How to Approach Investors for Funding for your Startup

📖 Learning

Starting your own business or what we call now a startup can both be overwhelming and scary. Funding is something that is needed heavily in this line or for anything you do even while organizing an event. According to a study conducted by “Forbes,” “about 10% of startups survive, despite the fact that 90% fail.” Businesses, specifically emerging companies, have a difficult time raising funds. How can you get that first investment so you may expand your business?

When it comes to raising capital for enterprises, many entrepreneurs approach investors and pitch their idea right when they need it. The difficulty here is that why would an investor give you a huge sum of money if they have no idea who you are? There are a number of things that can help you turn your startup idea into the successful firm you've always imagined. In addition to working on your business idea, you are also the banker for it. You'll need a business and a marketing strategy. Most significantly, you'll need to learn how to raise funds and find investors.

When looking for investment for your startup, there really are a number of options to explore. Some funding alternatives may make more sense than others depending on where your firm is in its development. Choosing an appropriate investor could make or destroy your firm, whether you're crowdfunding or leaning toward the private investment sector.

Approach Investors for Funding - Initial Plan of Action

1. Early on, establish a network

2. Know how to pitch the Idea

3. Results speak more than Words

4. Ask for Advice

5. Benefit from the internet fundraising sector

6. Get the Traditional way and take help from the Bank

Approach Investors for Funding - Conclusion

Approach Investors for Funding - FAQs

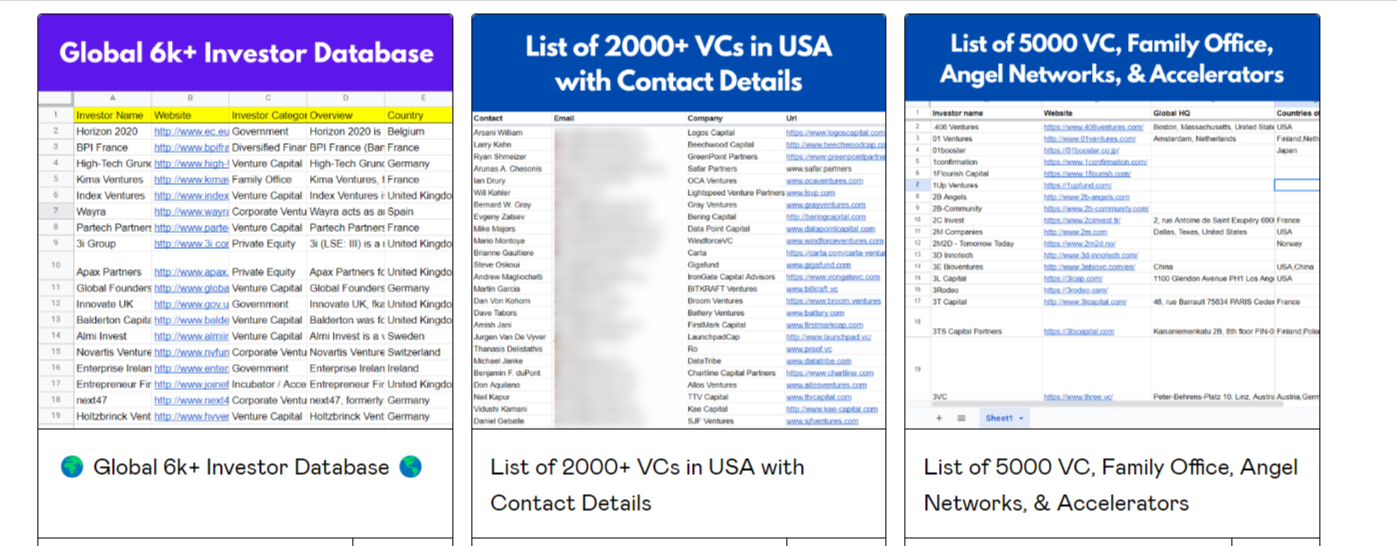

Unlock Your Startup's Potential with Our Exclusive Investor Lists and Resources

Supercharge your startup's success with our comprehensive resources. Access investor lists, pitch decks, KPIs, and fundraising guides. Connect with pre-seed investors, angel networks, and family offices, while mastering VC pitches. Ignite your entrepreneurial dreams today!

Approach Investors for Funding - Initial Plan of Action

You can approach an investor in a few different ways to get him or her to invest in your startup. When you pitch for funding, it is essential that you have all the information about your startup, as a little misinformation may cause the rejection of the proposal for the investment.

1. Early on, establish a network

The sooner you begin, the better. Entrepreneurs must meet investors in the early stages of their businesses. Learn about the industry they invest in and allow them to learn about your business. This helps in building a strong network for the later stage of investment. Sending a pitch deck to them later will feel less awkward if you create an informal relationship with the investors at first. During the idea stage, most entrepreneurs' gets a financial aid from friends and family. These are generally your constant supporters or people closest to you who want to see you succeed.

2. Know how to pitch the Idea

While investors may trust in your business, their investment is ultimately a means to an end - they want to profit from it. As a result, it is important to emphasize how investing in your company would benefit them directly. While pitching, have your basics in place. If you are pitching to an established company or any other businessman the easiest method to stand out and stimulate a person's curiosity is to show them exactly how and when they'll get their money back.

3. Results speak more than Words

When you are pitching you may want to show them your initial results. It could be your business graph, potential customers or stakeholders you aim to bring in the future and how. Also building a strong team and showing them that you have a team which means business.

4. Ask for Advice

By proactively approaching an investor for advice initially, you may be able to build relationships with them that leads to a stronger desire to invest in your company later. It allows investors to bring out potential weaknesses in your business while also demonstrating that you value their opinion.

5. Benefit from the internet fundraising sector

While networking in person is crucial, your location should not be a stumbling block to securing financing. With the prominence of crowdfunding websites available like Kickstarter, Indiegogo, FuelADream, and Milaap, you'll no longer be limited to the traditional way. More than this, try and take help from social media. Grow your firm on Social Media. The more digital the business gets the more social attention it will get.

6. Get the Traditional way and take help from the Bank

If you can secure favorable terms, traditional bank loans could be a helpful funding choice. Banks often offer the lowest interest rates on business startup loans and do not need equity in the company. Bank loans have a lengthy application process and a high credit score is required. A bank may need you to sign a personal guarantee on the loan in exceptional instances. This means that if the loan is defaulted on, they can recuperate their losses from personal assets.

Approach Investors for Funding - Conclusion

The argument would be that investors receive a lot of inquiries on the funding, and one approach to stand out is to have someone who they trust highlight you as worthwhile and worth paying attention to. Many investors won't even reply to startups that don't have a warm introduction because their deal flow is too heavy. Pause for a moment and consider how to create a 'critical path' for investors. This may have an impact on your future investor relationships. Ensure you get it right the first time so you don't have to go searching for another chance.

Approach Investors for Funding - FAQs

What are ways of approaching an investor to get the funding?

Establish a network, know how to pitch an idea, show then the results, ask for advices, use internet fundraising sector, take help from bank.

What are the different sites in internet fundraising sector?

Kickstarter, Indiegogo, FuelADream, Milaap, Gofundme and many more.

What is the percentage of startups that survive?

According to a study conducted by Forbes, “about 10% of startups survive, despite the fact that 90% fail.”

Must have tools for startups - Recommended by StartupTalky

- Convert Visitors into Leads- SeizeLead

- Website Builder SquareSpace

- Run your business Smoothly Systeme.io

- Stock Images Shutterstock