB Eterna Credit Card

- BoB Premier Credit Card

- BoB Select Credit Card

- IRCTC BoB RuPay Credit Card

- BoB Prime Credit Card

- BoB Easy Credit Card

- BoB Sentinel Credit Card

AU Small Finance Bank

Established in April 2017, AU Small Finance Bank is an emerging Indian private sector bank focused on assisting low and average-income earners, as well as small and medium enterprises. Despite having a limited range of credit cards from entry-level to premium categories, AU Small Finance Bank offers an array of benefits, from grocery shopping to international trips, with cards such as Altura, Altura Plus, Vetta, and Zenith Credit Cards.

IndusInd Bank

IndusInd Bank, one of India's largest private-sector lenders, launched its credit card services in 2013, providing a wide range of premium credit cards. With over 15 credit cards in its portfolio, IndusInd Bank caters to various spending categories, offering exclusive benefits over diverse sectors.

Some popular IndusInd Bank credit cards include:

- IndusInd Bank Legend Credit Card

- IndusInd Bank Pioneer Heritage Credit Card

- IndusInd Bank Celesta Credit Card

- IndusInd Bank Indulge Credit Card

- IndusInd Bank Pinnacle World Credit Card

- IndusInd Bank EazyDiner Credit Card

- IndusInd Bank Signature Visa Card

RBL Bank

Known for its customer-centric approach, RBL Bank, or Ratnakar Bank Limited, is a prominent Indian private sector bank offering a vast array of credit cards. With more than 40 credit cards presently available, RBL prioritizes customer needs, providing options to meet various requirements.

Popular RBL credit cards include:

- RBL ShopRite Credit Card

- RBL World Safari Credit Card

- RBL MoneyTap Black Card

- RBL Platinum Bonus SuperCard

- RBL Icon Credit Card

- BookMyShow RBL Credit Card

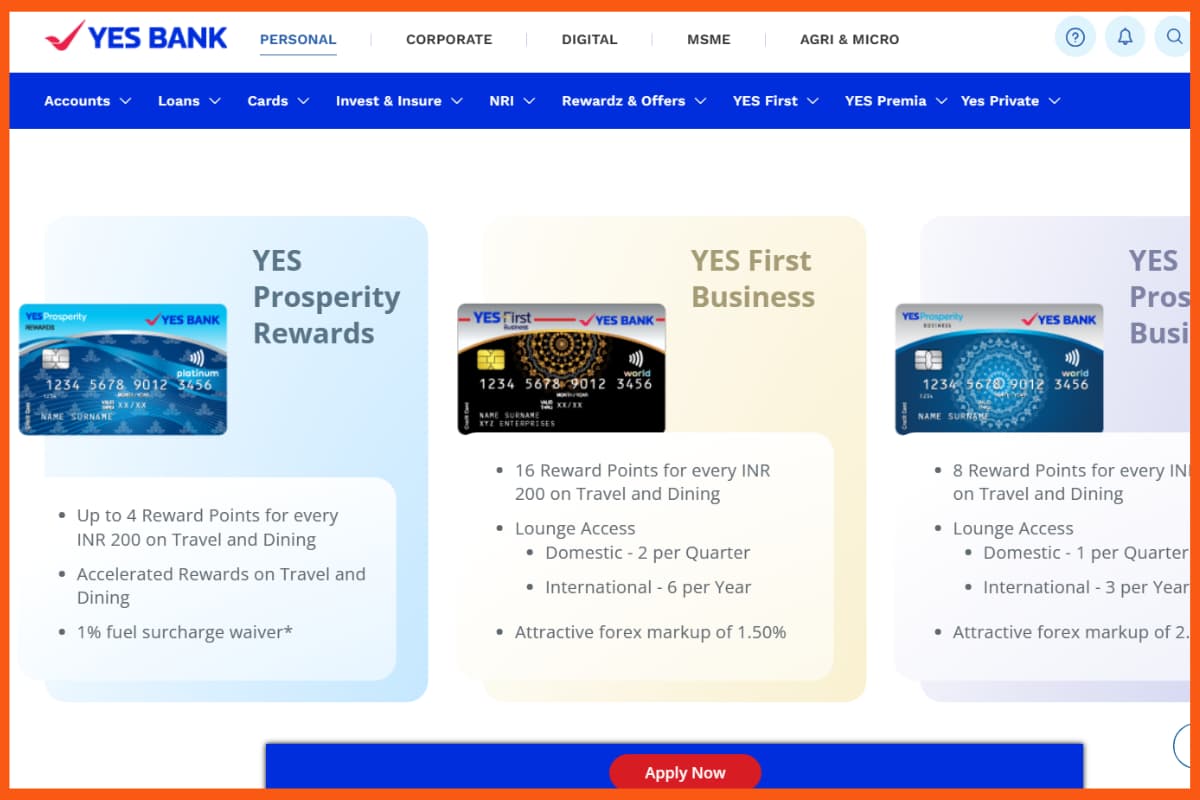

Yes Bank

Yes Bank, a key player in the Indian banking sector, is also recognized for its premium credit card services. Yes Bank credit cards offer benefits such as welcome vouchers, reward points, cashback, milestone and travel benefits, fuel surcharge waiver, and spend-based waiver of annual fees.

Popular Yes Bank credit cards include:

- Yes Private Prime Credit Card

- Yes First Exclusive Credit Card

- Yes First Preferred Credit Card

- Yes Premia Credit Card

- Yes Prosperity Edge Credit Card

- Yes Wellness Plus Credit Card

Standard Chartered Bank

London-based Standard Chartered Bank, a major foreign bank and credit card issuer in India, holds a significant share in the credit card business. Following AmEx, Standard Chartered offers a diverse range of credit cards across categories like shopping, lifestyle, travel, and premium.

Some popular Standard Chartered Bank credit cards include:

- Standard Chartered Ultimate Credit Card

- Standard Chartered EaseMyTrip Credit Card

- Standard Chartered Super Value Titanium Credit Card

- Standard Chartered Platinum Rewards Credit Card

- Standard Chartered Smart Credit Card

- Standard Chartered DigiSmart Credit Card

- Standard Chartered Emirates World Credit Card

Credit Card Expansion in India

The Indian credit card market remains relatively untapped, with only a small segment of the population possessing credit cards. Efforts are underway by card issuers to transform this landscape by introducing diverse benefits and raising awareness about credit card usage.

In recent years, credit card issuers have laid the groundwork for continuous technological advancements and expansion. The current focus revolves around enlarging the customer base through enhanced fraud management techniques, competitive product offerings, and enticing loyalty programs. With these strategic initiatives, the credit card industry anticipates exponential growth in the forthcoming years.

Must have tools for startups - Recommended by StartupTalky

- Convert Visitors into Leads- SeizeLead

- Payment Gateway- Razorpay

- Spy on your Competitors- Adspyder

- Manage your business smoothly- Google Workspace