Top 11 GRC Software Companies in India for Risk, Compliance, KYC & Governance

Collections 🗒️GRC software plays a key role in helping Indian businesses manage compliance, risk and governance. This article highlights the list of leading GRC software companies in India and explains what each platform is best suited for.

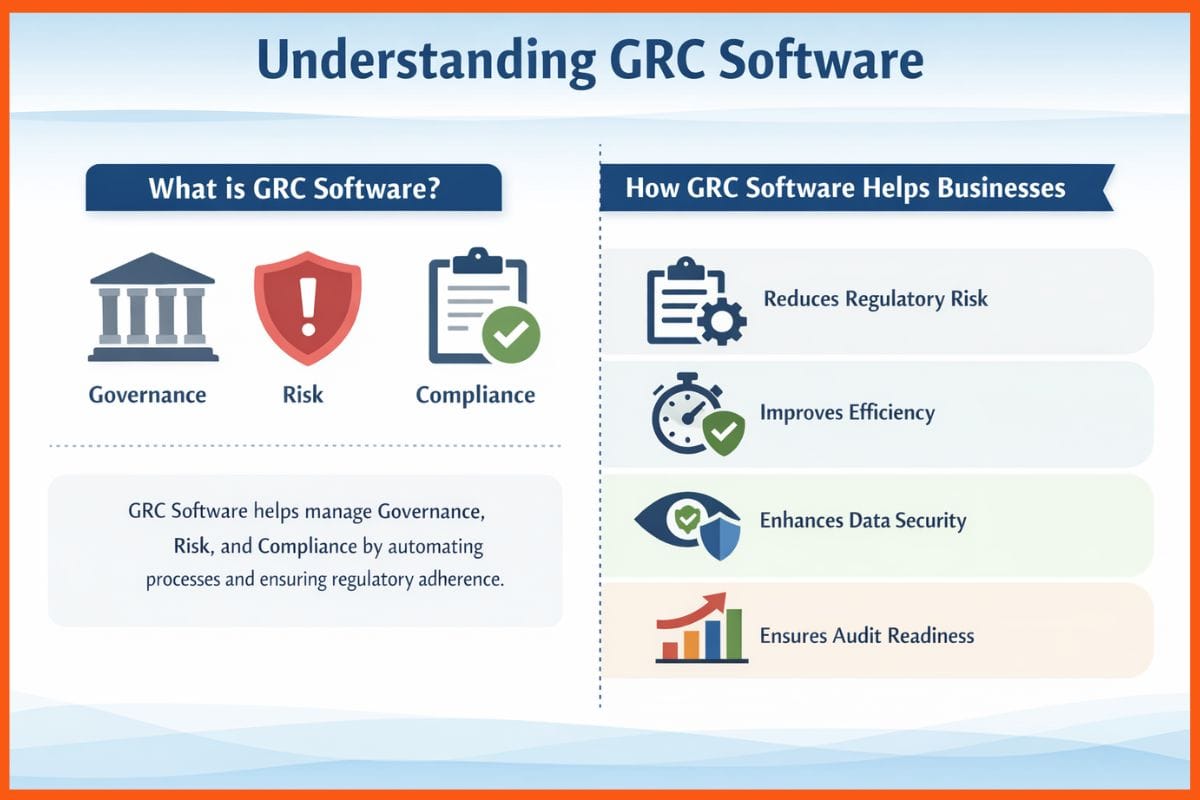

Governance, Risk, and Compliance (GRC) software has become essential for Indian businesses dealing with regulations, data security, lending risk, identity checks, and audits. From banks and fintech firms to large enterprises and fast-growing startups, companies now need tools that reduce manual work, improve accuracy, and help them stay compliant.

Here is a curated list of the top GRC software companies in India, based on product focus, real usage, client suitability, and recent revenue performance.

