Top Discount Brokers in India | List of Low-Cost Trading Platforms for Smart Investors

Collections 🗒️

It has recently been discovered that individuals are pumping millions into the Indian equity market. While there is a prevalent belief that equity market investing is riskier than other asset classes, the recent surge of the Indian equity market has enticed many to make share price investments. The stockholders' eagerness to put their funds in various equities has been increasing at all of India's main stock traders.

Now, if you want to buy stocks, the notable point is that you'll need a broker to function as a liaison between you and the equity markets. The stockbroker's function is crucial since he serves as your single interface for all stock-related issues. That's why all traders use the assistance of the best brokers in India. Full-Service Stockbrokers and Discount Brokers are the two kinds of brokers in India.

List of Discount Brokers in India

| S.No. | Platform | Key Feature | Suitable For |

|---|---|---|---|

| 1 | Zerodha | Low brokerage, advanced Kite platform, API for algo trading | Beginners & active traders |

| 2 | Angel One | AI-powered ARQ advisory, research-backed recommendations | Long-term investors & advisory seekers |

| 3 | Upstox | Fast execution, advanced charts, options strategy builder | Options traders & tech-savvy users |

| 4 | 5paisa | Flat ₹20 brokerage, robo-advisory, easy-to-use app | Cost-conscious traders & beginners |

| 5 | Groww | Simple UI, direct mutual funds, F&O trading | First-time investors & mutual fund users |

| 6 | Paytm Money | Zero brokerage on delivery, SIPs, fractional investing | Beginners & long-term investors |

| 7 | Dhan | TradingView integration, algo trading API, real-time data | Active options traders & algo developers |

| 8 | Alice Blue | ANT Mobi app, flat brokerage, commodity trading expertise | Commodity traders & discount brokerage users |

| 9 | Fyers | Advanced charting, thematic investing, zero brokerage on delivery | Chart-focused traders & equity investors |

| 10 | Kotak Securities | Zero intraday brokerage, full-service research support | Intraday traders & research-focused users |

| 11 | IIFL Securities | IIFL Markets app, comprehensive research reports, wide asset coverage | Investors wanting strong research & diverse investments |

Difference Between Full-Service Stockbrokers vs Discount Brokers

Top 11 Best Discount Brokers in India

How to Choose the Right Discount Broker?

Advantages of Online Brokers

Disadvantages of Online Brokers

Difference Between Full-Service Stockbrokers vs Discount Brokers

Full-service Brokers

Let's start with full-service brokers, also known as conventional brokers. The majority of these brokers have been in business for years. Angel Broking, HDFC Securities, Motilal Oswal, and others are examples. These intermediaries are unique in that they are licensed to offer both offline and internet services.

That is, you visit their workplace and have your problem resolved. They provide excellent service. You'll also get a trusted and experienced manager who is always available.

They also offer research reports, stock advice, fund management, and investment management services, among other things. They employ a large number of employees, including consultants and market analysts, to ensure that you have an enjoyable outlook and receive accurate research reports.

All of these services, however, are not free. Their brokerage is sure to be higher because their spending is more. In contrast to discount brokers, they cost a larger brokerage fee. However, they are attempting to vie with discount brokers. They cover a plethora of low-cost brokerage solutions for high-volume investors.

Discount Brokers

Discount brokers like Zerodha, Upstox, and others are popular among individual investors and traders. They are becoming incredibly common among today's youngsters as smartphone usage rises and data rates fall.

As the title suggests, these brokers provide discounted or very minimal brokerages. They have set brokerage plans in place. How much more valuable will your deal be if you must pay a set brokerage fee? Their users are largely virtual and have little substantial form.

They don't offer a whole variety of services, so they don't have to pay for a license, infrastructure, or staff. These advantages are delivered to clients in the mode of reduced brokerage fees. The majority of these dealers don't offer investment managerial services or research reports.

How Do You Benefit From These Brokers?

Let’s say you bought 100 shares of Asian paints, each valued at Rs.2000.

Total value = Rs.200000 (100*2000).

