Top SaaS Payment Gateway & Processing Solutions: Best Platforms for Your Business

Collections 🗒️

When it comes to Software as a Service (SaaS) applications, payment processing usually involves either a shopping cart/payment checkout or the management of recurring/subscription payments. Both of these methods present unique challenges and opportunities for the SaaS platform. The right payment gateway can help you securely process payments, manage subscriptions, and provide an excellent user experience for your customers. However, selecting the right payment processor for your SaaS company is a crucial decision, given that customers trust you with their sensitive financial information. Ensuring their details are secure is a top priority. In addition, you want to guarantee a seamless payment process with no interruptions, which is especially critical when selling software to established businesses.

B2B customers are willing to pay a premium price for the right solution, but their standards are high, and they won't hesitate to switch to a competitor if they feel let down. Thus, selecting the appropriate payment gateway for your B2B SaaS is critical. With so many options available, it can be overwhelming to choose the best one for your business. In this blog post, we'll explore the six best payment gateways for your SaaS startup to help you make an informed decision and set your business up for success.

Best Payment Gateways for Your SaaS Startup

| S.No | Platform | Pricing | Key Features |

|---|---|---|---|

| 1 | Stripe | 2.9% + 30¢ per transaction | Global payments, robust APIs, subscription billing |

| 2 | Braintree | 2.9% + 30¢ per transaction | Cards + PayPal, vaulting, fraud protection |

| 3 | Paddle | Custom (revenue-share model) | Subscription management, tax/VAT compliance |

| 4 | Paypal | 2.9% + 30¢ per transaction | Widely accepted, buyer protection, simple setup |

| 5 | Adyen | Custom (volume-based pricing) | Multi-currency, unified commerce, enterprise security |

| 6 | Chargebee | Starts at $599/month | Subscription billing, dunning, analytics |

| 7 | GoCardless | ~1% per transaction (capped) | Direct debit, recurring payments, low fees for ACH/SEPA |

| 8 | Recurly | Starts at $199/month | Subscription billing, churn management, reporting |

Stripe

| Website | Stripe.com |

|---|---|

| Rating | 4.7 out of 5 |

| Free Trial | Available |

| Platforms Supported | Web, Android, iPhone/iPad |

Stripe is a popular payment gateway Software as a Service (SaaS) software that offer online services or subscriptions. With Stripe, SaaS businesses can easily accept online payments from their customers, set up recurring billing, and manage subscription plans.

It offers a range of features and benefits, including easy integration with websites and mobile apps, support for multiple payment methods such as credit cards, digital wallets, bank transfers, fraud prevention tools and customizable checkout options.

Stripe's comprehensive suite of products includes a payment platform, billing system, and software that empowers platforms to remit payments to vendors. With support for over 135 currencies, the likelihood is high that Stripe covers the currency that is most relevant to your business.

Stripe is trusted by millions of businesses, including companies like Amazon, Google, Lyft and Slack, as well as non-profits such as Unicef, Oxfam and Khan Academy.

What is Stripe and How Does it Work | SaaS Payment Processing

Pricing:

Stripe standard payment processing fee starting at 2% for cards issued in India and 3% for cards issued outside India.

| Plan | Price |

|---|---|

| Pay As You Go (for cards issued in India) | 2% per successful card charge |

| Pay As You Go (for cards issued outside India) | 3% per successful card charge |

| Enterprise | Custom Plans |

Braintree

| Website | www.braintreepayments.com |

|---|---|

| Rating | 3.8 out of 5 |

| Free Trial | Not Available |

| Platforms Supported | Web, Android |

Braintree is a software-as-a-service (SaaS) payment gateway that allows businesses to accept online payments from their customers. It was founded in 2007 and acquired by PayPal in 2013. Braintree offers two main products, Braintree Direct (to accept online payments) and Braintree Extend (to connect with partners). There’s also Braintree Marketplace (payments for online marketplaces) and Braintree Auth, which is still in beta at the moment of writing, but will “enable your merchants to connect a Braintree account to your platform, and receive permission to take action on their behalf.”

