Best Apps to Open Demat Account in India: Top Demat Account App List for Easy & Fast Demat Account Opening

Collections 🗒️Open your Demat account online with the best and most trusted sites like Zerodha, Groww, Trading Bells, Upstox, etc., and start your trading journey today.

In today’s time, almost every process or activity is going online. We can purchase or sell anything without going anywhere, right from the comfort of our homes.

In tune with this, even the stock market operates online now. It means one can have stocks and securities in a company and, thus, can trade online.

For this, a person needs to have a Demat account. With this account, one can have the possession of mutual funds, shares, and more digitally.

Many sites let you open this account online. For example- Upstox, Trading Bells, etc.

What is a Demat Account?

It is the short form for a Dematerialised account. In simple words, it is an account that maintains shares and securities in a digitalized form. It means an investor can hold them without any physical possession of the certificates.

This account is full of perks. The foremost perk is that it allows you to access your trading details online. This makes your online trading journey easy. Stocks, dividends, etc., get automatically credited. It offers low transaction costs and also allows you to transfer funds with ease. The best thing is that one does not have to be worried anymore about losing one’s physical bonds or dividend certificates.

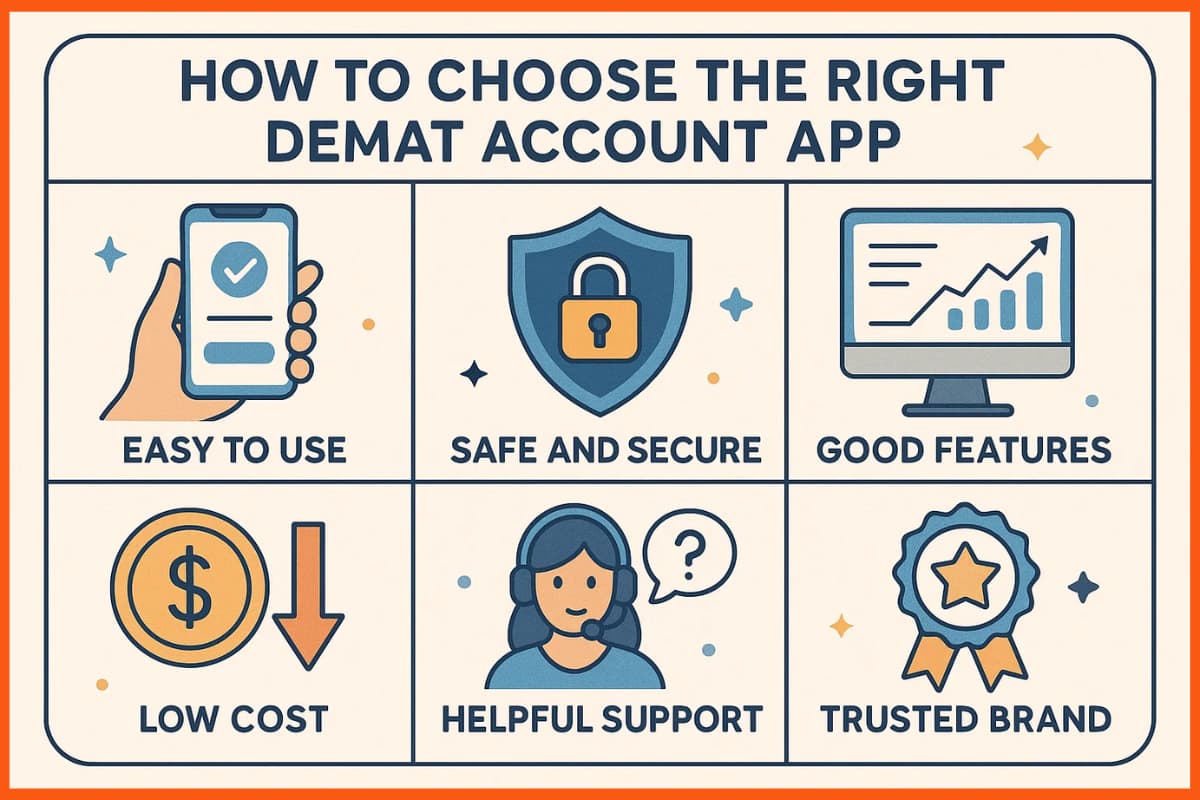

How to Choose the Right Demat Account App

Choosing the best Demat app is simple if you look at these points:

- Easy to Use: The app should be simple, so you can trade and invest without confusion.

