Why did Paytm IPO Flop on its Market Debut?

🔍Insights

The intrinsic need of every human is to live a comfortable life. Leading a comfortable life is not easy if you don't have some resources. It is important to note here that peace and comfort are not googleable. You need to do something to make your life a smooth sail. So that you have enough resources.

Speaking of resources, one of the most important resources is money. It is a battery for storing value. The more you have it, the more free you will(feel) be. And mark my words, “freedom” is the ultimate flex.

So to amass more of it, we people do many sorts of things. Some do business and others work for other businesses. If you look into the recent past you will notice how ‘investing’ as a domain has risen many folds. How people all over the internet are making portfolios. How stock market participants are rising. How everyone is hoping to get that IPO allotment. All these are examples of people trying to create some more income. Income leads to freedom. Not to mention how the “financial freedom” phrase gained momentum recently.

Getting into stock markets has been a fad for more than a year now. Chasing IPOs is another fad for some young investors. There is an intrinsic trait of IPOs that interests everyone. The hype of listing gains. Quick profits and the first come badge. A recent hot chase was the huge Paytm IPO. Which didn't go well. This is the article about that failure and the behemoth PayTM. Read on to see through.

Indian Fintech Revolution

A Brief about Paytm

Financial State of Paytm

Paytm Initial Public Offering (IPO)

Paytm Listing Losses

Paytm IPO Reviews

Anticipated Reasons for the Downfall of Paytm IPO

What should you do if you have bought Paytm's Share?

FAQ

Indian Fintech Revolution

Have you heard this term before? Fin-tech is a word derived from amalgamation of finance and technology. This could be named as the word of the decade. You won’t ask the reason for this, because you probably know it already.

As the technology sector is rising, lines between companies are blurring. So much so that I would say that every company is a technological company now. With gaps blurring between sectors, the financial sector is the next most diffusing sector. It is hugely automated and also supported by countries' governments. For example, in India the government is promoting digital payments after the demonetisation. This is a good boost for online digital payments companies, UPI (unified payments methods) and the like.

A Brief about Paytm

Paytm is a name that needs no introduction. The name is just enough. It is a leading digital payments company that is digitalizing India. Not to mention the immense support that the company is being provided by the government. Not only this, Paytm started the digital revolution in India.

From that, they became the leading payments app in the second most populous country in the world. Today, to the north of the 20 Million mark, merchants & businesses are powered by Paytm to Accept Payments digitally. This is because more than 300 million Indians use Paytm to pay at daily stores. That's not all, the Paytm app is used to pay bills, Send money, do Recharges to friends & family, Travel tickets & Book movies.

The goal as the company mentions is to get unregulated businesses in the economy to the mainstream economy. Taking most of all the transactions happening in the country and enabling them digitally is an almost impossible thought. This is such a behemoth task but the digital payments provider is not looking backwards.

It recently was listed in the stock market. It was a huge IPO. Investors all around the world were excited. It is now the biggest IPO ever in the history of the stock market in India. Previously it was Coal India which raised about 15,000 crores. Paytm is now listing to raise 18,000 crores rupees.

Financial State of Paytm

Paytm has been a loss making startup for a long time now. It is not earning at all. The startup has losses of about 4000 crore in FY 2019. That went to 3000 in FY 2020 and then to 7000 crore.

Even though the losses are declining, this doesn't hide the fact that the company is not earning at all. So why is that? Why a loss making company is valued so much. It is valued at over 16 billion dollars. Moreover it is able to raise money from big VCs. Asset management companies are pumping money into this loss making startup.

The reason why the company is left with such abundance of money is that it is a startup. An immensely successful startup. Which tries to get customers first, that is to capture a large market share.

After getting a good chunk of the market, they will monetise themselves and earn ridiculous amounts of real cash. This is how most startups model work. They hack growth and become big organisations. They try to establish a strong company and reduce the time that is required to build a strong company.

The startup has also already raised 8000 crores in its anchor round. Its initial public offering of Rs 18,300 crore. Top sovereign wealth funds around the world, financial investors such as Canada’s CPPIB, Singapore's GIC, Alkeon Capital, BlackRock, Abu Dhabi Investment Authority are among those to have picked up stakes in this fintech.

The parent organisation of Paytm is One97 communications. Other than recent fundraising rounds, One97 communications has shareholdings by top capitalists and Asset management companies. It has a 2.8 percent stake by Berkshire Hathaway, the company of world’s best known investor Warren Buffet. It has Ant group as a shareholder, that is as a subsidiary of Alibaba, founded by China's richest man, Jack Ma.

The promoter or the Chief executive officer of the company Vijay Shekhar Sharma has a stake of around 14 percent of the whole mammoth organisation. Other notable shareholders include Alibaba itself, Softbank, Elevation Capital. With all these big supporters this company recently filed for an IPO.

