How To Sell on Amazon: The Ultimate Guide

🔍Insights

Indians prefer ordering from amazon compared to other marketplaces, Amazon has been dominating the Indian market since its entry in India, and it's the most profitable website to market your products. Most businessmen prefer selling their products on amazon. Amazon has seen massive growth since its entry into the Indian market many competitors have to try to come as close as the figures of amazon but in vain. If you want to start selling on amazon we will guide you right away. Are you ready to grow your business on Amazon, let's get started:

Here are some documents you'll require for registering an amazon seller account:

- PAN Card - PAN card can be individual if you hold the proprietorship or if you own a Pvt limited company, so the PAN card should be in the name of your company.

- GST Number - You need a GST number to fulfill the registration process.

- Bank Account - You require a bank account that can be current or a savings account.

- Email Id - Email id is also required to fill the registration form which can be your email id or your business email id.

- Mobile No.- Last but not least you need a mobile no. for registering your account.

How to sell on Amazon (10 Easy steps)

How can you get your first order on Amazon?

How to Advertise a Product on Amazon?

How does Amazon pay the seller?

Refund Related to Customers

How To Sell on Amazon (10 Easy steps)

1. Get Started

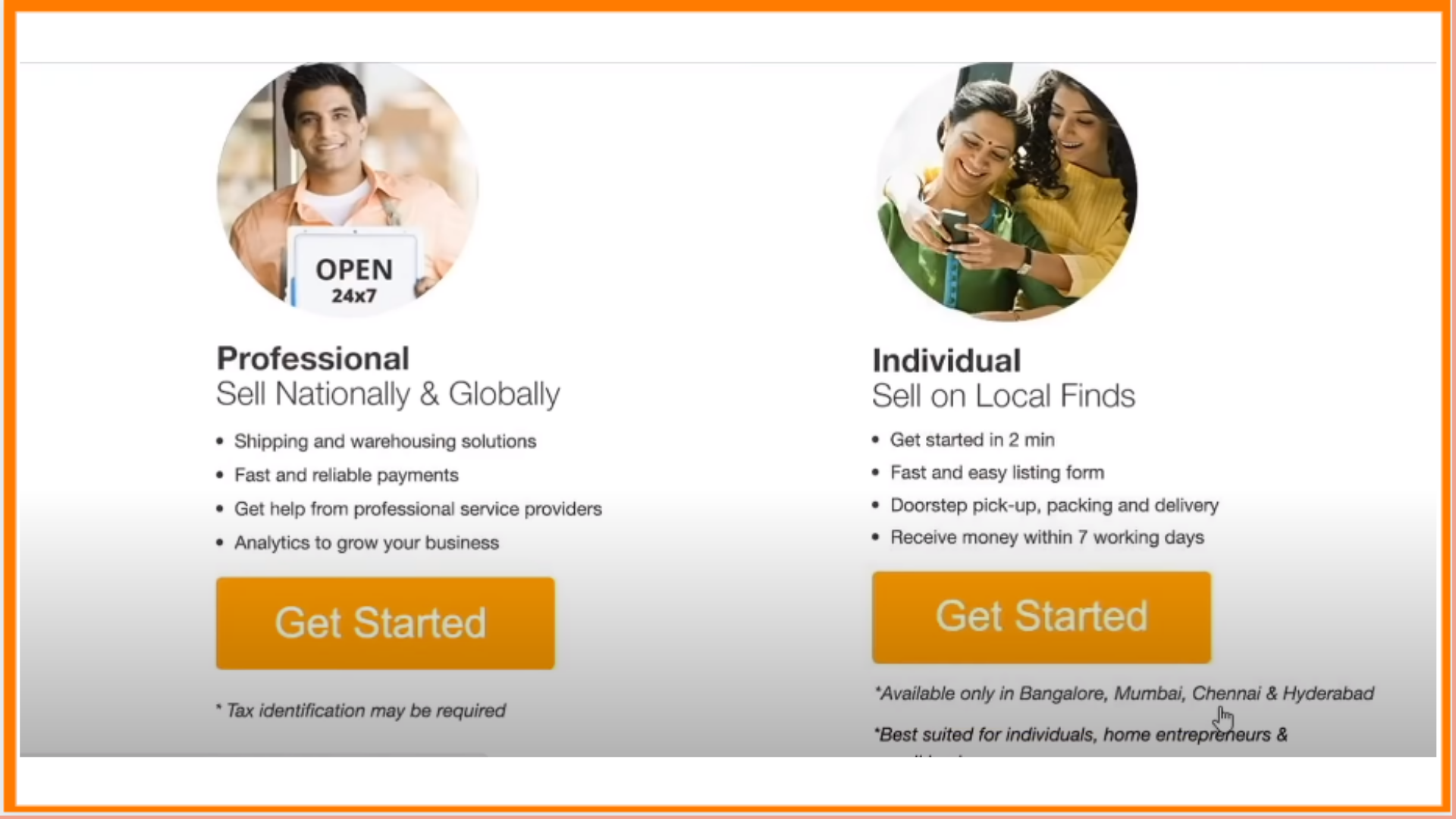

First, you need to visit Amazon.in then scroll down there you'll find an option sell on amazon, click on that option and a new tab will be open after that Amazon will offer you 2 business plan Professional and Individual.