Full service brokerage = 0.4% * 200000 = Rs.800

Discount Brokerage = Flat RS.9 to Rs.20

Savings = Rs. (800-20) = Rs.780

Full-Service Broker Vs Discount Broker

Top 11 Best Discount Brokers in India

Zerodha

| Name | Zerodha |

|---|---|

| Founded | 2010 |

| Founders | Nithin Kamath and Nikhil Kamath |

| Active Clients | 65,98,363 |

With the most active clientele and a customer base of 18.85 per cent, Zerodha is at the pinnacle of success. It was the first Indian company to explore the idea of stock brokerage. It is a firm with offices in several Indian cities that was established in 2010.

Its trading platform is known as Kite. It has a web-based and smartphone-based UI. For stock delivery trading, it does not impose a brokerage fee. However, it costs 0.03 per cent or Rs.20 per placed order for stock intraday and stock futures, whichever is lesser. It charges a fixed fee of Rs.20 per placed order for stock options. It charges fees for creating an account, which most brokers do not.

Dealing in equity, futures options, and currencies costs Rs.200 account opening fee. If you want to add a commodities account to it, you'll have to pay an additional Rs.100, and the starting fee would be Rs.300. Aside from that, there is an annual account upkeep fee of Rs.300 + GST. The Coin by Zerodha portal also offers services for investing in mutual funds and is best discount broker in India.

Angel One

| Name | Angel One |

|---|---|

| Founded | 1996 |

| Founders | Dinesh D. Thakkar |

| Active Clients | 50,98,124 |

Like Zerodha, it was formerly named Angel Broking, and it is India's largest brokerage firm in several ways. It is a classic stockbroker that has maintained its commissions low, similar to a discount broker. For its one-of-a-kind nature, it stands out.

Dinesh Thakkar launched the company in 1987. Its offices are based in Mumbai. It's also a publicly traded firm, which implies its equity is traded on a stock market. It offers full-service brokerage solutions at a fraction of the cost of a discount broker. It costs only Rs.20 for each order and allows you to deal with any amount. It provides a multitude of services, including research and advising services.

It is one of the few discount brokers that offer study and advising services and is one of the top 10 discount brokers in India. It provides a variety of programs, including sub-brokerage, franchise, alliance, and others.

Angel One, as a full-service stockbroker at a discount brokerage firm, provides a ton of products that you won't find with other discount firms. It provides clients with ARQ Robo advice, which is among the most unique services available today. It is known as the best stock broker in India.

Upstox

| Name | Upstox |

|---|---|

| Founded | 2009 |

| Founders | Shrini Viswanath, Ravi Kumar, Kavitha Subramanian, and Raghu Kumar |

| Active Clients | 22,37,974 |

With a customer base of 10.9 per cent, the Mumbai-based discount brokers rank second among active clients. Ratan Tata and Tiger Global, a US venture capital, fund this brokerage ID, which was established in 2011.

Pro by Upstox is the trade system's title, and it has both web-based and smartphone-based UI. Like Zerodha, it provides free stock delivery trade brokerage. However, it charges a fee of 0.05 per cent or Rs.20 per placed order for stock intraday and stock futures, whichever is lesser. It charges a fixed fee of Rs.20 per placed order for stock options and Upstox is considered as the top 3 discount brokers in India.

Account setup costs are not charged. However, there is a Rs.25+GST monthly account upkeep fee. It offers services to trade in Mutual funds and digitized gold.