- Safe and Secure: It must have strong security to protect your money and personal details.

- Good Features: Pick an app that gives live market updates, charts, and helps you manage your portfolio.

- Low Cost: Check the brokerage and other charges. Apps like Zerodha and Upstox have low fees.

- Helpful Support: Choose an app with quick and friendly customer support, especially if you are new.

- Trusted Brand: Go for apps from well-known brokers like HDFC, ICICI, or Kotak as they are more reliable.

List of Sites to Open a Demat Account Online

In modern times, people are getting keener to understand and invest in the stock market. Indeed, the most important thing here is to conduct research and understand where and when to invest. Along with this, people need a Demat account to get themselves into the area of trading.

Since everyone likes to get their work done online, here is a list of sites where you can open your Demat account from home:

| S.No | Demat Account App | Key Features |

|---|---|---|

| 1 | Zerodha | Low brokerage, Kite trading platform, good for active traders |

| 2 | 5Paisa | Flat ₹20 brokerage, easy-to-use app, multiple investment products |

| 3 | Upstox | ₹20/order brokerage, fast app, free equity delivery |

| 4 | Groww | No account opening charges, simple UI, mutual funds & stocks |

| 5 | Angel One | Free advisory, low brokerage, advanced app features |

| 6 | Sharekhan | Research-based advice, good trading tools, trusted brand |

| 7 | Motilal Oswal | Strong research, multiple products, advanced analytics |

| 8 | India Infoline | Free research reports, good trading app, diverse investments |

| 9 | Trade Smart Online | Low brokerage, fast account opening, good for traders |

| 10 | Trading Bells | Low-cost trading, good support, simple app |

| 11 | Aditya Birla Capital | Investment variety, easy app, strong brand |

| 12 | Axis Direct | 3-in-1 account, bank integration, research tools |

| 13 | Kotak Securities | Free intraday trading, Kotak 3-in-1 account, research reports |

| 14 | SBICAP Securities | 3-in-1 account with SBI, strong support, reliable |

| 15 | HDFC Securities | 3-in-1 account with HDFC Bank, advanced trading tools |

| 16 | ICICI Direct | Research-backed recommendations, ICICI 3-in-1 account |

| 17 | IIFL | Good advisory, trading tips, multiple investment options |

| 18 | Choice Equity Broking | Variety of services, user-friendly platform |

| 19 | Paytm Money | No AMC, simple app, mutual funds, stocks, NPS |

| 20 | Fyers | Free account opening, TradingView charts, ₹20/order |

| 21 | Edelweiss Broking | Strong research, multiple plans, easy to use app |

Zerodha

| Company Name | Zerodha |

|---|---|

| Founded | 2010 |

| Account Opening Charges | INR 200 |

| Maintenance Charges | INR 300 per year |

| Brokerage Charges | INR 20 per executed order |

| Exchange Membership | BSE, NSE, MCX |

Another name that will help you to open your Demat account online is Zerodha. The name seems to be the talk of the town these days. It not only allows you to open an account but also helps you with its research tools and educational trading tutorials.

First, you need to visit their site and sign up with a mobile number. Once you get the OTP, you will be asked to fill in other basic details and submit the Demat account opening fee (200 INR). The rest of the process will be pretty self-explanatory on the site. You can open an account with no minimum balance.

5Paisa

| Company Name | 5Paisa |

|---|---|

| Founded | 2016 |

| Account Opening Charges | Free |

| Maintenance Charges | INR 300 per year |

| Brokerage Charges | INR 20 per executed order |

| Exchange Membership | BSE, NSE, MCX |

Another valuable name on the list to open your Demat account online is 5Paisa. It offers people share market services like the distribution of mutual funds, bonds, and IPOs. The site enables you to open your account for free with 0% brokerage and a fixed charge of 20 INR for every order.