As a PayPal service, Braintree’s innovative payments technology, scalable solutions, and legendary white-glove support are backed by one of the world’s largest and most trusted fintech brands. It is the payments platform for some of the world’s leading brands including Uber, Dropbox, GitHub and yelp. Braintree accepts most major credit and debit cards such as Visa, MasterCard, American Express, etc. They also accept most widely adopted e-wallets such as PayPal, Apple Pay, Google Pay, etc.

Pricing:

Braintree's pricing is based on a per-transaction fee structure, with no setup or monthly fees. The fee varies depending on the payment method used and the country in which the transaction occurs.

| Plan | Price |

|---|---|

| Cards and digital wallets | 2.59% + $.49 per transaction |

| PayPal and PayPal Credit | Fees are subject to the terms applicable to your PayPal account |

| Venmo | 3.49% + $.49 per transaction |

| ACH Direct Debit | 0.75% per transaction |

Paddle

| Website | www.paddle.com |

|---|---|

| Rating | 4.0 out of 5 |

| Free Trial | Not Available |

| Platforms Supported | Web, iPhone/iPad |

Paddle provides a unique approach to payment infrastructure for software-as-a-service (SaaS) companies. Instead of just offering payment processing options, Paddle provides a range of tools and services, including customizable checkout pages, upselling and cross-selling capabilities, recurring billing and subscription management, and fraud prevention services. This comprehensive approach allows SaaS companies to streamline their payment processes and increase revenue while also ensuring the security of their transactions.

No extra tools to buy and bolt together. With Paddle, software products can grow into software businesses. It optimizes your pricing, scale self-service sales, and move upmarket with team plans and enterprise invoicing. You can use Paddle Checkout and APIs to create, customize, and control website and in-app purchase and subscription flows that match your brand, including upsell, cross-sell, and language localization. Paddle also allows to create any billing cycle, seat-based, usage-based, credit-based, whatever-based billing model with Paddle's flexible subscription management.

Pricing:

Paddle's pricing is based on a percentage of the transaction value, with no setup or monthly fees. The transaction fee varies depending on the country and the payment method used. Paddle also offers volume-based pricing discounts for businesses with high transaction volumes.

| Plan | Price |

|---|---|

| Pay-as-you-go | 5% + 50¢ per transaction* |

| Based on ROI assessment | Custom pricing |

Paypal

| Website | www.paypal.com |

|---|---|

| Rating | 4.7 out of 5 |

| Free Trial | Not Available |

| Platforms Supported | Web, Android, iPhone/iPad |

PayPal is a SaaS payment gateway that allows individuals and businesses to send and receive online payments securely. It was founded in 1998 and is headquartered in California, USA.

PayPal helps you get paid even if you don’t have a website or online checkout. Easily track and manage your cash flow-and get ready to sell more. It provides 3 easy ways to get paid: Email payments, Professional invoices and your personalized link to get paid In India or globally. With PayPal customers enjoy 180-day window for dispute resolution and zero liability for unauthorized transactions.

One of PayPal's main strengths is its wide reach and popularity. It is accepted in over 200 countries and supports more than 100 currencies. This makes it a popular payment gateway choice for businesses operating internationally.

Pricing:

PayPal's pricing is based on a percentage of the transaction value, with no setup or monthly fees. The transaction fee varies depending on the country and the payment method used. PayPal also offers discounted transaction fees for businesses with high transaction volumes.