List of Top GRC Software Companies in India

| Company | Founded | Headquarters | Primary GRC Use Case | Best Suited For | Key Strength |

|---|---|---|---|---|---|

| IDfy | 2010 | Mumbai | KYC, AML, fraud prevention, background verification | Banks, NBFCs, large fintechs, enterprises | High-volume compliance, enterprise-grade scale |

| HyperVerge | 2014 | Bengaluru | AI-based identity verification, video KYC | Fintechs, digital banks, lending platforms | Fast onboarding with high accuracy AI |

| FinBox | 2015 | Bengaluru | Credit risk assessment, underwriting compliance | Digital lenders, NBFCs, MSME lenders | Data-driven lending and risk scoring |

| Atlan | 2018 | Delhi | Data governance, metadata management | Enterprises with large data teams | Strong data visibility and audit trails |

| Signzy | 2015 | Bengaluru | AML monitoring, compliance automation | Banks, payment firms, financial institutions | Unified RegTech compliance platform |

| OnFinance AI | 2023 | Bengaluru | AI-led compliance monitoring | Early-stage fintech startups | Lightweight, automation-first compliance |

| TransBnk | 2022 | Delhi | Transaction risk monitoring | Payment platforms, neobanks | Focus on payment and transaction risk |

| Digio | 2016 | Bengaluru | Digital KYC, eSign, document compliance | Fintechs, insurers, enterprise onboarding teams | Legally valid digital workflows |

| Rubix Data Sciences | 2018 | Mumbai | Risk intelligence, business risk profiling | Enterprises, lenders, large vendors | Deep data-backed risk insights |

| Scrut | 2020 | Bengaluru | Security compliance, audit readiness | SaaS and tech companies | ISO, SOC 2, GDPR automation |

| Electronic Payment and Services | 2011 | Mumbai | Payment compliance, transaction security | Payment processors, banks | Strong presence in payment infrastructure |

IDfy

What it does well: IDfy is one of India’s largest identity verification and compliance platforms, trusted by major banks, fintechs, and enterprises for KYC, risk scoring, fraud detection and compliance automation.

Why it’s considered best: IDfy processes millions of verifications each month and operates in multiple countries, including India and the Middle East. Its suite goes beyond basic ID checks to include bank-statement risk analytics, consent management for data protection laws (like India’s DPDP), video KYC, background screening, and fraud patterns.

Who should use it: Large banks, NBFCs, insurers, large fintechs, and enterprises with high compliance loads and heavy onboarding needs benefit most from IDfy’s depth and scalability.

Why readers should notice it: Backed by strong enterprise references (Kotak Life, Yubi and Aditya Birla Capital report faster, more reliable onboarding), IDfy also helps reduce fraud losses and speeds up regulatory reporting.

HyperVerge

What it does well: HyperVerge specialises in AI-driven identity verification, biometric face match, document OCR and video KYC that works even on low-bandwidth networks.

Why it’s considered best: It claims to have verified over a billion identities globally and powers onboarding for many large enterprises such as SBI, Swiggy, CRED, Vodafone and Home Credit across multiple industries.

Who should use it: Fintechs, digital banks, lending platforms and marketplaces that want faster onboarding with high accuracy (often above 99% match quality) will benefit from HyperVerge’s technology.

Why this matters: HyperVerge’s AI is built to reduce drop-offs during signup and prevent fraud in real time, a big advantage for platforms needing frictionless compliance at scale.

FinBox

What it does well: FinBox is best known for credit risk assessment, intelligent underwriting and compliance infrastructure that helps automate decision-making in digital lending.

Why it’s considered best: Its platform combines Account Aggregator data, device analytics and bureau feeds into comprehensive risk profiles, helping lenders assess creditworthiness quickly.

Who should use it: Banks, NBFCs and fintech lenders focused on digital credit and MSME underwriting, especially those basing decisions on real-time financial data.

Why this matters: FinBox’s tools can boost approval rates, reduce fraud and improve the quality of lending decisions, turning compliance from a cost centre into a productivity driver.

Atlan

What it does well: Atlan is a modern data governance and metadata management platform that helps teams catalogue, govern and track data across organisations.

Why it’s considered best: Rather than just compliance checklists, Atlan focuses on data discovery, cataloguing and policy enforcement across data assets, making it ideal where data compliance & lineage matter (such as enterprises with large BI teams or cross-border data flows).

Who should use it: Data-intensive enterprises, large SaaS firms, analytics teams and organisations preparing for internal and external audits.

Signzy Technologies

What it does well: Signzy offers an end-to-end GRC suite with AML screening, transaction monitoring, fraud detection and compliance automation in one platform.

Why it’s considered best: Trusted by 1,800+ financial institutions globally, Signzy allows companies to automate complex compliance reporting, AML monitoring, vendor risk management, and reduce false positives with advanced risk scoring.

