Top Women Investors in India

Collections 🗒️

The investment game has always been a male-dominated arena across the world. However, over time the market is seeing more and more confident women coming into the area of investment. The case has not been different in India either. Even during the pandemic, India saw an increasing number of women coming into investing especially because of the monetary benefits it entails and the idea of financial independence.

Even though the numbers and popularity are very low, there is absolutely no doubt in the fact that it is a good start. This article will introduce the readers to some of the top women investors in India who have made a significant mark through their wise investments. The time when women were pretty hesitant towards the game of investment is long gone now. Women are more inclined to make strategic investments for earning profits and developing financial security for themselves. Nowadays, more and more women investors are emerging in the Indian market. Some of the most popular women investors in India are:

Aarti Gupta

Anisha Singh

Anjali Bansal

Anjali Sosale

Archana Jahagirdar

Debjani Ghosh

Ishani Chanana

Kanika Mayar

Namita Thapar

Ankita Vasishta

Vani Kola

Padmaja Ruparel

Bharati Jacob

Nita Mirchandani

Sakshi Chopra

Bala Deshpande

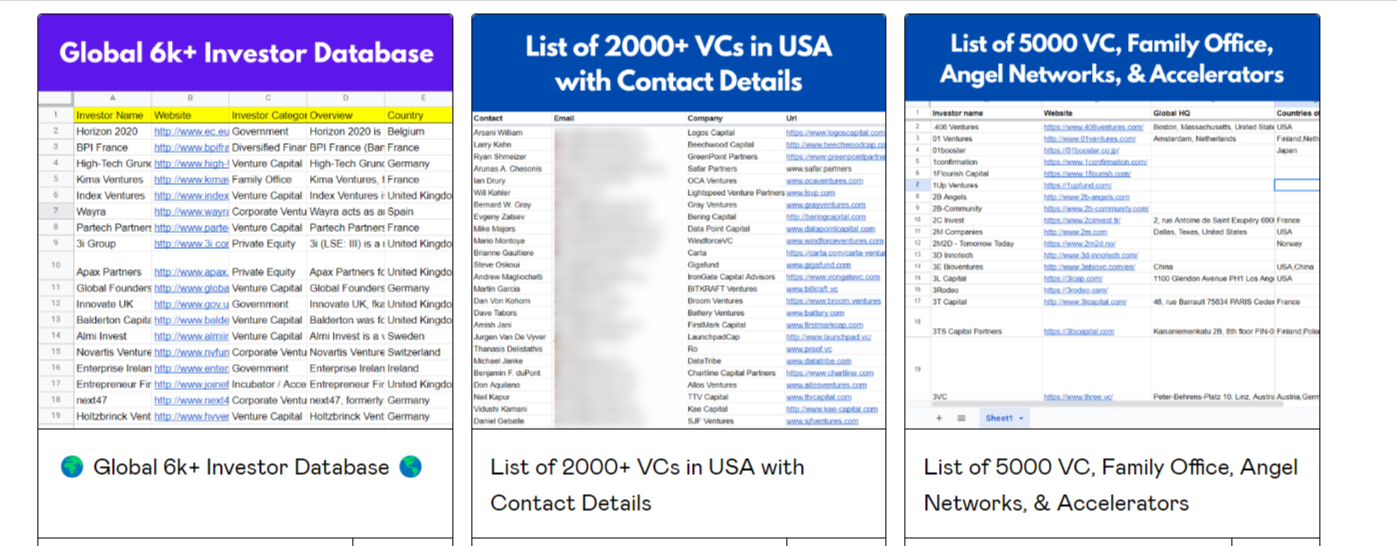

Unlock Your Startup's Potential with Our Exclusive Investor Lists and Resources

Supercharge your startup's success with our comprehensive resources. Access investor lists, pitch decks, KPIs, and fundraising guides. Connect with pre-seed investors, angel networks, and family offices, while mastering VC pitches. Ignite your entrepreneurial dreams today!

Aarti Gupta

A veteran investment strategist, she has been one of the forerunners of the Jagran Group since 2011. She has a Master’s degree in Economics from Northeastern University, a PhD in Economics from IIT Kanpur, and a postgraduate diploma in business studies from Harvard University.

She is also the Chief Investment Officer at Anikarth Ventures, an angel investing firm. Some other positions she holds include being a National Head for FICCI FLO Startups, which focuses on women investors, to an independent director for Jindal Stainless Steel.

Aarti also leverages her investment strategy to contribute to several boards of startups and family-owned businesses. She is also a champion for women’s financial literacy, entrepreneurship, and readiness for jobs.