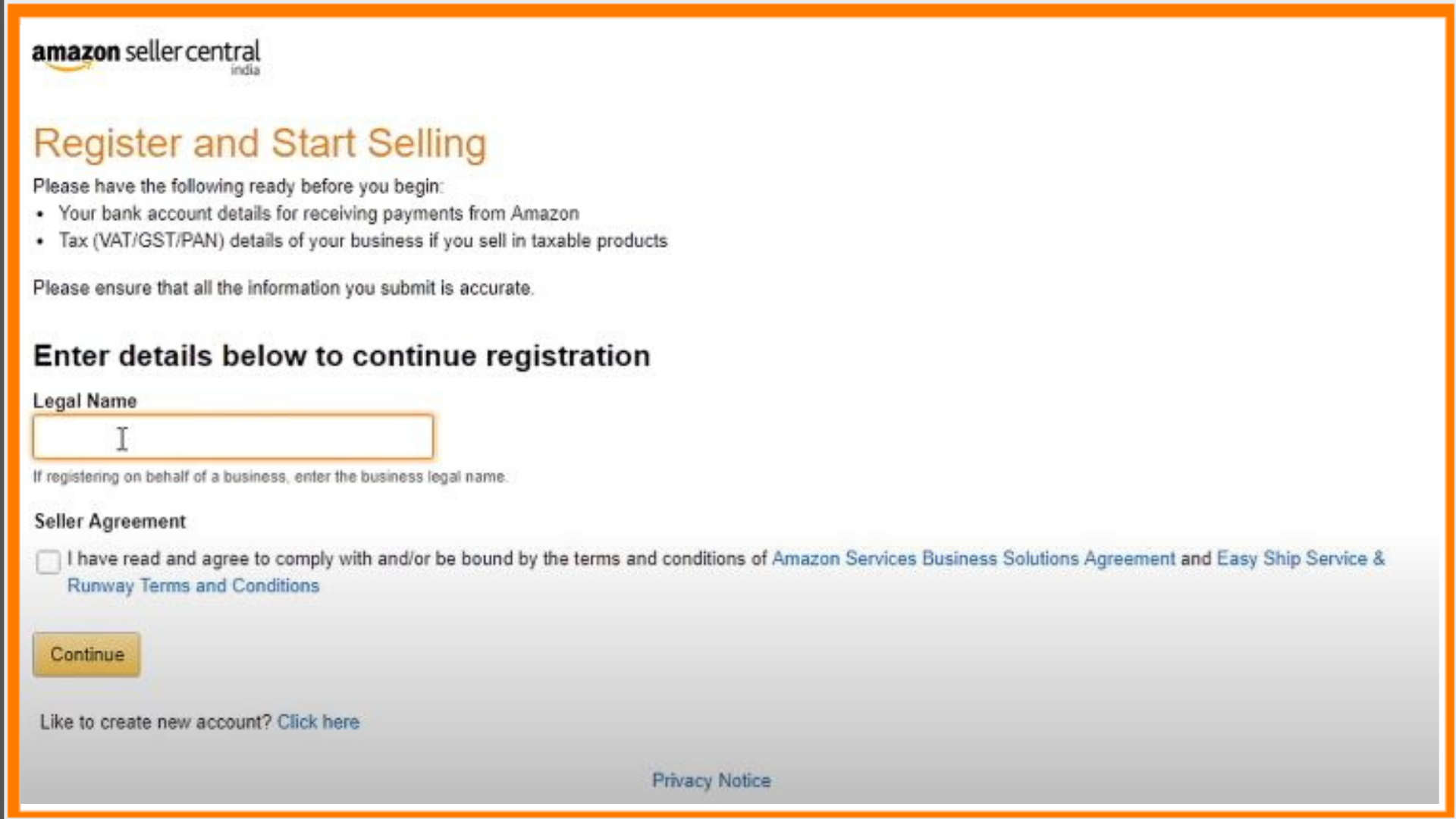

2. Create an Account

Enter your personal details and create your amazon seller account.

3. Register your Store

Fill in your details and create your amazon seller account then you will be asked to add your Registered Business name or the legally registered store name.

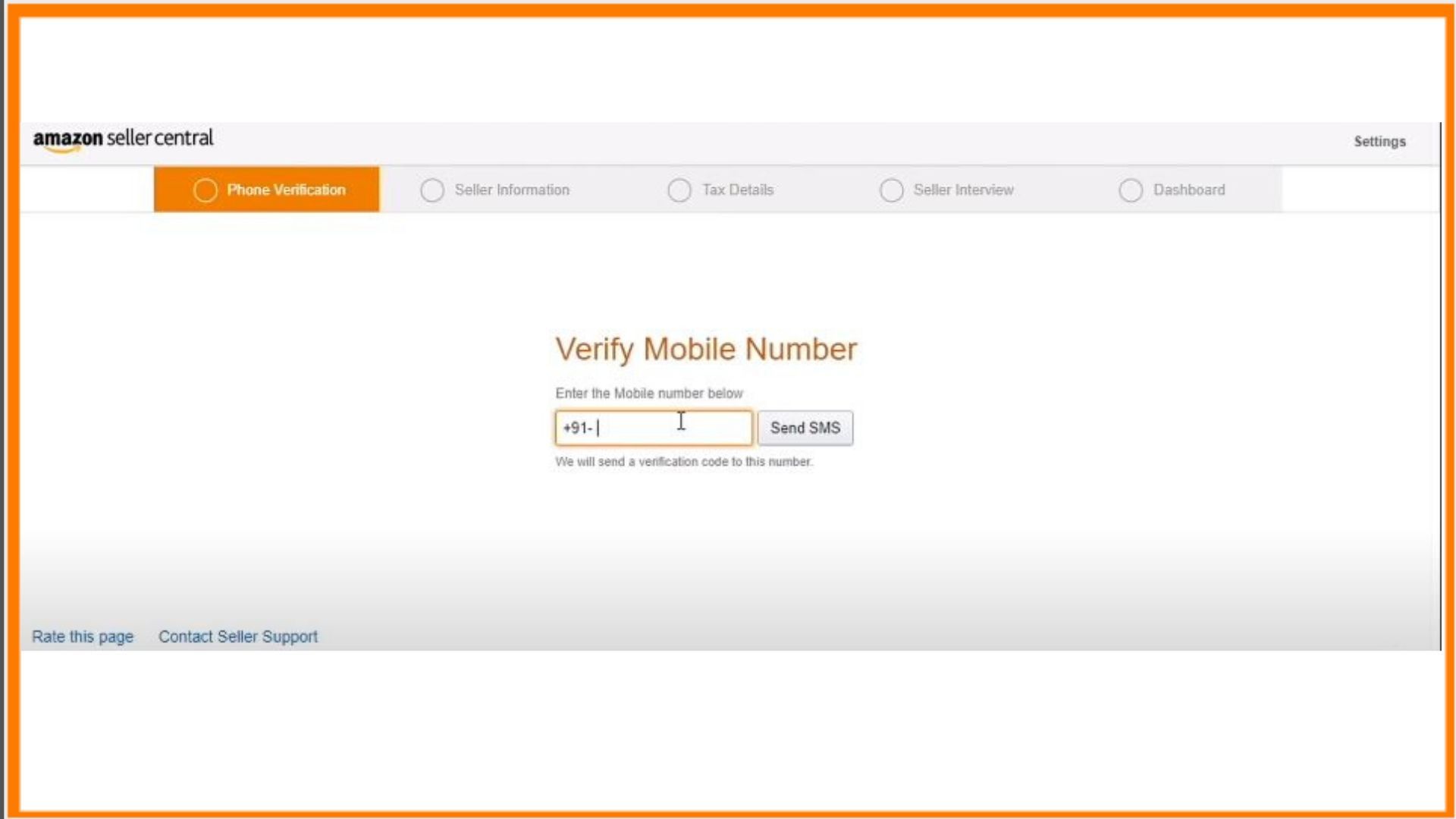

4. Verify your Mobile Number

Verify your mobile number for further.

