Peak XV Offloads About INR 82 Crore Worth of MobiKwik Shares

On December 26, Peak XV Partners Investment Holdings III, a foreign venture capital investor in One Mobikwik Systems, sold shares in the company for INR 81.63 crore through open market transactions. Recently, One Mobikwik Systems was added to the benchmark index. According to an NSE bulk sale, Peak XV Partners Investment, formerly Sequoia Capital India and SEA, sold a 1.54% share in the business. At INR 679.38 per share, the investor sold off 12.01 lakh shares.

As of December 16, Peak XV Partners Investment Holdings III owned 2.81% of the business, per BSE statistics. However, as of December 6, Peak XV Partners Investment Holdings III owned 3.67% of the business, according to the Red Herring Documents. for a premium of 57.71%, the stock made its debut on the National Stock Exchange for INR 440 a share. At INR 442.25 per share, it was listed on the BSE, representing a 58.51% premium.

MobiKwik’s Recently Concluded IPO

The initial public offering (IPO) of MobiKwik Systems, which ended on December 13, was subscribed for 119.38 times, with qualified institutional purchasers driving demand. Only a new issue of shares valued at INR 572 crore was included in the IPO.

The IPO proceeds will be used by MobiKwik for a number of initiatives, such as INR 150 crore for financing organic financial services growth, INR 135 crore for payment services, and INR 107 crore for investments in data, machine learning, artificial intelligence, and product and technology research and development. The remaining INR 70.28 crore will be allocated to general corporate objectives and capital expenditures for its payment devices division.

About MobiKwik and Expansion of Fintech Sector in India

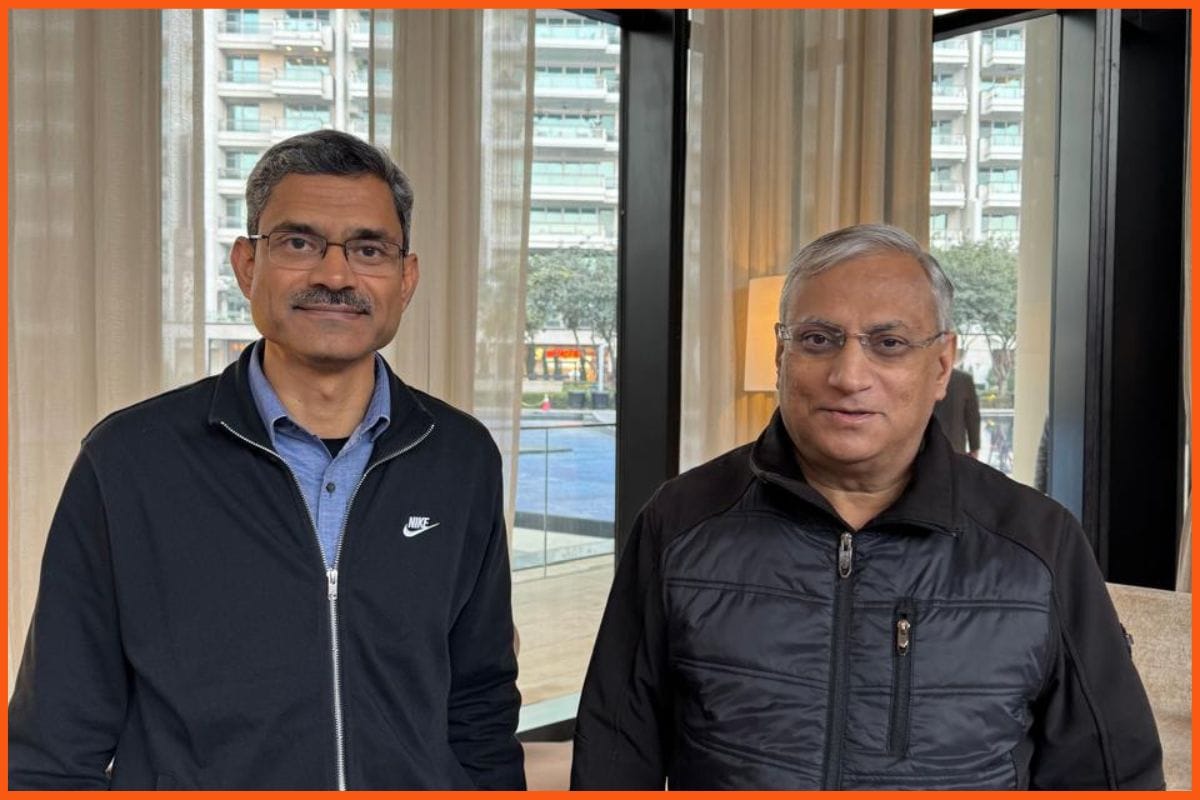

MobiKwik, a digital banking platform that provides a range of financial solutions for both customers and merchants, was founded in 2009 by Bipin Preet Singh and Upasana Taku. The fintech startup makes money by offering payment gateway services, buy now pay later (BNPL), and consumer payments. In India's growing fintech market, it faces competition from companies like Paytm, PhonePe, and Google Pay. Recently, MobiKwik became public on the stock exchanges. Its initial public offering (IPO) included no offer for sale and only a new issuance of shares valued at INR 572 Cr.

Company’s Performance at BSE

MobiKwik's stock debuted on the BSE at INR 442.25, which was 58.5% higher than the issue price of INR 279. The shares were listed at INR 440 each on the NSE, which was 57.7% more than the issue price. The stock has been rising steadily ever since. Dolat Capital, a broking firm, began covering the stock earlier this month with a "BUY" rating and a price objective of INR 500. In the first quarter of FY25, MobiKwik recorded a net loss of INR 6.6 Cr, down from a net profit of INR 3 Cr in the same period last year. During the reviewed quarter, operating revenue was INR 342.2 Cr.

Must have tools for startups - Recommended by StartupTalky

- Convert Visitors into Leads- SeizeLead

- Website Builder SquareSpace

- Run your business Smoothly Systeme.io

- Stock Images Shutterstock