Anisha Singh

Anisha is the founder of the women-focused VC firm ‘She Capital’ in 2020 to help encourage more women founders to enter the Indian startup ecosystem. Some of the companies associated with VC are BrainSight AI, Samosa Singh, Clovia, Elev8 India Sportz, Spark Studio, and Nova Nova.

She also founded the eCommerce platform MyDala and started the B2B startup Kinis Software. She is passionate about women’s empowerment and supporting women-focused startups.

Anjali Bansal

The founder and chairperson of the climate-focused venture capital firm Avaana Capital, Anjali is heavily active in Indian startups. Avaana has funded agritech platform FarMart, electric mobility startup Kazam, and HR tech unicorn Darwinbox.

Her firm has also closed its early-stage funding called Avaana Climate and Sustainability Fund at $135M in 2024. Anjali has also invested in multiple startups such as Nykaa, Delhivery, and Urban Company. She is also in multiple Indian brands such as Nestle India, Tata Power, and Piramal Enterprises.

Anjali Sosale

Anjali Sosale is a partner at Waterbridge Ventures and plays an important role in shaping the success of early tech companies for the VC firm. She wants to support the next wave of rural Indian internet users by focusing on consumer tech, marketplaces, and eCommerce.

Anjali is also active in multiple startups like BitClass, BigFatPhoenix, Yellow Metal, and EloElo. Previously, Anjali was a senior director at Jabong and oversaw the brand-accelerating program at Myntra.

Archana Jahagirdar

Archana is the founder and managing partner of Rukam Capital. She is one of the few women general partners in Venture Capital but not only in India but across the globe.

She has invested in over 18 startups in areas such as Go Desi, Sleepy Owl, Curefoods, BECO, Pilgrim, Yoho, and more. She has been nominated to the National Startup Advisory Council (NSAC) because of her contributions to the startup landscape.

Previously, she headed brands like Espace Corporate, Textron, and Angelworks and even worked as a journalist with major brands like The Times of India and Business Standard.

Debjani Ghosh

Debjani is the president of NASSCOM, the industry representing IT-BPM space. She has an experience of over 3 decades and has also worked with Yes Bank and Intel Corporation. With an MBA from S.P. Jain Institute of Management and Research, she is also on Cisco’s Indian Advisory Board and an advisor to the FICCI S&T/Innovation Committee.

Ishani Chanana

Ishani is a partner of investments at Sarcha Advisors and manages family office investments and shapes capital allocation strategies across multiple spectrums such as debt, equity, and other investment options.

She has invested in over 60 startups such as Josh Talks, The New Shop, BluSmart, STAGEm Prescinto, TrulyMadly, and more, to the extent that she is considered an entrepreneur talent nurturer. Additionally, she is also an angel investor and has stakes in startups such as BatX Energies, JumpingMinds, Newmi, Yatrikart, and Jobsgaar.

Kanika Mayar

Kanika is a partner of Vertex Ventures that infuses money into Series B-stage startups across Southeast Asia and India.

Some companies she has invested in are Patsnap, Garb, FirstCry, Nium, 17Live, Validus, AsianParent, and Warung Pintar. So far, she has taken part in four startups - Proactive for Her, Chatty Bao, Karkhana.io and Onato. She has worked with multiple brands such as Ernst & Young, IFC, Goldman Sachs, and TechnoServe.

Namita Thapar

Namita is the executive director of India Business for Emcure, a pharma company. She rose to fame after joining the TV show ‘Shark Tank India’ as an investor. So far she has invested in over 80 startups such as Perfora, SUGAR Cosmetics, Snitch, Sahayatha, Janitri, and more.

Ankita Vasishta

This Bengaluru-based angel investor is indeed an inspiration to all aspiring women investors in the country. Ankita is the founder and CEO of Saha Fund which she started with Usha Amin. She is also the founder and Managing Director of StrongHer. Her VC firm StrongHer ventures is conquering milestone after milestone in funding startups of different industries like fintech, consumer, health care and so on.

Recently, under her leadership, the firm floated $100 million dollar specifically for women-funded startups. They aspire to be a billion-dollar venture fund platform that would be the largest of its kind for women globally. While it caters to women entrepreneurs in India and US, they are soon going to expand its base across Europe, Latin America, the Middle East and North Africa.

Vani Kola

She is a venture capitalist from Hyderabad. Vani is the founder of an early Indian Venture Capitalist firm called Kalaari Capital. After finishing her engineering in India, she went to the United States of America to pursue her successful career as an entrepreneur in Silicon Valley. When she came back to India in 2006, she observed the growing opportunity in the realm of investments.

Vaani Kola, along with Vinod Dham founded Indo-US Venture Partners in 2006. It was through New Enterprise Associates that she had her first Indian undertaking in the year 2012. They later rebranded it as Kalaari Capital. At Kalaari, she promotes budding founders to develop useful products and solutions. She has made investments in startups like Zivame, Myntra, Curefit, Active, Apps Daily, Dream 11 etc.