Domestic Personal Transactions

| Payment method | Price |

|---|---|

| PayPal balance or a bank account | No fee |

| Cards | 2.90% + fixed fee |

| Amex Send™ Account | No fee |

International Personal Transactions

| Payment method | Price |

|---|---|

| PayPal balance or a bank account | 5.00% ( Min international fee - 0.99 USD, and max international fee - 4.99 USD ) |

| Cards | 5.00% ( Min international fee - 0.99 USD, and max international fee - 4.99 USD ) |

| Amex Send™ Account | 5.00% ( Min international fee - 0.99 USD, and max international fee - 4.99 USD ) |

Adyen

| Website | www.adyen.com |

|---|---|

| Rating | 4.9 out of 5 |

| Free Trial | Available |

| Platforms Supported | Web, Android, iPhone/iPad |

Adyen was founded in 2006 by a group of entrepreneurs, including Pieter van der Does and Arnout Schuijff and is headquartered in Amsterdam, Netherlands. Adyen is the platform built to simplify and accelerate global payments. As your customers continue to move fluidly between online and offline, you need to be able to meet their expectations. Adyen allows you to easily manage payments across platforms.

The Adyen platform enables merchants to accept payments in a single system, enabling revenue growth online, on mobile devices and at the point of sale. It is a scalable enterprise solution that powers the payment processing of big tech, such as, Facebook, Uber, Netflix and Airbnb. That tells you Adyen is suited for building an end-to-end payment infrastructure, which allows for expanding fast and tracking results at manageable risk levels.

How do Adyen Payments work? Saas Payment Processing Services

Pricing:

Adyen offers no fixed enterprise pricing plans, but charges a calculated processing fee and commission per each transaction. Fee is based on Interchange++ model for Visa, Mastercard and other cards. Interchange++ components include: interchange fee by issuing bank; scheme fee by cards scheme; and acquirer markup, if any.

Chargebee

| Website | www.chargebee.com |

|---|---|

| Rating | 4.4 out of 5 |

| Free Trial | Available |

| Platforms Supported | Web, Android, iPhone/iPad |

Chargebee is a subscription management software that specializes in handling recurring billing and SaaS subscriptions. While it doesn't have its own payment gateway and merchant account, Chargebee integrates seamlessly with a wide range of providers including Stripe, PayPal, and around 25 others. It is designed to meet the unique needs of businesses operating under SaaS subscription models.

Pricing:

Chargebee's pricing is based on a monthly subscription fee, with no transaction fees. The subscription fee varies depending on the number of customers and features required.