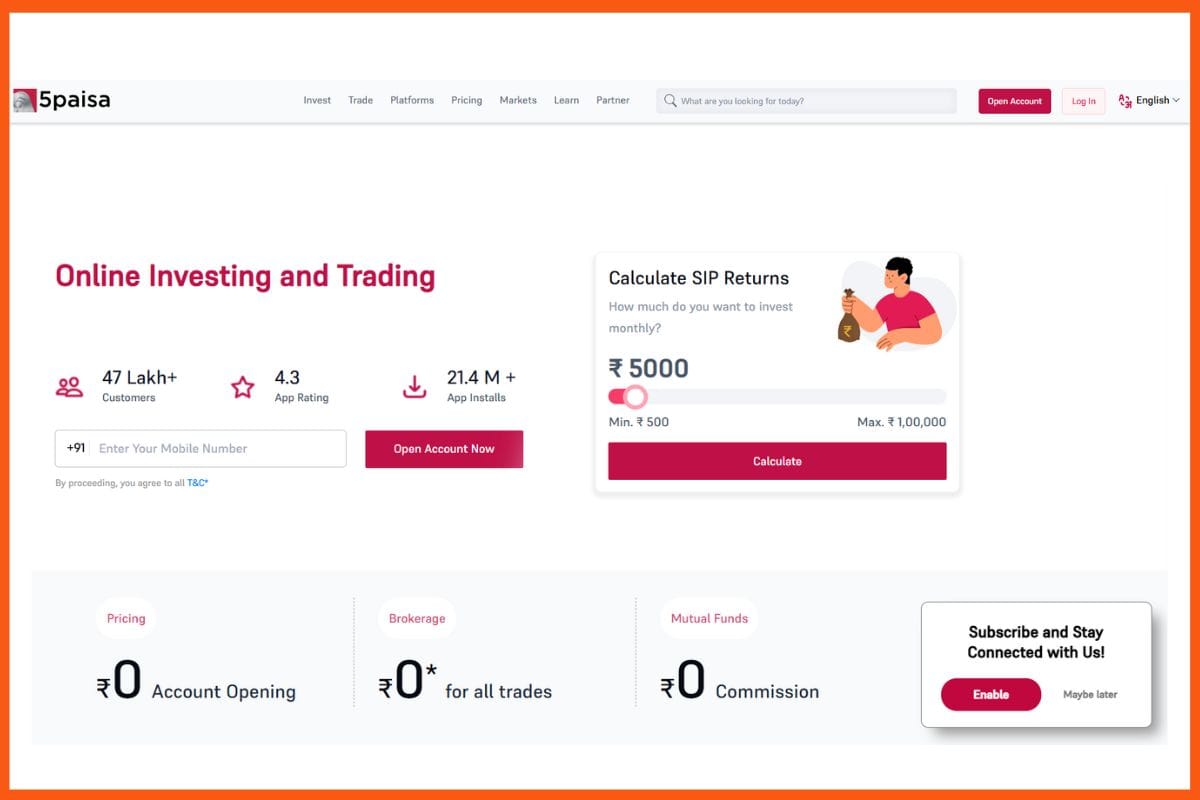

5paisa

| Name | 5paisa |

|---|---|

| Founded | 2016 |

| Founders | Nirmal Jain |

| Active Clients | 4.22 lakhs (March 2025) |

Founded by Nirmal Jain, 5paisa Capital is one of India's leading discount brokers, with an active client base of around 4.22 lakhs as of March 2025. It offers a simple and cost-effective trading platform with a feature-rich interface. Traders can invest across equities, derivatives, commodities, and mutual funds, all from a single account.

5paisa offers a flat brokerage fee of INR 20 per order across all segments — equity delivery, intraday, futures, and options (including equity, commodity, and currency). Mutual fund investments are completely free of charge.

The broker provides multiple trading platforms, including the 5paisa mobile app, web-based terminal, and EXE desktop software, each packed with advanced trading tools like real-time data, stock scanners, technical analysis charts, and customised watchlists. Additional offerings include margin trading facilities, algo trading support through Xstream and XTS APIs, expert research reports, direct mutual fund investments, IPO access, real-time notifications, and 24/7 customer support. With competitive pricing and powerful technology, 5paisa ensures a smooth and seamless trading experience for investors.

Groww

| Name | Groww |

|---|---|

| Founded | 2016 |

| Founders | Lalit Keshre, Harsh Jain, Neeraj Singh, and Ishan Bansal |

| Active Clients | 70,92,413 |

Groww is a discount brokerage firm that started operating in 2016, mainly as a portal for investment in mutual funds. The firm began its brokerage operation in 2020. Groww is the title of its smartphone app. You can engage in the equity section using its web-based and smartphone-based interfaces.

As a participant in the discount brokerage firms sector, Groww is poised to introduce an F&O solution shortly and is one of the top 5 discount brokers in India. Under this offering, the pricing structure entails 0.05 per cent or Rs. 20 per placed order for stock intraday and equities future, whichever is less. Additionally, for F&O transactions, a flat commission of Rs. 20 per transaction is applied.

There are no fees for creating or maintaining an account. It also provides mutual funds and digitized gold investment services. It also gives you the chance to trade in US stocks.