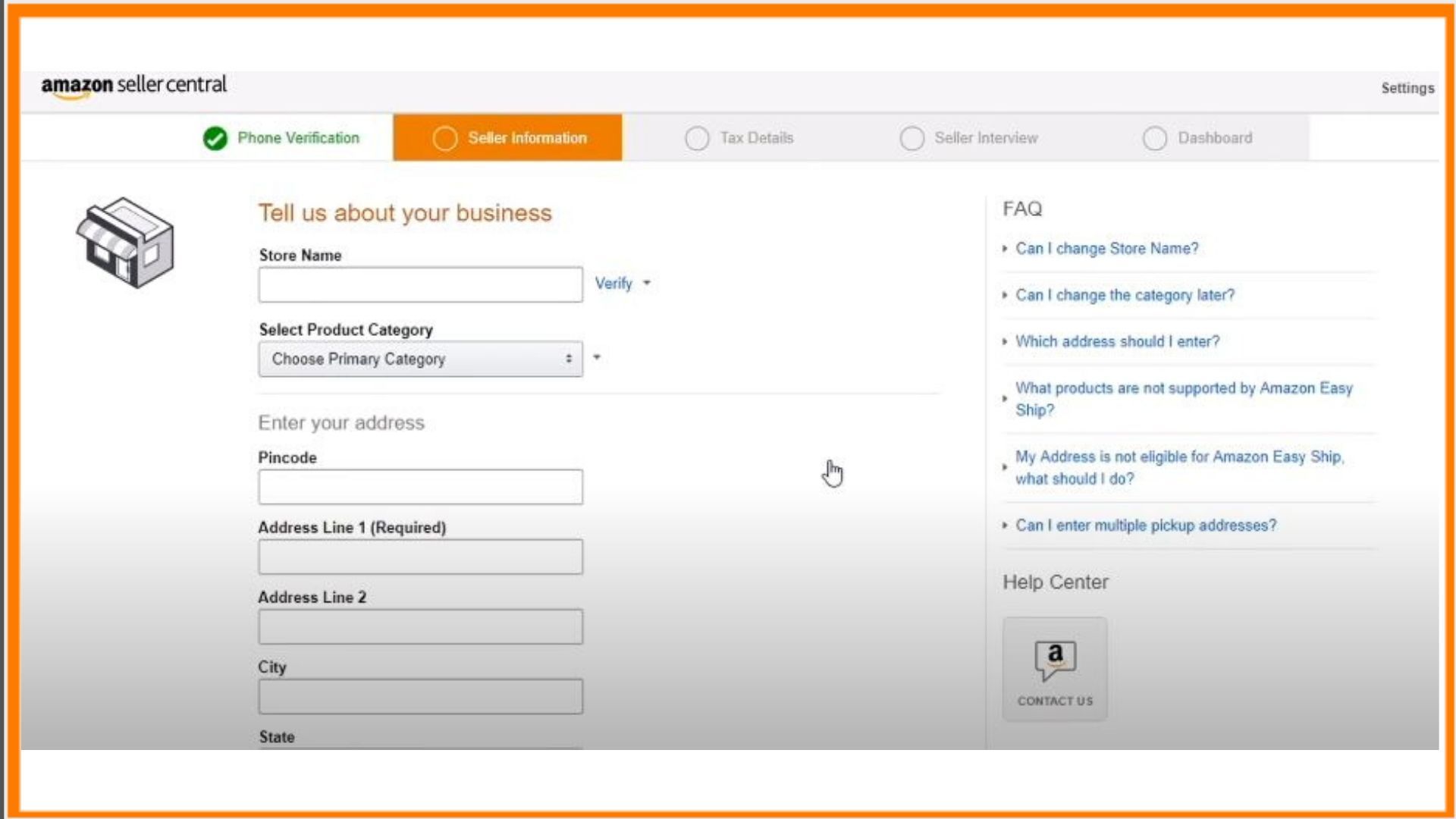

5. Seller Information

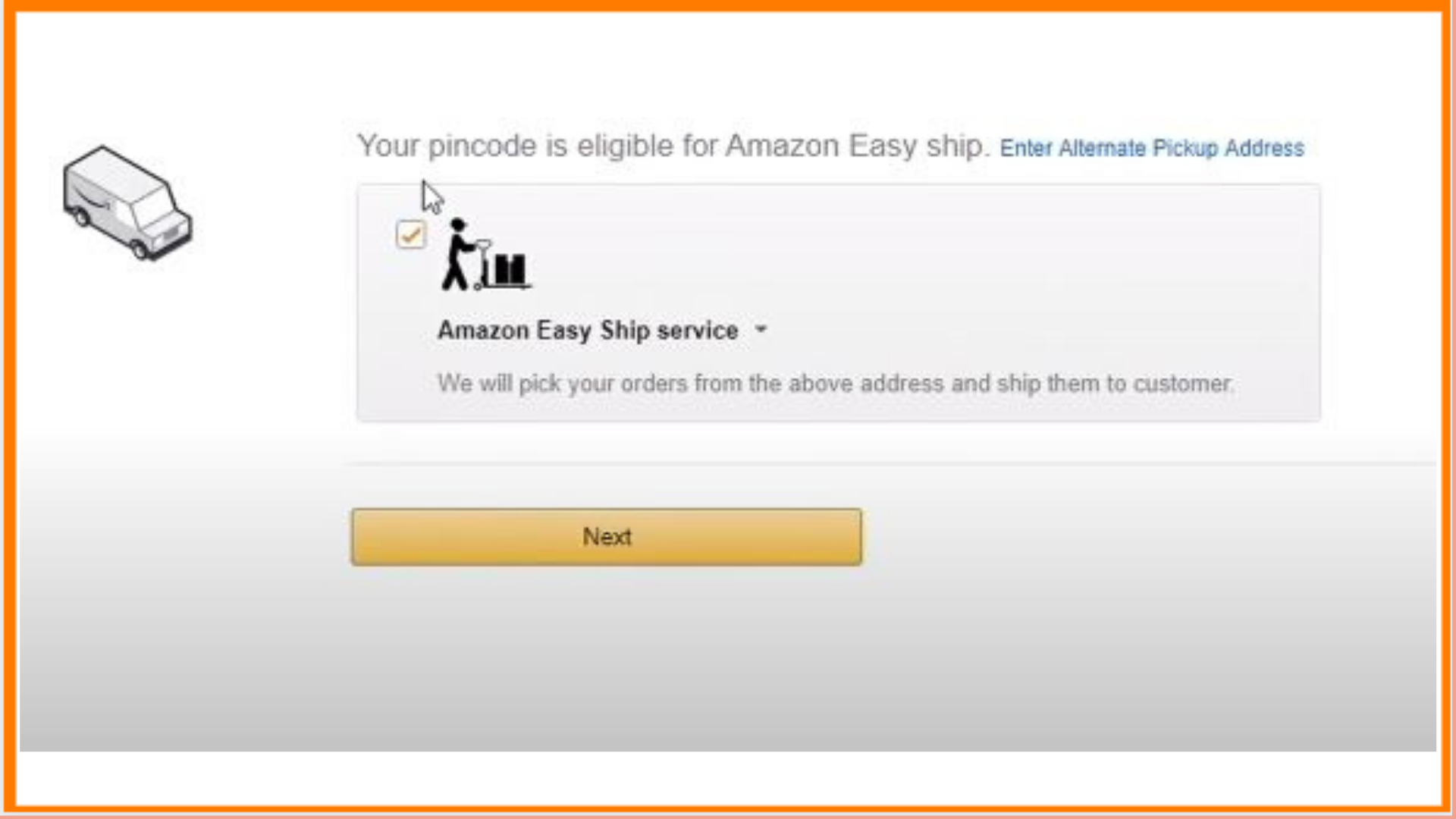

After that, you have to add your store name and the address of your store which it is located in after you add the address of your store, Amazon will display a message of amazon Easy ship service in this service amazon will pick orders from your store and directly