| Plan | Yearly Price | Monthly Price |

|---|---|---|

| Launch | $0/month | $0/month |

| Rise | $249/month | $299/month |

| Scale | $549/month | $599/month |

| Enterprise | Custom plans | Custom plans |

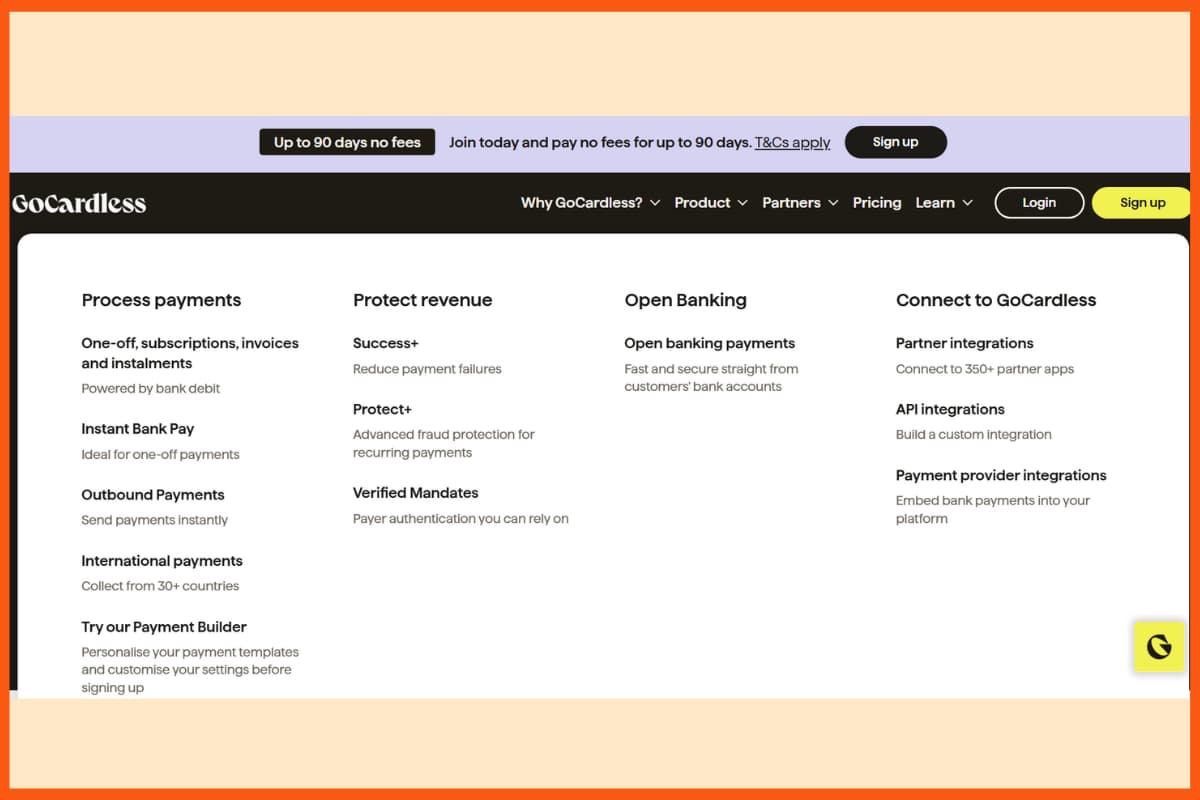

GoCardless

| Website | www.gocardless.com |

|---|---|

| Rating | 4.6 out of 5 |

| Free Trial | Available |

| Platforms Supported | Web, Android, iPhone/iPad |

GoCardless is a payment gateway made for SaaS companies, small, and mid-sized businesses. It lets you collect recurring payments directly from customers’ bank accounts, so you don’t have to deal with high card processing fees.

It works in 30+ countries and supports 8+ currencies. While it’s not the best option for international payments, you can still collect them. The platform also connects easily with project management, automation, and other business tools.

GoCardless has developer-friendly APIs, so integrating it into your system is smooth. Payments are processed through the Automated Clearing House (ACH), which is slower than card payments but much cheaper.

Security is a big plus, ACH with GoCardless gives you a safe, cost-effective way to handle payments without the extra fees of traditional cards.

Pricing:

| Plan | Yearly Price | Monthly Price |

|---|---|---|

| Standard | 1% per transaction (capped at £4) | 1% per transaction (capped at £4) |