To open your Demat account here, you need to fill in your bank and PAN details. Then, you will be asked to add your Aadhaar number and link it through DigiLocker. After this, you will be required to take a selfie and e-sign the form, and thus, your account is ready.

Upstox

| Company Name | Upstox |

|---|---|

| Founded | 2018 |

| Account Opening Charges | Free |

| Maintenance Charges | INR 150 per year |

| Brokerage Charges | INR 20 per executed order |

| Exchange Membership | BSE, NSE, MCX |

It is a tried and trusted platform for many in terms of investing services for many years. Upstox, one of the greatest stock trading platforms allows you to open a free account and also gives you the choice to open it online anytime, anywhere.

It is better if you keep your scanned documents, like a bank statement, PAN, etc., ready in advance. Then, all you have to do is go to their account opening page, fill in the details asked, and upload your documents. After this, you will receive an OTP for the verification, and voila, it's created.

How To Open An Account on Upstox

Groww

| Company Name | Groww |

|---|---|

| Founded | 2016 |

| Account Opening Charges | Free |

| Maintenance Charges | INR 0 |

| Brokerage Charges | INR 20 or 0.05% which is lower |

| Exchange Membership | BSE, NSE, MCX, and NCDEX |

A name that has become quite popular for making investing simple is Groww. Its site will enable you to open your Demat account right from your home. Maintaining this account is super easy and will make your trading process even simpler. You can open your account for free on this site.

You will need to add your bank account and fill in some basic personal details. Then, you will be required to submit your KYC details online. After verification, you will be asked to check and sign your account opening form online. It offers IPOs, stocks, and ETFs.

Angel One

| Company Name | Angel One |

|---|---|

| Founded | 1987 |

| Account Opening Charges | Free |

| Maintenance Charges | INR 240 per year |

| Brokerage Charges | INR 20 per executed order |

| Exchange Membership | BSE, NSE, MCX, NCDEX, CDSL, NSDL |

The platform formerly known as Angel Broking has been gaining the trust of its customers for a long time and has made itself a renowned name. Its website will help you to open your Demat account online with no charges. The platform is a full package for all your financial service needs.

All you have to do is fill out the lead form on its site, and you will receive an OTP on your phone. After submitting the OTP, you will be asked to fill in some basic information and your bank account details. You will then receive your Demat account details on your enrolled email ID.

Sharekhan

| Company Name | Sharekhan |

|---|---|

| Founded | 2000 |

| Account Opening Charges | Free |

| Maintenance Charges | INR 400 per year |

| Brokerage Charges | INR 25 per executed order |

| Exchange Membership | BSE, NSE, MCX-SX, NCDEX, MCX |

This is probably one of the most popular names on this list. It has developed trust among people with its services for a long time. You can open your Demat account online for free from the Sharekhan website. You can also rely on its guidance along your trading journey.

To open your account on its site, you will need to fill in some personal details. Then, you have to upload the required documents online. Lastly, there will be a verification process through a video session. That’s it; you got your account activated.

Motilal Oswal

| Company Name | Motilal Oswal |

|---|---|

| Founded | 1987 |

| Account Opening Charges | Free |

| Maintenance Charges | INR 199 per year |

| Brokerage Charges | INR 30 per executed order |

| Exchange Membership | BSE, NSE, MCX, NCDEX, CDSL, NSDL |

Motilal Oswal is one of the most important names on the list. It is a tried and trusted name that allows you to open your Demat account online with great convenience. You can open it without any fee. However, there will be a maintenance charge from the second year.

You will need to fill out a form on their site, and then their executive will give you a call and share the EKYC link. You can upload the scanned copy of your documents there. Then, you will get a call for verification again. After this, you will receive an email with your login details.

India Infoline

| Company Name | India Infoline (IIFL) |

|---|---|

| Founded | 1995 |

| Account Opening Charges | Free |

| Maintenance Charges | INR 250 per year |

| Brokerage Charges | INR 20 per executed order |

| Exchange Membership | BSE, NSE, MCX-SX, NCDEX, MCX |

A name that has been a provider of brokerage services for more than 26 years is here to help you with the opening of your Demat account online in a few minutes. It enables you to open your account free of cost and also allows you to turn to its experts for all your investing queries.