ship them to the customers. If you don't want to employ amazon Easy ship you can provide the contract to any third-party shipping services which will ship the package for you.

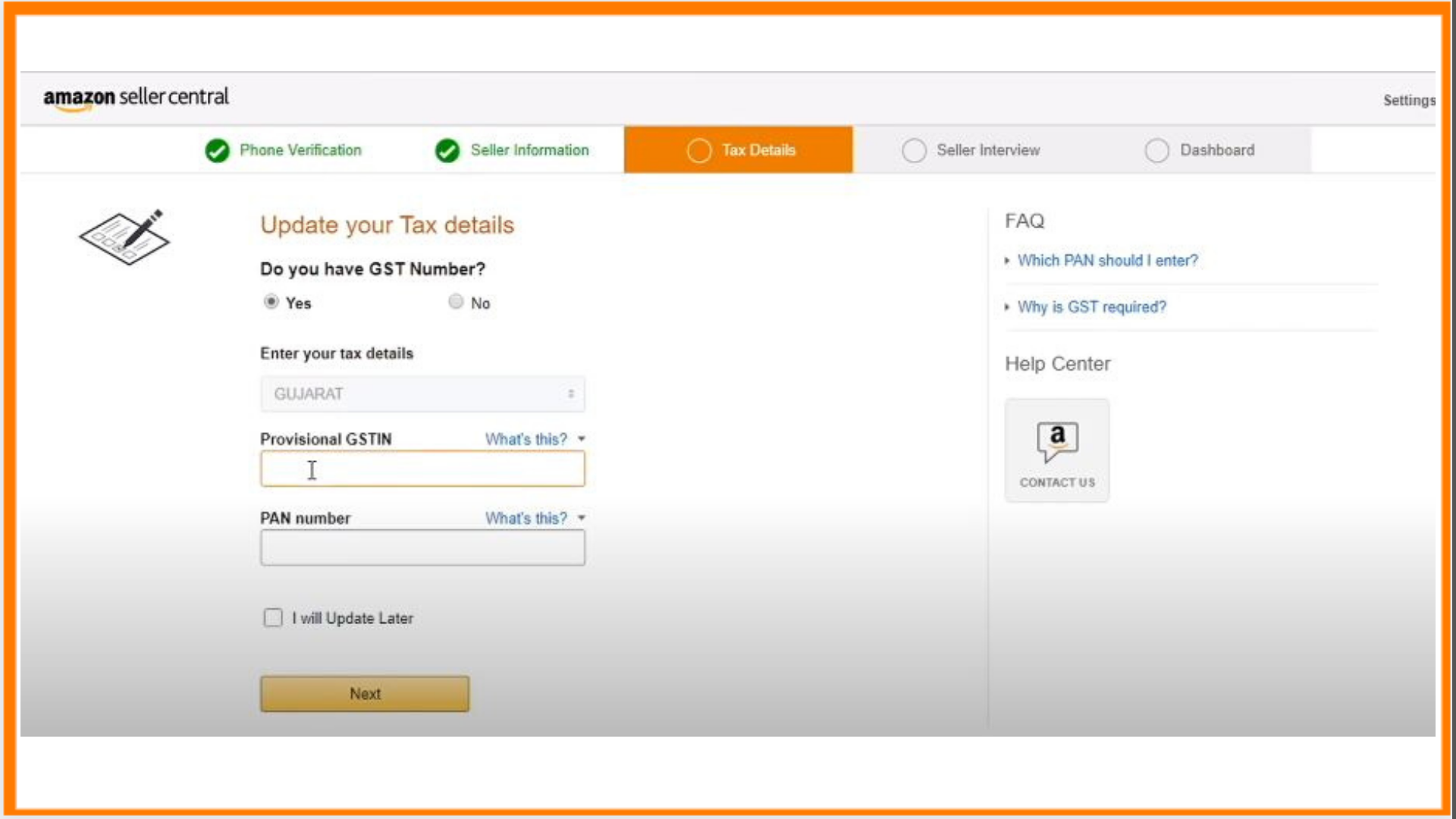

6. Tax Details

Fill in your GST details and if you don't have one register your GST at how to register GST at amazon services and proceed further.