Paytm Money

| Name | Paytm Money |

|---|---|

| Founded | 2017 |

| Founders | Vijay Shekhar Sharma |

| Active Clients | 7,40,285 |

Paytm Money is a financial services company based in India. It was launched in 2018 as a subsidiary of One97 Communications, Paytm's parent company. Paytm Money aims to provide easy and accessible investment opportunities for millennials and first-time investors. The company offers a mobile app and web platform with features that include paperless account opening, easy funds transfer, zero commission stock investing, and mutual fund purchasing with systematic investment planning, risk profiling, and real-time portfolio tracking and falls under top 50 discount brokers in India. Paytm Money is backed by major investors such as Ant Group and SoftBank. The company aims to tap into the growing population of digitally savvy, young Indian investors who are looking for seamless tools to enter the markets.

Dhan

| Name | Dhan |

|---|---|

| Founded | 2021 |

| Founders | Pravin Jadhav, Alok Kumar Pandey, and Jay Prakash Gupta |

| Active Clients | 3,10,070 |

Dhan is a discount brokerage company that has been gaining popularity in India since 2016. It is known for its innovative features, competitive pricing, and focus on educating its users. Unlike many other brokerages, Dhan does not charge any fees for account maintenance or stock delivery trades, making it an attractive option for long-term investors. For active traders, Dhan charges a flat ₹20 per trade or 0.03% of the trade value, whichever is lower, for intraday fees. The platform is modern, user-friendly, and comes equipped with advanced charting tools, educational resources, fractional share investing, and access to US stocks. Whether you are a seasoned investor or just starting out, Dhan's combination of affordability, features, and educational focus makes it a compelling choice.

Alice Blue

| Name | Alice Blue |

|---|---|

| Founded | 2006 |

| Founders | Sidhavelayutham Mohan |

| Active Clients | 1,55,619 |

Alice Blue is a discount broker that was established in December 2006 in Erode, Tamil Nadu. Initially, the company had only five employees and an MCX membership. In 2007, it became a discount broker and moved its headquarters to Chennai. In 2017, Alice Blue relocated to Bangalore, where it currently operates. Over the years, the company has grown significantly and now has around 400 employees. It has also formed partnerships with 12,000 associates and serves approximately 500,000 clients in 20 major Indian cities. Alice Blue holds membership in various exchanges, including MCX, NSE, NCDEX, MCX-SX, BSE, and CDSL. Alice Blue's Freedom 15 Brokerage Plan is designed to establish a competitive pricing structure in the Indian Stock Broking Industry and is one of the top 10 stock brokers in India. The plan charges only ₹15 for Intraday and F&O Trading while offering free Equity, IPO, and Mutual Funds Investments. Additionally, the company does not impose clearing member charges, which makes it more customer-friendly.

Fyers

| Name | Fyers |

|---|---|

| Founded | 2015 |

| Founders | Shreyas Khoday, Tejas Khoday, and Yashas Khoday |

| Active Clients | 2,04,904 |

Fyers is a discount brokerage firm that came into existence in 2015. It is known for its state-of-the-art tech platform and focuses on empowering active traders. Fyers has created a niche for itself with its advanced features, such as free equity delivery trades, a flat brokerage fee of ₹20 or 0.03% across other segments (capped at ₹20), and tools like algo trading, market depth scanners, and option strategy builders. Although their platform caters more towards experienced investors looking for a powerful toolkit, Fyers' focus on innovation and low costs makes them an attractive option for active traders who want to maximize their returns. They also provide special low fees and streamlined account opening for NRIs. However, it's important to note that they may not be the most beginner-friendly option due to their focus on advanced features.

Kotak Securities

| Name | Kotak Securities |

|---|---|

| Founded | 1994 |

| Founders | Jaideep Hansraj |

| Active Clients | 10,86,716 |

Kotak Securities, a member of the Kotak group, was a full-service broker before introducing its Trade FREE Plan in November 2020, which offers a unique approach to India's discount brokerage model. This plan, also known as the Free Intraday Trading (FIT) plan, allows zero brokerage for intraday trades across various segments.