Its opening process is super simple. You will need to fill up the lead form and submit your bank and PAN details. Then, digitally verify the KYC details. After this, you can download its application and start your way toward investing.

Trade Smart Online

| Company Name | Trade Smart Online |

|---|---|

| Founded | 2013 |

| Account Opening Charges | Free |

| Maintenance Charges | INR 300 per year |

| Brokerage Charges | INR 15 per executed order |

| Exchange Membership | BSE, NSE, MCX, CDSL |

Another tried and trusted name on the list of sites is Trade Smart. If you want to open your free Demat account online then, this is for you. It provides services in stock, commodity, and currency trading sectors.

To open your account on this site, you need to verify your phone number and fill in the basic details asked for. Then, submit your documents online and be done. You are ready to trade online with your new account.

Trading Bells

| Company Name | Trading Bells |

|---|---|

| Founded | 2016 |

| Account Opening Charges | INR 750 |

| Maintenance Charges | INR 750 per year |

| Brokerage Charges | INR 20 per executed order |

| Exchange Membership | BSE, NSE, MCX, NCDEX, ICEX |

When it comes to opening a Demat account online, Trading Bells is also a popular name to be considered. It allows you to open your account instantly with an opening fee of 750 INR. This charge might seem quite higher than others, but they do not charge any maintenance charges afterwards.

You will need to fill out the online application by submitting your UID number and the mobile number linked to it. You will also be required to upload the basic documents you asked for. Then, you have to pay the opening fee. Finally, to make the process more secure, you will receive a video call, where you have to showcase your documents for in-person verification. That’s it; you got your Demat account.

Aditya Birla Capital

| Company Name | Aditya Birla Capital |

|---|---|

| Founded | 2007 |

| Account Opening Charges | INR 750 |

| Maintenance Charges | INR 300 per year |

| Brokerage Charges | 0.50% of the transaction value |

| Exchange Membership | BSE, NSE, MCX |

If you're someone who is interested in investing in financial products like low-risk mutual funds, ETFs, equity delivery, intraday trading, and derivatives, then the Aditya Birla Capital Demat account might be the perfect fit for you. This account offers a wide range of investment options, all in one place, making it easier for you to manage your finances and invest your money with confidence. With the Aditya Birla Capital Demat account, you can take advantage of various financial products and services that can help you achieve your investment goals.

Expert investors have access to investment opportunities that are more complex but offer higher returns. They can also benefit from competitive brokerage rates. Demat accounts make the investment process in Indian stocks and mutual funds simpler while also providing tax benefits for Non-Resident Indians (NRIs).

Axis Direct

| Company Name | Axis Direct |

|---|---|

| Founded | 2011 |

| Account Opening Charges | Free |

| Maintenance Charges | INR 650 per year, free for the first year |

| Brokerage Charges | INR 20 per executed order |

| Exchange Membership | BSE, NSE, MCX, and NCDEX |

If you're searching for the best app to open Demat account, look no further than Axis Direct! With over 2 million satisfied customers, Axis Direct is a trusted provider of a 3-in-1 account that seamlessly integrates banking, trading, and Demat services. By choosing Axis Direct, you will benefit from a wide range of investment options, including equities, mutual funds, bonds, derivatives, ETFs, and more.

Additionally, Axis Direct offers free market analytics reports to help you make informed investment decisions. But that's not all! You will also receive personalized trading guidance from expert researchers. This means that you will have access to expert advice to help you make the most of your investments. So, whether you're a seasoned investor or just starting out, Axis Direct has something for everyone.

Kotak Securities

| Company Name | Kotak Securities |

|---|---|

| Founded | 2011 |

| Account Opening Charges | Free |

| Maintenance Charges | INR 600 per year |

| Brokerage Charges | INR 21 per executed order |

| Exchange Membership | BSE, NSE, MCX, and NCDEX |

Kotak Securities is an esteemed name in India's stock market industry, serving almost 20 million users. It offers a comprehensive 3-in-1 account that includes a savings account, a Demat account, and an online trading account. The platform enables users to access market analysis tools, trading recommendations, and expert advice to make informed investment decisions. As a SEBI registered broker and a member of major stock exchanges such as NSE, BSE, MCX, and NCDEX, Kotak Securities offers a wide range of investment options in Equity, F&O, Currency, Commodities, IPO, Mutual Funds, Tax-free Bonds, and Stock Lending. With robust technology and a user-friendly interface, Kotak Securities is a one-stop solution for all your investment needs.