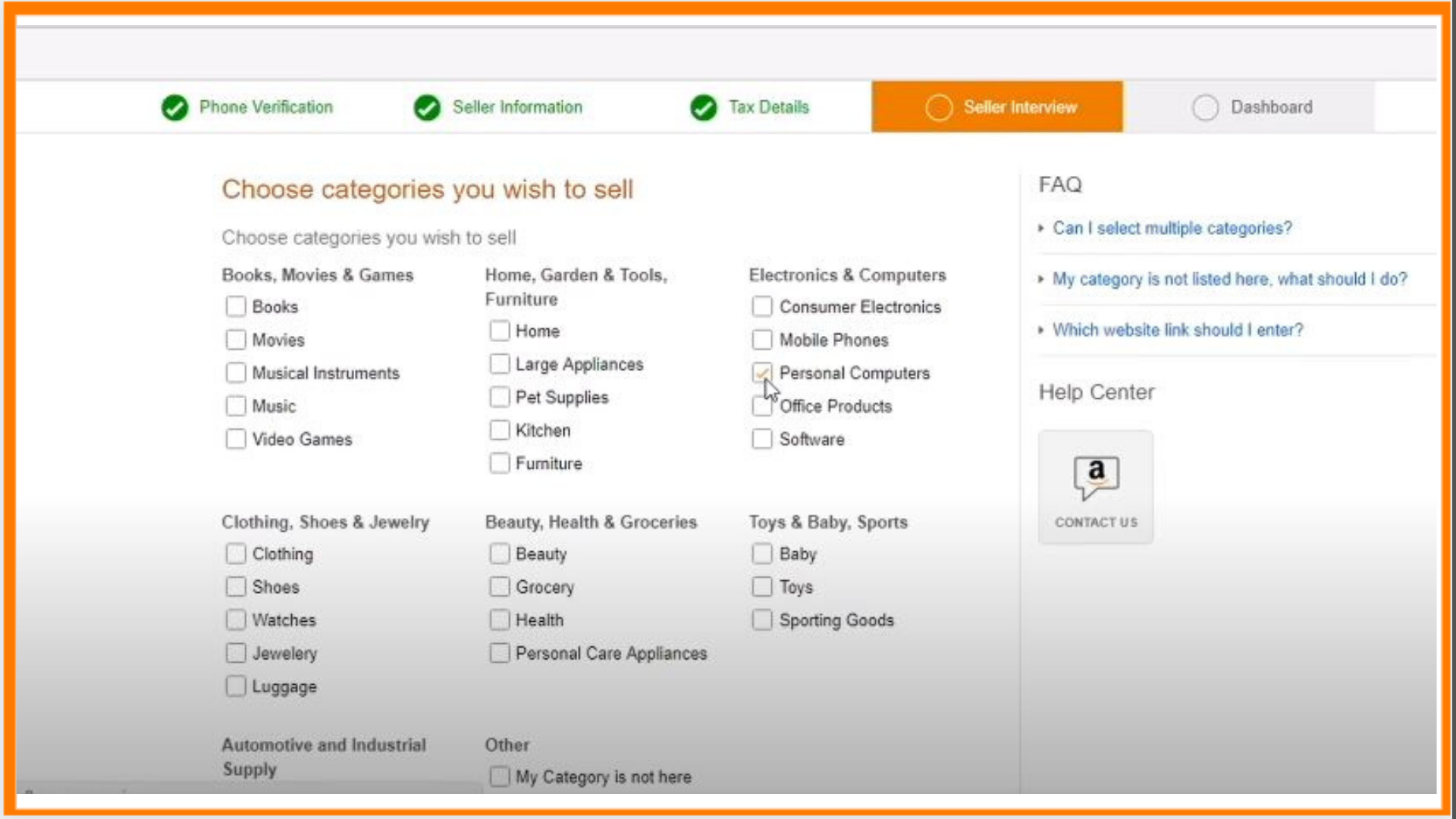

7. Choose the Category of Products

Now you have to choose the categories you want to sell in your store. (Choose the products which are high in demand to get maximum sales), after selecting the categories Amazon will ask you to fill some questions such as where do you get your products from and what is your annual turnover answer these questions and proceed to the dashboard.

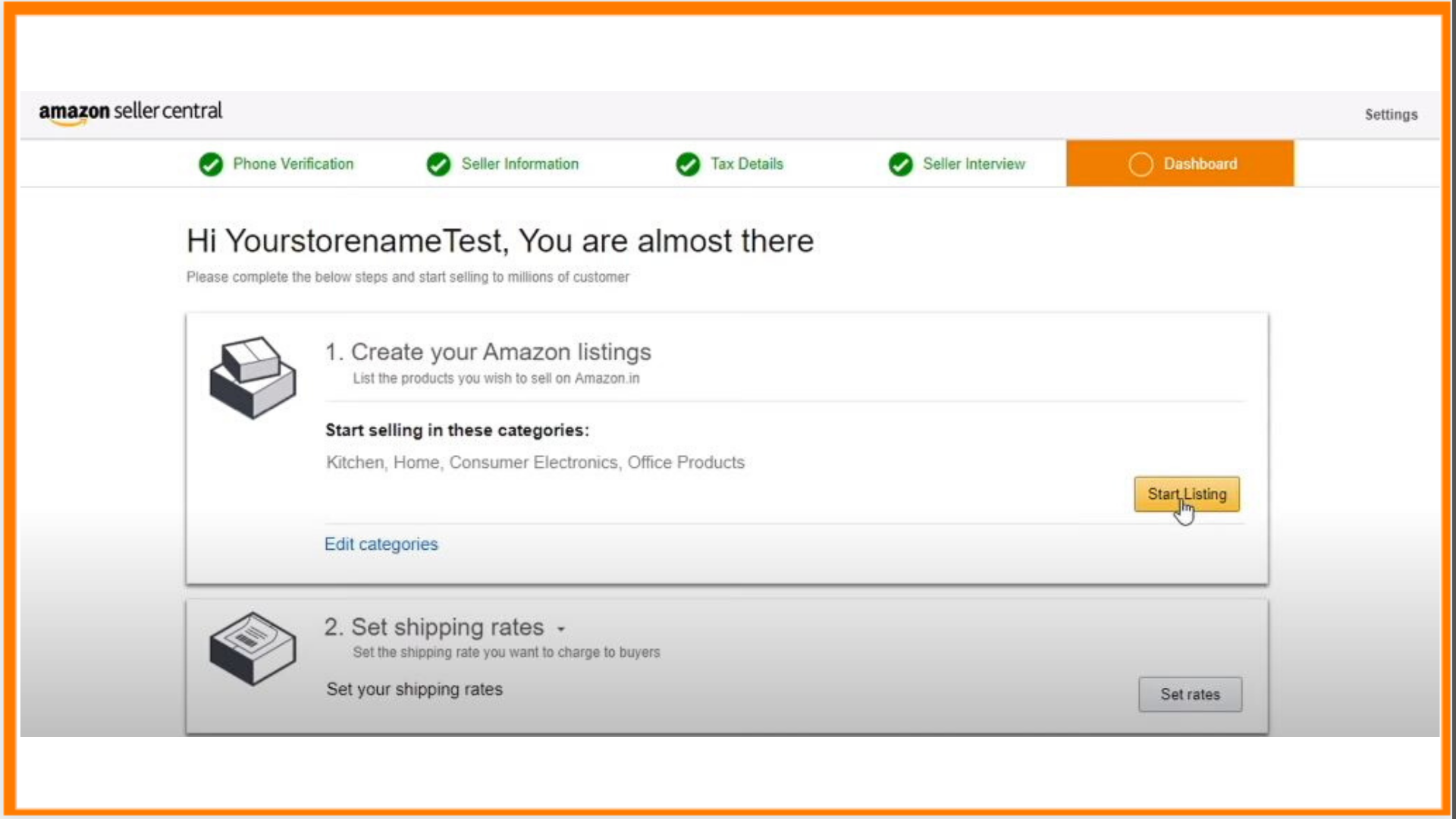

7. Amazon Listings and Shipping Rates

Click on start listing and list down all the products you're going to sell in your store.