Who should use it: Traditional banks and large payment providers that need unified compliance visibility and reduced human effort in audit reporting.

Why this matters: It integrates monitoring, AML checks and reporting into a single system that adapts as regulations evolve, reducing operational hassle and helping compliance teams stay audit-ready.

OnFinance AI

What it does well: OnFinance AI brings AI-centric compliance monitoring and anomaly detection to financial data, helping to automate risk signals for fintechs.

Why it’s considered best: Though still emerging, its focus on automation and AI alerts suits fintech startups and smaller lenders that want early signals of non-compliance or risk without large compliance teams.

Who should use it: Early-stage fintechs and NBFCs that need lightweight, data-driven risk insights rather than full enterprise onboarding engines.

TransBnk

What it does well: TransBnk focuses on transaction risk monitoring and compliance checks specifically for digital payments and banking platforms.

Why it’s considered best: It helps detect risky payment patterns, unusual transfers and non-compliance flags, important for platforms handling high volumes of digital money movement.

Who should use it: Payment aggregators, neobanks, and fintechs focused on secure transaction rails.

Digio

What it does well: Digio is a leading platform for digital KYC, e-signatures (eSign), eMandates, and document automation that helps businesses cut down paper processes and stay compliant.

Why it’s considered best: With integration into DigiLocker, OCR, KYC and liveness checks, Digio is widely used by banks, NBFCs and enterprises for secure onboarding and legal compliance.

Who should use it: Fintechs, insurance firms, enterprise onboarding teams and legal operations that want robust and compliant digital documentation workflows.

Why this matters: Digio’s compliance certification and RBI-authorised integrations make it effective for secure, automated customer verification without heavy manual review.

Rubix Data Sciences

What it does well: Rubix aggregates public and proprietary data to generate risk intelligence and business insights that go beyond basic checks.

Who should use it: Lenders and enterprises that want deep profiles of vendors, borrowers and business entities.

Why it’s considered best: By combining datasets and analytical insights, Rubix helps teams spot early warning signals and non-compliance behaviours that simpler tools might miss, adding depth to risk processes.

Scrut

What it does well: Scrut is focused on security compliance automation with audit readiness for standards such as ISO, SOC 2 and GDPR.

Who should use it: SaaS companies and tech firms preparing for audits or global compliance frameworks.

Why it matters: Helps teams centralise audit evidence, track controls, and keep compliance documentation up-to-date without spreadsheets.

Electronic Payment and Services

What it does well: This provider supports payment compliance, transaction security and operational risk controls in India’s digital payment ecosystem.

Who should use it: Payment processors, aggregators and banks that need reliable compliance checks and secure transaction flow governance.

Why it’s considered best: Its large revenue and ongoing use by financial networks show consistent demand for secure, compliant payment solutions.

Conclusion

GRC software has become essential for Indian businesses dealing with compliance, risk management, and data security. From KYC and AML checks to audit readiness and transaction monitoring, the right GRC platform helps reduce manual effort and regulatory risk.

Companies like IDfy, HyperVerge, and Signzy are well-suited for high-volume compliance in banking and fintech, while FinBox and Rubix Data Sciences support deeper credit and business risk analysis. Digio and Scrut address digital onboarding and security compliance needs, especially for SaaS and technology firms.

Choosing the right GRC software in India depends on business size, industry regulations, and growth plans. A well-matched GRC solution not only ensures compliance but also improves operational efficiency and trust.

FAQs

What is GRC software used for in India?

GRC software helps businesses manage governance rules, reduce financial and operational risks, and stay compliant with Indian regulations such as KYC, AML, data protection, and audit standards.

Which GRC software is best for fintech startups?

For fintech startups, platforms like HyperVerge, Signzy, Digio, and Scrut are suitable as they offer automation, fast onboarding, and regulatory compliance without heavy manual effort.

How do companies choose the right GRC software?

Companies should consider their industry, regulatory requirements, scale of operations, and budget. A lending platform may focus on credit risk tools, while a SaaS company may prioritise security and audit compliance.

Must have tools for startups - Recommended by StartupTalky

- Convert Visitors into Leads- SeizeLead

- Website Builder SquareSpace

- Run your business Smoothly Systeme.io

- Stock Images Shutterstock