SBICAP Securities

| Company Name | SBICAP Securities |

|---|---|

| Founded | 2005 |

| Account Opening Charges | INR 850 |

| Maintenance Charges | INR 0 |

| Brokerage Charges | INR 20 per executed order |

| Exchange Membership | BSE, NSE, MCX, and NCDEX |

SBICAP Securities offers a Demat Account that can be accessed through both web and mobile platforms. This account provides investors with valuable educational resources, market analytics, and trading tips that can help them make informed decisions. Due to its excellent services, it is considered one of the best Demat accounts in India. Some of its pros include having a dedicated relationship manager and market analytics. However, it has a downside of having an account opening charge of ₹850.

HDFC Securities

| Company Name | HDFC Securities |

|---|---|

| Founded | 2000 |

| Account Opening Charges | Free |

| Maintenance Charges | INR 750 per year |

| Brokerage Charges | INR 25 per executed order |

| Exchange Membership | BSE, NSE, MCX-SX, NCDEX, MCX |

HDFC Securities Limited is a leading subsidiary of HDFC Bank that offers a comprehensive 3-in-1 account solution. This account integrates savings, trading, and Demat accounts, making it a one-stop shop for all your investment requirements. One of the standout features of HDFC Securities Limited is its Demat account, which simplifies the trading process by eliminating the hassle of paperwork. With this account, you can trade in Indian and global stocks with ease, thanks to the 24/7 customer support that HDFC Securities provides.

Some of the significant advantages of using HDFC Securities Limited for your investments include portfolio tracking features, margin trading, and global investment options. With these features, you can keep track of your investments, leverage your portfolio, and explore global investment opportunities without any hassle.

ICICI Direct

| Company Name | ICICI Direct |

|---|---|

| Founded | 1995 |

| Account Opening Charges | Free |

| Maintenance Charges | INR 300 per year |

| Brokerage Charges | INR 25 per executed order |

| Exchange Membership | BSE, NSE, MCX-SX, NCDEX, MCX |

The ICICI Direct Demat Account is a versatile investment platform that provides access to both domestic and international markets. Whether you want to trade in stocks, mutual funds, fractional shares, or other assets, this account has got you covered. What's more, for in-house customers, it offers the added convenience of a three-in-one account that seamlessly integrates your bank, trading, and demat accounts.

One of the standout features of this account is that it allows investors to buy a fraction of a share, which can be particularly helpful for those who want to invest in high-priced stocks but don't have a large amount of capital to spare. Additionally, the platform is designed to be user-friendly and easily accessible, even with slow or unreliable internet connections.

IIFL

| Company Name | IIFL |

|---|---|

| Founded | 1995 |

| Account Opening Charges | Free |

| Maintenance Charges | INR 250 per year |

| Brokerage Charges | INR 20 per executed order |

| Exchange Membership | BSE, NSE, MCX-SX, NCDEX, MCX |

IIFL Demat Account is a trusted name in the financial industry, with a remarkable 25 years of experience in providing comprehensive trading and investing services. This platform offers an array of financial instruments, including derivatives, stocks, equities, loans, Bonds, IPOs, FDs, and commodities, making it an all-in-one solution for investors. With the added advantage of free account opening and market analysis tools, IIFL Demat Account is an ideal choice for novice investors who wish to invest their money with confidence.

Choice Equity Broking

| Company Name | Choice Equity Broking |

|---|---|

| Founded | 2010 |

| Account Opening Charges | Free |

| Maintenance Charges | INR 300 per year |

| Brokerage Charges | INR 20 per executed order |

| Exchange Membership | BSE, NSE, MCX, NCDEX, CDSL, NSDL |

Choice, a reputable company with over 25 years of experience, provides a top-notch service that allows you to open a Demat account for free, with only a minimal annual charge. Their cross-platform app ensures a fast account opening process that takes less than 5 minutes, thanks to its user-friendly interface and quick 4-step process that anyone can easily follow. Choice offers free research and advisory services to help with informed investment decisions. They also have low brokerage and DP charges to save money.