Now you have to set the shipping region your going to ship such as rural or urban and set the shipping rates and days for that area, if you don't want the hassle of shipping choose amazon easy ship, and Amazon will ship it for you.

After selecting the shipping rates confirm the shipping rates and move ahead to enter the bank details.

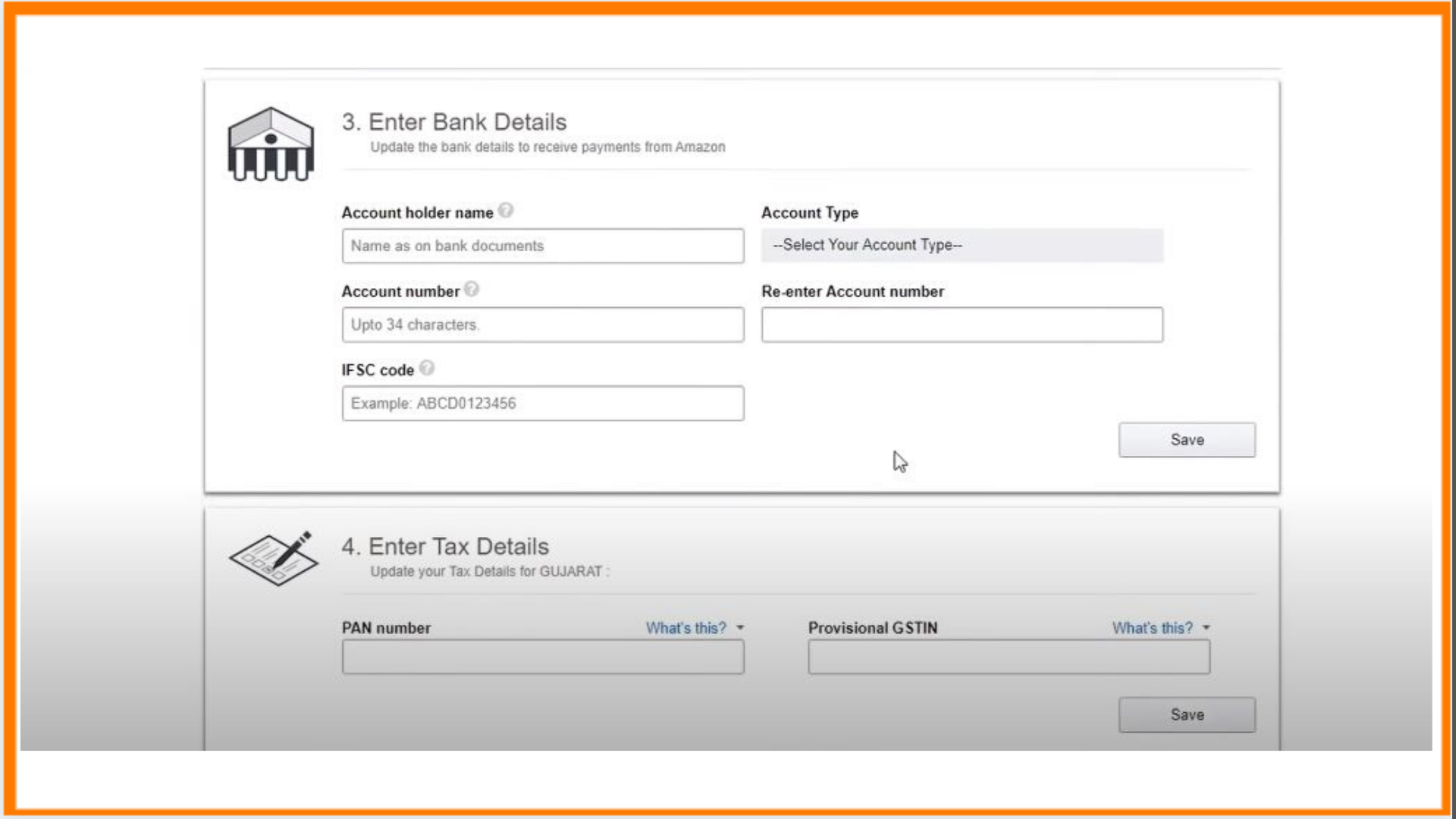

8. Bank Details and Tax Details

Enter your bank details properly because you will receive payments in this bank account.

Enter the tax details such as your PAN and GST number and click save.

9. Tax Code and Digital Signature

The government has imposed a different taxon different for some it's 8% or 12% search the tax code of your product and which category it falls in and add the tax codes to the product.

Upload a scanned copy of your signature and proceed further.

10. Dashboard

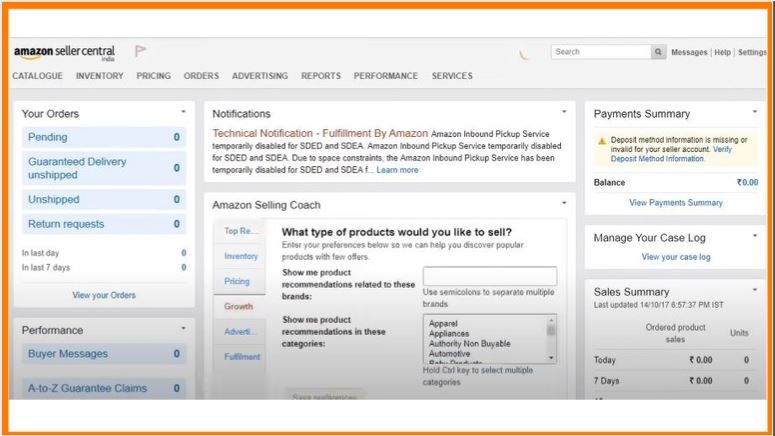

After completing the entire process of registering your business a dashboard will appear, from the dashboard you can manage all the functions of the amazon seller central dashboard you can monitor the orders which are shipped or not inventory prices, and everything.

So, This was the complete process of registering as a seller on amazon and inaugurating your own business.