For all other future and options (F&O) trades, including equity, commodity, and currency, Kotak Securities sets the brokerage at Rs. 20 per order under the TRADE FREE PLAN. The plan's key features include no brokerage charges on intraday trades, a nominal charge of Rs. 20 per order for other F&O trades, and a currently waived Rs. 499 opening charge for the Demat account. Kotak Securities provides a wide array of investment options and research reports to its clients while offering full broker services at a discounted rate. The fee structure includes zero account opening charges and an annual maintenance charge of Rs. 50 per month, and 0.25% of the transaction as delivery brokerage charges.

IIFL Securities

| Name | IIFL Securities |

|---|---|

| Founded | 1995 |

| Founders | Nirmal Jain |

| Active Clients | 15,00,000+ |

IIFL Securities is a prominent player in the Indian stock market, known for combining full-service expertise with the benefits of discount broking. Under its discount broking plan, it charges a flat fee of ₹20 per trade, making it a cost-effective choice for active traders. The platform offers advanced research tools, in-depth reports, and robust customer support to help investors make informed decisions and is one of the biggest stock broker in India.

With seamless trading access across mobile and desktop platforms, IIFL Securities caters to both beginners and seasoned investors. It also provides portfolio management solutions and a wide range of investment products, making it a comprehensive solution for trading and wealth creation.

How to Choose the Right Discount Broker?

Now that you've learned about certain greatest discount broker firms, you'll need to learn how to choose a reputable discount broker. Here are some things to consider while selecting a discount broker:

Brokers Fee

Verify that the broker's fee is as low as possible if you transact frequently. It's critical to evaluate intermediaries and pick the one with the finest and least expensive price.

Trading Interface

Pick a trading interface that makes things easy for you, such as order placement, analysis tools, etc., so that you can get the most out of it. It's also important to look at the service provided by the discount broker, as this aids in making it a streamlined experience for the investors.

Margin Trading

Margin trading is an important factor to consider when choosing a discount broker because it distinguishes between two brokers.

These are the most important factors to consider when selecting a discount brokerage firm. Also, keep an eye out for additional fees, broker reviews, distribution structure, electronic trading terminals, and discount broking company's financial strength when deciding on a broker.

Advantages of Online Brokers

- In comparison to conventional full-service brokers, they offer the lowest brokerage fees. This enables investors to earn from a deal with a low transition point.

- They provide an electronic trading interface that allows investors to buy and sell easily and swiftly.

- One of their finest features is that they provide the same services to large and small investors alike.

- They are fairly trustworthy as all of their transactions are visible since everyone has access to the margins estimator.

- Several offer their users instructional video training to assist them in trading with them for a while.

Disadvantages of Online Brokers

• They don't offer free consultation, while full-service brokers do.

• They allow you to open both a trading and a Demat account.

• They usually function remotely, so if you require branch assistance for documentation, you'll have to find another solution.

• They don’t provide investment management services. A full-service broker is an ideal alternative for you if you want a portfolio manager.

Conclusion

You must use a discount broker if you are tech proficient, can perform your transactions by yourself, your trades are small, and don't need further analysis or add-on services or trading support. There are numerous discount brokers in India; however, you must select the appropriate stock broker according to your needs.

FAQs

Which is the No. 1 stockbroker in India?

Groww is considered one of the best stock brokers in India. It has a client base of 70,92,413 active clients.

What is a discount broker?

A discount brokerage firm charges lower fees than traditional full-service brokers, typically offering self-directed investing with limited guidance. They focus on trade execution at low costs, leaving investment decisions to the client.

How to be a broker in India?

- Meet eligibility: Indian citizen, 21+, 10+2 education, 2+ years experience in financial services.

- Pass exams & register for NSE/BSE certification, SEBI RIA exam/IRDAI license (depending on broker type).

Which is the best discount broker in India?

Zerodha, 5paisa, Groww, Angel One, and Upstox are some of the best discount brokerages in India.

Are discount brokers safe in India?

Yes, your money is safe with discount brokers, but they will not advise about the risks of the investment like a full-service brokerage.

Must have tools for startups - Recommended by StartupTalky

- Convert Visitors into Leads- SeizeLead

- Website Builder SquareSpace

- Run your business Smoothly Systeme.io

- Stock Images Shutterstock