The IPO was huge and reportedly the biggest that Indian markets have ever seen. Unfortunately, The public offering of Paytm fell down immediately after the listing. In fact today is the second day of the shares trading in the market. They went as low as 37% since the IPO.

Let us discuss the whole public offering scenario in minute detail.

Paytm Initial Public Offering (IPO)

Initial public offering is the offering of shares to the general public. General public here means retail investors and big investors as well. When it happens for the first time, we call it the initial public offering. Accordingly it can happen second or third time also, in that case we will call it FPO or further public offering.

IPO or any public offering happens when a company decides to take money from general people and not raise more rounds of funding. The money is needed to fuel growth. It is needed to scale the enterprise and thus the money becomes the new capital.

In Paytm’s case, the company wanted to raise a little over 18,000 crores. This is the biggest amount ever raised in India. So the Paytm IPO is expected to be the biggest offering in Indian markets yet. The breakdown of the total money is that, 8000 something crores were new offering of shares. So, they were a fresh issue. And the remaining 10,000 crores were offered for sale, that is existing shareholders selling their share of stake. The price band of the shares ranged from 2080 to 2150 rupees per share. The valuation of the company at the time was about 1.5 lakh crores.

The RHP is a legal prospectus for every new listing company. The red herring prospectus (RHP) of this company said that it expects to incur losses for more years before it starts making profits. The opening IPO date was 8th of November and the last date to apply was 10th of November. Face value of the share was One rupee. So it was going to be listed at a premium.

Paytm Listing Losses

The Paytm IPO was subscribed only 1.89 times on Nov 10, 2021 17:00. The public issue subscribed 1.66 in the retail category, 2.79 in the QIB category, and 0.24 in the NII category. It shows that investors weren't much interested in it or the IPO was so big that it just covers up all the demand.

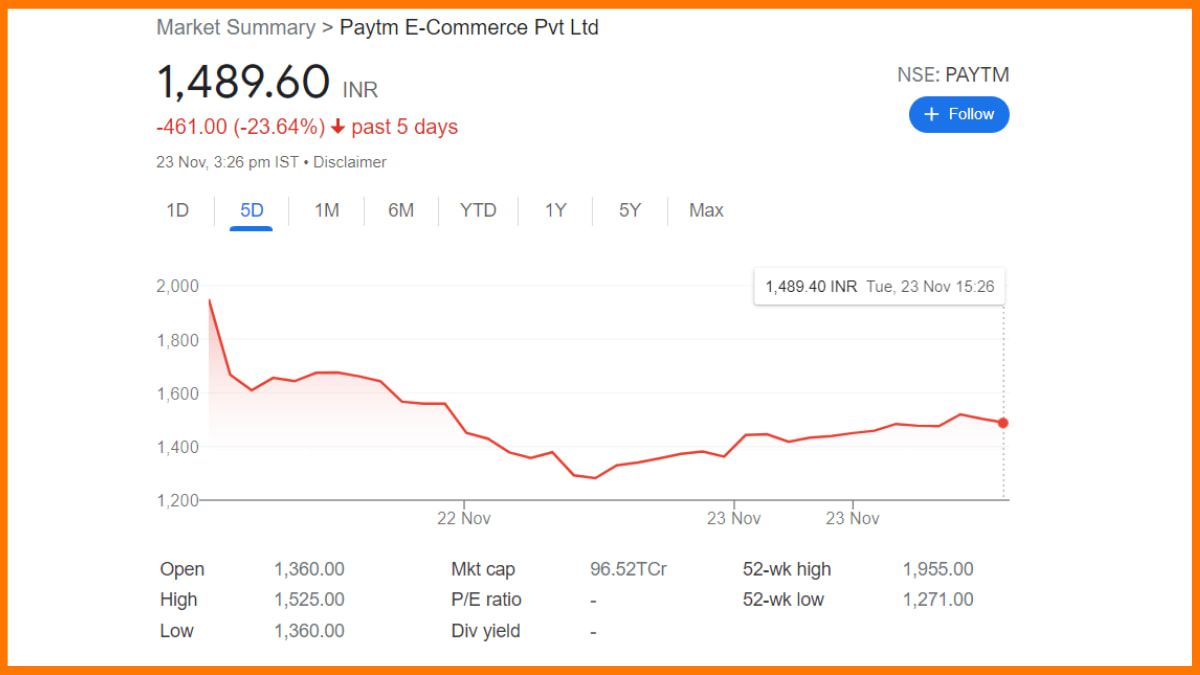

Paytm shares fell down by about 10.35% to Rs 1,402 against previous close of Rs 1,564.15 on BSE. Market cap of the company, which remained above the Rs 1 lakh crore mark on the listing day, faced down to about Rs 93,490 crore on the first listed day. This loss making startup is acting like a money guzzler.

Paytm IPO Reviews

Here are some reviews of the IPO from major and big fund coordinators and Asset management companies.