Amazon Fees

While selling on Amazon, Amazon charges a small fee for every product you sell. Amazon charges three types of fee on your product:

Amazon Referral Fee

Based on the category of product you choose a small percentage of your selling price is charged by Amazon, you can check the referral fee on different categories of products at selling on the Amazon fee schedule.

Amazon Fixed Closing Fees

Amazon closing fees is the fee charged by amazon based on your selling product and the shipping services you choose. you can check the fee charged by amazon by visiting the amazon calculator.

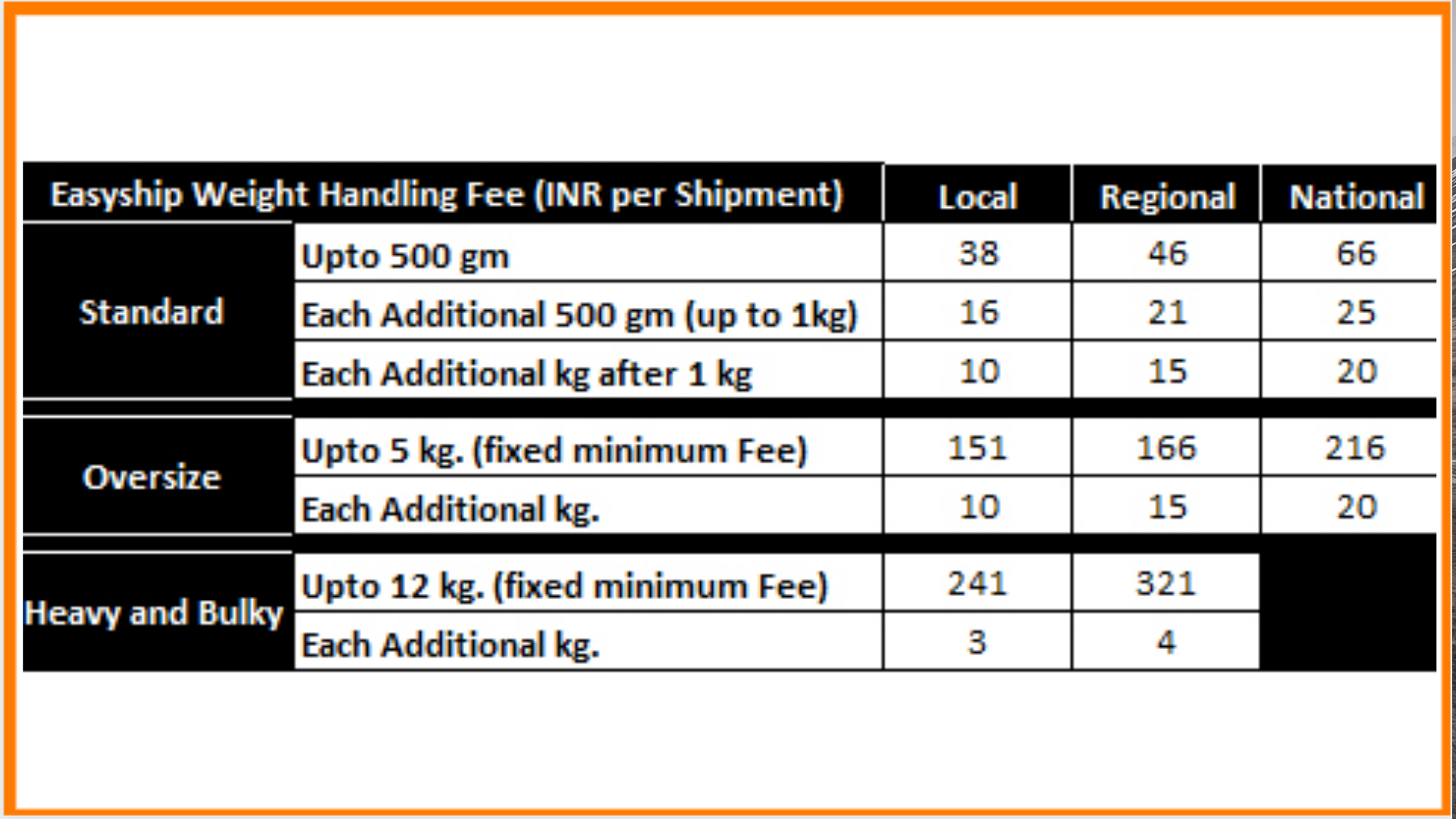

Amazon Easy Ship

Amazon easy ship is a service offered by Amazon in which Amazon will pick the product from your store and directly ship it to the customer if you want to ship manually, there also an option to ship manually but if you prefer amazon easy ship, Amazon will charge you a fee based on your product.

Now you're all set to sell your product on amazon lets learn how to get your first order when you don't have any seller ratings

How can you get your first order on Amazon?

Product display is the most important aspect of any shopping site when a consumer is scrolling through amazon your product display should be such that he/she clicks on it immediately

- While displaying your product on amazon use Hd images to showcase your product

- Add bullet-points that highlight feature of your products

- The description of your product should be informative so that the customer gets a complete idea about your product

- Highlight the benefits of your product

- A low pricing strategy never fails to attract customers

- Promote your products on social media platforms like Facebook, Instagram, Twitter, etc.

How to Advertise a Product on Amazon?