Padmaja Ruparel

She is the co-founder and the president of the Indian Angel Network which has transformed into a global institution under her leadership. Today, IAN has made investments in over 10 countries with more than 400 investors. It is one of the largest seed and early-stage investing platforms in India. Today, the market value of all the companies bred by IAN will add up to four billion US dollars. Through IAN, she has made very diverse and dynamic investments in fields ranging from, finance, agriculture, SAAS, and D2C to the space sector, manufacturing technology, biotechnology, pharmaceuticals and medical devices.

She is determined to improve the startup ecosystem in India. She was recognised as the “Most Powerful Woman” by Fortune India for four years. The Women Economic Forum has also acknowledged her contribution by awarding her their “Women of the Decade in Investment Banking” award.

Get Actionable Tips to Successfully Raise Funds for Your Start-up

A 5-Day Crash Course for individuals wishing to find investment for their start-up dream

Bharati Jacob

With a formidable reputation in the realm of investments, Bharati Jacob is a popular name in the field. Her commendable experience in venture investing and finance marketing, which is on the run after completing 2 decades, shapes her vision which makes her one of the most efficient female investors in the country.

She is the co-founder and also the managing partner at Seedfund advisors which is a venture capitalist firm, based in Bengaluru. She started her investment venture in 2000. Today, her firm provides stark support to newcomers by helping them hold their ground. Additionally, the company helps them with networking as well. She has made investments in companies like Vaatsalya, Redbus, Sportskeeda, Edusports, Axisrooms etc.

Nita Mirchandani

Being one of the first female venture capitalists in India, she has an experience of over 30 years in the market. She is the founder of Kae Capital, which is a venture capitalist firm that primarily focuses on early-stage companies that bring in efficient and relevant solutions to the existing problems in the market.

Apart from that, the company also helps startups with their operational, strategic and financial issues. At Kae Capital, she is the director of Finances and legal matters. She is also an active angel investor with investments in various fast-growing startups like InMobi, Innovcare, Squadron and iGenetics.

Sakshi Chopra

She is the Managing Director at Sequoia Capital. She has launched a new programme at Sequoia wherein she will select 15 women founders and grant them a no-strings-attached sum of $100,000 along with a mentorship program and network expertise that lasts a year. Based in Mumbai, her primary areas of investment are Consumer Products and Services which has led her to invest in startups like Ladies Who Lead and Purple.

Bala Deshpande

Another prominent women investor in India is Bala Deshpande. At present, she heads the India operation for NEA (New Enterprise Associates), the US-based investing firm as its Senior Managing Director. She is an alumna of the University of Mumbai, where she completed her post-graduate degree in Economics. Bala has also got a master's degree in Management Studies from the Jamnalal Bajaj Institute of Management Studies.

She has great private equity experience where she has seen young companies nurturing, buybacks, capital market divestments, and more. Her investment portfolio includes names like Air Works, Panacea Medical, MediSys, Naaptol, Nova, GreytHR and Intelligence Node.

Grow your business using WhatsApp

- Broadcast Promotional Offers to Unlimited Users

- Automate Messages via Integrations

- Enable Multi-Agent Live Chat for Customer Support

- Install A.I. Chatbots and be available 24 x 7

Conclusion

It is a fact that gender disparity exists when it comes to women investors in India. A study by an online wealth management platform revealed that only one out of five investors in India are women. A lack of awareness, expertise and access to relevant tools can be the reason why women fall back into this realm. However, the shining examples of the above-mentioned women investors from India are a great inspiration to all the women out there who would like to try their hand at investment.

FAQs

Who are the largest investors of FDI in India?

The largest investors of FDI in India are Singapore with an equity inflow of 27%, followed by the USA with 21% and Mauritius with 16% equity inflows in FY22.

Who is the youngest stock trader?

Lauren Simmons is the youngest stock trader. She did a crash course on the financial world and became a full-time stock trader at the mere age of 22 years at the New York Stock Exchange.

How many women invest in mutual funds in India?

There are 5.9 million women investors having 14 million folios and assets, as per the 'Women Power in Mutual Funds' report released by RTA (Registrar and Transfer Agent).

Who are women investors in India?

Some of the most popular women investors in India are:

- Padmaja Ruparel

- Bharati Jacob

- Ankita Vasishta

- Nita Mirchandani

- Vaani Kola

Must have tools for startups - Recommended by StartupTalky

- Convert Visitors into Leads- SeizeLead

- Website Builder SquareSpace

- Run your business Smoothly Systeme.io

- Stock Images Shutterstock