International Brokerage firm Macquarie published a report on Monday. A second report on Paytm, maintaining its earlier target price of Rs 1,200 and an ‘underperform’ rating after its first one on listing day, ruffled the feathers of investors. This means that they concluded that the price of the share should be Rs1200 and the listed price is well overvalued.

On the second day it went down to 40 percent. Exactly to the price what Macquarie anticipated but they released it after Paytm was listed on the stock market.

After the first day listing loss, investors panicked and tried selling this. This is a huge reminder that if you pick up a stock or an IPO to invest, do your own research. After an honest report only should you consider investing.

Mobikwik whose IPO was in the turn later in time also postponed their listing. Witnessing huge losses that investors incurred in Paytm’s IPO. Let us see some of the anticipated reasons that we all can see which led to the downfall of Paytm on the very first day of being listed.

Anticipated Reasons for the Downfall of Paytm IPO

Some of the most common seen and anticipated reasons for Paytm losing value are listed here. Let us figure out why this mega IPO is seen as a loser in the race for listing gains.

Overall Market Conditions

The current market conditions are also somewhat affecting the IPO listing. The current market trends show a downward trend. Today, you can see news of the market falling down 1170 marks. The day's loss was the biggest for the index in over six months.

This downward trend of Sensex is mainly due to Reliance sliding down 4.4% after it announced reviewing of a recent deal. Outside India and around the globe, inflation tension is rising and so are the Covid cases in Europe. All these activities have also in some sense affected Paytm's downward trend. It is at about 37% down now from the listing day.

Paytm’s Financial Situation

If you have invested in Paytm looking at the fundamentals then you know for a fact that Paytm is not going to make profit anytime soon the profitability game is slightly a long way ahead. We still don't know when Paytm will become profitable.

Another fact is that the newly listed companies right now are also trying to be very smart because they know that there's heavy retail participation in the market. A lot of people like me and you will go for listing gains so Paytm came out and did a mega IPO which was 18,000 crores.

Size of the IPO

Listing gains comes when supply is short and the demand is quite big. In layman language, when the offering is small, listing gains are expected. In Paytm's case, the IPO is so big that it covers the overall demand and it leaves no space left for a force to push the price up.

The Paytm IPO was subscribed 1.89 times on Nov 10, 2021, 17:00. The public issue subscribed 1.66 in the retail category, 2.79 in the QIB category, and 0.24 in the NII category. So you see all the demand was covered with the hugeness of the IPO and less space was left to pump the price up.

What should you do if you have bought Paytm's Share?

If you are someone or you know someone who is stuck with this stock. I would suggest two options. First is to just get rid of this stock as quickly as possible. Second, if you are an investor with a long term horizon then you can consider holding this stock. But keep this in mind that this stock will take a good amount of time to go profitable.

The reason is as we discussed earlier is that the company is making consistent losses for now. It also is forecasted that the company will only scale for now and it has no immediate plans to bring the profit perspective to the table.

As of now, the company is down to 30-40% and it is going to take time to take back these percentages of losses, only then one can expect some profits. Again if you are looking for quick listing gains, then maybe this might not be the probable right stock and time to stay invested in this stock.

For all the inventors who didn't apply for this IPO this is the right moment to be aware of such scary situations. It is always best to research before you invest your money. It is really a scary situation when you invest in a big loss making startup, and you are stuck in it. Startups can be a blackhole for money for a very long time.

Conclusion

The reason for such a hype of this fintech company being listed is that, India is the second most populous country in the world. China, the top populous has already had their share of the fintech revolution. They are also harsh on regulations. Now it is India’s turn. India is the next hub for investors that may be domestic or foreign.

Digital payments are expected to grow up to 5% in the next five years. Digital commerce will likely move up to 3.3%. With these things in store, India becomes the next hot spot for investments.

Jio and digital revolution boosted the Paytm business. Demonetisation skyrocketed it. Their tagline “Paytm karo” became a household thing during these times. With the government promoting digital economy and cashless transactions, hope is high for fintech revolutionaries like Paytm.

The listing losses taught many people to do their own research before investing anywhere. The company is expected to take a long time to jump to profits.

Whether Paytm will change Indian payments face or it will dissolve, this is to be seen and only time will tell. One thing is for sure, it has massively added to the cashless economy that the world is striving towards.

FAQ

What is Paytm IPO?

Paytm is a digital payment system, the company lunched its IPO in Bombay Stock Exchange with largest initial public offering (IPO) with the value of Rs 18,300 crores.

Why did Paytm IPO flopped?

Some of the common reasons why Paytm IPO flopped was Overall Market Conditions, Size of the IPO, and Paytm’s Financial Situation.

Must have tools for startups - Recommended by StartupTalky

- Convert Visitors into Leads- SeizeLead

- Payment Gateway- Razorpay

- Spy on your Competitors- Adspyder

- Manage your business smoothly- Google Workspace