If you are confused about how to promote your product let amazon do it for you

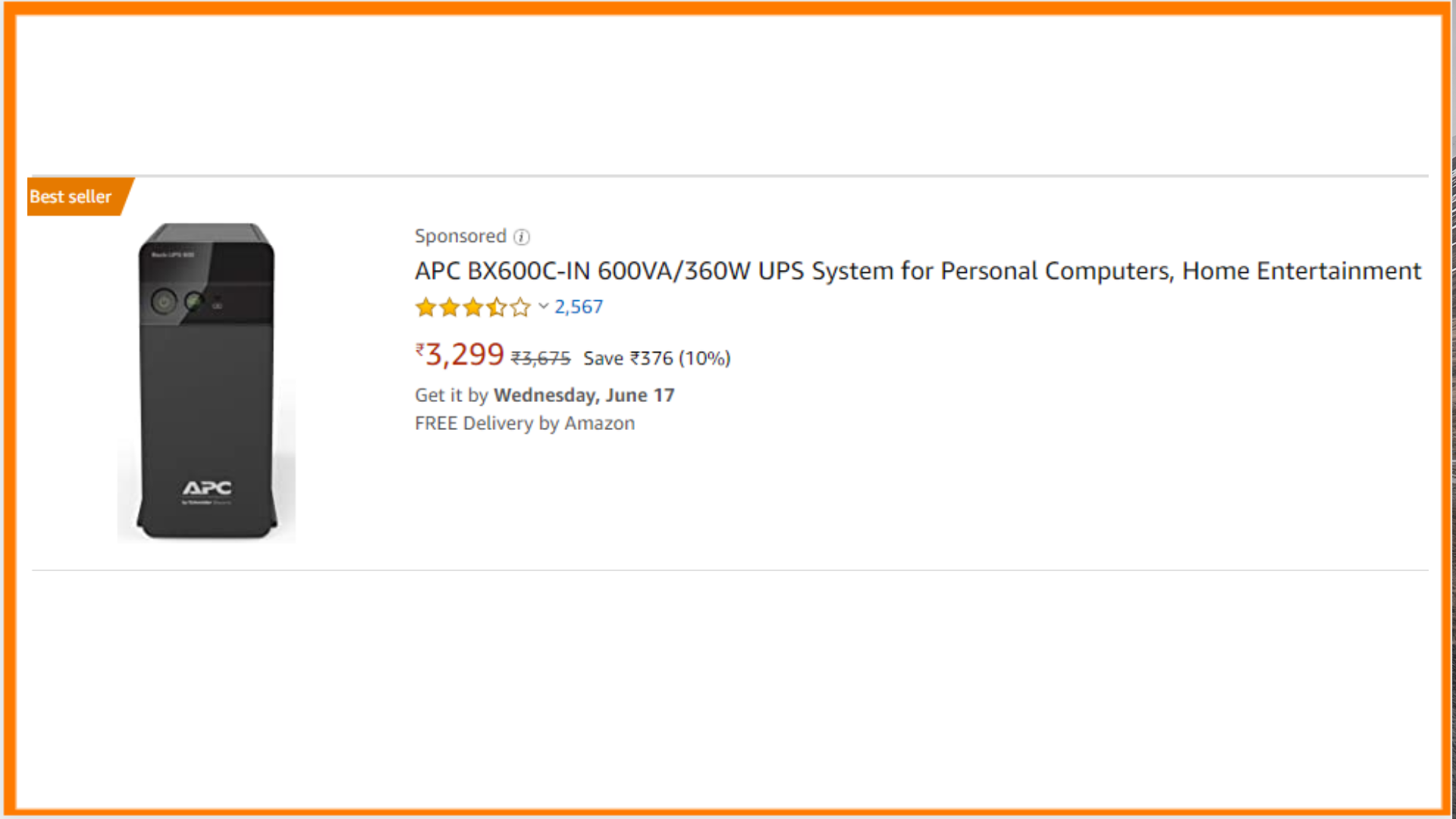

There is an advertising program by amazon in which amazon promotes your product for you. The sponsored products by amazon appear on top and bottom of the page, amazon sponsored products are displayed with a badge called sponsored.

This can help you to advertise your product and increase your seller ratings if you're a new amazon seller.

Amazon FBA

FBA (fulfillment by amazon) is a service provided by Amazon in which if a seller selects FBA the seller does not have to consider the hassle of storing the product in his store or warehouses, amazon store the product in their warehouses until it is delivered to the customer.

Benefits

- Less shipping fee as compared to third party shipments

- No burden of maintaining a warehouse full of products

- All FBA orders are processed and handled the same way as amazon handles its merchandise

Drawbacks

- There can be some handling issues by the amazon where a product can be lost or damaged

- There are really precise product guidelines which every FBA compliant must follow

- Given that Amazon handles returns with FBA, sellers may experience higher return rates once customers understand how easy it is to return a product on Amazon.

How does Amazon pay the seller?

When you provide valid information about your bank account, Amazon will directly transfer your money obtained from the sales into your bank account every 7 days. To initiate a payment from amazon you must have a positive seller account, positive seller account is when the number of sales is greater than the amount of fees incurred by the amazon.

How to manage returns on Amazon?

Every amazon seller has this concern of returning products from the customers, you can't get zero returns from the customers but you can add in extra effort to reduce the return rate such as pay special attention to defective products, great packaging, and delivery on time.

there are three types of return on amazon

- Customer Returns

- Undelivered Order Returns

- Rejected orders Returns

Customer returns are the products that are returned by the customers.

Undelivered returns are when the amazon cannot find the address of the seller or if the package is rejected by the customer then it is returned to the seller as it is.

Refund Related to Customers

To access the return setting in amazon seller central:

- Login to your amazon seller central account.

- In the top navigation bar, you'll find orders and under that, you can click on manage returns.

- Click on manage returns there you'll find an option "edit return settings". Click on it and you can manage the return settings.

If you wish amazon to authorize your refund request then, In case of amazon will authorize the return request. Once the parcel is picked from the customer end the money will be auto refunded to your bank account.

If you want to authorize each request you can authorize the return request, the parcel will be returned to you, and based on the return item condition you can generate a refund to the buyer.

So, this was your ultimate guide to owning your own store and starting your own e-commerce business using amazon. We wish you luck for your first e-commerce store now go out there and reach out to lakhs of customers.

Frequently Asked Questions

Can I sell on Amazon without GST number?

Yes. If you are listing taxable goods, GST details are required to sell online. You need to provide a GST number to Amazon at the time of registration. However, if you are selling only GST exempted categories, then this may not be required.

How long does Amazon take to pay the seller?

The first payment will take 14 days after which sellers will be paid every 7 days.

What if my product gets damaged or lost?

Amazon has a reimbursement policy (Amazon Safe T Claim) to reimburse the seller from the losses incurred due to the buyer. Easy Ship sellers can file a claim against the order for which the shipments get lost, damaged, original item not returned to claim reimbursement from Amazon.

What is the product tax code?

Product tax codes are the codes of the tax which is levied by the government on a different category of products.

I don't have a current bank account can I sell on amazon?

You can sell on Amazon if you don't have a current bank account but experts recommend having a current bank account.

How does easy shipping on Amazon work?

Amazon Easy Ship is a delivery service for Amazon.in sellers. Amazon.in orders are picked up from the seller's location by an Amazon Logistics delivery associate and delivered to the buyers' location with minimal effort from sellers. With Easy Ship, customers can track their orders and delivery date.

What is product tax code in Amazon?

Product Tax Code Amazon: Product tax codes direct Amazon how to charge sales tax to your customers in the states where you tell them to charge sales tax. Product tax codes don't cover every item, but they do cover items that are sometimes taxed differently across different states or jurisdictions.

How to sell on amazon without GST?

You can sell online without GST only if you sell goods which are exempted. If you sell goods on which GST is applicable, then you have to get a GST number to be able to sell online. You have to take GSTIN even if turnover is less than Rs. 20 lakh.