However, it should be noted that some users have found the app's UI to be less smooth than other applications. Despite this, Choice remains a trustworthy and reliable choice for anyone looking to open a Demat account quickly and efficiently.

Paytm Money

| Company Name | Paytm Money |

|---|---|

| Founded | 2017 |

| Account Opening Charges | INR 100 |

| Maintenance Charges | INR 0 |

| Brokerage Charges | INR 0 (free) per trade |

| Exchange Membership | BSE, NSE, MCX |

Paytm Money is a highly desirable investment platform that stands out from the competition by offering one of the best Demat accounts in India. With a minimal investment starting from just Rs. 100, Paytm Money makes it easy for users to create a Demat Account that supports a wide variety of investment options, including the Stock Market, Mutual Funds, ETF, IPO, F&O, and NPS retirement funds. This makes it an ideal choice for anyone looking to invest in the Indian financial market, whether they are seasoned investors or just starting out. The platform is designed to be user-friendly and cost-effective, ensuring that investors get the most out of their investments with minimal hassle.

Fyers

| Company Name | Fyers |

|---|---|

| Founded | 2015 |

| Account Opening Charges | Free |

| Maintenance Charges | INR 300 per year |

| Brokerage Charges | INR 20 per executed order |

| Exchange Membership | BSE, NSE, MCX, NCDEX, CDSL, NSDL |

The FYERS Demat account provides convenient trading access across different market segments, such as Equity, Currency, Mutual Funds, and IPOs, along with a range of analytical tools, user insights, and educational resources. Emphasizing financial literacy, FYERS offers features like heatmaps, stock screeners, market meters, and trend scanners to enhance understanding of market dynamics.

The account opening process is lightning-fast and hassle-free, taking less than 5 minutes to complete. Competitive pricing is available for all trades, giving you the edge you need to succeed. However, be aware that server problems may occur during peak trading hours, so it's best to plan accordingly.

Edelweiss Broking

| Company Name | Edelweiss Broking (Nuvama) |

|---|---|

| Founded | 2008 |

| Account Opening Charges | Free |

| Maintenance Charges | ₹500/year for Demat (1st year free); ₹0 for Trading AMC |

| Brokerage Charges | Lite Plan: ₹10 per executed order (or 0.01%, lower) Elite Plan: Equity Delivery 0.30%, Intraday/Futures 0.03%, Options ₹75 per lot, Currency Futures 0.02%, Currency Options ₹20 per lot |

| Exchange Membership | BSE, NSE, MCX, NCDEX, CDSL, NSDL |

Edelweiss Broking offers an easy-to-use app where you can invest in stocks, derivatives, and mutual funds. It provides strong research and advice to help you make smart decisions. The app is simple for beginners, gives real-time market updates, and lets you track investments anytime. It also has quick customer support, making it a good choice for all investors.

Conclusion

The world of trading online is expanding at a very rapid rate, contributing to demat account growth in India. Every other person wants to take a dive into it and try to be successful with their investing decisions. To begin with the process, one must have a Demat account, without which one cannot be a part of the many stock investment platforms. So, the above-mentioned is the list of sites that will allow you to create your account online anytime and anywhere.

FAQs

What is the best app for opening Demat account?

Zerodha, Upstox, Groww, Angel ONE, 5Paise, Sharekhan, Trading Bells, Trade Smart Online, Motilal Oswal.

Which are the prominent free demat account opening apps?

Upstox, Groww, Sharekhan, Motilal Oswal, Angel One.

Can I open my Demat account from home?

Yes, many sites enable you to open your Demat account online.

Can I open a Demat account on Zerodha for free?

No, it charges an opening fee of 200 INR.

How to make a Demat account?

To make a Demat account, choose a Depository Participant (DP) such as a bank or brokerage firm, fill out the account opening form, and provide necessary documents like identity proof and address proof. Complete the KYC process and sign the agreement to activate your Demat account.

Must have tools for startups - Recommended by StartupTalky

- Convert Visitors into Leads- SeizeLead

- Website Builder SquareSpace

- Run your business Smoothly Systeme.io

- Stock Images Shutterstock