| Plus | Custom pricing | Custom pricing |

| Pro | Custom pricing | Custom pricing |

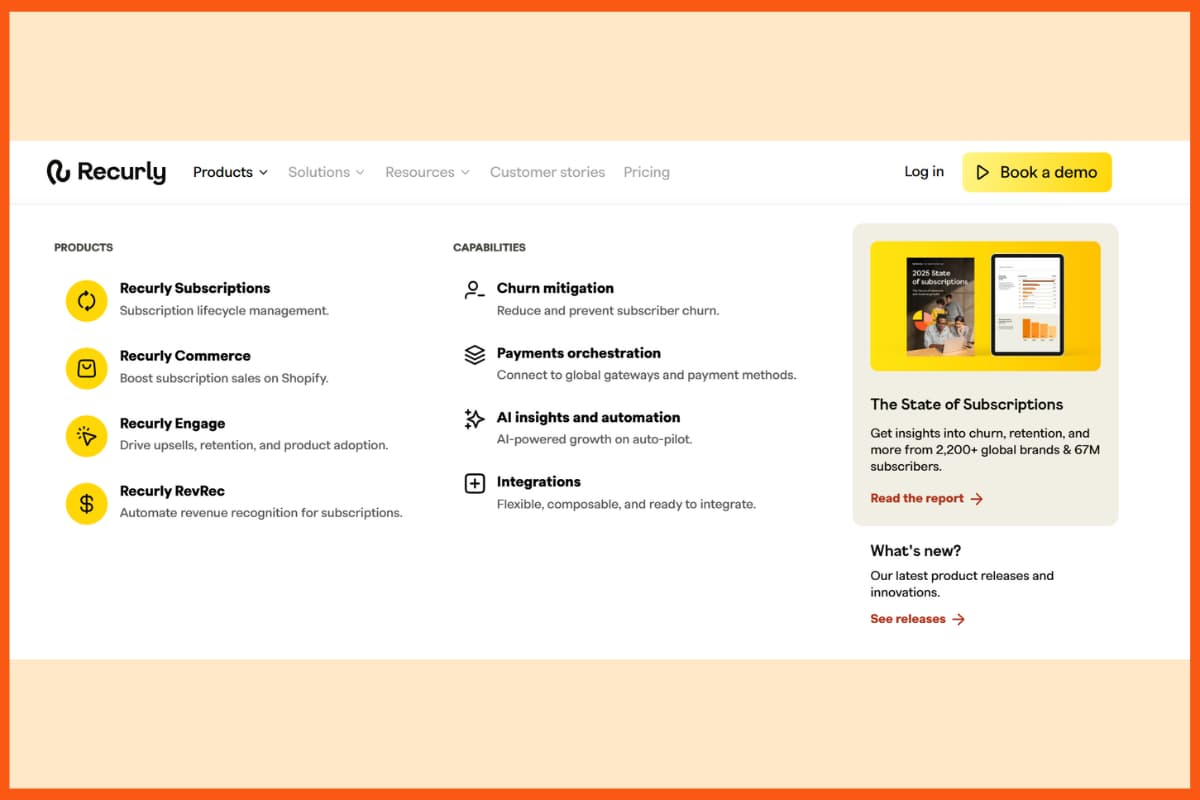

Recurly

| Website | www.recurly.com |

|---|---|

| Rating | 4.6 out of 5 |

| Free Trial | Available |

| Platforms Supported | Web, Android, iPhone/iPad |

Recurly is a subscription billing and payment platform made for SaaS businesses. It works like Stripe and Braintree but is especially focused on managing recurring payments. The platform is easy to use, quick to set up, and gives you helpful data insights to grow your business. Many well-known brands such as LiveChat, Full Cube, and AccuWeather already use Recurly.

Recurly supports 140 currencies and 30 languages, making it a great choice for global businesses. It connects with 28 different payment gateways and offers 12 payment methods, so you can give your customers flexibility in how they pay.

On the security side, Recurly keeps customer data safe with advanced hosting solutions, two-factor authentication, and PGR encryption. This means you can focus on your business while Recurly takes care of secure billing.

Pricing:

| Plan | Yearly Price | Monthly Price |

|---|---|---|

| Starter | Custom | $249/month |

| Professional | Custom | Custom |

| Elite | Custom | Custom |

Conclusion

Choosing the right payment gateway is a critical decision for any SaaS startup. Each payment gateway has its strengths and weaknesses, and it's important to consider factors such as transaction fees, payment methods supported, fraud prevention, and international payment processing capabilities. By carefully evaluating the available options and choosing a payment gateway that aligns with your goals, you can ensure a smooth and secure payment processing experience for your customers.

FAQs

What is the best payment method for SaaS?

Some of the best SaaS payment gateways on the market are Stripe, PayPal, and Braintree.

What is SaaS payment gateway?

A SaaS (Software-as-a-Service) payment gateway is a service that enables businesses to securely and efficiently process online payments from customers for their subscription-based services or products.

How do SaaS companies collect payments?

SaaS companies collect payments through various methods including credit/debit card, bank transfer, ACH, invoice, and mobile payments.

Why use Chargebee instead of Stripe?

Chargebee is a subscription billing and revenue management platform that provides more advanced functionality and features compared to Stripe, which is primarily a payment gateway.

What are some factors to consider when choosing a payment gateway for SaaS startups?

Some key factors to consider when selecting a payment gateway for a SaaS startup include security, transaction fees, ease of use, customer support, compatibility with existing systems, and scalability.